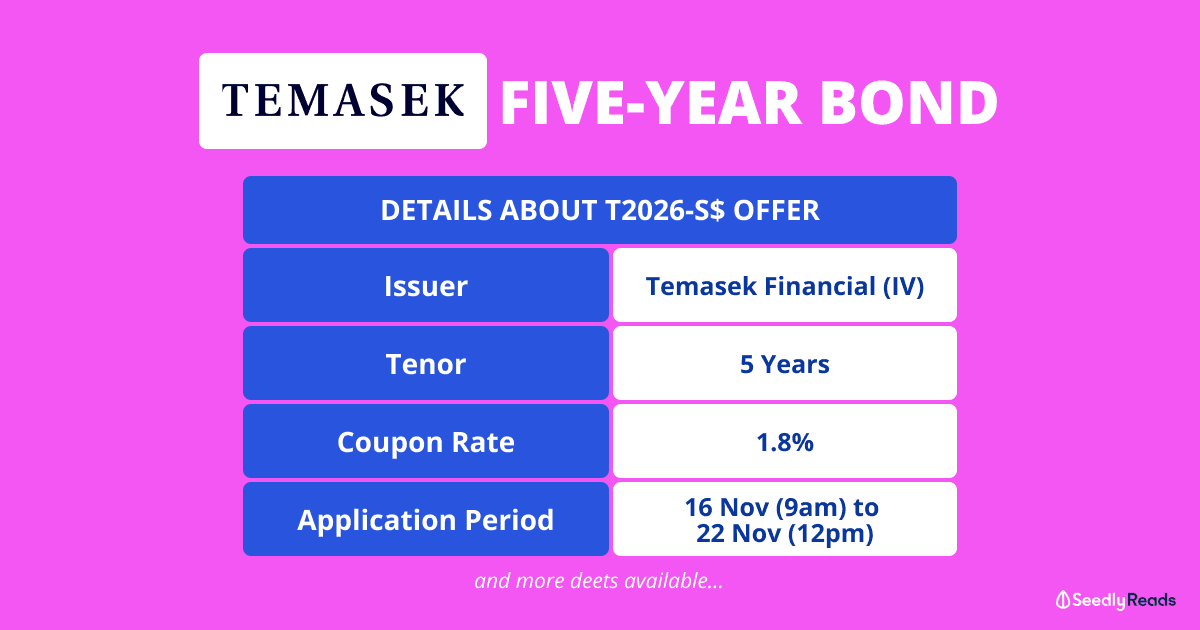

Temasek, one of three investment entities in Singapore, is offering the T2026-S$ Temasek bond, a five-year Singapore dollar bond that gives a coupon rate of 1.8% per annum.

The bond will mature in 2026, as the name might suggest.

Right here, we give you the full scoop of the Temasek bond…

… including an overview of applying for it and alternatives to the bond for you to make an informed decision!

What Is the T2026-S$ Temasek Bond?

The T2026-S$ Temasek bond comprises 1.8% fixed rate guaranteed notes that will mature in November 2026.

Temasek’s wholly-owned subsidiary Temasek Financial (IV) offers the bond under its S$5 billion guaranteed medium-term note programme.

Under Temasek’s proposed total offering of up to S$350 million, there will be a public offer of S$100 million of bonds for retail investors in Singapore.

The rest will be allocated to institutional, accredited and other specified investors.

Here’s an introductory piece about bonds if you are new to bond investing.

More Details About the T2026-S$ Temasek Bond

The T2026-S$ Temasek bond pays a fixed coupon of 1.8% per year and is payable at the end of every six months.

The bond has a tenor of five years from its expected issue date of 24 November 2021.

Temasek is the guarantor. It fully guarantees all payments of interest due and the full repayment of the principal amount at maturity.

The issue price of the T2026-S$ Temasek bond is S$1,000, and for retail investors, the minimum application will be S$1,000 or higher amounts in multiples of S$1,000.

| T2026-S$ Temasek Bond | Details (For the Public Offer) |

|---|---|

| Issuer | Temasek Financial (IV) Private Limited |

| Issue Ratings | Aaa by Moody’s and AAA by S&P |

| Guarantor | Temasek Holdings (Private) Limited |

| Guarantor Ratings | Aaa by Moody’s and AAA by S&P |

| Coupon Rate | Fixed rate of 1.8% per year, payable every six months |

| Tenor | 5 years |

| Maturity Date | Expected to mature on 24 November 2026 |

| Minimum application | S$1,000 or higher amounts in multiples of S$1,000 |

| Offer Size | Up to S$100 million |

Risks Involved With the T2026-S$ Temasek Bond

No investment is free of risks, and that includes the T2026-S$ Temasek bond.

One main risk of investing in bonds is that of issuer default.

This means that there’s always a risk of the bond issuer defaulting on its interest payments or principal repayment to you.

Some of the other risks include interest rate and market liquidity risks.

They may affect the price at which you can sell the bond or your ability to sell your bond if you choose to do so before maturity in 2026.

Investors should look at the Temasek bond’s offer documents and understand the risks involved before investing in the bond.

How to Apply for the T2026-S$ Temasek Bond?

The public offer for retail investors opened on 16 November 2021 (at 9am) and closes on 22 November 2021 (12 pm).

Retail investors in Singapore will need their own individual Central Depository (CDP) account to apply for the T2026-S$ Temasek bond.

Unfortunately, investors cannot use their Supplementary Retirement Scheme (SRS) funds or CPF Investment Scheme (CPFIS) funds to apply for the bond.

Those who are interested in investing in the T2026-S$ Temasek bond can do so via:

- ATMs of DBS, POSB, OCBC or UOB

- Internet banking websites of DBS, POSB, OCBC or UOB

- Mobile banking apps of DBS, POSB or UOB

Trading of the Temasek bond is expected to start on the Singapore stock exchange on 25 November 2021 (9 am).

Here’s an expected timeline of key events for the T2026-S$ Temasek bond offer:

| Important Events for T2026-S$ Temasek Bond Offer | Details |

|---|---|

| Opening date and time for application | 16 Nov 2021, 9am |

| Last date and time for application | 22 Nov 2021, 12pm |

| Date of allocation for applications and expected announcement on SGXNET of offer results | 23 Nov 2021 |

| Expected issue date | 24 Nov 2021 |

| Expected start of trading on the Singapore Exchange | 25 Nov 2021, 9am |

So, Should You Buy The T2026-S$ Temasek Bond?

It all depends on your financial goals and objectives.

If you wish to diversify your investments into bonds and prefer a stable investment like the T2026-S$ Temasek bond, you may want to apply for it.

However, you should note that your money will be locked up for at least five years unless you can sell it on the stock exchange. Of course, there are other things to consider when you want to sell (as highlighted earlier).

Investors could also consider alternatives for their money that are more flexible, such as the Singapore Savings Bonds, cash management accounts, or even insurance savings plans.

Looking for a Like-Minded Community of Investors?

That’s what we have here at Seedly where you can participate in lively discussions regarding stocks and everything money!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.

Advertisement