Whenever I have friends over, one of the most commonly asked questions I get, especially if they don’t own their own home yet, is:

“Is there anything you wished you knew before you bought your BTO?”

And that’s a pretty good question.

Because, why learn by making mistakes when you can learn from others?

In order to help you, soon-to-be first-time homeowners, make an informed decision.

I asked a couple of friends (all of whom have their own homes) the same question and pooled our collective knowledge here so that you can learn from our experience and hopefully not repeat our mistakes when buying your first home!

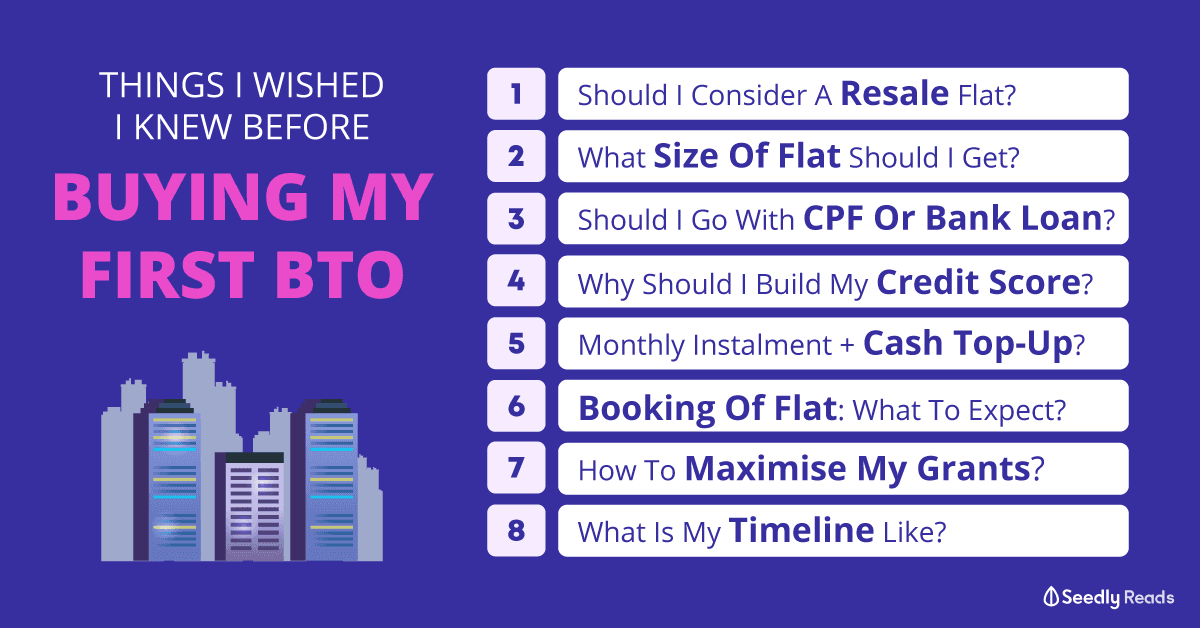

TL;DR: A Checklist of Things to Think About Before Buying Your First BTO Flat

- Have you considered resale flats as a viable option?

- Apart from the budget, what other considerations are there when deciding what type of flat to get?

- Is a CPF housing loan the only option?

- Planning to take a bank loan? Build a credit score with the banks

- Should I purchase a flat which requires me to do cash top-ups for the monthly instalments?

- What happens during the booking of the flat? And should I opt-in for the Optional Component Scheme?

- How can I maximise the number of grants I can qualify for?

- What is my timeline like?

Need more help with regard to buying your first home?

Not sure if you should consider a BTO, Resale or EC?

Why not ask our friendly SeedlyCommunity and get answers!

1) It Doesn’t Always Have to Be a BTO…

While it’s widely known that BTO flats are cheaper as compared to resale flats.

But did you know that resale flat prices have been depressed since 2013?

Thanks to cooling measures and regulations that were put in place…

That means that you can potentially get a flat in a matured estate close to your parents or even within the neighbourhood you grew up in.

There is also a myriad of grants for first-timer applicants buying resale flats which you can apply for as well.

Assuming you and your partner are first-timer applicants, with a combined income of $4,000, buying a 4-room HDB resale flat.

