Fed Interest Rate Hikes (June 2023): What Are The Implications For Singapore?

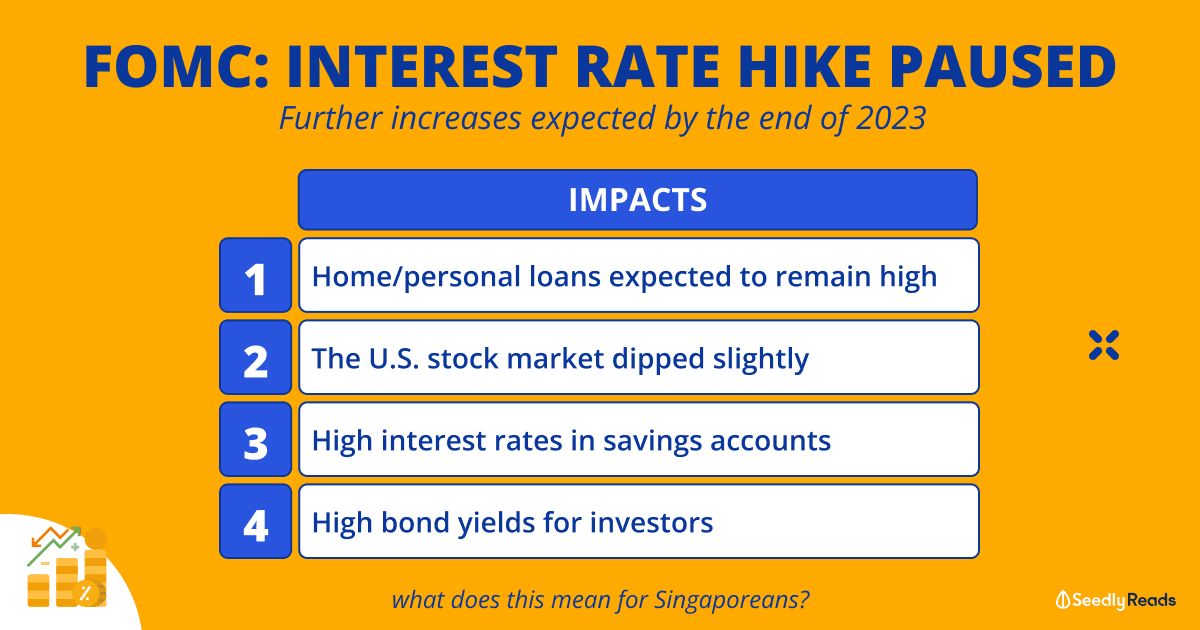

FOMC Has Paused Rate Hikes But Signals Two More Increases by The End of 2023

Earlier this month (3 May 2023), the U.S. Federal Reserve (Fed) announced that it would raise interest rates by 0.25% amidst turmoil in the banking sector with the collapse of Silicon Valley Bank, the forced acquisition of Credit Suisse and the collapse of First Republic Bank.

This brings the federal funds rate to a range of 5.00% to 5.25%, the highest level since January 2008 (the year of the Great Financial Crisis)!

Previously, the Federal Open Market Committee (FOMC) had indicated that they will not pause interest rate hikes, but earlier today, they did exactly that:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5 to 5-1/4 percent. Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.

– Federal Reserve issues FOMC statement

The FOMC also signaled that it may need to take interest rates higher this year and ruled out the possibility of rate cuts for the foreseeable future.

So…

What has this got to do with me?

As you know, Singapore is a trade-dependent nation, and any change in interest rates in the world’s largest economy will affect everyday Singaporeans in one way or another.

Things like your home loans, investments, and savings will be impacted when interest rates in the U.S. are adjusted.

How?

Read on to find out!

TL;DR: Impact of The Federal Reserve Interest Rates Hikes — What Is the Current Fed Interest Rate?

