Dreading The Idea Of Funding Your Local University Degree? Tuition Fee Loan To The Rescue!

Whether you are planning to embark on your own tertiary education, or you are planning for your children’s future education.

Do give yourself a pat on your back, it’s quite a feat. You deserve that!

In Singapore, university tuition fee averages around S$30,000. That’s quite a hefty amount for a typical student to bear!

Fret not!

There are several ways that you can fund your tertiary education, including the CPF Education Scheme (CES) and bursaries, but for this article, we will be focusing on the Tuition Fee Loan (TFL).

At Seedly, we provide unbiased opinions for you to tap on for you to embark on your personal finance journey. Fret not, we don’t do any sponsored posts so you can browse our blog at ease!

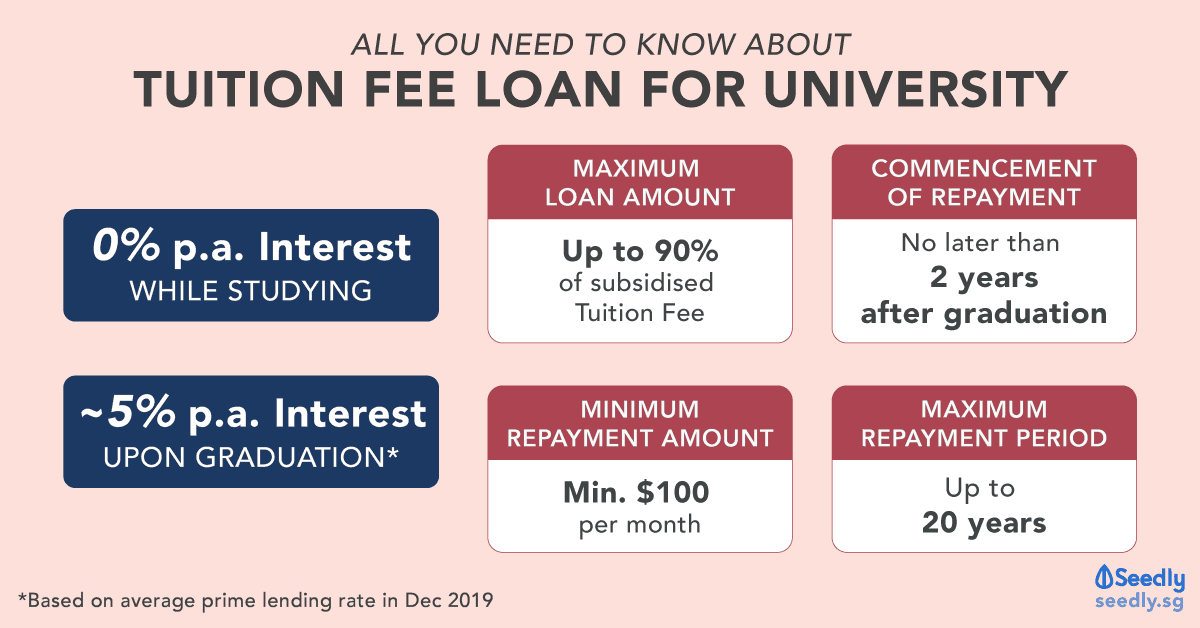

TL;DR – All You Need To Know About Tuition Fee Loan

The best thing about the Tuition Fee Loan is that you don’t have to think about it while you’re still studying!

Did you know, you can take a loan to cover up to 90% of your subsidised tuition fees?

It’s interest-free during the course of your study, and you’ll only need to start repayment after you’ve completed your courses.

Once you’ve graduated, the interest will start rolling at the average prime lending rate, which is currently at 5.25% per annum.

Don’t worry if you’re afraid your starting salary will not be the best, the minimum repayment is $100 per month and you’ll have up to 20 years to repay the entire loan.

What Is A Tuition Fee Loan?

The Tuition Fee Loan is essentially a government-funded education loan. It is provided by the Ministry of Education (MOE) and is administered by 2 local banks, DBS and OCBC.

| Tuition Fee Loan administered by DBS | Tuition Fee Loan administered by OCBC |

|

|---|---|---|

| Nanyang Technological University (NTU) | Yes | Yes |

| National University of Singapore (NUS) | Yes | Yes |

| Singapore Institute of Technology (SIT) | Yes | No |

| Singapore Management University (SMU) | Yes | No |

| Singapore University of Social Sciences (SUSS) | Yes | No |

| Singapore University of Technology and Design (SUTD) | Yes | No |

Students of Singapore Management University, don’t panic! Tuition Fee Loan is available to you too, just that it’s administered by SMU instead.

