Supplementary Retirement Scheme (SRS): What Is SRS + What Can You Invest in & Everything You Need To Know

If there’s anything more complicated than Additional Math…

it’s got to be our Central Provident Fund (CPF).

To further complicate things, there’s also this thing called Supplementary Retirement Scheme or SRS.

So what in the world is SRS for?

And should you even bother opening an SRS account?

Let’s find out!

TL;DR: Should I Open a Supplementary Retirement Scheme (SRS) Account?

If you’re earning more than $40,000 a year, you should seriously consider using the SRS to enjoy tax relief and pay lesser income tax.

Even if you’re not earning $40,000 a year, you can open your SRS account and top-up $1 to “lock-in” your retirement age.

This is a strategy widely used by many Singaporeans.

But leaving your SRS funds alone after earning a tax break isn’t enough.

Because you’ll only be getting a standard 0.05% p.a.

So, you’ll need to invest your SRS funds in order to minimally beat inflation and grow that fund for your retirement.

Reminder: make your SRS contributions before 31 Dec every year to qualify for tax relief in Year of Assessment.

- What is the Supplementary Retirement Scheme (SRS)?

- How much can I save with SRS tax reliefs?

- Is there a limit to my SRS contribution and tax reliefs?

- SRS top-up, CPF top-up, or bank savings account? Which is better for my retirement?

- How do I open an Supplementary Retirement Scheme (SRS) account?

- What can I invest with my Supplementary Retirement Scheme (SRS) account?

- When can I make an SRS withdrawal?

What Is the Supplementary Retirement Scheme (SRS)?

The Supplementary Retirement Scheme is a voluntary scheme to help you with your retirement.

I know.

I know.

Many of you might be thinking, “Retirement? Isn’t that what my CPF savings are for?”

Yes, however, the CPF is an involuntary savings scheme that will only give you a very basic retirement income.

Plus, most Singaporeans will probably use their CPF accounts to fund the purchase of their homes.

So banking on your CPF savings as a form of retirement is not the best idea either.

This is where the Supplementary Retirement Scheme (SRS) is particularly useful as you’ll be putting aside funds specifically for your retirement.

Plus, if you contribute to your SRS account by 31 Dec of every year, you’ll qualify for tax relief.

Sounds great right?

WAIT.

You can’t just throw your entire year’s income into the SRS and avoid tax completely because there’s a contribution cap of $15,300 for Singaporeans and PRs.

And if you’re a foreigner, there’s a contribution cap of $35,700.

Oh, and unlike the CPF, you can withdraw your SRS funds anytime you want.

BUT.

If you perform an early withdrawal before the stipulated retirement age, you’ll be subjected to a 5% penalty.

And you’ll also be taxed on whatever amount is withdrawn.

See? Not so straightforward right?

Basically, these measures are put in place to make sure you ACTUALLY put aside the money for your retirement.

How Much Can I Save With SRS Tax Reliefs?

The biggest advantage of putting money into your Supplementary Retirement Scheme account is that you get to enjoy tax breaks.

And are deliberately putting money aside for your retirement.

Think of it as delayed gratification.

Here’s an idea of how much you can expect to pay in income tax each year for every dollar that you earn:

| Annual Income | Income Tax Rate | Tax Payable |

|---|---|---|

| Up to $20,000 | 0% | - |

| $20,001 to $30,000 | 2% | $200 |

| $30,0001 to $40,000 | 3.5% | $550 |

| $40,001 to $80,000 | 7% | $3,350 |

| $80,001 to $120,000 | 11.5% | $7,950 |

| $120,001 to $160,000 | 15% | $13,950 |

| $160,001 to $200,000 | 18% | $21,150 |

| $200,001 to $240,000 | 19% | $28,750 |

| $240,001 to $280,000 | 19.5% | $36,550 |

| $280,001 to $320,000 | 20% | $44,550 |

| Above $320,000 | 22% | > $44,500 |

You’ll notice that there’s a significant jump once your annual income crosses the $40,000 mark.

So if you’re one of the lucky (or unlucky, depending on your perspective) ones earning more than $40,000 a year.

You might want to consider opening an SRS account to enjoy some income tax savings.

Here’s why…

Let’s say you earned $40,000 last year, according to the IRAS income tax calculator it means that this year, you’ll need to pay $550 in income tax.

Let’s also assume that you got a huge pay raise this year, and your annual income is now $55,000.

Which means that next year, you’ll need to pay $1,600 in income tax.

Note: this is not taking into consideration any other tax reliefs that may be available to you

That’s almost 3 times the amount of income tax that you were paying initially!

But if you were to put that additional $15,000 into an SRS account…

You’ll be able to bring your income tax back down to $550!

That’s $1,050 in taxes saved.

Is There A Limit To My SRS Contribution and Tax Reliefs?

Yes, so you can’t just deposit your entire annual income into your SRS account.

Besides, what are you gonna survive on?

