Ultimate Guide to Singapore's Reserves: Difference Between Past and Current Reserves

We have been hearing a lot about the government drawing on its reserves lately in our battle to fight COVID-19. Majority of the Singaporeans seem to be pretty satisfied at the way things are handled for now.

Some might even say ‘No Horse Run‘ (means it is the best).

Not literally, of course.

With the word reserves being thrown around often, we decide to dig deeper to find out more about the government’s reserves.

Author’s Note: We do not work for the government. There is nothing much to do at home, so I might as well feed my curiosity.

Our Government’s Reserves vs COVID-19

We did a little coverage on how is the Singapore Government paying for the Unity and Resilience Budget. We went on to commit another $5.1 billion with the Solidarity Budget.

Here’s a quick breakdown on the 3 Budgets and where is the budget coming from:

| Cost | Some examples of where the money is going | Money taken from where? | Where else? | |

|---|---|---|---|---|

| Unity Budget (February 2020) | $6.4 Billion | $800 Million: Ministry of Health to fight COVID-19 | Government Budget | Current Reserves |

| $4 Billion: Stabilisation and Support Package | ||||

| $1.6 Billion: Care and Support Package | ||||

| Resilience Budget (March 2020) | $48.4 Billion | $15.1 Billion: Support 1.9 million local employees under Jobs Support Scheme | Past Reserves ($17 Billion) |

|

| $1.2 Billion: Self-Employed Person Income Relief Scheme (SIRS) | ||||

| $48 Million: Self-Employed Person Training Support Scheme | ||||

| $145 Million: ComCare | ||||

| $20 Billion: Enterprise Financing Scheme (EFS) and Temporary Bridging Loan Programme (TBLP) | ||||

| $350 Million: Enhanced Aviation Support Package | ||||

| $90 Million: Tourism Industry | ||||

| and many more | ||||

| Solidarity Budget (April 2020) | $5.1 Billion | $4 Billion: Additional support for businesses and workers | Past Reserves ($4 Billion) |

|

| $1.1 Billion: Solidarity Payment | ||||

| Total Cost | $59.9 Billion |

We understand that this is confusing AF, especially when it comes to the difference between past and current reserve.

Just bear with us a bit more and we will get to the point.

What Makes Up Singapore’s Reserves?

After deducting the liabilities of the Government, statutory board and Government company, the remaining excess assets will be the reserves.

In short,

Reserves = Assets – Liabilities

Our Assets

With little resources, Singapore’s reserves are made up of land and financial assets.

| Assets | Examples |

|---|---|

| Financial Assets | Cash |

| Securities | |

| Bonds | |

| Physical Assets | Land |

| Buildings |

- The reserves is being managed by Monetary Authority (MAS) and government-linked companies such as GIC Private Limited and Temasek Holdings.

- These companies are to invest some of the reserves with the objective of generating long-term returns on assets.

- With regards to investment decisions made by GIC, MAS and Temasek, the Government has zero influence on their decisions.

Our Liabilities

The Government’s liabilities include securities such as the Singapore Government Securities (SGS) and Special Singapore Government Securities (SSGS).

When They Tap on Reserves, Is Our Cpf Money Part of It?

Now, here comes the tough question!

Before we start gathering at Hong Lim Park, it is important that we understand the fundamentals of our CPF system.

To give a quick answer, our CPF monies DO NOT make up our reserves.

This is because CPF monies are invested in securities (SSGS) issued and guaranteed by the Singapore Government. As mentioned above, securities such as SSGS is one of the government’s liabilities.

Hence, CPF is part of the government’s liabilities, and if we refer back to our previous formula of

Reserves = Assets – Liabilities

CPF is NOT part of the reserves.