Here’s what the prices look like:

| 4-room HDB Flat | Tampines GreenGlen BTO | Resale Flat Near Tampines GreenGlen |

|---|---|---|

| Price | $312,000 | $410,000 |

| 10% Downpayment | $31,200 | $41,000 |

| Enhanced CPF Housing Grant | $55,000 | $55,000 |

| Family Grant | - | $50,000 |

| Proximity Housing Grant | - | $30,000 |

| Final Price You Need To Take A Loan For | $225,800 | $234,000 |

Note: the resale flat price is an indicative one which I found online. Obviously, factors like which district the flat is in, which floor it’s on, and the age of the resale flat would affect the price.

Not too far off, huh?

Why Consider a Resale Flat?

When it comes to buying your first home, many would consider the location to be of utmost priority.

This is also a limiting factor because BTO projects aren’t launched in every part of Singapore all the time.

So if you wish to live in Queenstown for example, you’re going to have to wait for a BTO project — new launches are only available for application once every three months — to be planned for Queenstown.

Considering that it’s a mature estate that’s already pretty built up.

You’ll have a higher chance of winning Toto than seeing a BTO project launched there.

Also, can you imagine the odds of your application being successful…

For those who’re in a hurry to start their lives together, taking the resale route means you can potentially get your first home faster.

Additionally, the same amount of money they had budgeted for a 3-room BTO allowed them to get a 4-room resale flat (after factoring the grants of course) in an even better location.

2) What Type of HDB Flat Should I Get?

Budget is usually a huge factor when it comes to deciding what type of HDB flat you should get.

Apart from how huge you plan for your family to be or what kind of lifestyle you’re leading.

Here’re a couple of other things we learnt when purchasing our flats…

If Your First HDB BTO Flat Is Your Forever Home

Different-sized flats are available at different BTO launches, as well as at different orientations within the estate.

Assuming you only have a budget of $250,000 and would like to live in a BTO in Tampines.

Well, because you’ve been living there your whole life…

You’d have to consider Punggol, during the September 2019 BTO Launch, instead because the prices for Tampines GreenGlen would be out of your ‘financial league’.

| Flat Type | Estimated Floor Area (sqm) | Estimated Internal Floor Area (sqm) | No. of units | Indicative Price Range (Excluding Grants) |

|---|---|---|---|---|

| 4-room | 94 - 95 | 91 - 92 | 330 | $312,000 - $380,000 |

| 5-room | 113 | 110 | 319 | $418,000 - $504,000 |

And what if you would only like a 3-room flat?

You’d be out of luck too because the estate only offers 4 and 5-room options.

What if you’d like a 5-room flat (see image above: units in light green) that’s as close to the multi-storey carpark as possible?

Because you’re lazy like that.

You’d be limiting your options to block numbers 662A (69 units), 662C (26 units), and 663A (26 units).

All of your accompanying criteria for selecting the perfect unit would mean that you’ll be facing stiffer competition when it comes to flat selection.

So if you die die also must get a flat in an upcoming BTO launch, you might want to adjust your expectations accordingly.

If Your First HDB BTO Flat Is Just a Placeholder

Thinking of upgrading to a larger HDB flat or condo after the 5-year Minimum Occupation Period (MOP)?

Then the type of HDB flat you buy might affect how easily you can sell it off in the resale market.

In general, 4-room flats are still the most sought after.

Here’s a look at the figures from SRX’s HDB Flat Resale Market Flash Report for January 2020:

- 43.1% of resale flats sold are HDB 4-room

- 24.4% of resale flats sold are HDB 5-room

- 23.8% of resale flats sold are HDB 3-room flats

In fact, most of my friends chose 4-room flats as their first HDB BTO because a 5-room flat would be too much house for a young couple.

Especially if they’re not planning to have children.

While a 3-room flat might not be big enough to accommodate a 3-Generation family.

Many Singaporeans believe that they should aspire towards the largest house they can afford as their first home as it is a potential ‘investment’ that can be sold in the future.

But that’s because they’re probably misled by news reports of million-dollar flats like Pinnacle@Duxton.

Which create the false impression that 5-room flats potentially have the best resale prospects.

However, these premium BTOs, DBSS flats or rare maisonettes should not be considered in the same category as your typical 5-room HDB BTO flat.

They are fundamentally very different types of housing.

So if your first HDB BTO flat is a stepping stone to a larger home, consider an appropriately sized flat to keep your initial outlay as low as possible.

