“BTO already not?”

“When graduating ah? Getting married soon?”

“Y’all paktor how long already?”

We’re in the thick of Lunar New Year celebrations & house-visiting typically means having to go through interrogations like this.

It can all be very frustrating for a young couple, especially with the stress of schoolwork still looming over your heads during the festive season.

Since HDB has announced new measures allowing young couples (both above 21) to apply for a flat earlier, you might not get to use “Aiya Ah Ma, we’re still studying. Cannot BTO yet” as an excuse much longer.

TL;DR: Taking the next step, BTO before Marriage

For couples who are both full-time students, the process will be a bit different. The following guide is based on the assumption that you’re eligible for HDB BTO and/or have made an application.

We are also assuming that you’ll be taking a HDB loan considering the extreme difficulty for an unemployed couple to get a bank loan.

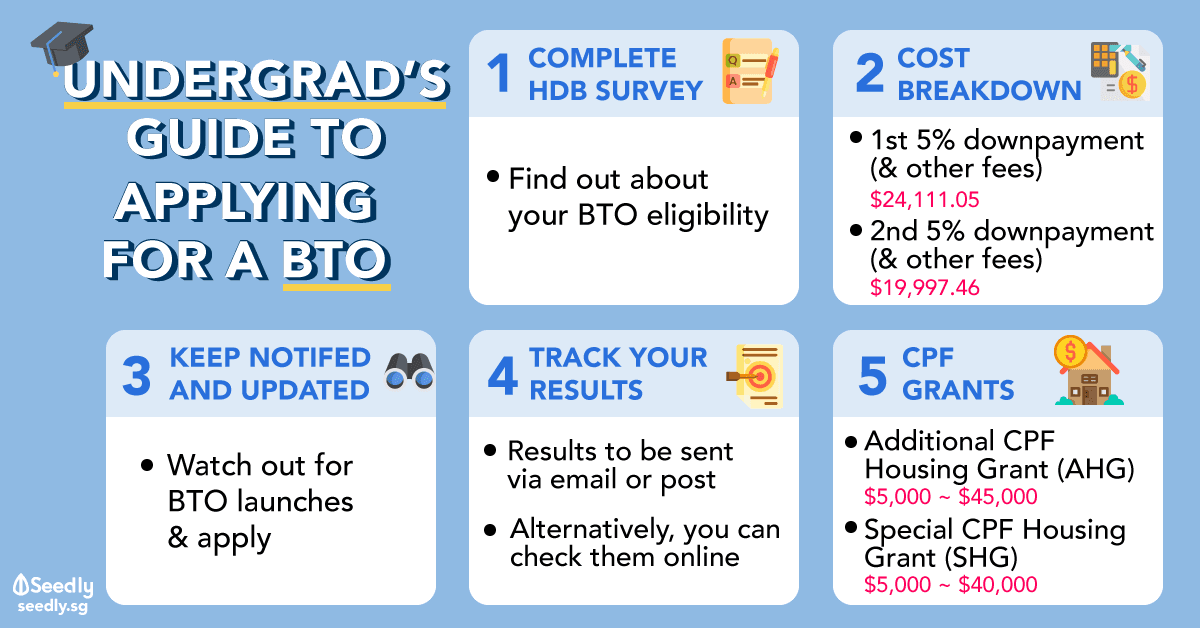

For ease of understanding, scroll for a summarised guide on applying for your BTO, followed by a case study on approximately how much money you’ll be needing.

Step by Step Guide

1. Complete a quick survey to check your eligibility. Do it here

Generally,

- At least 1 applicant is Singaporean

- The other applicant is either a Singaporean or PR

- Either/Both applicants are ≥ 21 years old

- Do not own any other local or overseas property

- Have not received ≥ 1 CPF Housing Grant so far

2. Financing your BTO

Are you purchasing a HDB flat?

| Stage | Payment Due | Mode of Payment |

|---|---|---|

| Submitting your application | $10 | Credit Card |

| Booking a flat | Option fee ($500 - $2,000) | NETS |

| Signing of agreement for lease | • Stamp duty • Downpayment | • Cashier's order • CPF |

| Collection of keys | • Stamp duty and legal fees • Home Protection Scheme • Fire Insurance • Balance of the purchase price | • Cashier's order • CPF |

3. Watch out for BTO launches & Apply

Keep track here.

4. Check your Application Results

When the application period ends, your queue position would be balloted and results would be sent to you via email/post.