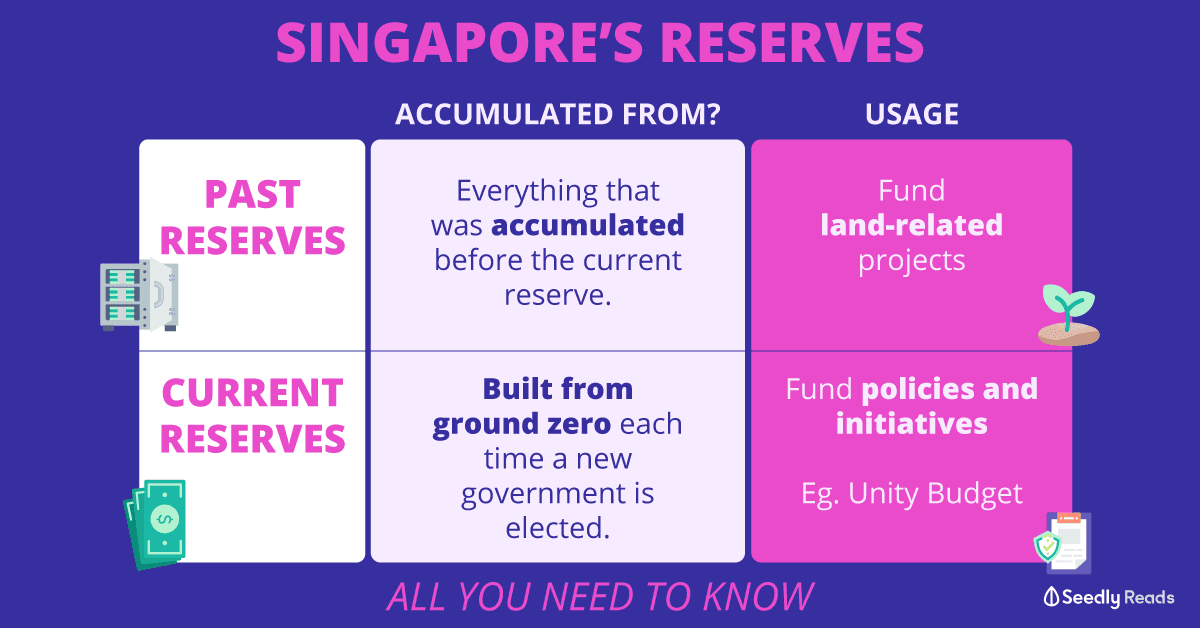

Past Reserves vs Current Reserves: What is the difference?

If you are confused about which bulk of assets falls under Current reserves and which under the Past Reserves, the answer is actually not rocket science.

Current Reserves

The Current reserves are the amount of reserve built from ground zero each time a new government is elected.

Past Reserves

The Past reserves consist of everything that was saved and accumulated before the current reserve.

Usage of Past Reserves vs Current Reserves

| Types of Reserves | Usage | Examples | After that? |

|---|---|---|---|

| Past Reserves | Used to fund land-related projects | Land reclamation Creation of underground space Selective En-bloc Redevelopment Scheme (SERS) | These fundings convert financial assets to physical assets. If physical assets were sold, money goes back to Past reserves. There will be no draw down. |

| Current Reserves | To fund some of the policies and initiatives you hear during budget. | Part of the Unity Budget announced in February 2020 | - |

Special Occasion

It is only on special occasions where a drawdown on Past Reserves can take place.

- First, a drawdown on Past Reserves happens in the occasion when the Government or a Fifth Schedule entity spends more than the reserves they accumulated during the current term of Government (Current Reserves)

- A drawdown on Past Reserves occurs when a physical asset funded is sold below its fair market value.

A Quick Timeline on the History of Singapore Reserves

To fully understand the Singapore reserves, there are a few key events to take note of.

| Date | What Happened? |

|---|---|

| August 1984 | Then Prime Minister, Lee Kuan Yew suggests giving the president of Singapore more power, to help safeguard the country's reserves. |

| Year 1990 | Then First Deputy Prime Minister Goh Chok Tong proposed the bill to create an elected presidency scheme that also comes with the power to safeguard the national reserves and the integrity of public service. |

| 3 January 1991 | The bill was passed. |

| 30 November 1991 | The bill took effect. The "two-key" system of protecting past reserves is formed. |

| Year 1999 | Former President Ong Teng Cheong worked with the government to develop the white paper, The Principles for Determining and Safeguarding the Accumulated Reserves of the Government and the Fifth Schedule Statutory Boards and Government Companies. |

| 13 May 1999 | It was approved by the Cabinet |

| 2 July 1999 | It was tabled in Parliament |

| Year 2008 | Global financial meltdown |

| January 2009 | The first time Singapore dipped into past reserves. The government sought the President’s approval to use $4.9 billion from past reserves to fund two one-off measures to boost the economy. Then President S. R. Nathan approved the request. |

| Year 2011 | The Government puts the money back into the reserves |

| Year 2020 | COVID-19 outbreak contracts Singapore's economy. The impact is said to be way worse than the 2008 Global financial crisis. |

| March and April 2020 | The government requested to tap on past reserves to provide assistance package to deal with COVID-19. President Halimah Yacob approved the draw. |

- The “two-key system” represents that the government and the president each holding one key. The government would be able to tap on past reserves only if with the approval of the president.

- The objective of the white paper, The Principles for Determining and Safeguarding the Accumulated Reserves of the Government and the Fifth Schedule Statutory Boards and Government Companies, is to put in place a guideline and prevent any significant drawdown of the past reserves without the president’s consent.

Is There a Need for Singapore to Have So Much Reserves?

The actual amount of reserves we have was never revealed to the public, but here are some numbers.

As of 31 March 2018,

- S$401 Billion: The Official Foreign Reserves managed by MAS

- S$313 Billion: Size of Temasek’s portfolio

- US$100 Billion: Assets managed by GIC

It is in the interest of Singapore to not publish the full size of reserves, simply because it can result in an attack on the Singapore dollar. With no natural resources or other assets, our reserves act as part of our defence in times of crisis.

Advertisement