3 Singapore Blue-Chip Stocks That Have More Than Doubled Their Profits In The Last Decade

For our Morning Stocks Analysis, the Seedly team worked closely with MotleyFool, who is an expert in the field, to curate unbiased, non-sponsored content to add value back to our readers.

Disclaimer: This is not a sponsored post. Opinions expressed in the article should not be taken as investment advice. Please do your own due diligence.

If you have any questions on the mentioned stocks, you can ask the Seedly Community here.

Long term investors seek companies that can sustain, or better still, grow their profitability for the foreseeable future.

As a matter of fact, no one can accurately predict the future, thus, the ability of a company to consistently be profitable over the long term. Thus, average investors might want to limit their investments to those companies that have a more predictable business, or in other words, blue chips.

Now, the conventional wisdom is that blue-chip companies are boring investments since they don’t usually grow much given their size. This is true, to a certain extent. Yet, there are some blue-chip companies that continued to grow their profitability over time, despite their size.

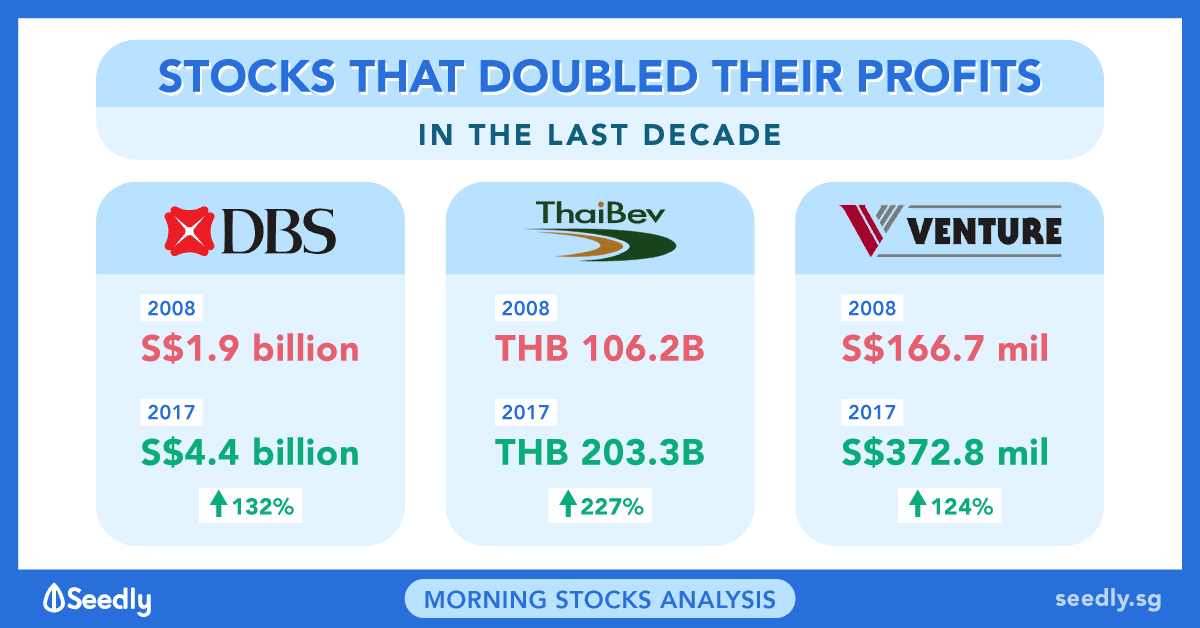

Here, we will look at three blue-chip companies that more than doubled their profits in the last decade. In this article, we will look at three blue-chip companies that more than doubled their profits in the last decade.

- DBS Group Holdings Ltd (SGX: D05)

- Thai Beverage Public Company Limited (SGX: Y92)

- Venture Corporation Ltd (SGX: V03)

1. DBS Group Holdings Ltd (SGX: D05)

DBS Group is a company that needs little introduction. Its financial products and services can be found not only locally in Singapore, but also in overseas. In fact, DBS was already a massive company a decade ago, Yet it’s still managed to grow its profitability in the last ten years.

From 2008 to 2017, DBS’s total income grew by 98%, from S$ 6.0 billion to S$11.9 billion. Not only did the top line grew during that period, but net profit also grew by 132%, from S$ 1.9 billion in 2008 to S$ 4.4 billion in 2017.

What’s more, DBS Group improved its dividend per share from S$0.65 in 2008 to S$ 1.43 in 2017 (including an S$0.50 special dividend). In other words, the dividend was up by 120% or 43% (excluding special dividend) during the period!

2. Thai Beverage Public Company Limited (SGX: Y92)

The second blue-chip company we’ll look at is Thai Beverage Public Company Limited (SGX: Y92).

For those who are new to the company, Thai Beverage with the bulk of its operation in Thailand. It operates in four different segments, namely, Spirits, Beer, Food, and Non-Alcoholic Beverages.

Thai Beverage did even better than DBS Group in growing its business over the last decade. Here are the growth figures you need to pay attention to:

From 2008 to 2017, Thai Beverage’s revenue grew by 91%, from THB 106.2 billion to THB 203.3 billion. Net profit also grew even more, up by 227%, from THB 10.6 billion in 2008 to THB 34.7 billion in 2017.

3. Venture Corporation Ltd (SGX: V03)

As a quick introduction, Venture Corporation is an electronics manufacturing services provider with expertise in a wide range of activities.

In the last decade, Venture Corporation has benefited from the increase in demand for electronics products/services. This has allowed the company to more than double its net profit during that period. From 2008 to 2017, net profit attributable to shareholders grew from S$166.7 million in 2008 to S$372.8 million in 2017, up by 124%. Revenue, on the other hand, grew at a slower pace from S$ 3.8 billion in 2008 to S$4.0 billion in 2017.

Recently, however, Venture Corporation is facing some challenges in its business performance. In its latest quarterly result (for the period ended 30 September 2018), Venture Corporation saw its revenue and profit attributable to shareholder plunged by 27.4% and 27.5%, respectively. The reason given is due to the “impact arising from customers’ planned transition to new replacement products and some customers’ M&A activities for the reported quarter.”

From the above, we can see that though Venture Corporation has been able to grow over the longer term, its short term business activities can be volatile. This is something that investors should note when studying this company.

Conclusion

There you go, three blue-chip companies that have more than doubled their profitability over the decade. Though there is no guarantee that these companies can continue to deliver such performance in the next decade, investors might still want to look into these companies given their past track records.

Seedly Guest Contributor: The Motley Fool

The Motley Fool (fool.sg) offers stock market and investing information, offering people suggestions on how to take control of their money and make better financial decisions.

The Motley Fool Singapore primarily covers the Singapore market, though we also bring investing news from around the world. We also host a range of educational content, written for everyday people. We feel that the best person to make your financial decisions is you, and we want to help you take control of your own money. The Motley Fool also champions shareholder values and advocates tirelessly for the individual investor.

Advertisement