Solidarity Budget 2020

The year 2020 has proven to be a very different year with what is going on around the world.

This is also the first time Singapore will be releasing three Budget statements in less than two months. We first had the Unity Budget 2020 in February, Resilience Budget in March 2020, targetting at helping Singaporeans cope with COVID-19, followed by the Solidarity Budget in April.

With Circuit Breaker to take place tomorrow, the Solidarity Budget look to provide assistance for Singaporeans who are affected by this pandemic. Short-term pains are necessary to prevent long-term damages on the economy.

Objectives of Solidarity Budget 2020

- To save jobs and protect the livelihoods of Singaporeans

- Help affect businesses stay afloat

- Help households in a more direct way (cash)

For Affected Businesses

To help affected businesses and sectors stay afloat, the government will increase support in 3 different areas.

- Cash

- Cost of operating

- Credit

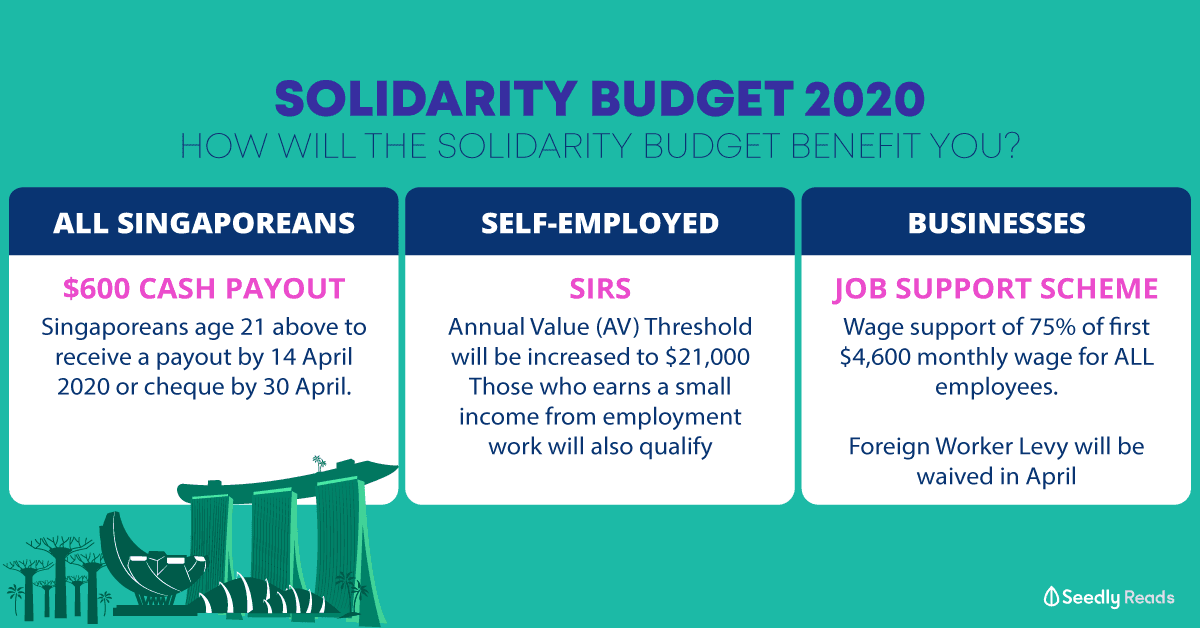

1) Increase Wage Support

With this, the government will look to increase wage support for all firms to 75% of gross monthly wages for the month of April.

After which, it will revert back to the original 75% will be for aviation, accommodation and tourism sectors, 50% for the food services sector and 25% for all other sectors. This budget will remove all the differentiation of sectors.

Do take note that this support will apply to the first $4,600 monthly wages (which is based on median or full time employed residents).

The payment will be brought forward to April 2020, as early as next week.

It will be received through GIRO or cheque. Companies are to refrain from putting employees on No Pay leave or Retrenchment.

2) Support for Employers with Foreign Workers

Foreign Worker Levy will be waived in April 2020.

There will also be a Foreign Worker Levy Rebate of $750 for each work permit or S Pass holders which will be received on 21 April 2020.

This is to help employers resume business once the Circuit Breaker is lifted.

3) Helping with Business Cost

There will be a bill to support tenants.

This will come in form of:

- Property Tax Rebate for non-residential and retail properties. The rebate should be passed to tenants.

- There will also be an increase in full rental waivers for industrial, office and agricultural.

4) Enhancing Financial Support for Enterprises

To help with the credit of businesses, there will be a temporary bridging loan programme such as SME Working Capital Loan.

Banks and finance companies can apply as well.

For Self Employed Person or Freelancers

There will be an improvement to Self-employed Person (SEP) Income relief Scheme or what we know as SIRS.

This is an attempt to reach out to more Self-employed Person and freelancers to help deal with this tough period of time.

Here are the changes:

- Annual Value (AV) Threshold will be increased to $21,000 instead of the initial $13,000

- Self-employed Person (SEP) and Freelancer who earns a small income from employment work will also be automatically included for this Relief Scheme.

- Other criteria remain unchanged

Eligible Singaporeans will receive 3 quarterly cash payouts of $3,000 each in May, July and October 2020.

For All Singaporeans

All Singaporeans aged 21 and above in 2020 will receive a $600 cash payout.

Do note that Singaporeans above 21 years old will receive a Solidarity Payment of $600 on 14 April 2020. The Solidarity Payout is made of of a NEW $300 and a brought forward of $300 from Care & Support that was suppose to be dispatched in August 2020.

To give an overview on how much cash payout you will receive, here’s a clearer illustration:

| Assessable Income for YA 2019 | $28,000 and below | Above $28,000 to $100,000 | More than $100,000 (or own more than 1 property) | Paid When? | |

|---|---|---|---|---|---|

| For Singaporean adults, 21 years and older in 2020 | Solidarity Payment (additional $300 top-up by Government) | $600 | April 2020 | ||

| Care and Support – Cash | $600 (originally $900 but $300 brought forward to Solidarity Payment) | $300 (originally $600 but $300 brought forward to Solidarity Payment) | $0 (originally $300 but $300 brought forward to Solidarity Payment) | June 2020 | |

| For Singaporean parents with at least 1 Singaporean child, 20 years and below in 2020 | Care and Support – Cash (Parents) | $300 | |||

| For Singaporeans, 50 years and older in 2020 | PAssion Card Top-up (in cash) | $100 | |||

This will be credited into your bank account by 14 April 2020.

Singaporeans who have yet to register their bank account with the government will receive it in cheque by 30 April 2020.

Do use the cash payouts and benefits sparingly. As for now, stay safe and make good personal finance decisions everyone!

Advertisement