What have you been doing with your monthly salary?

If you have been diligently following the 50/30/20 rule on allocating your salary where:

- 50% for expenses

- 30% to be set aside for wealth growth and investment

- 20% goes into savings

Then congratulations. You’re on the right track.

For reference, the median household income per household member is $2,792. That amount is also close to what most fresh graduates might be looking at for their first job.

So assuming you stick closely to the budgeting percentage of 30% for wealth growing. You should have saved slightly more than $10,000 after 13 months.

Recently, we asked some of the most established professionals and individuals, in the booming Singapore internet finance scene, the million dollar question: Where will they invest their “first” $10,000?

Bookmark this article because we will constantly update it with perspectives from more of your favourite speakers, bloggers, and personalities from the personal finance scene.

Brace yourself, as it’s going to be a helluva ride!

Editor’s note: We cannot stress enough how important it is to do your due diligence before investing, and the fact that whatever is shared here is NOT to be taken as investment advice.

For the more pedantic individuals questioning, “What exactly is ‘do your due diligence’?!”

Well… If you’re the type to blindly follow whatever you read off the internet and throw money at it… *sigh* Let’s just say that the world’s a much, MUCH harder place. So just maintain a healthy dose of scepticism, alright?

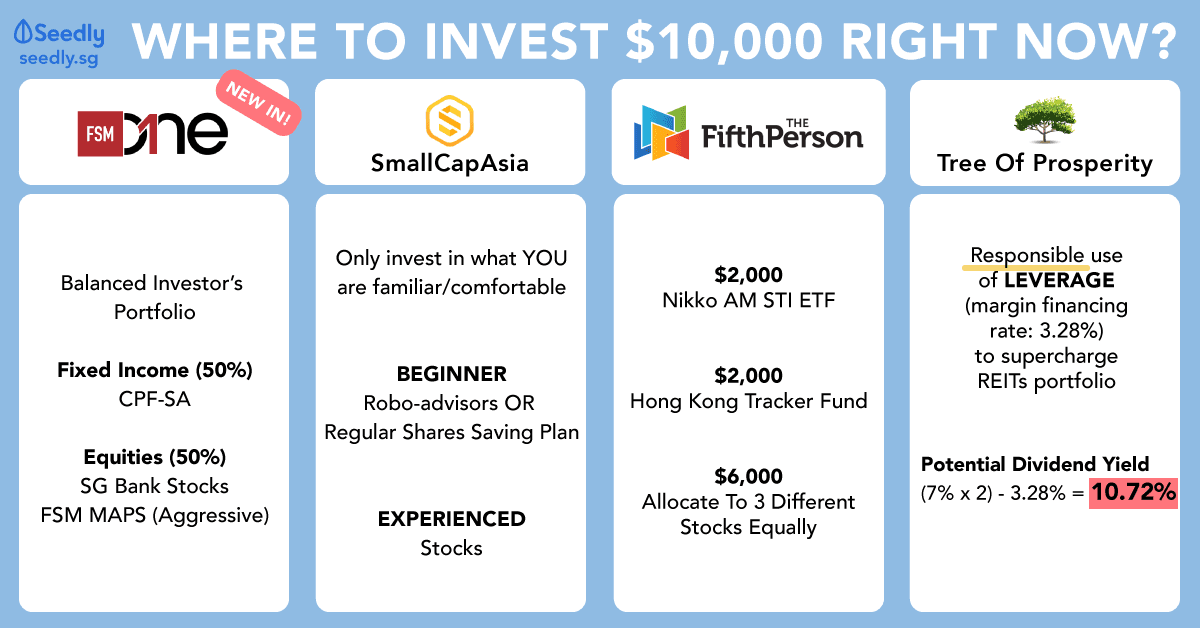

TL;DR: Where To Invest $10,000 Right Now?

Read perspectives from:

FSMOne

I was recently approached by a family member who is keen to put some money into investments. Her objective is simple: earn a higher return than the banks’ negligible interest rates.

