Singapore’s Top 10 Dividend Shares Among the World’s Best

For our Morning Stocks Analysis, the Seedly team worked closely with MotleyFool, who is an expert in the field, to curate unbiased, non-sponsored content to add value back to our readers.

Disclaimer: This is not a sponsored post. Opinions expressed in the article should not be taken as investment advice. Please do your own due diligence.

If you have any questions on the mentioned stocks, you can ask the Seedly Community here.

There are 26 Singapore-listed shares in the FTSE All-World High Dividend Yield Index. This global dividend yield index contains 1,389 globally-listed shares that have a higher-than-average dividend yield. The index excludes real estate investment trusts (REITs) and stocks that are forecast to pay no dividend over the next 12 months.

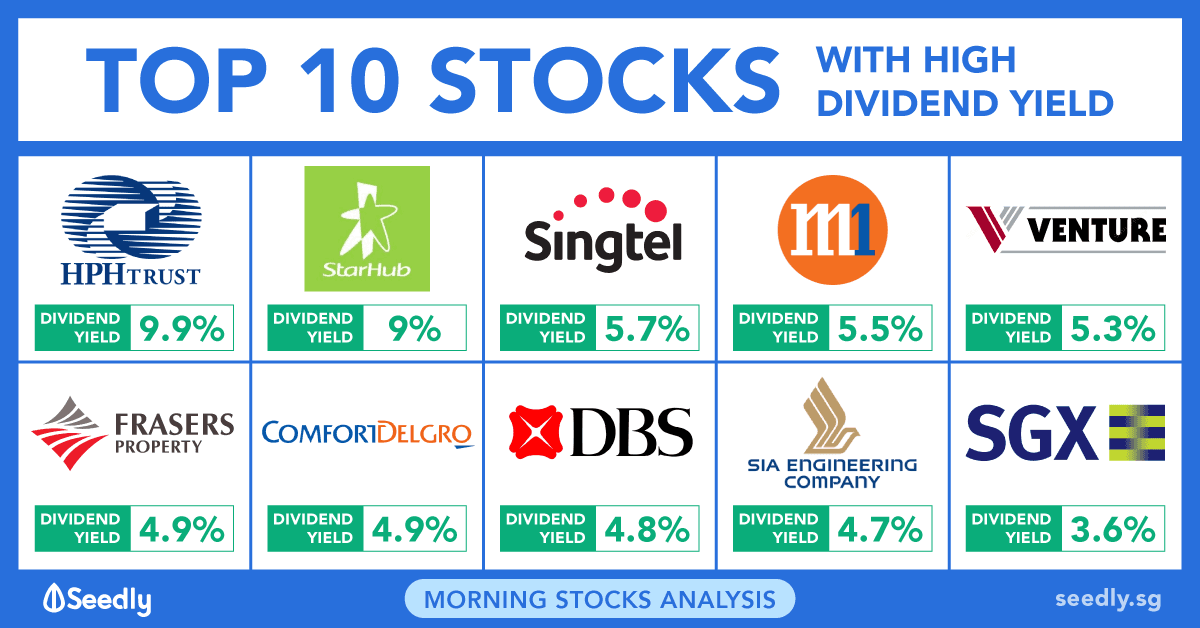

Here, let’s look at the best ten Singapore-listed companies – part of the FTSE All-World High Dividend Yield Index – that have the highest dividend yields (yield data as of 18 January 2019).

The Best of the Lot

- Hutchison Port Holdings Trust (SGX: NS8U)

- StarHub Ltd (SGX: CC3)

- Singtel Ltd (SGX: Z74)

- M1 Ltd (SGX: B2F)

- Venture Corporation Ltd (SGX: V03)

Cream of the Crop

- Frasers Property Ltd (SGX: TQ5)

- ComfortDelGro Corporation Limited (SGX: C52)

- DBS Group Holdings Ltd (SGX: D05)

- SIA Engineering Company Ltd (SGX: S59)

- Singapore Exchange Limited (SGX: S68)

1. Hutchison Port Holdings Trust (SGX: NS8U)

Taking the top spot is the Straits Times Index’s (SGX: ^STI) highest yielding component, Hutchison Port Holdings Trust (SGX: NS8U).

- The trust has a distribution yield of 9.9%.

Investors should not be misled by the high yield as the trust’s distributions have been falling of late. Distribution per unit for the trailing twelve months has declined by 33% to 19.62 Hong Kong cents from 26.10 cents in the prior period.

2. StarHub Ltd (SGX: CC3)

StarHub Ltd (SGX: CC3) comes in the second place with a dividend yield of 9%. Just like Hutchison Port, StarHub did not fare well on the dividend-sustainability front. The telco’s dividend has tumbled from 20 Singapore cents per share in 2016 to 16 cents in 2017.

