The Ultimate Guide to the CPF Housing Grant for Executive Condos

Looking to get an executive condominium for your first home?

We know, it’s pretty expensive even though you’ll get to enjoy all the awesome features of a private condominium.

But wait, there’s also a Central Provident Fund (CPF) Housing Grant for you!

TL;DR: The Ultimate Guide to the CPF Housing Grant for ECs

That’s right, one of the advantages of getting an EC over a condominium is the CPF Housing Grant for ECs!

Provided you’re eligible…

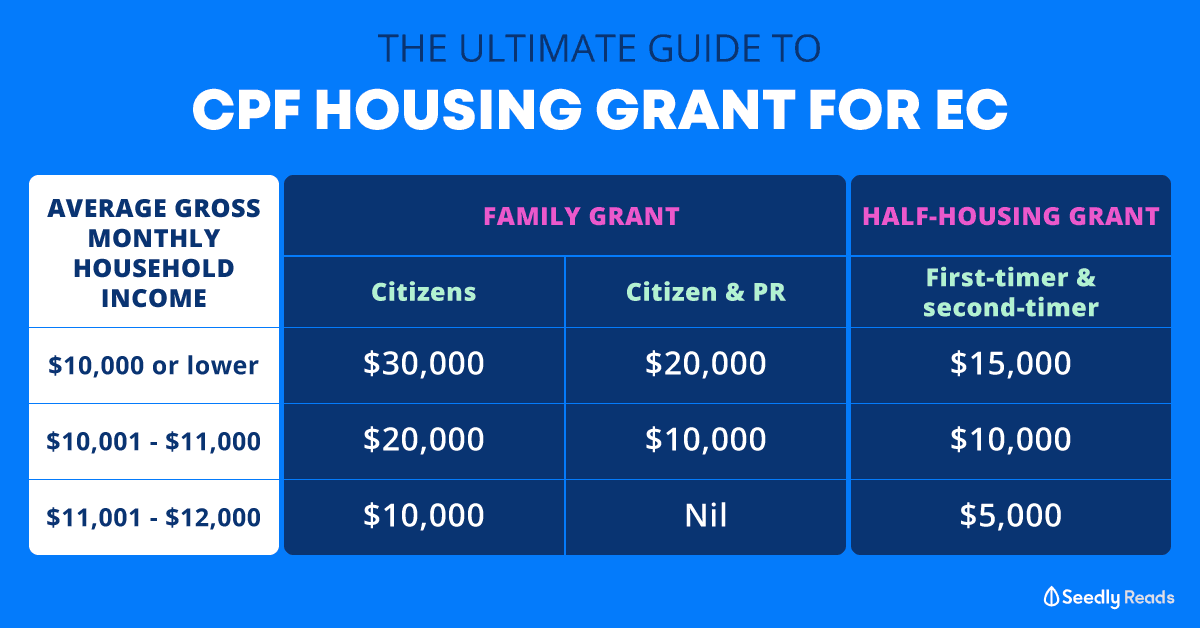

| Average Gross Monthly Household Income | Family Grant | Half-Housing Grant | |

|---|---|---|---|

| Of all persons in application (i.e. applicants & occupiers) | Singapore Citizen (SC/SC) Household | Singapore Citizen / Permanent Resident (SC/PR) Household | First-timer Singapore Citizen / Second-timer Household |

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $14,000* | Nil | Nil | Nil |

| * Figures retrieved from HDB website. As reflected in MND's press release, there are no housing grants for applicants with monthly household income from $12,001 to $16,000. |

|||

On top of the monthly household income, citizenship and housing status of you and your other applicants, there are property ownership criteria to fulfil:

- All applicants and occupiers do not own other property overseas or locally

- All applicants and occupiers have not disposed of any within the last 30 months

- All applicants and occupiers cannot invest in private residential property from the date of application till after the 5-year MOP

- All applicants and occupiers must not be buying an HDB resale flat that has been announced for SERS

Your CPF Housing Grant for ECs can only be used to offset the balance downpayment or the subsequent payments towards the purchase price of your EC.

Sorry to disappoint if you were planning to use it for the minimum cash downpayment or your monthly mortgage instalment payments!

How Much Will We Get From the CPF Housing Grant for ECs?

Good news y’all!

