More Than 1 in 2 Respondents Currently Own Cryptocurrency: Seedly x Coinbase Survey

The cryptocurrency and digital asset landscape has rapidly evolved over the past couple of years, with plenty of shifts in the perception of crypto.

We witnessed surging inflation amidst the Russia-Ukraine War, dips in the stock market due to high interest rates and the collapse of companies in the banking and cryptocurrency industry.

Despite these setbacks, technical and regulatory work on preparing the foundation of blockchain technologies for the next adoption wave continued through the bear market. Closer to home, there were 400+ digital asset events during Singapore Blockchain Week, and the Singapore Fintech Festival had significant announcements, notably around Project Guardian. These global efforts have been drumming up demand for crypto, which partly drove the price action. The market capitalisation of the global crypto market surged from US$795 billion at the start of 2023 to US$1.61 trillion as of 8 December 2023, a 79% increase. That said, this is still far off from the all-time high of US$3 trillion in November 2021.

With the rapid developments in the crypto space, the perception of the cryptocurrency market has shifted. Thus, Seedly has collaborated with Coinbase to find out how exactly Singapore-based adults view the cryptocurrency space in 2023.

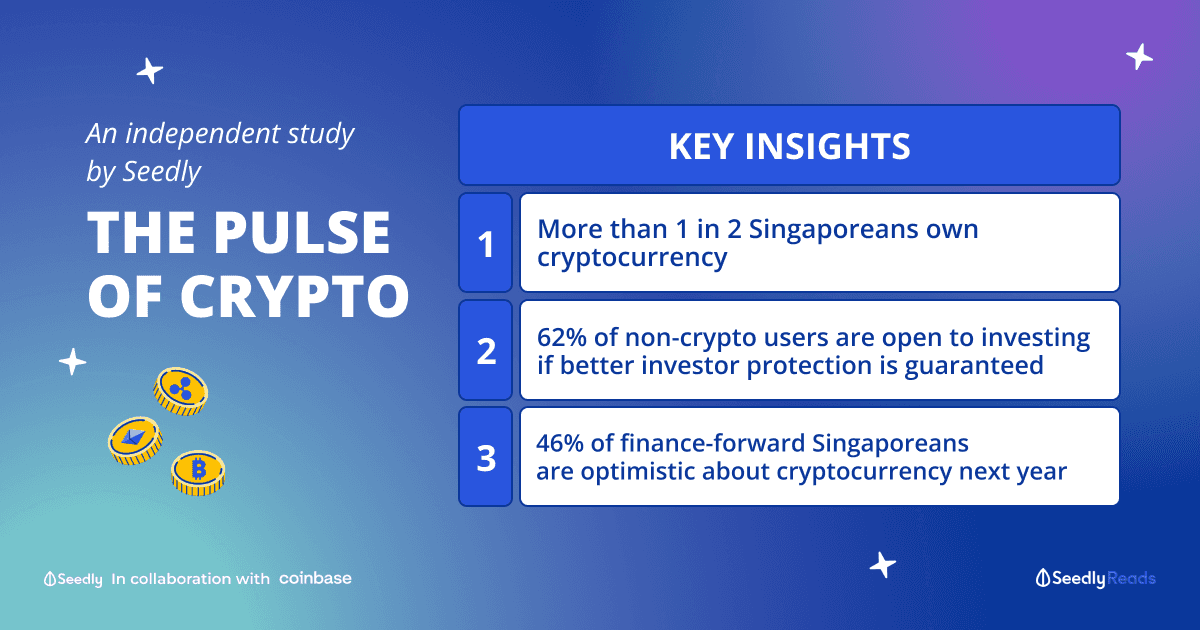

TL;DR: Key Insights From The Pulse of Crypto Singapore Report

- Singapore’s consumer cryptocurrency ownership is high among those surveyed and they want access to a low-cost, trusted, and regulated platform to manage their digital assets.

- Among current crypto-users, staking is the most popular use case among other use cases such as trading cryptocurrencies and holding cryptocurrencies for the long term.

- 56% of Finance-forward Singaporeans Believe That Crypto Is the Future of Finance

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Seedly does not recommend that any cryptocurrency should be bought, sold, or held by you. Readers should always do their own due diligence and consider their financial goals before investing in any investment product. The figures presented are rounded to the nearest whole number.

Survey Methodology

The Seedly x Coinbase: The Pulse of Crypto Singapore Report is based on a total sample of 2,006 Singapore-based adults, across all ages and household incomes.

The survey was distributed via Seedly from 23 October 2023 onwards and concluded on 15 November 2023. Respondents self-selected to respond to a survey on cryptocurrency.

As a result, the sample was reflective of finance-forward Singapore-based adults who have a strong interest in personal finance and investments, and users who actively discuss these topics among the Seedly community.

Definitions

Respondents: Everyone who has been surveyed

Crypto User: A respondent who has bought, sold, or held cryptocurrency in the last 24 months

Non-Crypto User: A respondent who has not bought, sold, or held cryptocurrency in the last 24 months

Crypto Familiar: A respondent who has selected one of the following options: “Currently own crypto”, “Previously owned, but not currently”, “Interested in owning crypto, but don’t currently own”, “Familiar with crypto but not interested”

Demographics of Survey Respondents

From our findings, respondents tend to have a higher income and are slightly younger than the general population in Singapore.

Key Insights

1. More than 1 in 2 Finance-forward Singaporeans Currently Own Cryptocurrency

The first key insight is that 57% of the respondents surveyed own cryptocurrency.

In another survey conducted back in March 2023 by Australian consultancy firm C|T Group, it was reported that 38% of Singaporeans currently own cryptocurrency.

This suggests that among the financially savvy, many do consider cryptocurrency to be a suitable alternative investment.

