Temasek Recorded a $7.3 Billion Loss: How Would This Affect Our National Budget & Reserves?

By now, you would’ve heard a word or two regarding Temasek’s reported record loss of $7.3 billion, the worst of its performance in the last seven years.

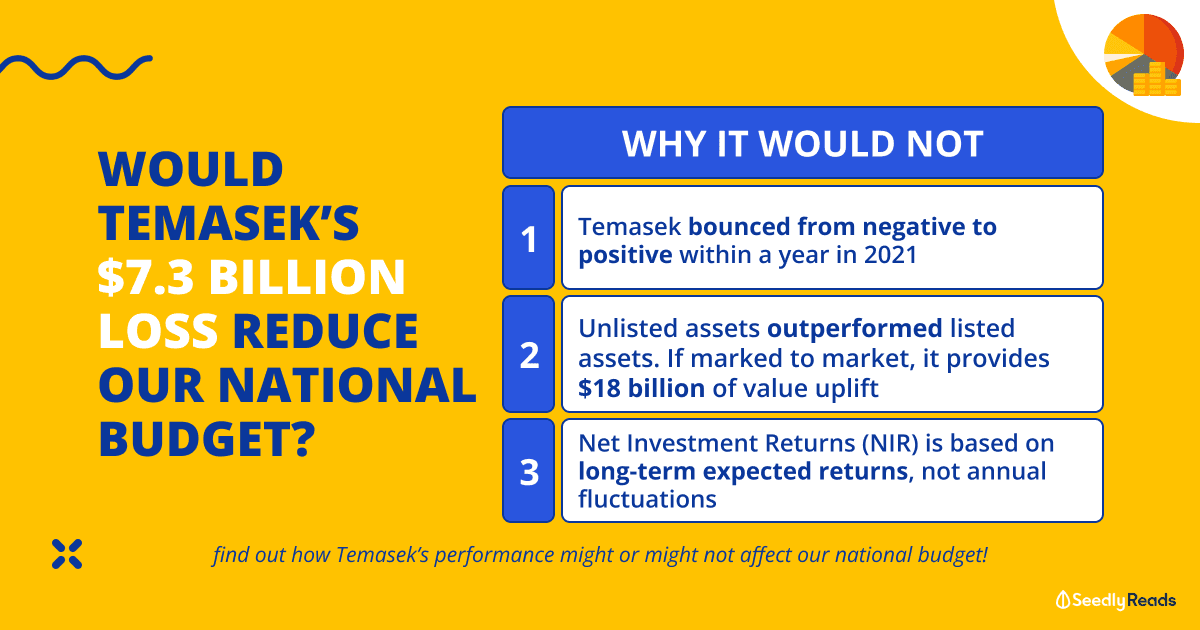

What would happen to our national reserves? Will we have lesser reserves and a reduced national budget because of this?

The short answers are: No, and no.

While the figures do look intimidating, before we get all panicky, let’s dive deeper.

TL;DR: Temasek Recorded a $7.3 Billion Loss This Year, But Should You Be Worried?

These are your key takeaways:

- Temasek’s net portfolio value dropped from $403 billion to $382 billion;

- Its one-year Total Shareholder Return (TSR) fell to -5.07 per cent from +5.81 per cent in the previous year;

- If unrealised gains and losses of sub-20 per cent investments were not included, Temasek would have had a net profit of $14.7 billion;

- Over the past decade, Temasek’s unlisted portfolio has generated returns of more than 10 per cent a year on an internal rate-of-return basis, delivering higher returns than its listed portfolio;

- The loss should not have much impact on the Net Investment Returns Contribution (NIRC), which is a key component contributing to each year’s Government Budget.

Click here to jump:

- Understanding Net Investment Returns Contribution (NIRC) and Net Investment Returns (NIR) framework

- Temasek’s performance in FY2022/2023

- Would our national budget and reserves be affected?

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.

What is Net Investment Returns Contribution (NIRC)

Let me first introduce you to the Net Investment Returns Contribution (NIRC).

For the uninitiated, the NIRC is a portion of the long-term expected real returns on the net assets managed by the government, including those managed by state-owned investment entities like Temasek. It is used to support government spending as it is an important source of revenue for the government’s budget.

It comprises of two parts:

- Up to 50% of the Net Investment Returns (NIR) on the net assets invested by GIC, Monetary Authority of Singapore, and Temasek; and,

- Up to 50% of the Net Investment Income (NII) is derived from past reserves from the remaining assets.

