What Does Sandwich Generation Mean?

The Sandwich Generation is a generation of people, who needs to take care of their ageing parents while supporting the financial needs of their own children.

Like a sandwich, in a literal sense – we are the ham, stuck between taking our parents and children who form the two bread.

Each generation will then have very different needs and expectations:

| Generation | Needs |

|---|---|

| Parents | To retire comfortably To not worry too much about possible medical expenses To have enough to spend |

| Self | To Achieve desired living standard To still enjoy life |

| Children | Growing up in an environment where there should be no worry about having food on the table To realise their fullest potential |

In fact, a survey done by NTUC Income revealed that 94% of parents (35-55 years old) face the pressure of having to support their children financially and also the need to take care of their ageing parents.

NTUC Income’s latest campaign titled “The Promise” urges Singaporeans to be the last sandwich generation.

While it is extremely impactful, a few questions immediately came to mind:

- What do we need to do to be the last sandwich generation?

- How much does it cost, to be the last sandwich generation?

- Can we really be the last sandwich generation? Or is this all a dream?

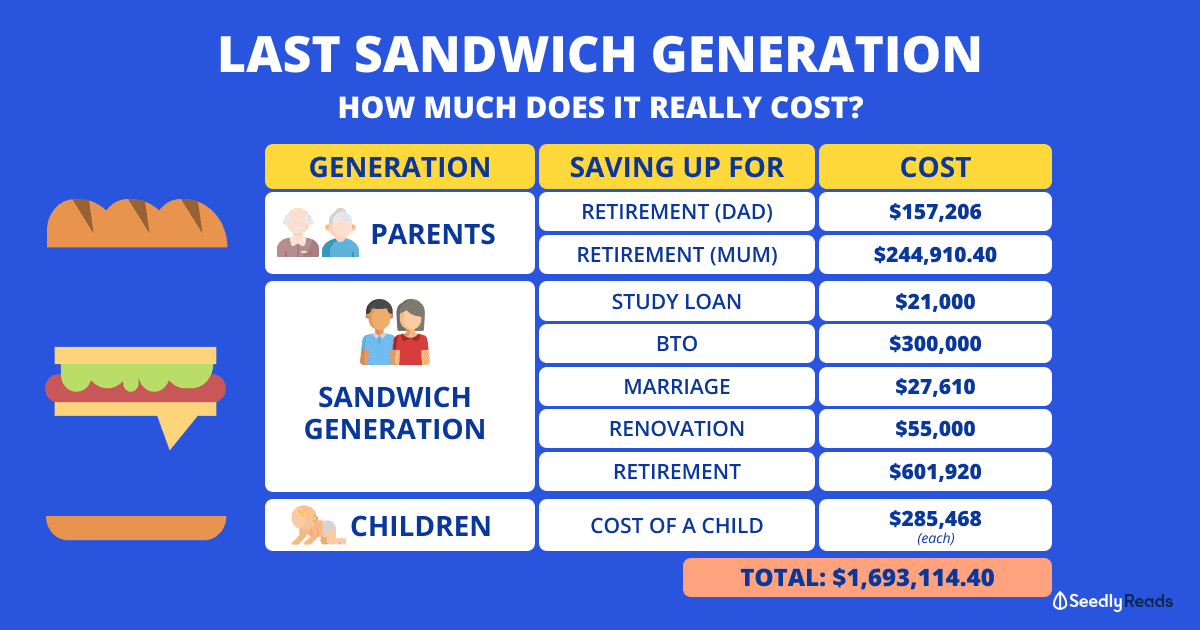

How Much Does It Cost To Be The Last Sandwich Generation?

What Do We Need To Do To Be The Last Sandwich Generation

If we can break this down into a proper checklist of things to do to be the last Sandwich Generation, this is what it will look like:

Understanding the financial situation of your parents |

|

|---|---|

| Do they have enough insurance coverage? | Insurance |

| How far away are they from hitting their CPF retirement sum? | CPF |

| Should they be hitting the CPF retirement sum they desire, how much is the monthly payout? | CPF |

| Are they still in any debt? | Mortgage loans, personal loans |

| How much is their assets? | Savings, investments |

Understanding you and your partner's financial situation |

|

| Are both of you getting enough coverage? | Insurance |

| How much is both of your monthly income? | Salary, income |

| What is the yearly return on your investments? Is it enough to beat inflation? | Investments |

| How much is the household's monthly expenses? | Expenses, mortgage loans, personal loans |

Understanding and planning for the cost of having your own family |

|

| Cost of giving birth | Pre-natal package, gynaecologist fees, delivery charges, baby bonus |

| Monthly expenses of children | Expenses |

| School fees | Cost of education |

Of course, the first step to everything is to recognise that you are part of the Sandwich Generation.