Singapore’s interest rate is largely influenced by the global markets, and more so by the U.S. given it is the largest market in the world:

| Date | Targeted Fed Funds Rate | % Change |

|---|---|---|

| 26 Jan 2022 | 0% - 0.25% | +0.25% |

| 16 Mar 2022 | 0.25% - 0.50% | +0.50% |

| 4 May 2022 | 0.75% - 1.00% | +0.75% |

| 15 Jun 2022 | 1.50% - 1.75% | +0.75% |

| 27 Jul 2022 | 2.25% - 2.50% | +0.75% |

| 21 Sep 2022 | 3.00% - 3.25% | +0.75% |

| 2 Nov 2022 | 3.75% - 4.00% | +0.50% |

| 14 Dec 2022 | 4.25% - 4.50% | +0.25% |

| 1 Feb 2023 | 4.50% - 4.75%, | +0.25% |

| 23 Mar 2023 | 4.75% to 5.00% | +0.25% |

| 3 May 2023 | 5.00% to 5.25% | +0.25% |

| 14 Jun 2023 | 5.00% to 5.25% | — |

| Upcoming FOMC meetings | ||

| 25/26 Jul 2023 | 5.25% to 5.50% | +0.25% |

| 19/20 Sep 2023 | — | — |

| 31 Oct/1 Nov 2023 | — | — |

| 12/13 Dec 2023 | — | — |

As a result, Singapore’s domestic interest rate has already risen and is expected to rise further in the coming years.

For everyday Singaporeans, here are some things that will follow:

- More expensive home/personal loans and credit card bills (if not paid in time)

- The higher cost of borrowing for companies may lead to layoffs and retrenchments

- Generally higher interest rates on savings accounts, Singapore Government Securities (SSBs/SGS Bonds/T-bills) and fixed deposits

As for investors, the interest rate hike is not a great sign for the stock market as a whole. The stock market dipped slightly as a reaction to the FOMC skipping a rate hike, indicating that the markets have already priced in the high interest rates.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.

Fed Rate Hike Explained: Why Is The Federal Reserve Increasing Interest Rates?

The Fed aims to ultimately promote “maximum employment and stable prices in the U.S. economy”. Stable prices also mean keeping inflation in check, which is done by adjusting the federal fund rate (interest rates).

With high inflation in the U.S. throughout 2022 and 2023 (4% y-o-y in May 2023), the Fed has thus increased interest rates to bring inflation down to a more comfortable 2%. The theory is that raising the rates will cause the cost of borrowing to go up, leading to a fall in demand for goods and services. When demand falls, inflation will subsequently fall as well.

Fed Monetary Policy Changes: What Happens When Fed Raises Interest Rates?

Rising interest rates in the U.S. will largely influence Singapore’s domestic interest rates, as can be seen from the increase in recent months. As the Fed continues to increase the rate, Singapore’s interest rate will continue to rise as well.

Expensive Loans: Is Fed Raising Interest Rates Again?

Higher interest rates will make the cost of taking up a loan much more expensive.

This affects the majority of Singaporeans as most of us will have to take up a home loan. Household owners taking up mortgage loans based on the SIBOR (Singapore Interbank Offered Rate) and Singapore Overnight Rate Average (SORA) can expect to pay higher interest on their loans in the coming years.

With the Fed ruling out the possibility of a rate cut, it looks like our SORA rates are going to stay high for now.

Singapore Overnight Rate Average (SORA)

According to the Monetary Authority of Singapore and the Federal Reserve Bank of New York, the SORA rate has been increasing steadily as the Fed hiked interest rates.

Generally, other loans, such as car loans and personal loans, have seen their interest rates increase as well.

| Date | Targeted Fed Funds Rate (% p.a.) | Effective Federal Funds Rate (EFFR) | SORA (p.a.) One Day After Fed Fund Rate Announcement Rounded up |

