Singlife Account June 2023 Update: Is This Capital Guaranteed Insurance Savings Plan Worth It?

Singlife Account Changes: Singlife Debit Card to be Cancelled on 6 July 2023

If you’re a Singlife user, here is some bad news.

In an email to users, Singlife announced that they would be cancelling the Singlife Debit Card from 6 July 2023:

But all is not lost.

You still have the Singlife Account insurance savings plan with a decent crediting rate for your cash.

Here’s all you need to know!

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

TL;DR: Singlife Account Review — Singlife Rates, Singlife Promotion and More

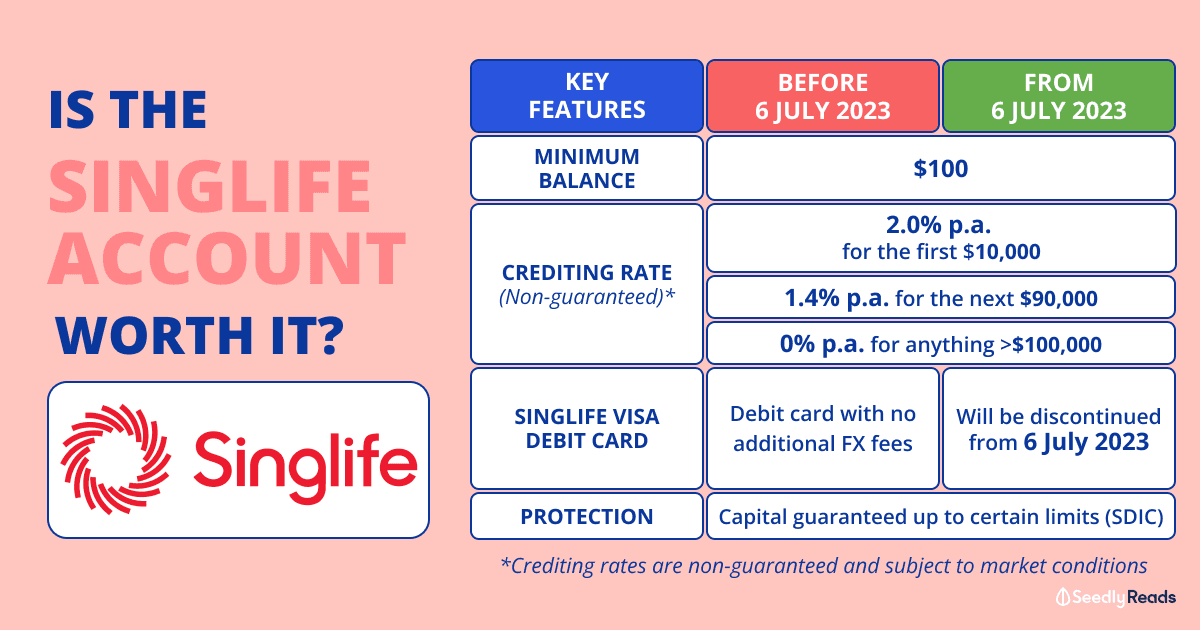

| Key Features | Details (With Effect From 1 Jul 2021) |

|---|---|

| Minimum balance | $100 |

| Crediting Rate (Non-Guaranteed) | 2.0% p.a. for the first $10,000 |

| Up to 1.4% p.a. for the next $90,000 | |

| 0% p.a. for anything above $100,000 | |

| Bonus "Special Incentive "Campaign | Up to $810 bonus for the first 1,000 Singlife Account customers who top up $10,000, $30,000 or $50,000 every month |

| Bonus "Sure Invest Bonus Return" Campaign | Bonus internet of 0.50% p.a. on the first $10,000 if you sign up for a Singlife Sure Invest Investment Linked Policy (ILP) |

| Bonus "Top Up" Campaign | Bonus interest 0.50% p.a. interest on your Singlife account when you make a net top-up of at least $800 every month |

| Life insurance coverage for death | Up to 105% of account value |

| Overseas spend on Singlife Visa Debit card (Will be cancelled from 6 July 2023) | No additional FX charges on overseas spend |

| Coverage | Covered by PPF Scheme* |

*The Singlife Account insurance savings plan is protected under the Policy Owners’ Protection (PPF) Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). The PPF Scheme provides 100 per cent protection for the guaranteed benefits of your life insurance policies, subject to caps where applicable. As the Singlife account is a universal life plan (as stated in the product summary), this puts it under the individual life and voluntary group life policies excluding annuities)