Alternatively, you can check them online here.

5. Option Fee

If you’re fortunate enough to be able to select your preferred unit, an option fee is required.

6. Signing lease agreement & getting your keys

At this stage, you’ll need pay for the downpayment, legal and stamp duty fees.

Hold off applying for HDB Loan Eligibility (HLE) Letter

Don’t even try applying for the HLE because it’s a lot of steps only to arrive here:

We wasted our time so you don’t have to.

And you can’t fill in grant application forms either, because you have no payslips to compile!

So what now?

Gather your documents for deferment of income assessment. This is crucial.

For full-time students, you’ll need a letter from the school stating your period of study and specify if it’s full- or part-time. For full-time students who are receiving a salary working for the school (teaching or research), you’ll need a copy of the contract stating your scope of work and conditions of the stipend. (Allowances from scholarships do not count.)

Remember to bring these when booking your flat!

If you have a paying side hustle/part-time job outside of school, it doesn’t count to HDB and you won’t have to provide any documentation for this.

Application for HDB Loan & Grants

Previously, at least 1 member of the couple was required to show proof of full-time employment for the previous 12 months when requesting for the HLE letter. This letter is to be submitted at your flat booking appointment for getting a loan.

The same documents are needed for your grant application to assess your income (and thus how much they can give you in grants).

BUT NOW, unemployed full-time students are allowed to first apply for their flat and have their incomes assessed later (about 3 months before flat completion).

Known as the Deferred Income Assessment, this was introduced late last year, in 2018.

| Eligibility Conditions | |

|---|---|

| Student/NSF | Both parties must be: Full Time Students/NSFs Completed studies or NS 12 mths prior to HDB application |

| Age Limit | Must be at ≥ 21 yrs old 1 applicant must be ≤ 30 yrs old |

| Marital Status | Couple must be married or Applying for HDB under Fiance/Fiancee Scheme |

| Household Status | At least 1 applicant must be first-timer |

| Income Assessment | For Completed Flat - During flat booking For Uncompleted Flat - Approximately 3 mths before flat completion |

Cost Breakdown

Maybe you have a side gig or maybe your parents have agreed to give you a loan. No matter what, it’s good to have a clear picture of all the fees involved.

If you’re both full-time students, it’s highly likely you’ll be eligible for the Staggered Downpayment Scheme. In other words, you get to pay the first 5% after flat booking, then the next 5% when you collect your keys.

BUT, that’s not all you gotta pay for.

Assuming you’re eyeing a 4-room flat that costs $390,000:

| Stage | Payment Due | $390,000 4-room Flat | Payment Mode |

|---|---|---|---|

| Submitting your application | Application Fee (Fixed) | $10 | Credit Card |

| Booking your flat | Option Fee | $2,000 | NETs |

| Signing of agreement for lease (approx. 4 mths after flat booking) | 1st 5% Downpayment Stamp Duty Caveat Fee (Fixed) Conveyancing Fee Minus Option Fee | $19,500 $6,300 $64.45 $246.60 -$2,000 | Cashier's Order CPF |

| Total = $24,111.05 | |||

| Collection of keys | 2nd 5% Downpayment Survey Fee Registration Fee (Fixed) Home Protection Scheme Fire Insurance Balance of the Purchase Price | $19,500 $275 $38.30 $178.66 $5.50 (For 5 yrs) Paid via HDB Loan | Cashier's Order CPF |

| Total = $19,997.46 | |||

Note:

- Purchase cashier’s order online or via app for free or pay $5 at the bank

- Figures above exclude renovation costs, which can modestly range anywhere between $30,000 to $60,000

General Thoughts

It all sounds like a lot of money, especially since you’d probably have to fork out upwards of $26,000 while still unemployed.

Overall, as cliche as it is, borrowing from your parents (whilst making sure to pay them back with interest ok!) or obtaining a partial loan if you have amassed some savings from part-time jobs, is advised.

What’s most important is that you sit down with your partner, figure out how much you both have and discuss collectively where you could earn extra income or cut down on expenses so that you could work towards buying your first property.

With Valentine’s Day upon us, a gentle, but not so subtle, reminder that this is just a commercial holiday designed to squeeze your dollars on overpriced roses.

Maybe do without the expensive celebrations this year so you can save more money for your downpayment? True romance (to us, at least) is financial security!

Seedly Contributor: Dollar Scholar Squad

Advertisement