A Singaporean's Guide To STI ETF: Is SPDR STI ETF or Nikko AM STI ETF Better?

Imagine this.

You’ve decided that you’re going to start investing in the Straits Times Index (STI).

But you don’t have enough capital to buy individual stocks and you realise that it’ll take a lot of effort to replicate the index exactly.

You research and read Seedly’s investment articles and you:

- Believe that index investing is a good fit for your investment strategy and time horizon

- Know that the STI ETF is a simple way to invest in Singapore’s top 30 companies

- Understand the difference between Dollar Cost Averaging (DCA) and Lump Sum Investing

But wait…

You now discover that there are two STI Exchange-Traded Funds (ETFs) to choose from:

- SPDR STI ETF (SGX: ES3)

- Nikko AM STI ETF (SGX: G3B)

So what’s the difference between these two STI ETFs?

Which is better?

Should you even invest in STI ETFs in the first place?

Let’s find out.

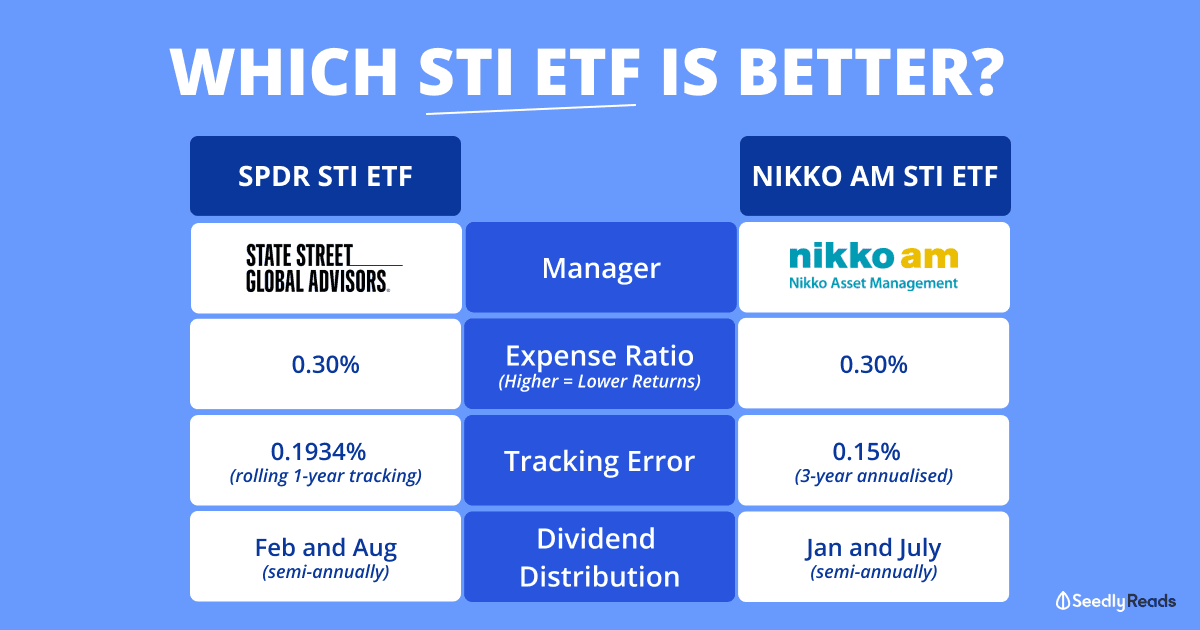

TL;DR: What’s the Difference Between SPDR STI ETF vs Nikko AM STI ETF?

The key differences between the two STI ETFs are in their:

- fund size

- expense ratio

- tracking error

- dividend distribution

SPDR STI ETF Nikko AM STI ETF What's The Significance?

Fund Size

(Assets Under Management)S$1,629.6 million

(as of 23 Aug 2021)S$578.5 million

(as of 23 Aug 2021)A larger fund size does not mean better performance.

Total Expense Ratio 0.30% 0.30% A higher expense ratio will eat into your returns.

Tracking Error 0.1934%

(rolling 1-year tracking)0.15%

(3-year annualised)Reports the difference between what how the fund does against the benchmark index

Dividend Distribution Semi-Annually

(usually Feb and Aug)Semi-Annually

(usually Jan and July)Not much? Just when you get paid.

Note: All information are cited from the respective fund’s factsheet correct as of 31 July 2021.

The Difference Between SPDR STI ETF And Nikko AM STI ETF

SPDR STI ETF is managed by State Street Global Advisors Singapore Limited.

On the other hand, Nikko AM Singapore STI ETF is managed by Nikko Asset Management Asia Limited.

Apart from the fact that both STI ETFs are obviously managed by different, reputable fund managers.

