How To Invest With Little Money? Investment Platforms To Invest A Fixed Monthly Savings

Investing Is Hard

I chanced upon a conversation between two friends at my neighbourhood Kopitiam recently. One of them, trying to encourage the other to start investing. His suggestion was instantly shot down with the usual, “Don’t want la! Investing is so difficult”.

I cannot help but take a peep at the screen of his Samsung Galaxy which lights up occasionally due to Facebook notifications.

The wallpaper of his phone has this quote plastered all over:

And yet, investing is so “difficult”.

Some Singaporeans can be quite interesting when it comes to the topic of investing.

Many do not find it difficult when it comes to getting the latest phone out in the market.

Neither was it difficult when it comes to weekend brunches, getting that new car or that Gucci handbag.

But when it comes to the topic of investing? Difficult.

We feel some of your pain. A study on consumer procrastination occurs when the barrier to entry is high. The lack of knowledge and possible high outlay of capital required can deter new investors from dipping their toes in the water.

Hence, products that allow Singaporeans to invest a fixed monthly saving can help encourage the habit of investing.

TL;DR: How To Invest Monthly In Singapore With Little Money?

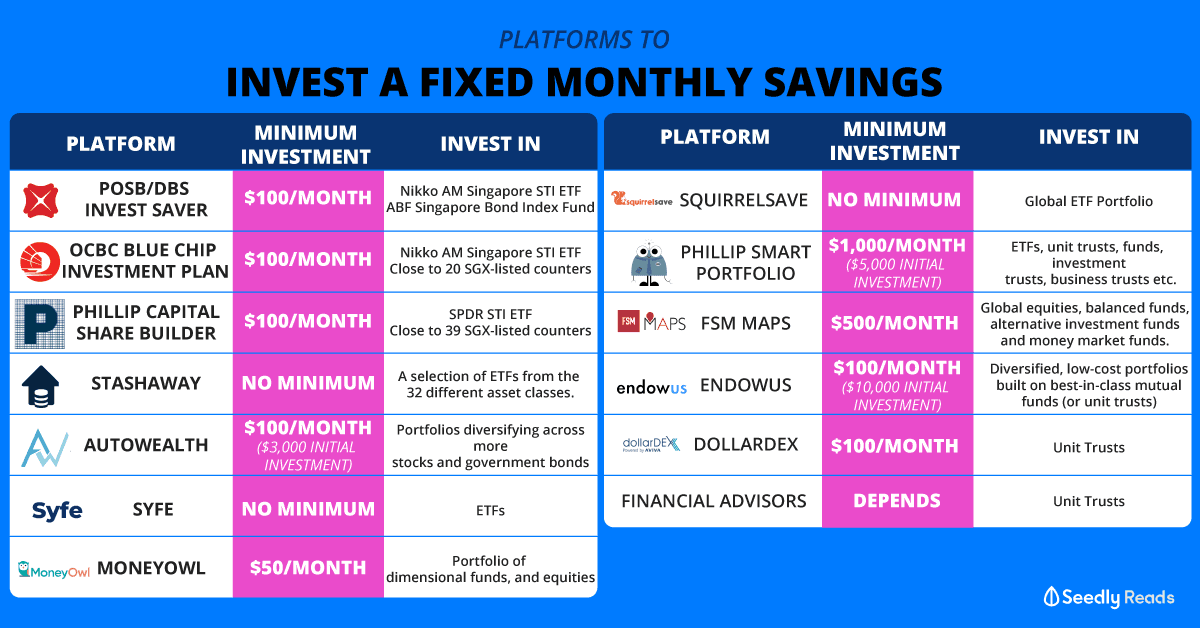

Singaporeans have no lack of options when it comes to platforms to invest a fixed amount every month.

| Products | Minimum Investment | Invests In | Fees and Charges |

|---|---|---|---|

| DBS/POSB Invest Saver | $100 per month | Nikko AM Singapore STI ETF ABF Singapore Bond Index Fund | 0.82% for Nikko AM Singapore STI ETF 0.5% for ABF Singapore Bond Index Fund |

| OCBC Blue Chip Investment Plan | $100 per month | Nikko AM Singapore STI ETF Close to 20 SGX-listed counters | 0.88% of the total investment amount |

| PhillipCapital Share Builders Plan | $100 per month | SPDR STI ETF Close to 39 SGX-listed counters | $6 for 1-2 counters, $10 for 2 counters or more |

| StashAway | No Minimum | A selection of ETFs from the 32 different asset classes. | 0.2% to 0.8% per annum |