We can all agree that the banks’ interest rates are unappealing and the reason why we keep our monies there is that we have bills to pay and usually have set up some form of GIRO arrangement for necessities like our insurance companies or mortgage loans.

I think in Singapore, most of the people know this fact very well. So the question is how, what, and where to put our hard-earned savings to work?

The Approach

While she is relatively new to investments, she has heard about Singapore Savings Bonds (SSBs) and she understands that it is an almost risk-free financial instrument with a potential annual yield of higher than 2%.

Additionally, she is also considering topping up her own CPF-SA because this was highlighted in a recent Straits Times article about tax savings and how to build your retirement portfolio.

From the information I gathered, I presume that she is looking for something that is conservative but is still able to generate higher returns than the banks.

I proceeded to ask her a couple of questions:

- When do you need this sum of money?

- Can you accept some form of risk?

- What kind of returns are you looking at?

She replied:

- I do not need this sum of money for the next 10 years or more

- I can accept risk; maybe just a 10% loss

- I just want a higher interest than the banks’ interest rates

I thought that this would be quite a simple undertaking because:

- Beating the banks’ interest rates will not be too difficult

- The level of risk she is willing to take is acceptable

- The investment horizon is long

Nevertheless, I told her that I will think about it and will propose some ideas for her to consider.

To be clear, this family member is relatively new to investment and does not know anything much about stocks, ETFs, and bonds apart from a Regular Savings Plan which she has been actively contributing to.

The Research

Thinking of the possible options available for a new investor as well as her considerations in mind, I decided to construct a diversified portfolio rather than putting all the eggs into one basket. Here’s what I came up with:

- Dividend-paying Blue Chip Stocks

- Funds

- Managed Portfolios aka robo-advisers

- Retirement Sum Topping-Up Scheme (top up to CPF-SA)

- Retail Bond e.g. SIA retail bond (5 years)

- Singapore Savings Bond (SSB)

Based on these available options, I can probably allocate the investable amount into three types of investments:

- Conservative investment instruments that provide stability during volatile market conditions

- Products that can outperform during favourable market conditions and are resilient during market downturns

- Products that could generate higher returns but may also have higher volatility

This is similar to how FSMOne determines a client’s risk profile and does investment allocations based on it.

For this family member, I’m taking a balanced investor approach because in-depth information relating to her risk appetite is lacking, the investment time horizon is long and ultimately, she is new to investing. The balanced investor approach means that I will recommend for her to allocate 50% in equity and 50% in fixed income. Subsequently, she can allow for a +/- 10% overweight or underweight in equity or fixed income.

Now, let’s look at some facts:

| Product | Yield/Past Performance (annualised) | Expected Duration | Additional Notes |

|---|---|---|---|

| Singapore Savings Bonds (SSBs) | 2.49% | 10 years | Can withdraw anytime before maturity but subjected to lower yield |

| CPF-SA | 4% | Until age 65 | Tax relief benefit |

| SIA Retail Bond | 3.03$ | 5 years | - |

| Portfolio of SG Banks Stocks (DBS, OCBC, UOB) | Refer to Appendix | Can be sold any time | Dividends expected on a quarterly basis |

| First State Bridge (recommended balanced fund) | Year-To-Date (YTD) return: 5.17% 2018: -2.82% | Can be sold any time | Dividends expected on a semi-annual basis |

| FSM Managed Portfolio | YTD return: 6.1% (Balanced Growth) | Can be sold any time | Portfolio management team will decide the allocation |

Note: information correct as of 22 March 2019

The Elimination

Before I start to evaluate what are the options for the portfolio, let’s start with why I remove some options and why they were there in the first place.

SIA Retail Bonds have been discussed widely, and since SIA is a household name for many, I included this retail bond into my consideration. However, my relative has a considerable investment horizon so after five years, she will face the issue of having to reinvest into something else at that point in time so I removed the bond from the final portfolio allocation.

Ultimately, I was looking at a portfolio with a 10-year time horizon.