2. 60% of Crypto Users Own Cryptocurrency for Short and Long Term Capital Appreciation

Question: What benefits are you hoping to gain out of cryptocurrency? Select all that apply.

More than half of crypto users also use cryptocurrency as a way to diversify their investment portfolios.

3. Staking Is the Most Popular Use Case for Cryptocurrency in Singapore

Question: In the past 12 months, which of the following ways have you used crypto?

Among crypto users, many are seeking short/long-term profit through staking, be it through a centralised exchange (55%) or decentralised finance app (38%).

Almost 1 in 2 crypto users also store crypto in a self-custody wallet, most likely for long-term capital appreciation purposes.

One possible reason why it is popular among crypto users to stake cryptocurrency for short/long-term investment is due to the higher interest rates and a lower barriers to entry for staking as compared to traditional financial products such as high-yield savings accounts and fixed deposits.

In Seedly’s latest articles for these products, it was found that the highest realistic interest rate for bank accounts was 3.85% p.a. after fulfilling certain conditions while the highest fixed deposit rate for November 2023 was 3.68% p.a. with a $20,000 minimum deposit and assuming that the customer is a privilege banking customer.

Meanwhile, cryptocurrency staking and rewards rates typically fall between 5% to 10% APY with little to no minimum investment amounts.

That said, do note that cryptocurrency staking is not SDIC-insured unlike savings accounts and fixed deposits. Moreover, cryptocurrency staking carries a much higher risk than placing money in a bank or fixed deposit.

4. For Crypto Users, Low Fees, Regulation, and Ease of Use Are The Most Important Features of a Cryptocurrency Exchange

Question: Which features or benefits of a cryptocurrency exchange are important to you? Select all that apply.

Low fees were the most important feature of a cryptocurrency exchange, which doesn’t come as much of a surprise since a large majority of Singaporeans are price-sensitive. According to Singapore Business Review, 48% of shoppers surveyed search for the best deals in stores while 42% search for them online.

It is also interesting to note that 62% of crypto users want a cryptocurrency exchange to be regulated.

5. However, When Both Crypto and Non-Crypto Users Were Asked, Security of Assets, Ease of Use and Regulation Were The Most Important Features That Matter

Question: What attributes do you consider as important for cryptocurrency exchanges?

On a broader scale, the security of assets, ease of use and regulation of a cryptocurrency exchange are important to survey respondents.

Coinciding with reports that Singaporean investors are more risk-averse than their global counterparts, according to the Singapore Business Review, these insights show that crypto and non-crypto users alike want a trusted and regulated platform to manage their digital assets in Singapore.

6. Market Volatility Is the Top Reason Holding Non-Crypto Users Back From Participating in Crypto

Question: What holds you back from participating in crypto?

High risk (53%), a lack of regulatory oversight and investor protection (45%) and a lack of understanding about crypto (43%) are also among other reasons why non-crypto users are not participating in crypto.

Again, these findings further corroborate the notion that most Singaporeans are risk-averse investors.

7. 62% of Non-Crypto Users Would Buy Crypto If There Were Better Investor Protection

Question: What will spur you to buy crypto?

More than 1 in 2 non-crypto users would also buy crypto if there was a good price to enter the market.

8. More Than 1 in 2 Non-Crypto Users Are Likely to Acquire Crypto in the Next 12 Months

Question: Which of the following best describes how likely you are to acquire (e.g., buy, receive, mine) cryptocurrency in the next 12 months?

56% of non-crypto users are likely to acquire crypto in the next 12 months. Conversely, 44% of non-crypto users are not at all likely to acquire crypto in the next 12 months.

These results are largely in line with the survey done by C|T Group where 61% of all Singaporeans surveyed were likely to buy cryptocurrency in the next few years.

9. 46% Of Finance-forward Singaporeans Are Bullish About Cryptocurrency in the Next 12 Months

Question: What is your overall outlook on cryptocurrency in the next 12 months?

Despite the setbacks in 2022, 33% of respondents were neutral about cryptocurrency while only 12% of respondents were bearish.

Since January 2023, the market capitalisation of the largest cryptocurrency, Bitcoin, has doubled.

Other factors such as a fear of “global wartime inflation” as reported by Forbes hint at a cryptocurrency boom in the future.

These could be reasons why respondents and the larger crypto market have a positive outlook on cryptocurrencies.

10. More Than 1 in 2 Finance-forward Singaporeans Believe That Crypto Is the Future of Finance

Among survey respondents, 56% of them somewhat/strongly agree that cryptocurrencies are the future of finance.

Singapore has been known as a digitally forward, tech-savvy nation and is among the most developed in the world according to Open Gov Asia. It was also the second most digitally competitive country, right after the United States in the 2019 IMD World Digital Competitiveness Ranking.

Moreover, the government has already begun research and experimentation on a retail Central Bank Digital Currency (CBDC).

As such, it is no wonder that many respondents surveyed were open to the concept of cryptocurrency as the future of finance.

Conclusion

These key insights suggest that finance-forward Singaporeans are resilient and continue to have a strong interest in cryptocurrencies as an asset class despite market volatility.

Singapore’s consumer cryptocurrency ownership is high among those surveyed and they want access to a low-cost, trusted, and regulated platform to manage their digital assets.

Among current crypto-users, staking is the most popular use case among other use cases such as trading cryptocurrencies and holding cryptocurrencies for the long term.

On the future of cryptocurrency, about 1 in 2 finance-forward Singaporeans are optimistic about it and believe that cryptocurrency is the future of finance. We believe this optimism is partly based on the vibrancy of Singapore’s web3 ecosystem which is welcoming of builders, investors and users, ensconced within the strong digital asset regulatory framework that seeks to balance consumer protection with innovation.

Related articles

Advertisement