Am I Eligible For A Tuition Fee Loan?

| Tuition Fee Loan Eligibility | |

|---|---|

| Income Requirement | None |

| Age Restriction | None |

| Financing of Tuition Fee | Not receiving any Government/Statutory Board/any school scholarships which cover tuition fees |

| Not receiving full Tuition Fee Subsidy from MENDAKI | |

| Not using CPF savings for payment of 100% of the subsidised tuition fees | |

| Student's Status | Full-time undergraduate student |

| Part-time student pursing first undergraduate degree | |

| Not on self-funded courses | |

| Not foreign students who are paying full fees (not eligible for any Tuition Fee Grant) |

|

Be sure to check your school’s respective terms and conditions as some of the universities have additional requirements on top of those stated above.

The cool thing about the Tuition Fee Loan? There’s no income requirement and age restriction!

Unless you already have other means to finance your tuition fees, it seems that the Tuition Fee Loan is designed to benefit most students.

How Much Can I Get From My Tuition Fee Loan?

You’ll be able to loan up to 90% of your subsidised tuition fees for the remaining course of and it does not cover any hostel fees or compulsory miscellaneous fees.

If you feel that you don’t actually need to loan 90% of your tuition fees, you can also choose to loan in other percentages, such as 30%, 50% or 80%.

Now, you might think that you’re too young to think about the Total Debt Servicing Ratio (TDSR), but it’s never too early to start on the personal finance journey!

Even though the TDSR usually kicks in for Singaporeans when they are taking a housing loan, keeping future monthly repayments for your Tuition Fee Loan lower than 60% of your future income will definitely be helpful!

Do I Need A Guarantor?

That’s right, you are required to have a guarantor to apply for your Tuition Fee Loan!

Your guarantor is there to guarantee that he/she will pay the loan in any case of your dismiss or if you default on the loan.

| Guarantor Requirements | ||

|---|---|---|

| Age | 21 - 60 years old | |

| Financial Status | Must not be a discharged bankrupt | |

| Nationality | If Student is a Singaporean | Singaporean |

| If Student is a Permanent Resident | Singaporean or Permanent Resident | |

| If Student is a Foreigner | Any Nationality | |

Technically, anyone can be your guarantor as long as they meet the requirements above.

Repayment of the Tuition Fee Loan

| Repayment of Tuition Fee Loan | |

|---|---|

| Repayment Period | Maximum of 20 years |

| Commencement of Repayment | No later than 2 years from date of graduation |

| Repayment Type | Monthly Instalments (min. $100) |

| Lump sum full repayment | |

| Partial repayment | |

Oh yea! If you still have funds left in your Post-Secondary Education Account (PSEA), you can use it to pay off your loan partially too!

If you haven’t started repaying the loan even after 2 years from your graduation:

- An additional interest of 1% per month will be imposed.

If you leave the University without completing school,

- The loan will immediately become due and payable.

- You may be able to repay the outstanding sum by monthly instalments (but terms and conditions apply).

Interest on Tuition Fee Loan

The interest rate on your Tuition Fee Loan is based on the average prime lending rate of DBS, OCBC and UOB, currently at 5.25% per annum (as of 12 December 2019).

As much as we would love to give you a fixed figure to make the planning process easier for you, the interest rate on your Tuition Fee Loan may change over the years.

When Does The Interest Start Rolling?

It will start on the 1st day on the 3rd month upon your graduation.

An example of interest commencement date is:

| Final Exam Results releases in: | Interest Commencement Month |

|---|---|

| June | 1st August of the same year |

| December | 1st February of the following year |

Just a heads up, the interest will start rolling regardless if you delay the start of your monthly repayments to the bank.

What If My Repayments Are Late?

We know you can’t predict the future, but try to make sure you make your repayments online, otherwise, the late payment charge is levied at 1% per month!

You definitely wouldn’t want to get charged a late payment fee of 1% per month, which will snowball into an effective rate of 12.74% that year. That is the power of compounding.

If you have an existing debt issue or suffer from a tendency to roll over your debts, you need to practice the 2 ways to clear your debts effectively.

Should You Take the Loan?

Yes, if you are currently unable to fork out the hefty sum of money for your school fees.

- If you know that you are able to fund your repayment upon graduation. – Means able to secure a proper job upon graduation.

- If not, you can always take a gap year to work and save for your education, this is one of the most common practices here in Singapore.

No, if the interest on the loan at 5.25% per month scares you like it scares me and you are afraid that you will be unable to pay back in time. There are other alternatives to pay your school fees such as:

- Credit Cards 0% monthly instalment

If you happen to have S$30K with you, first of all, congratulations, you are able to pay your school fees in one lump sum! Should you or should you not take up this tuition fee loan?

Yes, it is one way you can help yourself “buy time” with the 30K that you have on hand,

- You are able to invest to earn a return of approx. 6% per year.

- Upon graduation (4 years), if you have consistently been achieving 6% p.a. in return, you would have $37,874.

- That is $7,874 higher than what you originally have.

- You get to pay the bank back in one lump sum prior to the interest kicking in

- And earn an additional $7,874!

Comment down below if you have tried this and if it worked for you!

We know, some of you may be interested in universities overseas instead, that’ll come real soon!

Till the next one, may the Personal Finance force be with you!

Advertisement