Singapore Press Holdings Limited (SGX: T39) to Restructure Media Business: What Investors Should Know

Sudhan P

Sudhan P●

Singapore Press Holdings Limited‘s (SGX: T39) long-term share price chart reveals a lot of things.

Singapore Press Holdings (SPH), which was once a local stock market darling, has seen its share price crumble amid the headwinds in its traditional media business.

With the proliferation of online advertising through Facebook and Google, SPH’s advertising arm has been severely crippled, and so too has its overall business.

To arrest this issue, SPH just announced a major restructuring to hive off its media business into a not-for-profit entity and to march forward on a cleaner slate.

Here’s what investors should know about SPH’s breaking news (pun not intended)!

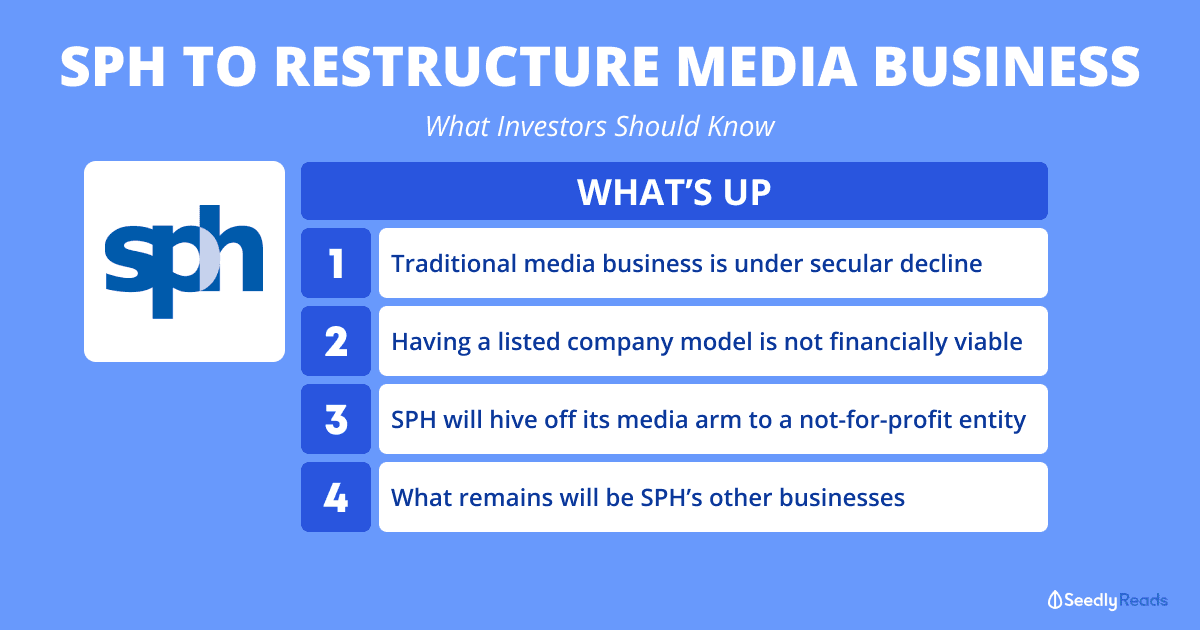

TL;DR: Singapore Press Holdings Restructuring Its Media Business

Key highlights from the SPH’s announcement:

- SPH will be restructuring its media business into a not-for-profit entity, which will be a newly formed public company limited by guarantee.

- Following the restructuring, SPH will no longer be subject to shareholder and other relevant restrictions under the Newspaper and Printing Presses Act.

- SPH’s other businesses will remain under SPH.

- The group’s media business is undergoing structural decline due to the proliferation of digital media.

- Decline in SPH’s print ad revenue is expected to continue.

- Listed company model is not financially sustainable for SPH’s media arm and without regulatory restrictions after restructuring, SPH can unlock value for shareholders.

Pssst… Discuss with fellow investors about SPH’s restructuring once you sign up for your free Seedly account!

What’s the News All About?

SPH announced earlier today that it will be restructuring its media business into a not-for-profit entity.