Here’re the differences that matter.

1. Fund Size

Even though SPDR STI ETF is almost three times the size of Nikko AM STI ETF, a large fund size doesn’t automatically mean that it’s better.

It just means that SPDR STI ETF has been around for much longer.

It was incepted in 2002 as compared to Nikko AM’s offering, which was only incepted in 2009.

And is, arguably, more popular.

And rightfully so, because larger funds are usually seen as more stable and are preferred because they can enjoy economies of scale.

If you’re going, “Simi economies of scale? Can explain, please?”

Sure.

Think of it this way.

All ETFs have an operating expense, and if this expense is spread over a larger asset base like in a larger fund, then it reduces the overall expense ratio.

The bottom line is, you can’t pick a random large-size fund and say that just because it’s large, therefore it must be good.

Conversely, you can’t discredit a smaller fund based on its size, especially if it has good performance or (sometimes) a lower expense ratio.

2. Expense Ratio

Back in 2018, the expense ratio for the ETF managed by Nikko AM was 0.33%.

That was slightly higher than the expense ratio of State Street’s offering which was 0.30%.

That may not seem like much but any investor worth his or her salt will tell you that higher expense ratios always eat into an investor’s returns.

Assuming you have an initial investment of $10,000 and plan to contribute $1,000 a month for a period of 25 years.

The first fund you choose is growing at 8% per annum, with an expense ratio of 0.3%. While an alternative fund is also growing at 8% per annum, but with an expense ratio of 0.33%. This is what it looks like:

To put it simply, that seemingly small amount of 0.03% amounts to a difference of $4,621 paid in fees over a span of 25 years.

That’s money which could be invested to allow you to accumulate an even larger fund balance (read: more money for your retirement).

When it comes to ETFs, investors are generally advised to buy one with the lowest fees.

From both funds’ latest factsheets, the expense ratios for SPDR STI ETF and Nikko AM STI ETF are the same at 0.30%.

3. Tracking Error in STI ETF

An ETF’s degree of tracking error tells us how much its performance deviates from the underlying index’s actual performance.

For reference:

- SPDR STI ETF has an annualised tracking error of 0.1934% (rolling 1-year tracking)

- Nikko AM STI ETF’s is 0.15% (3-year annualised)

Overall, both STI ETFs’ tracking errors are almost negligible.

But if you’re wondering why they’re different and why that matters.

Here’s why.

The Problem of Owning Constituent Stocks When the STI Changes

When the STI adjusts its constituent stocks — including how much it holds in each.

It will take time for the ETF managers to react.

Since they’re relatively large funds, any changes in their constituent stocks will result in large buy and sell orders.

And large orders may not be fulfilled easily.

This is why there might a slight difference in their holdings vs their benchmark.

Transaction Costs

When the benchmark changes, an ETF manager will have to decide if it makes sense to follow.

This is because the buying and selling of stocks will incur transaction costs — which are ultimately passed down to the investors.

The STI, on the other hand, doesn’t have to contend with this and can change immediately.

As a result, this might become a situation where say…

An ETF holds onto a higher percentage of a stock constituent than the benchmark index it is tracking.

And if that particular stock does really well in the market, the tracking error might seem higher than usual…

But if you look at the fund’s overall performance, it actually outperforms the index it is tracking.

And vice versa.

So How?

Overall, tracking error can be viewed as an indicator of how actively a fund is being managed as well as for investors to get a sense of its corresponding risk level.

It’s not a straightforward indicator of whether an ETF is better than another.

4. Dividend Distribution: Does the STI ETF Give Dividends?

Singapore investors love dividends.

So it’s a good thing that both SPDR and Nikko AM STI ETFs pay out dividends on a semi-annual basis.

However, both pay their investors at different times of the year.

FYI: Both funds will take their fees from the dividends before distribution to you as an investor.

But the good thing is that since both STI ETFs’ expenses are relatively low, the declared dividends are usually more than enough to cover the fees.

However, it’s important to note that — as stated in both funds’ prospectuses — in the event dividends are insufficient to cover costs, the Managers may sell units or take up short-term loans to top up the difference.

In case you’re wondering when you’ll get paid:

- SPDR STI ETF: usually around February and August each year

- Nikko AM STI ETF: usually around January and July each year

So… How Do I Start Buying STI ETFs?

There’re many ways which you can do so.

And we’ve written plenty of articles explaining how.

If you’re a beginner investor, one of the easiest ways would be through a Regular Share Savings Plan (RSSP).

Assuming you wish to buy SPDR STI ETF every month, you can do it through PhillipCapital’s Share Builders Plan.

And if you want to buy Nikko AM STI ETF instead, you can do it through OCBC’s Blue Chip Investment Plan or DBS Invest-Saver.

