Endowment Series Four: Singlife's Short Term Endowment Plan 2020

When it comes to finding a safer financial instrument to grow your wealth.

Most of us would turn to fixed deposits or bonds like the Singapore Savings Bond (SSB).

If you’re looking at safe-r (still highly subjective depending on your risk appetite) options with liquidity, did you know that there’s another option called the endowment plan?

Yep.

Here’s one that’s available in the market right now…

TL;DR: Is the Singlife Endowment Series Four Worth It?

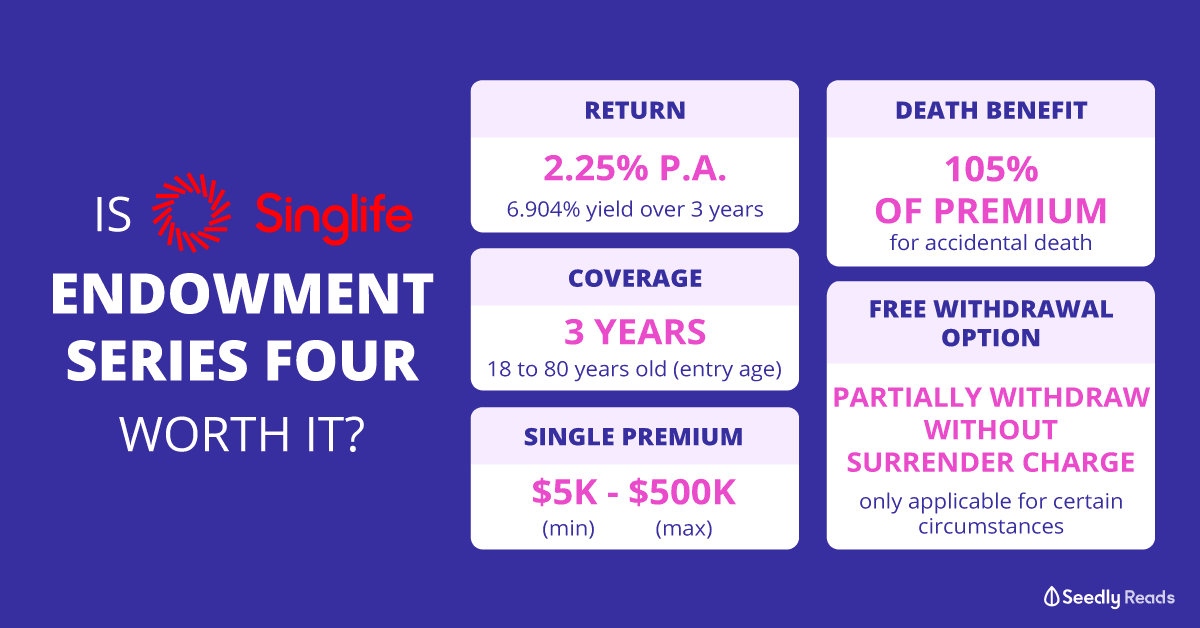

The Singlife Endowment Series Four is a single premium non-par savings plan.

| Singlife Endowment Series Four | |

|---|---|

| Coverage | 3 Years |

| Premium | Single premium (one lump sum) $5,000 (min) $500,000 (max) Cash only |

| Death Benefit | Accidental Death Pays 105% of your single premium or surrender value, whichever is higher, upon your demise |

| Non-Accidental Death Pays 101% of your single premium or surrender value, whichever is higher, upon your demise |

|

| Guaranteed Maturity Benefit | 2.25% p.a. |

| Partial or Full Surrender | Allowed |

| Free Withdrawal Option | Available |

| Entry Age | 18 years old (min) 80 years old (max) |

| Policy Protection | Up to specified limits by SDIC |

| Credit Rating of Insurance Company | BBB |

Disclaimer: We are NOT sponsored and this article does not constitute financial advice. We’re just sharing information here for YOU to make smarter financial decisions.

So… What is an Endowment Plan?

An endowment plan is basically a life insurance policy.

But apart from covering the life of the insured.