Here are the current annual SRS contribution limits:

| If you are a... | Annual SRS Contribution Limit |

|---|---|

| Singapore citizen or PR | $15,300 |

| Foreigner | $35,700 |

Contributions may be made anytime and must be in cash.

Also, you’ll have to factor in your personal income tax relief cap which currently stands at $80,000.

And includes your SRS contributions as well.

So if you’re planning to max out your SRS contribution, you’ll want to see how to best optimise your tax savings from other forms of tax relief.

SRS Top-Up, CPF Top-Up, Or Bank Savings Account? Which Is Better For My Retirement?

Now that you have an overview of what the SRS is like and how it can help you.

I’m sure you might be wondering if there are better alternatives to the SRS.

Especially since you’ve got options like CPF Special Account top-ups.

Or can even hold your cash in a high-interest savings account instead.

Well… it really depends because there’s no obvious answer.

Here’s an overview of the differences between using your SRS Account, CPF Special Account, or a Bank Savings Account to save for your retirement:

| SRS vs. CPF vs. Cash | Supplementary Retirement Scheme (SRS) | CPF Special Account (CPF SA) | Cash (Savings Account) |

|---|---|---|---|

| Interest Rate | 0.05% p.a. Note: returns can be higher depending on what you choose to invest in | 4% p.a. | 0.05 to 1+% p.a. (realistic) |

| Yearly Contribution Cap For Tax Relief | $15,300 (Personal) | $16,000 ($8,000 Personal + $8,000 Family) | No |

| Tax Deductible? | Yes | Yes | No |

| Withdrawal Conditions | At 62 years old (retirement age) Note: if withdraw before, subject to 5% penalty | At 65 years old (default) At 55 years old ($5,000 if you have not met Full Retirement Sum FRS or Basic Reitrement Sum BRS with pledging of property. If you have met either one you can withdraw any amount above the sums) | Anytime |

| How To Start | Open with DBS, OCBC, or UOB | Automatically enrolled for Citizens or PR | Open with any bank |

See what I mean?

There’s no clear choice because all three options have their pros and cons.

The largest difference is that with SRS or CPF SA top-ups, they are at least tax-deductible.

But let’s focus on the SRS for now.

How Do I Open An Supplementary Retirement Scheme (SRS) Account?

All ready to open an SRS account?

You must be:

- A Singaporean citizen, PR, or a foreigner who has an income

- At least 18 years old

- Not an undischarged bankrupt

- Not suffering from a mental disorder (side note: this is a totally legit requirement set by IRAS)

- Capable of managing yourself and your affairs

If you meet all of these criteria, you can open an SRS account with any of the following local banks:

Can’t decide which bank to go with?

These SRS Account Opening Promotions for 2020 might be able to help you make up your mind:

SRS Account Opening Promo 2021 | New SRS Account Opening Promo | Gift | Invest With New SRS Account Promo | Additional Gift | Valid Till |

|---|---|---|---|---|---|

| DBS/POSB SRS Promo | Open new SRS Account via digibank (online) & contribute min $10,000 - First 4,000 only | $50 cash gift | Purchase Unit Trusts and/or Insurance with new SRS Account funds via digibank or at any DBS/POSB Branch - First 4,000 only | $30 cash gift ($1,000 to $5,000) | 5 December 2021 |

| $40 cash gift ($5,001 to $10,000) |

|||||

| $50 cash gift (more than $10,000) |

|||||

| OCBC SRS Promo | TBA | ||||

| UOB SRS Promo | TBA | ||||

Once you’ve decided, you can use this step-by-step guide to help you figure out how to open your SRS account and make a contribution.

Can I Transfer My SRS Account From One Bank To Another?

If you change your mind for whatever reason, you can transfer your SRS account from one bank to another.

All you need is the “Transfer of Account” form from your new bank.

Who will then talk to your existing bank to make the transfer.

What Can I Invest With My Supplementary Retirement Scheme (SRS) Account?

So you’ve opened your account and made your first contribution…

Considering that the interest rate is only a mere 0.05% p.a., you might want to consider investing your SRS funds to make your money grow more.

Or at the very least not lose its value due to inflation.

