Singapore Property Market 2021 Outlook: Will Singapore Property Prices Keep Going Up?

●

In the blink of an eye, 2020 is coming to an end.

And, I would think you would agree that the year has not been the best, as Singapore is knee-deep in a recession.

The Ministry of Trade and Industry (MTI) reported in August that in the second quarter of 2020, the economy shrank by 13.2 per cent year on year.

In fact, Mr Chan Chun Sing, the Minister for Trade and Industry stated:

“This is our worst quarterly performance on record. The forecast for 2020 essentially means the growth generated over the past two to three years will be negated.”

The global economy is also knee-deep in a recession and still is still fighting the economic crisis caused by COVID-19.

Also, the unemployment rate for Singapore Citizens (seasonally adjusted), increased from 3.3% in Q1 2020 to 3.8% in Q2 2020.

But, there are still things to be optimistic about.

Singapore has been handling the COVID-19 pandemic fairly well, as we will be entering Phase 3 of Circuit Breaker with relaxed safe distancing management.

Our property prices have also remained resilient as in 2020m with private home prices higher than they were in 2019.

Why is this happening during a recession? Will this bullishness continue?

Here’s what you need to know!

Singapore Property Prices Rose in 2020

We are living in strange times.

Typically, property prices tend to tank when there is a recession.

To see this we will need to look at the Private Residential Property Price Index provided by Urban Redevelopment Authority (URA), Singapore which tracks the overall price movement of the private residential market.

FYI: This index is based on the price indices of private properties, office, shop, multiple user factories and warehouses.

Singapore’s private property prices crashed after the Asian financial crisis in 1997 and the global financial crisis of 2008.

Source: URA | Private Residential Property Price Index

But interestingly enough, Housing and Development Board (HDB) resale flat prices seem to be more resilient to the impact of recessions.

If you look at the HDB Resale Price Index, prices did crash after the Asian financial crisis in 1997 and rebounded during the global financial crisis of 2008.

FYI: The index tracks the overall price movement of the public residential market and is based on the quarterly average resale price by date of registration) of HDB resale prices.

Source: URA | HDB Residential Property Price Index

And now that we are experiencing one of our most severe recessions since independence, you might expect that the property market will be hit just as hard.

But that’s not the case.

Property prices are actually rising.

Private home prices in Singapore actually went up by 0.8 per cent quarter-on-quarter in Q3 2020.

Prices of landed property rose 3.7 per cent, after a flat reading in Q2; while those of non-landed properties inched up 0.1 per cent, following a 0.4 per cent gain in Q2.

In the same time period, HDB resale flat prices went up by 1.5 per cent quarter-on-quarter in Q3 2020.

This was the second straight quarter of increase in private home and HDB resale prices, as the Singapore government gradually reopens the economy amidst the COVID-19 crisis.

Unemployment and retrenchment numbers in Singapore are also going up which might also affect demand for property.