It also helps you save over a period of time so that ultimately, you get to collect a lump sum (principal + interest) upon policy maturity.

Usually, you’ll have to contribute regularly or pay a lump sum (this is called ‘single premium’) which most financial advisors will term as ‘forced savings’.

An endowment plan is typically used if you wish to save up money towards a specific financial goal.

A Closer Look at Singlife Endowment Series Four

Released back in 2019 with a guaranteed return of 2.38% p.a., Singlife’s Endowment Series Four is back again.

The Pros of Singlife Endowment Series Four

Issuance of the endowment plan is guaranteed as medical underwriting is not required.

Your capital is guaranteed if you hold the endowment plan to maturity.

In return, you’ll get 106.904% of your principal sum invested.

Or a yield of 6.904% over three years.

A relatively small sum of $5,000 is all you need to get started.

The Cons of Singlife Endowment Series Four

You will incur a surrender charge if you choose to surrender the policy before maturity.

However, the Endowment Series Four has a special ‘Free Withdrawal Option‘ feature which allows you to partially withdraw the policy and get back part of the single premium paid without incurring the surrender charge.

Only under special circumstances though.

And naturally, you don’t get to keep the interest earned either.

Based on what I understand from the terms and conditions, you can only do so if the policyholder is certified by a registered medical practitioner to:

- be physically or mentally incapacitated from ever continuing in any employment; or

- have a severely impaired life expectancy; or

- lack capacity as defined in Section 4 of the Mental Capacity Act (MCA) and the lack of capacity is likely to be permanent; or

- be terminally ill

OR during life stage events where you:

- get married

- become a parent by giving birth to a child or if you legally adopt one; or

- purchase a new house

OR if you get retrenched involuntarily.

Note: consult your financial advisor or read the terms and conditions carefully before making your investment

How Do I Purchase SingLife Endowment Series Four?

You can purchase the endowment plan through your financial advisor.

Endowment Series Four in Comparison to Singapore Savings Bonds (SSBs)

When it comes to low-risk investments, the benchmark that most Singaporeans have these days would be SSBs.

Looking at the current SSB’s average return per year (bond id: GX20030V; issue date: 2 March 2020), holding it for three years only yields an average return of 1.43% p.a.

Even if you held onto it for five years, the SSB would only yield an average return of 1.51% p.a.

This is as compared to Endowment Series Four’s 2.25% p.a. over three years.

Long story short, the returns of Singlife Endowment Series Four unequivocally beats the SSB.

That being said, even though your policy is SDIC guaranteed, SSBs have the edge here as they are government-backed.

Also, you’ve got to be really sure that you won’t need the money anytime soon because you’ll incur a surrender charge if you suddenly decide that you need your money before the 3-year maturity is up.

But with SSBs, you just need to pay a $2 transaction fee and you’ll get your principal and any interest accrued by the 2nd business day of the following month.

What If I Don’t Have $5,000 to Invest in Singlife’s Endowment Series Four?

Unlike the other endowment plans we’ve covered before, $5,000 should be within the reach of most Singaporeans.

You just need to know how to allocate your monthly salary and save!

But if you’re still saving up and making your way there, fret not.

There’re always other low(er)-risk alternatives if you’re looking to invest your money. You have:

- Singapore Savings Bonds which require a minimum of $500

- Fixed deposits which require a minimum of $500

- High-interest savings accounts

But all options listed here come with different lock-in periods, so choose wisely and consider when you’ll need that money which you’re putting away.

Should I Buy Singlife’s Endowment Series Four?

As with any other endowment plan, or McDonald’s latest promo, the Endowment Series Four is available while stocks last.

But that doesn’t mean that you should rush into it.

You should always read the terms and conditions carefully.

And consider your investment horizon before committing your hard-earned money.

Remember: nobody cares about your money more than you do.

Except maybe your parents.

They love you more than anything in the world.

When was the last time you gave your mom or dad a call to ask them about their day?

Go ahead and give them a call.

Your folks will love it.

Even if they say they don’t.

Advertisement