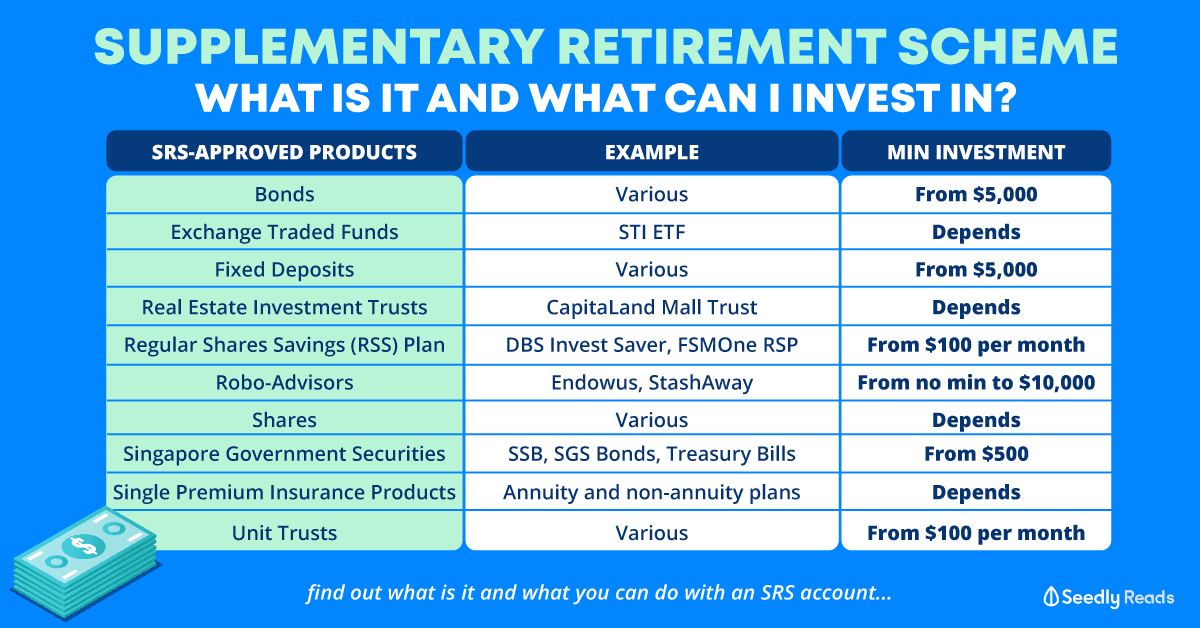

Here’re some government-approved SRS investment options:

- Bonds

- ETFs

- Fixed Deposits

- Life Cover (including total and permanent disability benefits)

- Real Estate Investment Trusts (REITs)

- Robo-Advisors

- Shares

- Singapore Savings Bonds

- Single-Premium Insurance Products (recurrent single premium products, both annuity and non-annuity plans)

- Unit Trusts or Mutual Funds

| SRS-Approved Products | Example | Minimum Investment |

|---|---|---|

| Bonds | Various | From $5,000 |

| Exchange-traded Funds (ETFs) | STI ETF | Depends |

| Fixed Deposits | Various | From $5,000 |

| Real Estate Investment Trusts (REITs) | CapitaLand Mall Trust | Depends |

| Regular Shares Savings (RSS) Plan | DBS Invest Saver FSMOne Regular Savings Plan OCBC Blue Chip Investment Plan (BCIP) Selected PhillipCapital Unit Trust Regular Savings Plans | From $100 per month |

| Robo-Advisors | Endowus Stashaway | From $10,000 (Endowus) No minimum (Stashaway) |

| Shares | Various | Depends |

| Singapore Government Securities | Singapore Savings Bond (SSB) SGS Bonds Treasury Bills | From $500 |

| Single-Premium Insurance Products (recurrent single premium products, both annuity and non-annuity plans) | NTUC Income Guaranteed Life Annuity Manulife Retire-Ready NTUC Income SAIL Tokio Marine Retirement@65 GREATLife Endowment Insurance 5 | Depends |

| Unit Trusts | Lion-OCBC Global Core Fund Schroder Asian Income Fund Fidelity Global Multi-Asset Income Fund | From $100 per month |

If you’re interested to find out more about your options, our SeedlyCommunity has shared some interesting insights as to how to maximise your SRS investment options.

Ultimately, one of the best things about investing using your SRS monies is that your investment gains will not be taxed.

When Can I Make An SRS Withdrawal?

The Supplementary Retirement Scheme is for your retirement, which means that you should make a withdrawal ONLY on or after the statutory retirement age.

FYI: the current statutory retirement age is 62.

That aside, you can also do so on medical grounds or due to bankruptcy.

If you choose to withdraw before the retirement age, you’ll have to pay a 5% penalty as well as taxes on the withdrawn amount.

Well… it’s not called Supplementary RETIREMENT Scheme for nothing right?

But if you choose to wait till the retirement age to withdraw your SRS savings, you’ll only be taxed 50% of the withdrawn amount.

Psst!

Remember the table above which shows you how much income tax you need to pay a year depending on your annual income?

Did you notice that for an annual income of $20,000, you don’t need to pay taxes?

And since 50% of $40,000 = $20,000…

This means that you can make SRS withdrawals of up to $40,000 a year without incurring any taxes!

Note: this is all assuming that you don’t have any other sources of income though.

Not Sure About SRS? You Can Start By Contributing $1 To Your SRS Account Today…

Still not convinced about how the Supplementary Retirement Scheme can help in your retirement planning?

Not earning $40,000 a year yet?

Don’t want to throw a minimum of $10,000 into your SRS account just to qualify for the gifts which the banks are offering?

Well… you can always open an SRS account and contribute just $1 to it today.

Especially if you’re worried that the government could potentially increase the statutory retirement age in the future.

.

.

.

That being said, opening an SRS account might be easy.

But having the discipline to contribute regularly and not perform an early withdrawal is going to be difficult.

So… are you ready to make a commitment to your retirement today?

Advertisement