One of the funds that I suggested was First State Bridge. This is one of FSMOne’s recommended funds for many years. The fact that it has existed for so long is a testament to its ability to manage risks and yet be able to generate consistent outperformance over the years (Editor’s note: although historic performance should never be taken as an indication of future performance).

Coincidentally, my relative is not new to this fund because she has an existing RSP which invests in this fund, and it has been performing very well for her. On that basis, I decided not to add to her existing investments and look at alternatives instead.

The Portfolio

Armed with this information, I started to sketch out what the portfolio should look like – bearing in mind that the investable amount is quite small.

So let’s start with the easiest part: 50% in fixed income.

I thought that the SSB option was quite attractive given that interest rates have gone up. However, I noted that the investor has to open a CDP account and knowing that she is quite clueless about these things, I decided to skip this option.

Next, I contemplated getting her to top up her CPF-SA because 4% per annum guaranteed is quite attractive.

The downside is that this amount of money will be locked in until she is 65 (assuming no change in CPF policy rules). I mentioned this to her and she is quite happy to let the returns compound until she is 65. She is also aware that she will receive a tax benefit from this top up. For the unaware, she will get a one-time tax relief capped at $7,000 for the amount that she tops up to her own CPF-SA.

Based on that, I will use CPF-SA as the 50% fixed income allocation and work on the next 50% on equity. Since CPF-SA provides a very stable foundation, I can suggest a more aggressive approach on the equity portion.

I decided to look at SG banks because I believe that there is ample room for their growth. I also noted that the average forward dividend yield is about 4%, which is quite decent. Coming from a Singaporean’s perspective, I think it is easier for her to relate to the local banks and invest in them.

I ultimately chose OCBC Limited (SGX: O39) because of its favourable outlook, and its investable amount is within the total amount for the portfolio.

After deciding on CPF-SA and OCBC, I decided to look at the FSM Managed Portfolios (FSM MAPS) because it has a focus on Asia (excluding Japan), China, and technology. These are potential growth sectors which can potentially generate excess returns.

FSM MAPS is also handled by a team of investment professionals who look at it on a daily basis, and are in the best position to analyse and make the right calls to rebalance the portfolio when necessary. The best thing about this is that she does not need to look at her funds so closely and she can rest easy knowing that her money is well taken cared of by a team of professionals.

With that being said, here’s how the sample portfolio will look like:

| Product | Allocation | Invested Amount |

|---|---|---|

| CPF-SA | 50% | $5,000 |

| OCBC Limited Stocks | 25% | $2,500 |

| FSM Managed Portfolios (Aggressive Growth) | 25% | $2,500 |

The Summary

With this portfolio, I am confident that she will be satisfied with her returns 10 years from now:

- CPF-SA provides the foundation

- OCBC is the base which will generate returns during favourable market conditions while remaining resilient

- FSM Managed Portfolios (Aggressive Growth) is the aggressive approach to deliver higher returns (which also comes with higher volatility)

In fact, this portfolio can be replicated quite easily if you have some knowledge of the products and what you are investing in.

We often scratch our heads and are unsure on how to get started, but its not that difficult. We just need to ask ourselves a few simple questions:

- Do I need the money any time soon?

- How much loss can I accept until I cannot sleep at night?

- What are my financial objectives?

Appendix – SG Banks’ Performance

A comparison of the 3 banks’ performances on a year-to-date (YTD) basis and 2018 respectively.

Contributed by: Roger Leng, Assistant Director, Content & Marketing at iFAST Corporation Ltd.

SmallCapAsia

Ah… $10,000. The magic number that many people set aside to get started on their first try at investing.

I first started investing (okay… stocks trading) with whatever savings I could garner from my part-time work at McDonald’s and Popular Bookstore.

As you would’ve guessed, the outcome was terrible and I lost a 5-figure sum.

My heart always sinks whenever I think about the money I lost and how many hours were spent working at $5 per hour jobs just to lose it all, almost a decade ago. Come to think of it, I didn’t even dare to tell my parents about it.