And if you’re selling your current BTO flat to buy a second BTO, you’ll also want to consider a little something called the Resale Levy:

- $30,000 for a 3-room flat

- $40,000 for a 4-room flat

- $45,000 for a 5-room flat

This applies whether you’re upgrading to a larger flat or downsizing to a smaller flat.

There is a small silver lining though as the Resale Levy does not apply if you’re buying:

- Design, Build and Sell Scheme (DBSS) flat from a developer

- EC from a developer, where the land sale was launched before 9 December 2013

- HDB resale flat

- Private residential property

3) Should I Pay for My BTO With CPF or Cash?

Most Singaporeans would automatically defer to using their CPF to pay for their monthly instalments.

However, in some circumstances, this may not be the wisest choice.

First, you need to understand that our Central Provident Fund (CPF) is a social security system that helps Singaporeans set aside savings for retirement.

So if you used your CPF to pay for your flat, you’ll need to return the principal as well as any accrued interest (2.5%) which you would’ve earned if the principal were not withdrawn from your CPF account.

This also means that using your CPF to purchase a flat and selling it is NOT a way to magically ‘unlock’ your CPF monies.

Between my friends and I, we’re evenly split with regard to whether you should opt for a CPF housing or bank loan.

But the key takeaway here is that you always have options.

So consider your financial goals and circumstances when making your decision!

4) Why Should I Build a Credit Score With the Banks?

One of my friends, who funded the purchase of her first HDB BTO with a bank loan, has this advice to share:

“Whether you’re planning to take a bank loan or not, give yourself the option by applying for a credit card today to build a credit score.”

After graduating from school, she was under the impression that credit cards would be the start of an unhealthy relationship with credit.

Which might lead to unnecessary debt accumulation.

As a result, she never applied for a credit card and only went as far as using a debit card for her purchases.

Bear in mind: she is a fiscally responsible person who allocates her monthly salary, paid her bills on time, and never spent more than what she needed to.

But when she applied for a bank loan to fund her HDB BTO, the bank considered her an unknown risk as she didn’t have a credit score at all.

With any bank for the matter.

As a result, the loan she was eventually granted was of a much lower quantum than she had hoped for.

And she had to settle for a 4-room flat instead of a 5-room flat that she wanted.

Note: This is, of course, only really applicable to you if you use your credit card responsibly and pay your bills in full and on time. EVERY TIME.

5) The Burden of Monthly Instalments

Another friend of mine decided to spring for a 5-room HDB BTO even though he and his partner’s monthly CPF contributions were not enough to cover the monthly instalment.

At that point, their combined income allowed them to supplement the difference with cash.

So naturally, they thought that it would not be a problem.

Until he suffered a personal accident and had to take an unpaid leave of absence from work.

During that period, they realised that their finances were severely strained due to the need to make cash top-ups to their monthly instalments.

Imagine if one of them were to, unfortunately, lose their job… #siaoliao

Lesson learnt?

Only purchase a property which has monthly instalments which you can cover fully using your CPF.

6) Booking of Flat: Always Give Yourself Options

So you’ve submitted an online flat application and paid the $10 non-refundable administrative fee.

Now what?

When Will I Know If I’m Successful?

For BTO, it’ll usually take about 2 to 3 weeks after the application period closes.

If you’re successful, you’ll receive a queue number and a selection appointment date and time for you to book a flat.

So What’s Next?

You’ll first need to apply for a mortgage loan.

For an HDB loan, you’ll need to get an HDB Loan Eligibility Letter (HLE) before booking a flat.

For a bank loan, you’ll need to get produce a Letter of Offer before signing the Agreement of Lease.

What to Take Note of During the Booking of Flat

This is where it gets interesting.

If a project has 100 flats in total available for booking, it is possible to get a queue number that is, for example, 222.

It just means that your project is oversubscribed.

If you don’t even get a queue number, it means it’s highly oversubscribed (read: think Bidadari).

If you’re lucky enough to be invited for an appointment to book your flat, you’ll need to do two things…

1. Research and Shortlist as Many Options as Possible Beforehand

During the Booking of Flat, you’ll need to let the HDB representative know exactly which unit you would like.

Back in 2012, my wife and I prepared 15 selections to choose from.

Just in case any unit we wanted was selected before it got to our turn.

Remember the different considerations I was talking about when deciding what size HDB flat to get?

Yep.

You’ll need to have all of that thought out because the HDB sales representative is not going to wait 10 hours for you and your partner to decide which unit you want.