For 2018, StarHub has guided for a total dividend of 16 cents.

3. Singtel Ltd (SGX: Z74)

Slotting into the third place is StarHub’s peer, Singapore Telecommunications Limited (SGX: Z74). The largest telco in Singapore has a dividend yield of 5.7%. For the fiscal year ended 31 March 2018, the telco paid a total dividend of 20.5 cents per share, including a special dividend of 3.0 cents per share.

Going forward, Singtel said that it expects to “maintain its ordinary dividends of 17.5 cents per share for the next two financial years and thereafter, will revert to the payout of between 60% and 75% of underlying net profit”.

4. M1 Ltd (SGX: B2F)

Yet another telco, M1 Ltd (SGX: B2F) is among the world’s best dividend-yielding companies with a 5.5% dividend yield. However, its dividend payout has been coming down too. In 2017, M1 decreased its total dividend to 11.4 cents per share, down from 12.9 cents per share dished out in 2016.

5. Venture Corporation Ltd (SGX: V03)

Venture Corporation Ltd (SGX: V03) takes the fifth spot with a dividend yield of 5.3%. In 2017, Venture increased its dividend payout by 20% from 50 cents per share to 60 cents per share.

The electronics services provider doled out a surprise dividend of 20 cents per share for the 2018 second-quarter. Venture last rewarded shareholders with a special dividend in 2007, when earnings hit a peak then. The company typically only pays a final dividend yearly.

6. Frasers Property Ltd (SGX: TQ5)

Coming in sixth is Frasers Property Ltd (SGX: TQ5) with a dividend yield of 4.9%. The property developer has maintained a dividend per share of 8.6 cents from FY2014 (financial year ended 30 September 2014) to FY2018. The company has a dividend policy of paying up to 75% of its yearly net profit after tax as dividends.

7. ComfortDelGro Corporation Limited (SGX: C52)

ComfortDelGro Corporation Limited (SGX: C52) is next in line with 4.9% in dividend yield. For 2017, the land transport giant upped its dividend payout to 10.4 cents per share from 10.3 cents per share in the prior year. Will the company increase its dividend again for 2018? We will know for sure when ComfortDelGro announces its full-year financial results in February.

8. DBS Group Holdings Ltd (SGX: D05)

DBS Group Holdings Ltd (SGX: D05) takes the eighth position with a dividend yield of 4.8%. In 2017, DBS’ dividend per share surged 138% to S$1.43, up from S$0.60 in 2016. The 2017 dividend includes a special dividend per share of S$0.50. Without this special dividend, the dividend in 2017 would have climbed by a lesser amount of 55% year-on-year, but still commendable nonetheless. In the second quarter of 2018, DBS paid an interim dividend of S$0.60 a share, 82% higher than the interim dividend paid in 2017.

9. SIA Engineering Company Ltd (SGX: S59)

With a dividend yield of 4.7% and taking the ninth spot is SIA Engineering Company Ltd (SGX: S59). For its financial year ended 31 March 2018 (FY2017/18), the company paid a total dividend of 13 cents per share. In FY2016/17, it dished out 18 cents per share in total dividend, which includes a special dividend of 5 cents.

10. Singapore Exchange Limited (SGX: S68)

Singapore’s bourse operator, Singapore Exchange Limited (SGX: S68), takes the final spot. The company paid out a dividend of 30 cents per share for its fiscal year ended 30 June 2018 (FY2018). The dividend payout marked a 7% increase from the dividend payment of 28 cents per share dished out in FY2017. To know more about Singapore Exchange’s dividends, such as its dividend policy and dividend sustainability.

The Foolish Takeaway

As can be seen above, companies with the best dividend yields may not necessarily make good investments. Before investing in any dividend shares, we should thoroughly research on whether their dividends are sustainable by looking at the dividend payout ratio, among other metrics. Only then can we make a holistic assessment of an income share.

As prudent investors, we should never invest based on high dividend yields alone. The dividend yield tells us nothing about the sustainability of a firm’s dividend. What we should do instead is to look for companies that can grow, or at least sustain, their dividends year-on-year. The above list, though, can serve as a basis for further research before you invest in any of them.

Seedly Guest Contributor: The Motley Fool

The Motley Fool (fool.sg) offers stock market and investing information, offering people suggestions on how to take control of their money and make better financial decisions.

The Motley Fool Singapore primarily covers the Singapore market, though we also bring investing news from around the world. We also host a range of educational content, written for everyday people. We feel that the best person to make your financial decisions is you, and we want to help you take control of your own money. The Motley Fool also champions shareholder values and advocates tirelessly for the individual investor.

Read other articles by The Motley Fool:

Advertisement