Luckily, I didn’t give up.

After years of experience and finally coming up with my own investment plan, I would say that I am much better off now…

.

.

.

Apologies for rambling on about the bad decisions I made earlier in my investment journey. Now, let’s look at how to invest your first $10,000!

The Low-Cost Approach For Beginners

As compared to when I first started out, the investment landscape today is much more confusing with so many investment options to choose from such as robo-advisors, peer-to-peer (P2P) lending, and more.

Thus, in my own opinion, I would recommend that people start investing in something you are familiar or comfortable with.

For a start, you can go for a hassle-free low-cost approach using robo-advisors. They keep costs low by using robots or “algorithms” to invest into a mix of equities and bonds. You can even choose to diversify across geographical regions.

Another option would be investing a fixed amount into what we call a Regular Shares Savings Plan (RSSP). An RSSP allows for dollar-cost averaging and removes the need to time the market or figure out when is the lowest point to buy. It is a fuss-free way that is good for newbie investors since you don’t have to monitor the market regularly.

When You Gain More Experience

As you gain more experience, you can probably get into stock selection. While some people may stick to their passive investment methods, I personally feel that buying quality stocks can definitely reap good returns over the long run.

A simple case study here is Sheng Siong, your neighbourhood supermarket. Its share price at the time of writing is S$1.05.

Imagine just buying it when it first IPO-ed at S$0.33 in August 2011 and holding it till today…

You would have made 318% returns in about 7+ years. That translates to approximately 18% compounded annual returns, without factoring in all the yummy dividend gains along the way!

On an ending note, I am glad you took the time to read this post. Because as Benjamin Franklin said, “An investment in knowledge pays the best interest (return)”. By equipping yourself with the knowledge of various instruments and the tools you need to be successful as an investor, the better your returns will be.

Contributed by: James Yeo, Author at SmallCapAsia

The Fifth Person

2018 ended badly for the indices – the Strait Times Index (STI), Hang Seng Index (HSI), and S&P 500 all closed the year at 10.3%, 14.3%, and 9.6% down respectively due to the ongoing trade war crisis between China and the United States.

In times of uncertainty like this, it normally increases the number of opportunities to invest in the market as stock prices fall.

However, the markets have recovered quickly from this mini-crisis. In 2019, the major indices have already bounced back to their pre-trade war valuations, reducing the number of opportunities to invest in right now.

Where To Invest $10,000?

Since the markets have somewhat recovered, the question is: Where would I invest $10,000 right now?

If you’re new to investing, I think it’s important to start with something safer like investing in an index ETF while you are still learning how to analyse and invest in stocks.

In general, market indices tend to rise over the long run because the nature of an index like the S&P 500 always means the top 500 companies in the U.S. are always represented.

If a company isn’t doing well, it will eventually be replaced by a new, well-performing company ready to take its place.

I mentioned that the markets have somewhat recovered because if you look at the STI and HSI right now, they are trading at P/E ratios of 13.2x and PE 11.3x respectively.

Based on those valuations, the STI and HSI are still trading below their long-term average P/E ratios of 15x.

Of course, no one knows where the STI or HSI will be in the next year or two, but knowing that market indices usually rise over the long term and that they’re trading below their long-term averages gives you a decent margin of safety.

And of course, you cannot buy the STI or HSI directly. But you can buy a fund that mimics the index – the index ETF. When searching for the right index ETF to invest, I usually go for the lowest-cost index because saving on fees will make a big difference to your portfolio over the long term.

For the STI, I would go for the Nikko AM Singapore STI ETF because they have lower fees compared to SPDR STI ETF (though the latter is more liquid). For the HSI, I would look at the Tracker Fund of Hong Kong which has a low expense ratio of just 0.09%.

So if I had $10,000 right now, I will probably allocate $2,000 each to the Nikko AM Singapore STI ETF and the Tracker Fund of Hong Kong.