I don’t want to let the cat out of the bag so quickly, but you’ve got to know that the NIR is based on the long-term expected returns of the government’s assets.

The NIRC calculation is based on long-term performance/long-term expected returns from past reserves rather than annual fluctuations to allow the government to smooth out the volatility of spending. E.g. this ensures that the government does not overspend in a bull market and finds itself short of resources in a bear market.

You are probably thinking to yourself right now: If Temasek incurs a loss, this may affect the overall returns generated by the government’s investments and, consequently, impact the NIRC to the government’s budget?

And with that, let’s take a look at Temasek’s performance.

Temasek’s Overall Performance in FY2022/2023

If you haven’t read already, we’ve covered Temasek’s performance in that it closed the financial year ended 31 March 2023 with a Net Portfolio Value (NPV) of $382 billion.

This is a decrease of S$21 billion when compared to Temasek’s portfolio in the year 2022.

Source: TemasekIts One-year Total Shareholder Return (TSR)* went into the negative, at -5.07%, from +5.81% a year ago, and over a longer term, its 10-year and 20-year total shareholder returns stood at 6% and 9%, respectively, down slightly from 7 and 8% in the previous year.

*TSR is one measure of Temasek’s portfolio performance, and it includes all dividends distributed to its shareholder and excludes investments made by its shareholder in Temasek’s shares.

I know this looks gloomy, but there’s a catch.

When we zoomed out, we could see that within a year, there was actually a bounce back in 2021 (25%) from a negative in 2020 (approx -2%) when the stock market/world was recovering from COVID-19 as governmental efforts poured in to make things better.

And, as we know, the Russian-Ukraine war happened, and investors were met with a bearish market, with inflation and interest rates at all-time highs all through 2022.

But we wouldn’t know about this year, and hopefully, things will get better.

Unlisted Assets Outperformed Listed Assets

According to Temasek, over the past decade, its unlisted portfolio has also generated returns of more than 10 per cent a year on an internal rate-of-return basis, delivering higher returns than its listed portfolio.

For the uninitiated, unlisted assets are investments not listed on a securities exchange and not traded daily like shares. Their values are based on the estimated value of the asset and recent sales of similar assets.

Simply put, Temasek’s unlisted assets have outperformed listed assets, with the former comprising 53% of its portfolio, up from 27% in 2013.

These unlisted assets include its investments in large Singapore companies such as Mapletree, SP Group, GHX, Sequoia, TPG and Seviora. It also added that if its unlisted portfolio was marked to market, it would provide $18 billion of value uplift!

National Reserves, Budget & Temasek’s Performance

So, is this a national emergency?

Probably not.

It’s worth noting that the impact of one year’s loss in net portfolio value by Temasek on the NIRC may be mitigated by several factors:

- Diversification: The government’s portfolio is typically diversified across various assets and investment vehicles. Losses in one area may be offset by gains in others, limiting the overall impact on the NIRC.

- Long-term perspective: The NIRC is based on the long-term expected returns of the government’s assets. A loss in one year may not substantially impact if the long-term performance remains positive.

- Reserve funds: Governments often maintain reserve funds or savings to handle fluctuations in revenue. These reserves can help bridge any short-term gaps caused by a loss in net portfolio value.

If you’re thinking about past reserves, according to the Ministry of Finance, after an investment is made, any losses arising from its sale at fair market value do not constitute a draw on Past Reserves. Similarly, mark-to-market losses (i.e. falls in the market value of investments that are still being held) are also not considered a draw on Past Reserves.

As cliché as it sounds, it’s complicated, and it’s not clear-cut. Before we mark the entity down, we should also look at the industries Temasek intends to focus on and where they invest in the long run.

If you’re still not convinced, Temasek’s Chief Financial Officer Png Chin Yee has said the following:

…the loss is a reporting requirement under the International Financial Reporting Standards adopted in April 2018 and will not affect Temasek’s Net Investment Returns Contribution (NIRC) to Singapore’s annual Budget.

What are your thoughts on Temasek’s performance? Tell us in the community!

Related Articles:

- ‘Investing Is Risky’ and Other Stock Market Myths, Debunked

- ESG Investing Explained: How To Invest in a Better, More Sustainable Future

- Temasek To Write Down US$275 Million (S$377 Million) Investment in FTX

- Temasek Is Getting Into ESG Investing, but Is It Overhyped?

- Budget 2022: Does the Wealth Tax Make an Impactful Difference?

Advertisement