According to SDIC, the amount insured (amount deposited) has a guaranteed surrender value at the point of failure that is capped at $100,000. There is also a cap of $500,000 for the aggregated guaranteed sum assured. The coverage is automatic, and no further action is needed from you. You can also check out the SDIC site or the Life Insurance Association (LIA) site for more information about the benefits and caps of the PPF scheme.

Click to Teleport

- What is the Singlife Account?

- Singlife Promotion: How to Earn Bonus Interest on Your Singlife Account Balance

- Additional Features: Life Insurance Coverage

- Singlife Debit Card and Singlife Payment Method (Will be Cancelled From 6 July 2023)

- Pros and Cons of Singlife Account

- Is Singlife Safe?

- Singlife Savings Account Alternatives

What is the Singlife Account?

Singlife is positioning the Singlife account as capital-guaranteed insurance savings plan with no lock-in or fees.

If that’s not enough, they even have the Singlife Visa debit card: a Visa card that can be used as a worldwide multi-currency card with no additional FX fees and zero annual fees.

But unfortunately, the card will be cancelled from 6 July 2023.

So many features…

Now, allow us to break it down for you.

Singlife (Interest Rate) Account Rate of Returns

As of 8 June 2023, you will enjoy a return of 2.0% p.a. for the first $10,000 and 1.4% p.a. on the next $90,000 in your Singlife account.

This means that the blended interest rate will be up to 1.46% p.a. for the first $100,000 in the account.

But, any amount above $100,000 in the account will not earn any interest.

Here’s an example of how this works:

Also, do note this rate of returns is not guaranteed and may fluctuate according to economic and market conditions.

Singlife Account Registration Process

The registration process for the account is through their mobile app, another plus point for millennials and fintech lovers.

Singlife Minimum Balance

Also, here are some terms and conditions which you need to take note of:

- You will need to deposit a minimum amount of $500 to activate the account.

- But you will only need to maintain a minimum account balance of $100 required to enjoy the basic benefits of the account. There will also be no fall-below fee even if your balance falls below that amount.

Singlife Promotion: How to Earn Bonus Interest on Your Singlife Account Balance

Want to earn more interest on your Singlife account?

Well, here’s how you can earn up to 3.5% p.a.* on the first $10,000^ in your Singlife account:

*Up to 3.5% p.a. = 2% p.a. (promotional base return on first $10,000 of Account Value) + Cash Bonus from the Singlife Account Special Incentive Campaign + 0.5% p.a. bonus return from the Singlife Sure Invest Bonus Return Campaign + 0.5% p.a. bonus return from the Singlife Account Top-up Campaign. All campaigns are available from now until such time as updated by Singlife.

^On your first S$10,000. For amounts above $10,000, up to $100,000, enjoy a base return of 1.4% p.a. Available until such time as updated by Singlife.

1. Singlife Account Special Incentive Campaign

From 1 October 2022, Singlife is giving away up to $810 bonus exclusively to the first 1,000 Singlife Account customers every month who top up their Singlife Account with a minimum sum of $10,000, $30,000 or $50,000 and maintain the amount in their Singlife Account for at least 12 months:

Singlife Login Into Singlife Online / Singlife Portal

Simply follow the steps below and stand a chance to have up to $810 credited to your Singlife Account:

- Step 1: Log into your Singlife App and top up $10,000, $30,000 or $50,000 (the “Top-up Amount”) in your Singlife Account during any of the Qualifying Periods.

Note that the Top-up Amount should not originate from the withdrawal and redeposit of your existing Singlife Account. - Step 2: Maintain this Top-up Amount in your Singlife Account for at least 12 months (the “Holding Period”). Withdrawing the amount during the Holding Period will disqualify you from the Giveaway.