In fact, you can even check the Flats Available For Selection days before heading down to select your flat.

It’ll even tell you which unit in a specific block is still available.

2. Decide If You Want To Opt-In for Optional Component Scheme (OCS)

Besides choosing which unit you want, you’ll also need to decide if you wish to opt-in for the OCS.

If it is available for the project you are applying to.

The Optional Component Scheme will usually cover:

- floor finishes for living/dining room and bedrooms

- internal doors and sanitary fittings (washbasin with tap mixer and shower set with bath/shower mixer)

For the September 2019 BTO Launch, if you’re applying for a 4-room flat in Punggol Point Cove, the OCS will cost between $2,980 to $4,870.

To get a better idea of what the finishes look like.

I recommend heading down to the respective Sales Office of your project BEFORE your booking of flat to see and touch the finishes in person.

It’s important to do this because you don’t want to be caught in a situation where you’re unsure and commit to the OCS without giving it enough thought.

It might not sound like a lot of money to just opt-in for the OCS first and see how.

But my friend had to pay his contractor to hack and remove the OCS living room tiles because it was too slippery for his liking (not ideal when you have older folks or little ones running about).

While another chose a slightly more economical way of overlaying the existing tiles with tiles of his choice.

But the increased height of the floor meant that his contractor had to shave a couple of centimetres from the bottom of the doors to allow sufficient clearance…

So do think carefully before opting-in for the OCS as you might incur additional costs when you finally collect the keys to your flat and change your mind.

7) The Thing About Grants Which You Probably Never Thought About

We’ve written extensively about CPF Housing Grants and how you can qualify for them.

But here’s the thing about grants which you might not have considered.

If you’re a student, LISTEN UP!

The best time to apply for an HDB BTO flat is when the total income for both applicants are at the lowest (when you’re both still students).

When my wife and I applied for our BTO flat in 2012, I was still in uni while she just entered the workforce.

Because our average monthly household income was between $2,501 to $3,000, we managed to score an Additional Housing Grant (AHG) of $25,000 which really helped us with our purchase.

Note: this was before the Special Housing Grant (SHG) kicked in from November 2015 to May 2019 sales launches.

Under the new Enhanced CPF Housing Grant (EHG) today, we would’ve qualified for $60,000 in grants instead.

Assuming we were both working and our average monthly household income is, say… between $5,501 to $6,000, we would only have qualified for $35,000 in grants.

See? That’s a pretty huge difference in grants received.

HOWEVER.

You should only apply for an HDB flat if BOTH of you are 100% sure of your commitment to the relationship.

Because if you choose to break up after you BTO-ed, you might lose more than $77,000…

What If One of Us Is Currently Unemployed?

Ah… Here comes the caveat.

The EHG amount you receive depends on the average gross monthly household income for the 12 months prior to you submitting your flat application.

So even if one of you is currently unemployed, your income for the 12 months prior will still be taken into consideration.

8) Consider Your Timeline

If you’re planning to get married around the same time you’re expecting to collect the keys to your BTO HDB flat, you’re probably thinking of renovating your home as well.

If so, I highly recommend planning to have your wedding and your home renovated as far apart from each other as possible.

I know.

I know.

The ideal plan for most would be: after you get married, you can move into your new BTO flat immediately.

But money is a HUGE consideration (and problem) here.

I’ve worked out in an earlier article that an ‘average’ wedding will cost you almost $28,000.

And if you’re planning to renovate your home before you move into it, it’ll easily cost you anywhere between $30,000 to $80,000.

Note: these figures are the lowest and highest, my friends and I have paid for our renovations. Obviously, it can be lesser or even higher than what we’ve spent, depending on what you intend to do.

Assuming your home renovations are completed around the same time you have your wedding, you’re looking at dropping anywhere between $60,000 to $110,000 within a very short period of time.

With this consideration in mind, some of us planned to collect our keys and get the renovations done at least half a year before the wedding.

I had friends who even moved into their flat before their actual wedding day.

On the other hand, some of us chose to have the wedding a year before we collect the keys to our BTO.

My wife and I did this and we continued staying with our parents – after the wedding – while we waited for our BTO flat to be fully renovated.

With the wedding out of the way, doing this gave us the money and time to properly focus on the renovations.

One of my friends had the unfortunate experience of managing the renovations of her home WHILE planning for her wedding.

And that was one of the most stressful periods of her life (read: highly NOT recommended).

Advertisement