|---|---|---|---|

| 26 Jan 2022 | 0% - 0.25% | 0.08% | 0.46% |

| 16 Mar 2022 | 0.25% - 0.50% | 0.33% | 0.31% |

| 4 May 2022 | 0.75% - 1.00% | 0.83% | 0.47% |

| 15 Jun 2022 | 1.50% - 1.75% | 1.58% | 0.40% |

| 27 Jul 2022 | 2.25% - 2.50% | 2.33% | 1.53% |

| 21 Sep 2022 | 3.00% - 3.25% | 3.08% | 1.62% |

| 2 Nov 2022 | 3.75% - 4.00% | 3.83% | 2.65% |

| 14 Dec 2022 | 4.25% - 4.50% | 4.33% | 1.64% |

| 1 Feb 2023 | 4.50% - 4.75%, | 4.58% | 3.57% |

| 23 Mar 2023 | 4.75% to 5.00% | 4.83% | 4.08% |

| 3 May 2023 | 5.00% to 5.25% | 5.08% | 3.61% |

| 14 Jun 2023 | 5.00% to 5.25% | 5.08% | 3.51% |

Note: According to the Federal Reserve Bank of New York, the effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates. As such, I have used the EFFR as it is a more accurate representation of what the Federal funds rate is compared to the Fed funds target. As for the SORA rate, I used the SORA rate one day after the Fed fund rate announcement to account for the time zone difference, as Singapore is 12 hours ahead of America.

But you can’t just take it at face value.

We’ll have to look at the correlation coefficient to figure out the relationship between the EFFR and SORA.

According to Investopedia:

The correlation coefficient is a statistical measure of the strength of a linear relationship between two variables. Its values can range from -1 to 1. A correlation coefficient of -1 describes a perfect negative, or inverse, correlation, with values in one series rising as those in the other decline and vice versa. A coefficient of 1 shows a perfect positive correlation or a direct relationship. A correlation coefficient of 0 means there is no linear relationship.

Correlation coefficients are used in science and in finance to assess the degree of association between two variables, factors, or data sets. For example, since high oil prices are favourable for crude producers, one might assume the correlation between oil prices and forward returns on oil stocks is strongly positive. Calculating the correlation coefficient for these variables based on market data reveals a moderate and inconsistent correlation over lengthy periods.

As such, the Effective Federal Funds Rate (EFFR) and SORA have a strong positive correlation as the value of R is: 0.9122. This means that if the EFFR falls, SORA will likely start falling as well.

As for those of us about to borrow, it might be a good time to wait as SORA is falling and inflation in the U.S. is falling, which might mean the Fed will pause interest rate hikes or even cut them if inflation continues to go down.

Layoffs

On a macro scale, an increase in interest rates also means that it is more expensive for companies to borrow money. This particularly affects companies that have not yet seen profitability which resulted in many layoffs and pay cuts.

Of course, this largely depends on your company. Be that as it may, it would be wise to have an emergency fund if you haven’t already done so.

Higher Interest Rates and The Stock Market: When and How Much Will the Fed Raise Interest Rates?

For investors, it’s widely known that higher interest rates tend to negatively affect earnings and stock prices.

When interest rates go up, it makes it more expensive for companies to borrow money. This hampers their growth prospects as well as near-term earnings. When investors see that a company is cutting back on growth or is less profitable, this also eventually leads to a lower stock price ceteris paribus.

On a larger scale, higher interest rates hence affect the stock market negatively, as evident from last year when the S&P 500 index fell 19.40 per cent in 2022.

If you’re invested, remember not to panic sell and stick to fundamentally good companies:

Read More

- How to 6X an Investment Portfolio: Lessons From How Temasek Invests

- 3 Warren Buffett Quotes To Keep Us Sane in a Volatile Market

- When Should You Actually Sell Your Stocks?

Higher Bank Interest Rates and Better Returns on Certain Investments and Bonds

Thankfully, not everything is doom and gloom.

With higher interest rates, Singaporean banks have already increased interest rates on their savings accounts and fixed deposits. Singapore Government Securities such as the Singapore Savings Bond (SSB), Singapore Government Securities (SGS) bonds and Treasury Bills (T-Bills) have also risen but have been falling the past few months.

Afterthoughts From the Federal Open Market Committee (FOMC) Meeting 2023: When Is the Next Fed Rate Hike?

After the latest FOMC meeting, the stock market dipped slightly after Fed Chair Jerome Powell paused rate hikes and signaled further increases later in the year.

That said, when that might happen is anyone’s guess as new information continues to be analysed by the Fed.

In Singapore, the effects of inflation and rising interest rates have been rising in tandem with what is happening in the U.S.

While these are things beyond our control, you can now better plan your finances and be prepared for the future.

Related Articles

Advertisement