The first 1,000 customers who complete Steps One and Two every Qualifying Period will be eligible for the following bonus credited into their Singlife Account (the “Bonus”)

Top-up Tier Top-up Amount and Bonus:

- Tier 1: $ 10,000 to $ 29,999.99 — $50

- Tier 2: $30,000 to $ 49,999.99 — $430

- Tier 3: ≥$50,000 — $810.

All participants who are eligible for the Bonus will be notified that they have received the Bonus in their Singlife Account via push notification and/or email within two months after the month the abovementioned steps are completed.

This Campaign starts on 1 October 2022 and will continue until such time as updated by Singlife.

2. Singlife Sure Invest Bonus Return Campaign: Pay Singlife Premium Payments on Singlife Sure Invest

There’s also the Singlife Sure Invest programme.

You’ll get additional bonus internet of 0.50% p.a. on the first $10,000 if you sign up for Singlife Sure Invest, ‘an investment-linked life insurance plan that provides a flexible combination of investment and protection, including death and terminal illness benefits.’

3. Singlife Account Top-up Campaign

Last but not least, you’ll get an additional 0.50% p.a. interest on your Singlife account when you make a net top-up of at least $800 every month:

Additional Features: Life Insurance Coverage

There will also be a life insurance coverage element for Singlife Account.

This means that upon death, up to 105% of your account value in your Singlife Account will be passed to your loved ones.

Here’s a more detailed explanation of the life insurance coverage in the event of death or terminal illness:

| In Event of Death or Terminal Illness | Death Benefit |

|---|---|

| Before the policy anniversary on which account holder’s age last birthday is 61 | The sum of: - account value AND - 5% of account value or $50,000, (whichever is lower) |

| On or after the policy anniversary on which account holder’s age last birthday is 61 | The sum of: - account value AND - 1% of account value or $50,000 (whichever is lower) |

This means that the additional 5% death benefit coverage is only for account holders who are before the age of 61. The benefit becomes 1% after the age of 61.

Here is an example of this:

Singlife Debit Card and Singlife Payment Method (Will be Cancelled From 6 July 2023)

You will be able to apply for a Singlife Visa Debit card upon account opening. This card can be used worldwide with no additional FX fees and zero annual fees.

For overseas transactions through the Singlife Card, there will be an option for you to either make your payment in Singapore Dollars or in foreign currency at the point of sale.

But as mentioned above, the card will be cancelled from 6 July 2023.

Pros of Singlife Account and Singlife Debit Visa Card

Here are some pros of the Singlife Account and the Singlife Visa Debit card combination for those who are considering signing up for it:

- It is quite a worry-free product, given that there is no fees and no minimum condition to meet.

- Up to 2.0% p.a. return on the first $10,000 is decent

- Life insurance in the event of death is also something unique to make sure your loved ones are taken care of

- Everything is done through the Singlife app, which means convenience for users.

Cons of Singlife Account and Singlife Debit Visa Card

There are also some considerations which Singaporeans should pay attention to:

- Most of the benefits come with terms and conditions, so do your research and calculations before deciding

- With the removal of the Singlife Visa Debit card, the functionality of the account has been reduced to only an insurance savings plan which is meh

- The 2.0% p.a. return on savings is only applicable to the first $10,000, which is a little low compared to the alternatives in the market.

Is Singlife Safe?

In case you were wondering, Singlife has a Monetary Authority of Singapore (MAS) license to sell insurance, advise on investment products and is licensed as a Major Payment Institution:

The company is also rated BBB+ by Fitch.

Singlife Savings Account Alternatives

Now that the Singlife account has been nerfed, an alternative would be high-interest savings accounts. But you might need to jump through a few hoops to get the highest interest rate possible. The interest rate is also not guaranteed:

For example, with the UOB One account, you can get a blended 5% p.a. interest on the first interest on the first $100,000, provided you credit your salary and spend $500 a month on eligible cards.

Are You a Singlife Account User?

What is your experience with this insurance savings plan? Share your thoughts and help out fellow community members on Seedly!

Related Articles:

Advertisement