With the remaining amount, I would put it in Singapore Saving Bonds (SSBs) to earn some interest while waiting for opportunities.

The good thing about SSBs is that your capital is protected and there are no penalties for redeeming your bond early. All you need to give is a one-month notice.

Diversification

Investing is a game of probability. Not every stock that you pick will turn out to be a winner.

But if seven out of ten stocks you pick make you money, you will do very well. Of course, to ensure that the profit your seven stocks make is always more than the losses of your other three stocks, you have to invest in each of your ten stocks equally.

For instance, if seven of my equal-weighted stocks gained 50% and the other three lost 50%, I would still come out positive overall. However, if I invested 60% of my portfolio in three stocks (because I was somehow super-confident about them) that lost half their value (but ultimately wrong), the gains from my other seven stocks wouldn’t be enough to cover my losses. For that reason, I prefer to weigh my stocks equally.

Therefore, out of $10,000, if invested $2,000 each in the Nikko AM Singapore STI ETF and Tracker Fund of Hong Kong, I would still have $6,000 left over to allocate equally into three more stocks down the road if I planned to hold a total of five positions in my portfolio.

Contributed by Victor Chng, Director at The Fifth Person

Victor Chng and Rusmin Ang conduct a slew of investment-related (with a focus on REITs, growth, and income stocks) courses at The Fifth Person.

Tree Of Prosperity

The poet Homer tells a mythological tale of two sea serpents that were located on opposite sides of the Sea of Messina that were given the names Scylla and Charibdis. This is the way Ancient Greeks speak about choosing between two great evils.

Singapore Millennials face a stark choice: If they are not academically inclined and forego having a local degree, having a diploma means having a 40% probability of joining the gig economy and having a job that only pays you proportionately for the work you do. While those with degrees may find regular employment easier to obtain in their 20s, they are likely to face a moment of reckoning much later in life.

In 2018, PMETs with degrees in their 40s are prime targets for retrenchment exercises.

Therefore, in the best case, a Millennial has about 15 years to make good with their investments before their career begins to fade.

Is $348,752.20 At Age 40 Enough?

If we invest at 8.87% returns (which was representative of the STI ETF for the past 10 years up till December 2018 ) by setting aside $1,000 a month, a Millenial who starts work at 25 can accumulate about $348,752.20 at age 40.

This is hardly enough to generate enough dividends to pay for their monthly expenses as the STI ETF yields about 3.5% – you can expect $12,206.32 per year.

As such, we have a generation of workers that may find that they have to accept an amount of risk that previous generations would baulk at.

Responsible Use Of A Leveraged Portfolio

Responsible use of a leveraged portfolio that consists of real estate investment trusts may allow a Millennial to mitigate the career risk in their forties.

If you do wish to introduce leverage into your account, you should limit yourself to borrowing $10,000 from the broker if you only have $10,000 to spare.

Constructing a REIT portfolio to yield 7% with a margin financing rate of 3.28% means that after applying leverage, you can increase your dividend yields to (7% x 2 – 3.28%) or 10.72%.

Accumulating $1,000 for 15 years will allow you to accumulate $403,736.53, but your annual dividends from this arrangement are now much higher at $43,280.

Having $3,600 of extra income a month is definitely enough to mitigate the risk of retrenchment from the workplace.

At this point, number savvy folks will note that in my example I have excluded capital gains in my leveraged REIT investing strategy. Disclaimer: I am not a purveyor of financial pornography.

A back-tested strategy investing in 19-20 of the highest yielding REITs for the past 10 years would have resulted in returns over 18.45% with a standard deviation lower that of buying all the blue-chips in the STI in equal weights.

Leverage, when used irresponsibly, can result in a margin call that would ultimately destroy 60% of your portfolio value. This is a Dark Art that needs to be used with care.

Only portfolios that are tested to outperform the markets at lower risk should be introduced into a leveraged portfolio.

Christopher Ng Wai Chung conducts an Early Retirement Masterclass with Dr Wealth.

Advertisement