| AutoWealth | $100 per month (Initial Investment: $3,000) | Portfolios diversifying across more than 8,000 stocks and 600 government bonds | 0.5% management fees and US$18 platform fees per annum |

| MoneyOwl | $50 per month | Portfolios are made up of dimensional funds, and equities | 0.65% MoneyOwl Advisory Fees, 0.18% platform fees paid to iFast, 0.3% to 0.4% of fund expense ratio per annum |

| SquirrelSave | No Minimum | Global ETF portfolio | 0.5% management fee per annum and 10% performance fee |

| Phillip SMART Portfolio | $1,000 per month (Initial Investment: $5,000) | Exchange-Traded Funds listed on major stock exchanges, unit trusts, closed-end funds, investment trusts, business trusts and Exchange-traded notes | 0.5% management fee per annum |

| Syfe | No Minimum | Exchange Traded Funds (ETFs) | 0.65% management fee per annum |

| FSM MAPS | $500 per month | Global equities, balanced funds, alternative investment funds and money market funds. It may also invest in exchange-traded funds (ETFs) | 0.35% per annum for Conservative Portfolio, 0.50% per annum for other portfolios. |

| Endowus | $100 per month (Initial Investment: $10,000) | Diversified, low-cost portfolios built on best-in-class mutual funds (or unit trusts) | 0.25% to 0.60% per annum |

| dollarDex | $100 per month | Unit Trusts | 0% per annum |

| Financial Advisors | Depends | Unit Trusts | Depends |

Where Can Singaporeans Invest A Fixed Monthly Savings

When we talk about saving that fixed monthly sum of money, the first platform that comes to mind will be the Regular Share Savings (RSS) that some of the banks and brokerage provide.

Regular Shares Savings (RSS) Plan

Before diving into the different RSS plans available in Singapore, we take a look at the pros and cons of RSS plans.

Pros: RSS Plans allow investors to invest a small amount of money every month. Investing in these products when not on an RSS Plan, requires higher initial capital which may deter investors from investing.

Investors on RSS plans can enjoy the advantage of dollar-cost averaging, without having to constantly time the market.

Cons: The cons of RSS Plan is that there is a chance that lump sum investing has a higher chance of higher returns. Investors are also limited to the share counters by their RSS plan provider.

Investors may also experience higher fees if they invest past a certain investment amount.

DBS Invest Saver (POSB Invest Saver)

Invest Saver is a regular share savings plan offered by DBS and POSB bank.

Here are some details on the DBS/ POSB Invest Saver Regular Shares Savings Plan:

- Minimum investment: $100 per month

- Invest in:

Nikko AM Singapore STI ETF

ABF Singapore Bond Index Fund - Fees and charges:

0.88% for Nikko AM Singapore STI ETF or 0.5% for ABF Singapore Bond Index Fund

OCBC Blue Chip Investment Plan

The Blue Chip Investment Plan is a regular share savings plan offered by OCBC bank.

Here are some details on OCBC Blue Chip Investment Regular Shares Savings Plan:

- Minimum investment: $100 per month

- Invest in:

Nikko AM Singapore STI ETF

Close to 20 SGX-listed counters - Fees and charges:

0.88% of the total investment amount

PhillipCapital Share Builders Plan

Phillip Capital offers Phillip Share Builders Plan.

Here are some details on Phillip Share Builders Regular Shares Savings Plan:

- Minimum investment: $100 per month

- Invest in:

SPDR STI ETF

Close to 39 SGX-listed counters - Fees and charges:

For investment amount below $1,000: $6 for 1-2 counters, $10 for 2 counters or more

For investment amount above $1,000: 0.2% or $10, whichever is higher

Robo-Advisors

Robo-advisors are gaining popularity among investors in Singapore. Most Robo-advisors understands the financial situation, risk appetite and investment time horizon of investors before assigning one of their portfolios to the individual investor.

StashAway

StashAway adopts an Economic Regime-based Asset Allocation method for investors.

Here are some details on investing with StashAway:

- Minimum investment: No minimum

- Invest in:

A portfolio catered to your risk profile. The portfolio is a selection of ETFs from the 32 different asset classes Stashaway uses. - Fees and charges:

0.2% to 0.8% per annum, depending on the total amount you invested in StashAway. - 104 reviews rated StashAway 4.6 out of 5 stars.

AutoWealth

AutoWealth carters to your investment needs with 4 different types of portfolio.