The process involves transferring the entire media-related businesses of SPH to a newly incorporated wholly-owned subsidiary, SPH Media Holdings Pte Ltd.

SPH will provide SPH Media with the initial resources and funding.

SPH Media will then be transferred to a not-for-profit entity, which will be a newly formed public company limited by guarantee (CLG).

After the transfer of SPH Media to the CLG, SPH will no longer be subject to shareholder and other relevant restrictions under the Newspaper and Printing Presses Act.  Source: SPH restructuring analyst briefing deck

Source: SPH restructuring analyst briefing deck

SPH’s other businesses, such as property and aged care, will remain under SPH.

Why Now?

SPH’s media business is the group’s main revenue driver. The business contributed around 51% of its overall FY2020 revenue.

(Note: FY2020 means financial year ended 31 August 2020)

With the falling revenue from print advertisements, SPH’s media segment revenue has been on a downtrend for a couple of years now.

SPH’s media segment recorded its first-ever loss of S$11.4 million for FY2020.

And it doesn’t look like there’ll be a respite.

SPH said that even with “the resumption of business activities post-lockdown, the decline in advertising revenue is expected to continue at a similar pace to the last five years”.

A bright spot in SPH’s media business, though, is its digital subscription and digital advertising.

SPH’s online ad business had been growing steadily since FY2017, with the exception of FY2020 where advertisers pulled back on ad spend globally amid the COVID-19 pandemic.

However, revenue from its digital business won’t able to offset the decline in print advertising and print circulation revenues.

As a result, SPH said that the losses of the media business are likely to continue and widen.

Given SPH’s various needs and circumstances, such as further investment to strengthen its digital capabilities and the media business being a public good, restructuring the media business into a not-for-profit entity is the best option.

SPH’s media business would thrive better away from shareholder scrutiny and expectations of profitability and regular dividends.

Assuming the restructuring was completed in FY2020, SPH’s operating profit (excluding government grants) would have increased by 48.1%.

What’s Next?

SPH requires shareholder approval via an extraordinary general meeting (EGM) before the proposed restructuring goes through.

The following is a timeline of the whole process:

Assuming the EGM takes place in August 2021, the restructuring should be completed by February 2022.

My Take on SPH’s Restructuring

SPH has been destroying shareholder value with its declining media business.

As seen from the table below, SPH’s return on equity (ROE) — which reveals how efficient a firm’s management is in using shareholders’ capital to grow its business — has been falling over the years and it went into negative territory in FY2020.

| FY2016 | FY2017 | FY2018 | FY2019 | FY2020 | |

|---|---|---|---|---|---|

| Return on equity | 7.5% | 10.0% | 8.1% | 6.1% | -2.5% |

With the restructuring, SPH shareholders will be left with a pool of other businesses — such as properties, student accommodations, and nursing homes — which have better prospects. The group will essentially be transforming into a property business.

SPH’s property segment includes a 65% stake in SPH REIT (SGX: SK6U). SPH REIT is a retail real estate investment trust that has interests in Paragon, The Clementi Mall, and The Rail Mall in Singapore.

Over in Australia, the REIT owns a 50% interest in Westfield Marion Shopping Centre and an 85% stake in Figtree Grove.

SPH also owns The Seletar Mall and an integrated development consisting of The Woodleigh Residences and The Woodleigh Mall.

Furthermore, SPH has a portfolio of purpose-built student accommodation (PBSA) in the United Kingdom and Germany.

Not many may know this, but SPH owns Singapore’s largest private nursing home operator, Orange Valley, as well. It’s also in the aged care sector in Japan.

Elsewhere, SPH has a 20% stake each in education company, MindChamps PreSchool Ltd (SGX: CNE), and telco M1.

Compared to the media business, SPH’s properties and others segments have been holding up better.

It may take some time before SPH can see its heydays again, but I think it’s a step in the right direction.

What Are Your Thoughts on SPH’s Restructuring?

What do you think about the latest announcement by SPH? Come and can discuss your thoughts with fellow shareholders once you sign up for your free Seedly account!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the company mentioned.

Advertisement