Singapore Stock Market Review This Week: CapitaLand Mall Trust Starts Trading as CapitaLand Integrated Commercial Trust

Sudhan P

Sudhan P●

Singapore Stock Market Update (Week of 6 November 2020)

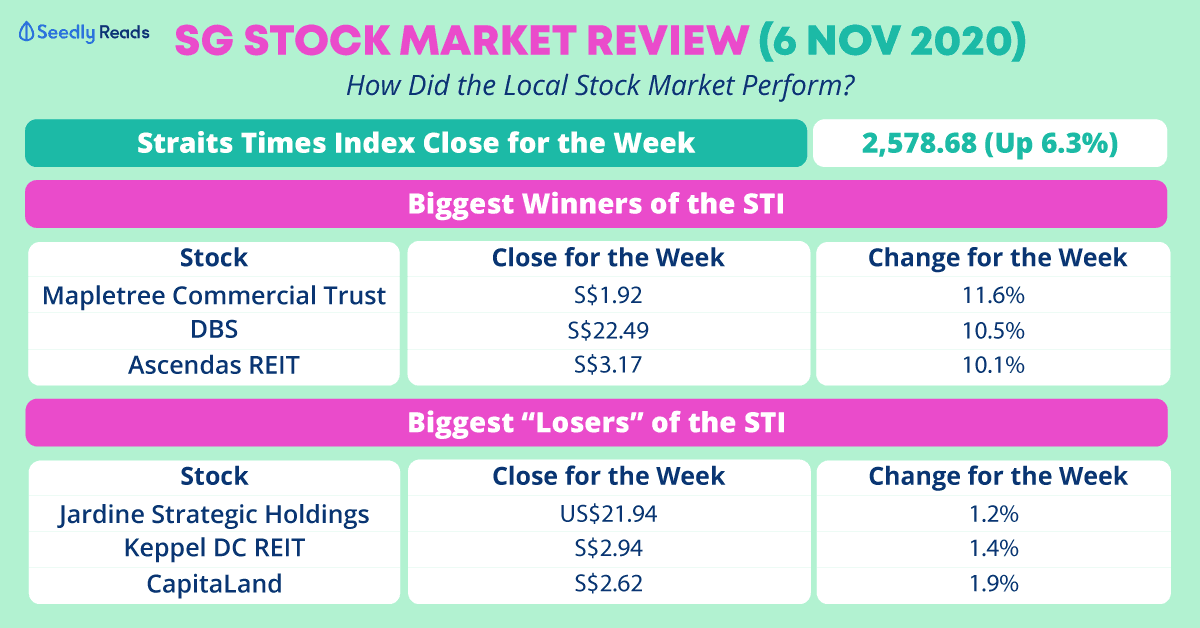

Singapore’s stock market benchmark, as represented by the Straits Times Index (STI), closed at 2,578.68 points on 6 November. It ended the week up 6.3% or around 152 points.

Surprisingly, all 30 index components were in the green this week.

The three biggest winners of the index were:

- Mapletree Commercial Trust (SGX: N2IU) — up 11.6% to S$1.92

- DBS Group Holdings Ltd (SGX: D05) — up 10.5% to S$22.49

- Ascendas Real Estate Investment Trust (SGX: A17U) — up 10.1% to S$3.17

The three biggest “losers” of the index were:

- Jardine Strategic Holdings Limited (SGX: J37) — up 1.2% to US$21.94

- Keppel DC REIT (SGX: AJBU) — up 1.4% to S$2.94

- CapitaLand Limited (SGX: C31) — up 1.9% to S$2.62

Here’s a chart showing the weekly STI movement:

CapitaLand Mall Trust Trading as CapitaLand Integrated Commercial Trust Since 3 Nov 2020

CapitaLand Mall Trust is now trading as CapitaLand Integrated Commercial Trust (SGX: C38U) (CICT) under the same stock code.

This comes after the successful merger between CapitaLand Commercial Trust and CapitaLand Mall Trust.

CICT is one of the biggest real estate investment trusts (REITs) in the Asia Pacific region and the largest REIT in Singapore by market capitalisation and total portfolio property value.

Valuation Data of the Straits Times Index

The SPDR STI ETF (SGX: ES3), an exchange-traded fund (ETF) that can be taken as a proxy for the index, ended the week with the following valuations:

- Price-to-earnings ratio — 12.1x

- Price-to-book ratio — 0.88x

- Dividend yield — 4.4%

SeedlyReads Investment Content for the Week

In case you missed out, here are some of the investment articles published during the week:

- Thinking of Investing in Stocks? You Should Consider Doing These First…

- Invest Well and Do Good: A Beginner’s Guide to ESG Investing

- ETFs in Singapore (SGX): What Investors Should Know

- What is The Perfect Number of Stocks to Have in Your Portfolio?

- 5 Growth Sectors to Consider Investing in for 2021 and Beyond

- Jack Ma’s Ant Group’s Giant IPO Suspended (4 Nov 2020 Update)

- DBS, OCBC and UOB: How Did They Perform for 2020 Third-Quarter?

- 3 Major Risks to Know About Nanofilm Technologies International Ltd (SGX: MZH)

Have Burning Questions Surrounding The Stock Market?

Why not check out the SeedlyCommunity and participate in the lively discussion regarding stocks!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the companies mentioned.

Advertisement