Here are some details on investing with AutoWealth:

- Initial Investment: $3,000

- Minimum investment: $100 per month

- Invest in:

Their portfolios diversify across more than 8,000 stocks and 600 government bonds across 4 geographical regions. - Fees and charges:

0.5% management fees and US$18 platform fees per annum. - 35 reviews rated AutoWealth 4.7 out of 5 stars.

MoneyOwl

MoneyOwl positions themselves as a Bionic Adviser. This means that they integrate technology with human wisdom when making decisions with regards to their portfolios.

Here are some details on investing with MoneyOwl:

- Minimum investment: $50 per month or $100 one-time investment

- Invest in:

MoneyOwl offers 5 different types of portfolios. These portfolios are made up of dimensional funds, and equities. - Fees and charges:

0.65% MoneyOwl Advisory Fees, 0.18% platform fees paid to iFast, 0.3% to 0.4% of fund expense ratio per annum. - 4 reviews rated MoneyOwl 4.5 out of 5 stars.

SquirrelSave

SquirrelSave believes that their machine learning AI designs global portfolio with the highest predicted return, matching their investor’s risk profile.

Here are some details on investing with SquirrelSave:

- Minimum investment: No minimum

- Invest in:

SquirrelSave offers Global ETF portfolio - Fees and charges:

0.5% management fee per annum and 10% performance fee. - 2 reviews rated SquirrelSave 4.5 out of 5 stars.

Phillip SMART Portfolio

Phillip SMART Portfolio invests in Exchange-Traded Funds listed on major stock exchanges. It may also invest in unit trusts, closed-end funds, investment trusts, business trusts and Exchange-traded notes.

Here are some details on investing with Phillip SMART Portfolio:

- Minimum investment: $5,000 initial investment. $1,000 monthly investment.

- Invest in:

Exchange-Traded Funds listed on major stock exchanges, unit trusts, closed-end funds, investment trusts, business trusts and Exchange-traded notes. - Fees and charges:

0.5% management fee per annum - 2 reviews rated Phillip SMART Portfolio 5 stars.

Syfe

Syfe‘s Automated Risk-managed investment strategy combines the best of two leading approaches – Global Market Portfolio (GMP) and Risk Parity Portfolio (RP).

Here are some details on investing with Syfe:

- Minimum investment: No minimum balance

- Invest in:

Quality Exchange Traded Funds (ETFs) preferred by institutional investors. - Fees and charges:

0.65% management fee per annum - Only 1 review rated Syfe 5 stars.

FSM MAPS

FSM MAPS is an online Managed Portfolio Service that builds, monitors and balances your portfolio for you continually.

Here are some details on investing with FSM MAPS:

- Minimum investment: $500 per month

- Invest in:

Global equities, balanced funds, alternative investment funds and money market funds. It may also invest in exchange-traded funds (ETFs). - Fees and charges:

0.35% per annum for Conservative Portfolio, 0.50% per annum for other portfolios.

Endowus

Endowus utilize modern portfolio theory that uses time-tested investing rules such as diversification and asset allocation to maximize your returns while minimising risk.

- Minimum investment: $10,000 initial investment/ $100 per month

- Invest in:

Diversified, low-cost portfolios built on best-in-class mutual funds (or unit trusts). - Fees and charges:

0.25% to 0.60% per annum depending on the amount of cash investment. 0.40% flat fee if using CPF. - Only 1 review rated Endowus 4 stars.

dollarDex

dollarDex is powered by AVIVA, allows investors to invest using a Regular Savings Plan or Value Averaging Plan. Regular Savings Plan invests a regular amount each month. Value Averaging Plan pegs your monthly investment amount to the growth of the portfolio.

- Minimum investment: $100 per month

- Invest in:

Unit trusts - Fees and charges:

0% per annum

Traditional Financial Advisors

If you prefer talking to somebody instead and having the luxury of someone settling your monthly investment for you, why not find a Financial Advisor you trust? Financial Advisors do help set up Regular Savings Plan into Unit Trusts. Of course, we strongly advise consumers to double-check any of the recommendations on Seedly Community before diving into it.

- Minimum investment: Can be as low as $100 per month

- Invest in:

ETFs, stocks, bonds, structured products, Investment-Linked Products - Fees and charges:

Depends

Dollar-Cost Averaging vs Lump Sum Investment

We understand the common questions most Singaporeans face.

The usual, I am new to investing, should I jump on lump-sum investment or monthly investment types of questions.

Monthly investment helps Singaporean’s busy lifestyle as we generally do not need to time the market when we do dollar-cost averaging (DCA) with monthly investments. All it takes is the discipline to set aside some money and let the product or platform do its job.

Advertisement