Note: different RSSPs will allow you to buy different share counters. So choose carefully!

Alternatively, you could buy them via an online brokerage instead.

The Case for Why You Shouldn’t Buy STI ETFs…

While there’s a lot of literature (including ours) out there telling you about the pros of STI ETFs.

A lot of people will probably ask, “Should I be investing in STI ETFs?”

Well… I’m going to play devil’s advocate here and give you a few reasons why you shouldn’t.

1. Are You Backing the Right Horse?

The chart below plots the performance of the STI against a global index like the NASDAQ (NYSE: IXIC) and a regional index like the Hang Seng Index (HKEX: HSI), over a span of close to 20 years.

Without going into specifics, it’s obvious that if you bought and held an ETF that tracked the correct index, you would be rich AF today.

Even if we take into account the market crash in 2020, it’s evident that an ETF that tracks a global index outperforms the STI by a huge margin.

So… how do we mitigate this?

The most obvious answer would be to consider diversifying into a global or perhaps even a regional index.

But naturally, there’ll be risk and volatility to contend with, if your portfolio is exposed to global markets.

2. Diversification? What Diversification?

If you look closely at the STI, you’ll notice that it is heavily weighted with financials.

Constituent Name Ticker STI Weight (%)

DBS Group Holdings Ltd D05 18.3

Oversea-Chinese Banking Corporation Limited O39 13.7

United Overseas Bank Ltd. (Singapore) U11 11.3

Singapore Telecommunications Limited Z74 6.0

Jardine Matheson Holdings Limited J36 5.2

CapitaLand Limited C31 3.5

Ascendas Real Estate Investment Trust A17U 3.4

CapitaLand Integrated Commercial Trust C38U 3.1

Wilmar International Limited F34 3.0

Singapore Exchange Ltd. S68 2.9

Keppel Corporation Limited BN4 2.5

Thai Beverage Public Co. Ltd. Y92 2.3

Hongkong Land Holdings Limited H78 2.2

Singapore Airlines Ltd. C6L 2.2

Mapletree Logistics Trust M44U 2.0

Singapore Technologies Engineering Ltd S63 2.0

Mapletree Industrial Trust ME8U 1.8

Venture Corporation Limited V03 1.7

Genting Singapore Limited G13 1.6

Mapletree Commercial Trust N2IU 1.5

Frasers Logistics & Commercial Trust BUOU 1.3

UOL Group Limited U14 1.2

Comfortdelgro Corporation Limited C52 1.1

City Developments Limited C09 1.1

Keppel DC REIT AJBU 1.0

Yangzijiang Shipbuilding (Holdings) Ltd. BS6 1.0

SATS Ltd S58 0.9

Jardine Cycle & Carriage Limited C07 0.7

Sembcorp Industries Ltd. U96 0.6

Dairy Farm International Holdings Limited D01 0.5

In fact, DBS Group Holdings, Oversea-Chinese Banking Corporation, and United Overseas Bank together account for 43.3% of the STI.

Which means that both STI ETFs have an overweight focus on local banks and financial institutions.

This also means that in terms of diversification, you should be a little concerned if STI is your only investment.

3. Is It REALLY Passive Investing?

Many people would associate investing in STI ETFs as passive investing.

But let’s look at what really constitutes a passive investing strategy:

- Select and buy a low-cost index fund that tracks the market

- Continue buying for the foreseeable future

So far so good.

The idea of passive investing is that investors will take the market return — otherwise known as the median performance of all stocks in a given market.

But how do you know which “market” to choose?

With thousands of ETFs tracking various “markets”, wouldn’t you have to actively choose a “market” to invest in?

And while we’re on that, why choose STI ETFs in the first place?

Why not consider something like an ETF that tracks the NASDAQ, which would give you a more globally diversified portfolio?

That way, you don’t have to choose a “market”.

However, you should note that there’s no straightforward way to buy a global ETF in Singapore.

Your best bet would be through a brokerage, but that also exposes you to:

- brokerage fees

- foreign exchange rates

- dividend withholding tax, and etc.

All of which will EAT into your returns.

Or you could look at Ireland-domiciled funds.

#justsaying

If Not STI ETFs… What Then?

I’m not saying that STI ETFs don’t have a place in your portfolio.

But if you’re going to invest in something, it’s best if you know what you’re getting yourself into.

After all, you wouldn’t buy a TV just because the salesperson said it’s the “best one in the market” right?

Still unsure about which STI ETF to go with?

Or investments in general?

Why not ask the friendly Community at Seedly or participate in the lively discussion regarding all things investment-related?

FREE one.

Don’t shy.

Come join Singapore’s biggest personal finance community!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

Advertisement