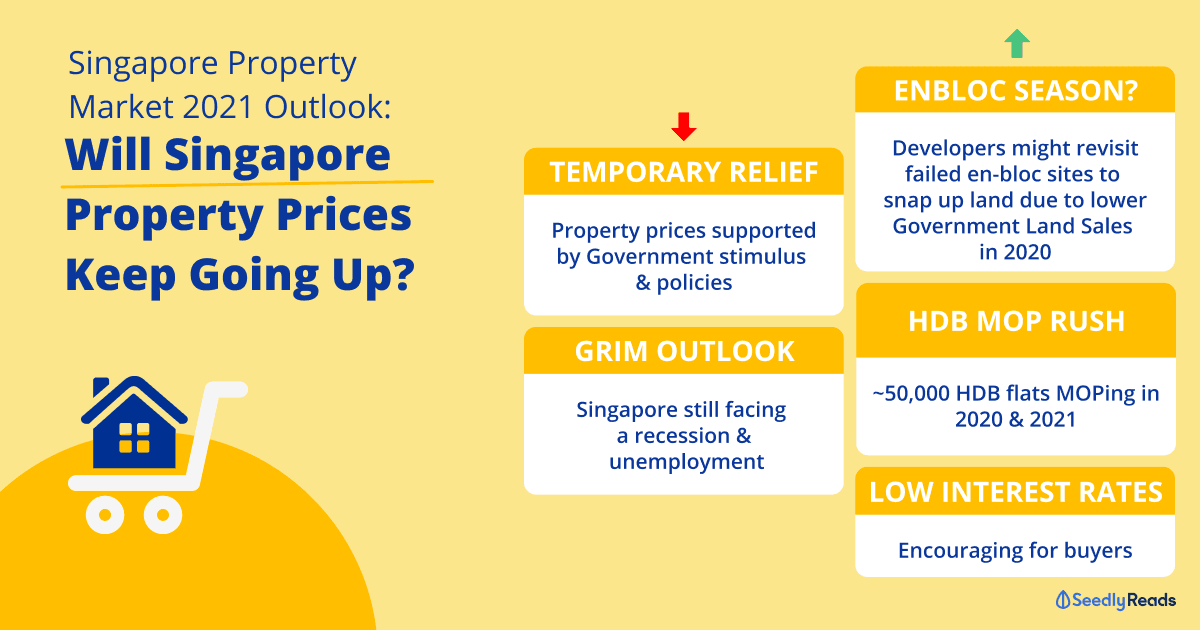

Why Property Prices Might Go Down in 2021

This resilience in the private and HDB resale market might not last.

This is because property prices in Singapore are being supported by Government measures.

Temporary Relief Measures Singapore

There has been generous support from the Government, with four stimulus packages that have cushioned the fallout from the global recession and COVID-19 crisis.

In 2020 we had four budgets: tge Unity Budget 2020; Resilience Budget; Solidarity Budget and the Fortitude Budget.

Also, homeowners breathed a sigh of relief when the Monetary Authority of Singapore announced that repayments for residential property loans could be deferred 31 Dec 2020; with banks approving about 90 per cent of deferment requests.

More recently, MAS announced an extension of the relief measures as according to CNA:

Those with residential, commercial and industrial property loans may apply to temporarily reduce their loan repayments to 60 per cent of their monthly instalments.

Those who meet the criteria can apply for the assistance between Nov 9 this year and Jun 30 next year. Instalments plans may be temporarily reduced for up to nine months, but not exceeding 31 Dec, 2021.

This provided relief for property investors relying on rental income, as they did not have to worry about finding a tenant to service their monthly home loan repayments.

In order words, these property investors did not have to sell their houses out of desperation.

Arguably, these two temporary measures played part in keeping property prices high.

But these measures are temporary and there’s no guarantee that these measures will be extended.

Recession, Unemployment and Retrenchments

Even with the relief measures, buyers would be wary due to the recession and increase in unemployment.

MAS has stated on 28 October that the current recession we are facing due to the COVID-19 pandemic is “deeper and likely to be more protracted” than past recessions.

On 30 Oct, the Ministry of Manpower (MOM) released estimates about the overall employment rate in Singapore.

Singapore’s overall employment rate went up to 3.6 per cent, up 0.2 per cent from 3.4 per cent in August, which was already higher than the peak unemployment rate during the global financial crisis.

In addition, there were more than 20,000 workers retrenched year-to-date.

This is significant as according to PropertyGuru, locals made up over 80 per cent of the property purchasers this year.

Locals might be putting off their property purchases due to all the uncertainty with the economy and the labour market situation.

But on balance, it is highly likely that the Singapore Government will continue its efforts to support the economy, reduce unemployment and ease the financial difficulties caused by the COVID-19 pandemic.

There is also cause for optimism as well.

Post-COVID 19 Outlook

We are now seeing the light at the end of the tunnel as the COVID-19 vaccine is being rolled out around the world.

The Straits Times has also reported that the first shipments of the Pfizer-BioNTech vaccines will arrive in Singapore by the end of this year; with enough vaccines for all Singaporean Citizens and long term residents in Singapore.

Hopefully, the pandemic will be contained sooner rather than later.

Once the pandemic is contained, the pent-up demand of investors might trigger an increase in demand for property which will drive up prices.

And according to the PropertyGuru Singapore Property Market Outlook 2021 Report, there might be more cause for optimism.

Here are some key property trends in 2021 to pay attention to.

HDB Resale Activity And Prices Could Increase

In 2020 and 2021, over 50,000 HDB flats will have reached or will reach their Minimum Occupation Period (MOP).