A Breakdown Of The Cost

To be able to break the cycle of Sandwich Generation, one needs to be able to take care of his parents, his personal retirement plan, his daily expenses and the expenses incurred when he has children.

We are going to assume the worst-case scenario in the coming calculation.

Supporting Your Parents

Assuming that

- Your parents have no savings and are not ready to retire at all

- Your parents stop working at the age of 64 years old.

- Your parents do not receive any monthly CPF payouts

- Your parents have no insurance.

According to Lee Kuan Yew School of Public Policy’s finding, a coupled elderly household require $2,351 per month to meet their basic needs.

| Demographic of household | How much you need for basic needs |

|---|---|

| Single elderly household | $1,379 per month |

| Coupled elderly household | $2,351 per month |

| Single person (aged 55 - 64 years old) | $1,721 per month |

The Life Expectancy of Males and Females is at 73.5 years old for male and 78.8 years old for female respectively. With this, based on our previous calculation, the total amount of money required for basic needs upon retirement will be at $157,206 and $244,910.40 respectively.

This makes up a total of $402,116.40.

As mentioned, the above cost is excluding the monthly CPF payouts which your parents will receive.

The payouts which they are eligible for upon reaching their retirement sum will be a very great help in offsetting any financial cost of supporting your parents.

We are also ruling out any possible medical cost in this situation.

Planning for Your Own Retirement

In a previous calculation about retiring at the age of 62, the amount of savings required is at $300,960.

This means that you and your partner will need a combined savings of $601,920 by age 62.

What About My Life?

A typical Singaporean’s financial journey includes a few major expenses.

We did a quick calculation of the total cost of expenses lined up ahead.

These major expenses can add up to $397,056 or more.

All these, excluding your daily expenses.

Cost of Raising a Child

Previously we did a calculation on the cost of raising a child in Singapore.

We assume supporting your children all the way until they graduate from university.

Here’s what we found:

| Stages | Amount Spent |

|---|---|

| Pregnancy & Child Birth | $5,055 - $27,001 |

| Infant Years | $44,113 - $92,941 |

| Toddler Years | $27,212 |

| Primary School | $68,541 |

| Secondary School | $50,267 |

| Pre-University | $24,876 |

| University | $69,945 |

| Total | $290,009 - $360,783 |

A total of $285,468 is required. This is on top of their basic necessities such as food, clothing, laptop, that latest iPhone etc.

Is It Possible To Put An End To The Sandwich Generation?

Putting an end to the Sandwich Generation with enough education and lots of hard work.

The Sandwich Generation needs to have a crazy amount of determination to do so.

First, we need to have enough knowledge of what we need to do with our finances. We then have to execute it well and manage our finances. This is provided we get a partner that feels the same way as we do.

Secondly, your parents and you need to be on the same financial literacy level, to work together as a team to plan for the future. There are no other tips around this other than to start early to allow more time for mistakes.

How should we go about planning our finances for retirement to avoid prolonging the future of the Sandwich Generation?

Here are steps towards planning for this:

- Live your own dream

More often than not, we let an outdated Singapore dream erode away our savings. Getting a car for social status, having an overpriced wedding that is out of your means is not worth the money in the long run. Start moving away from the social norm that makes little sense and have a more practical approach. - Getting proper insurance coverage

Having sufficient insurance coverage for your parents, yourself and your children can help reduce unexpected medical expenses that can erode our savings. - Invest as much as you can

Investing is now a necessity and no longer a choice. The cost of living is no doubt increasing together with inflation, a bowl of noodles cost $0.50, 20 years ago. Today, it is going at $4. Cost of healthcare is constantly increasing too, with Singapore having one of the highest medical inflation rates in the world. - Be prudent, save up

Every dollar saved is more important than the dollar you bring in, which brings me to an interesting quote mentioned by Dr Wealth. “Having capital is a requirement in capitalism.”

How Serious An Issue Is The Sandwich Generation In An Ageing Society Like Singapore’s?

The cost of living is constantly increasing. It can be due to inflation, increase in the cost of education, housing, healthcare and tuition enrichment classes.

Should we not attempt to be the last Sandwich Generation, the debt gets carried down to the next generation which can be really hectic for our children.

Money And Me: Are We The Last Sandwich Generation

If you are really keen to find out more, here’s a light-hearted session on MoneyFM 98.3 on the Sandwich Generation with Michelle Martin, and Dr Wealth!

Advertisement