There are two CPF Housing Grants for EC applicants, depending on you and your co-applicants’ income, citizenship and housing status.

| Average Gross Monthly Household Income | Family Grant | Half-Housing Grant | |

|---|---|---|---|

| Of all persons in application (i.e. applicants & occupiers) | Singapore Citizen (SC/SC) Household | Singapore Citizen / Permanent Resident (SC/PR) Household | First-timer Singapore Citizen / Second-timer Household |

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $14,000* | Nil | Nil | Nil |

| * Figures retrieved from HDB website. As reflected in MND's press release, there are no housing grants for applicants with monthly household income from $12,001 to $16,000. |

|||

While the income ceiling for buying a new EC has been raised to $16,000 since September 2019 to allow more housing options for first-timer families within this income level.

However, the income ceiling for the CPF Housing Grant for ECs remain unchanged. According to a press release by the Ministry of National Development, the housing grants are not currently available for those with a monthly household income between $12,000 to $16,000 as they should be able to afford the purchase.

Psst, don’t panic!

Here’s a checklist to know if you’re considered a first-timer!

| First-timer Applicant Checklist | |

|---|---|

| Housing Status | Must not be the owner of a flat bought from HDB |

| Housing Transaction | Must not have sold a flat bought from HDB |

| Must not have taken the CPF Housing Grant to buy an EC, Design, Build and Sell Scheme (DBSS) flat or an HDB resale flat | |

| Must not have taken over ownership of an EC, DBSS or HDB resale flat | |

| Must not have transferred the ownership of a flat bought directly from HDB, or an HDB resale flat bought with a CPF Housing Grant | |

| Must not have ever taken other forms of housing subsidy, such as Selective En bloc Redevelopment Scheme benefits or privatisation of HUDC estate | |

Citizen Top-Up

You’d have noticed by now that if you’re applying as a Singapore Citizen & Permanent Resident Household, you’ll receive $10,000 lesser for your Family Grant compared to a Singapore Citizen Household.

Did you know that you can apply for the Citizen Top-Up of $10,000 when you obtain Singapore citizenship or when you have a Singapore Citizen child?

All you need to do is to submit your Application for Citizen Top-Up through HDB’s e-Service within 6 months of obtaining the citizenship. Yay!

Am I Eligible for the CPF Housing Grant for ECs?

Since your application for the CPF Housing Grant for ECs will be made when booking your EC with the developer, you and your co-applicants will have to be eligible at the time of booking your unit.

| CPF Housing Grant for ECs Eligibility Conditions | ||

|---|---|---|

| Family Grant | Half-Housing Grant | |

| Citizenship | Singapore Citizen & at least 1 more Singapore Citizen or Permanent Resident | |

| Age | At least 21 years old | |

| Family Nucleus | Spouse & children (if any) | |

| Spouse-to-be | ||

| Children under your legal custody, care and control (if widowed or divorced) | ||

| Household Status | All applicants must be first-timer applicants | First-timer SC married/engaged to a spouse/spouse-to-be who is a second-timer applicant |

| Income Ceiling | $12,000 (SC/SC household) | $12,000 |

| $11,000 (SC/PR household) |

||

| Ownership or Interest in Property | All applicants and occupiers do not own other property overseas or locally | |

| All applicants and occupiers have not disposed of any within the last 30 months | ||

| All applicants and occupiers cannot invest in private residential property from the date of application till after the 5-year MOP | ||

| All applicants and occupiers must not be buying an HDB resale flat that has been announced for SERS | ||

Unfortunately, if you and your co-applicants are applying for the EC under the Joint Singles Scheme or the Orphans Scheme, you’ll not be eligible for the CPF Housing Grant for ECs.

How Will the CPF Housing Grant for ECs Be Disbursed?

Depending on your household status, your CPF Housing Grant for ECs will be disbursed differently.

But duh, it’ll be in the form of CPF monies into your CPF Ordinary Accounts!

| Type of Applicants | Distribution of Grant |

|---|---|

| Sole SC applicant | Full grant |

| Joint SC applicants (husband & wife) | Half of the full grant each |

| First-timer & second-timer applicant | Full grant given to the SC first-timer, who must be a co-applicant) |

| Multi-nuclei Singapore Citizen applicants, such as: - Married siblings with their respective spouses - Parents & married child | Grant given only to a maximum of 2 applicants who are husband and wife |

How Can We Use the CPF Housing Grant for ECs?

Before you get too excited, there are only two options when it comes to the usage of your grant.

| Can be used for: | CANNOT be used for: |

|---|---|

| Offset the balance downpayment for the EC | Minimum cash downpayment (if any) |

| Subsequent payments towards the purchase price | Monthly mortgage instalment payments |

Heads-up!

If you’re planning to make use of your CPF monies to fund your EC, the grant amount you received will also be taken into account when calculating your CPF withdrawal limit!

Advertisement