About 50 per cent of these newly minted resale flats entered the HDB resale market in 2020. This may have stimulated the market and caused the resale price index to grow 1.5 per cent in Q3 2020 on a quarter-on-quarter basis.

This might bode well for the private property as you could see these homeowners selling their HDB flat and upgrading to a condo.

Demand For Property is Resilient

Despite the recession and growing unemployment, demand for property remained resilient in 2020.

According to PropertyGuru, locals made up over 80 per cent of the property purchasers this year.

This is significant as the majority of the group will be real owner-occupiers, which mean that demand for property will remain strong.

In addition, the savvy foreign property investors will still continue to snap up property in the prime neighbourhoods.

This is largely due to the relative strength of Singapore as a country our policy transparency, safety and political stability,

Even the cooling measures like Additional Buyer’s Stamp Duty (ABSD) and the special permits required to buy landed properties which were implemented before COVID-19 did not deter them as much.

EnBloc Season Incoming?

Since 2019, the property market in Singapore has seen an oversupply of private housing.

The COVID-19 crisis did not help matters either as when the Circuit Breaker measures were implemented in April this year, there was a steep 58 per cent month-on-month (MoM) drop in new home sales.

This was one of the worst-performing months in the last six years.

Also, the PropertyGuru Supply Index saw a 46.4 per cent spike in property listings in Q2 2020, which was likely caused by the uncertain economic outlook.

Subsequently, in Q3 2020, there was a 32.7 per cent dip in the same supply index in Q3 2020, suggesting that more private residential units were being bought.

But, according to URA, there are still 26,483 unsold and/or uncompleted private residential units in the pipeline.

This might have influenced the Government to reduce the amount of confirmed Government Land Sales (GLS) this year.

This could create an opportunity for property developers to revisit past unsuccessful en bloc sites to snap up land in 2021.

In fact, RL East, a subsidiary of Roxy-Pacific Holdings has already moved fast to do this, buying a freehold 15-terraced house development site in Guillemard Road for $93 million in November 2020; after the en-bloc sale did not go through in 2018.

Low-Interest Rate Environment Favourable For Buyers

Mortgage rates in Singapore have dropped to record lows.

In the near future, housing/mortgage loan interest rates are likely to remain low as the US Federal Reserve has committed to keeping interest rates close to zero at least through to 2023.

As such, Singapore’s housing/mortgage loan rates which have a strong correlation with the Federal Reserve rates are likely to remain depressed until then.

Interest rates for housing/mortgage loans have dropped to record lows.

For example, those with preexisting SIBOR home loans have been enjoying low-interest rates below 1 per cent.

However, this has not reduced housing affordability as much as banks are still required to adhere to the MAS 3.5 per cent medium-term rate regulation to calculate borrowers’ Total Debt Servicing Ratio (TDSR).

This means that some homes might be still out of reach by some people.

In other words, this low-interest rate environment is beneficial for buyers in the market for new homes and for existing homeowners to refinance their home loans to pay less interest.

Singapore mortgage rates are likely to remain similarly low until then, an environment that is highly favourable for buyers looking for new homes and existing homeowners to refinance their home loans.

Dr. Tan Tee Khoon, Country Manager of PropertyGuru Singapore added that:

“Property prices have remained under control and relatively stable even against the challenges brought forth by the pandemic. As a result, Q3 has seen an upturn in the sector, with a release in pent-up property demand and changes to buyers’ habits due to the pandemic,” added Dr. Tan.

“The property sector has continued to perform into Q4 of 2020, and signs look encouraging as we head towards 2021. Despite the global pandemic, we can look forward to the coming year with cautious optimism.”

What Should Consumers Do?

Despite the cautious optimism, buyers should still exercise caution when buying property due to the uncertain economic climate and slow projected labour market recovery.

The COVID-19 crisis has shown that we should not overextend ourselves with too much debt or leverage in case of situations like this.

MAS has also advised Singaporean households to:

“be prudent in taking up new debt and in committing to property purchases as the labour market recovery is expected to be protracted. Whenever possible, they should continue servicing or consolidating their existing obligations to enhance resilience against unexpected shocks.”

For existing homeowners, you should consider refinancing your housing/mortgage loans to take advantage of the low-interest-rate environment.

Also, if you are looking to switch from your HDB loan to Bank Loan to take advantage of the low interest rate environment, here is what you need to consider:

Advertisement