A friend and I recently got into a – shall we say – constructive debate over the benefits of getting a degree.

While not exactly groundbreaking food for thought, I’ve many times questioned the value of my Arts degree, given the median salary is far lower than in other industries.

Never mind, then, that some of my diploma-holding friends earn salaries that exceed mine.

Jumping straight into full-time jobs after poly gave them a head start in the working world; hardly an impractical thing, considering the media industry favours talent and experience over qualifications.

On that, these are some ways to measure your worth the value of your degree.

Will My Degree Give Me The Returns I Need?

Three things come into play here: the length of your course, whether you’re studying locally or overseas, and which industry you intend to go into.

Having a degree is no longer a prerequisite for more and more companies – from Google and Apple to IBM and Facebook.

Specialised fields such as engineering, however, will understandably often require a degree in computer science or statistics.

And if it’s accounting you’re looking at, you’ll need both a degree and your ACCA.

The easiest way to ascertain your returns on that expensive degree is by calculating its Returns on Investment.

Calculating Your Degree’s ROI

If you’re new to this, Returns on Investment (ROI) involves pitting the amount spent (on getting your degree) against your realised benefits.

The latter could include your salary and bonuses.

Meantime, there’s ROI’s lesser-known counterpart: Value on Investment (VOI), which measures the intangible experiences gained while undergoing your course.

Putting a number to something so unquantifiable can be tricky. So for purposes of simplification, we’ll focus on your ROI.

Rightly, this is the formula for calculating your degree’s ROI:

ROI = (Net Profit/Investment) x 100%

What I’ll instead do, though, is calculate the number of years needed to recover the cost of your degree.

How Much Does Your Degree Cost?

It’s clear studying locally is always the cheaper option, but by how much?

The below table sorts seven job industries by cost of degree, median salary and maximum salary — based off our ultimate salary guide.

| Degree | Locally (total cost) | Overseas (total cost) | Median starting salary (annually) | Maximum salary (annually) |

|---|---|---|---|---|

| Law | $50,600 | $194,501 (AUD207,911) | $60,000 | $500,000 (Legal Counsel - Investment Banking) |

| Arts & Social Sciences | $32,800 | $89,814 (AUD96,000) | $37, 200 | $240,000 (Head of Marketing) |

| Accounting | $37,600 | $115,412 (AUD123360) | $48,000 | $350,000 (Tax Director) |

| Banking & Finance | $37,600 | $122,533 (AUD130,992) | $38,000 | $450,000 (Director/ED/MD) |

| Information Technology | $37,500 | $116,030 (AUD124,032) | $42,000 | $350,000 (Program Manager) |

| Engineering | $37,500 | $116,030 (AUD124,032) | $36,000 | $200,000 (Quality Assurance Director) |

| Healthcare & Life Science | $34,860 | $84,195 (AUD 90,000) | $30,000 | $480,000 (General Manager, APAC) |

Keep in mind the above numbers don’t take into account inflation rates for university fees.

While schools like NTU offer fixed rates throughout the duration of a course, expect annual or semestral increments at NUS, SUSS and most overseas universities.

Local VS Overseas Uni Fees

Let’s assume you’re considering an Arts degree, but haven’t decided whether to do it locally or overseas.

Here’s a comparison of the costs incurred from each.

Note: Course fees are estimates derived from the average cost of course fees in universities.

Studying At A Local University

| Annually | Over 4 years | |

|---|---|---|

| School fees | $8,200 | $32,800 |

| Course materials | $200 | $800 |

| Hostel Accommodation (Includes application fee) | $3,800 | $15,200 |

| Miscellaneous fees (Median figure) | $400 | $1,600 |

| Expenditure (Meals, transport, leisure) | Transport: $1,020 Dental: $150 Pocket money: $4,200 Polyclinic: $40 Phone bill: $240 Laptop: $1,500 Total: $7,150 | Transport: $4,080 Dental: $600 Pocket money: $16,800 Polyclinic: $160 Phone bill: $960 Laptop: $1,500 Total: $24,100 |

| Stage total | $19,350 | $72,900 |

Studying At An Overseas University

| Annually | Over 3 years | |

|---|---|---|

| School fees | $32,000 | $89,914 |

| Course materials | $200 | $600 |

| Accommodation | Around $12,720 | $38,160 |

| One-time miscellaneous fees | - | Visa: $570 Overseas Student Health Cover (OSHC): $1,410 Chest x-ray (for visa): $150 |

| Expenditure (Meals, transport, leisure) | Transport: $1200 Pocket money: $4,800 Clinic: $100 Phone bill: $300 Laptop: $1,500 Total: $7,900 | Transport: $3,600 Pocket money: $14,400 Dental: $300 Clinic: Covered by OSHC Phone bill: $900 Laptop: $1,500 Total: $20,700 |

| Stage total | $52,820 | $151,404 |

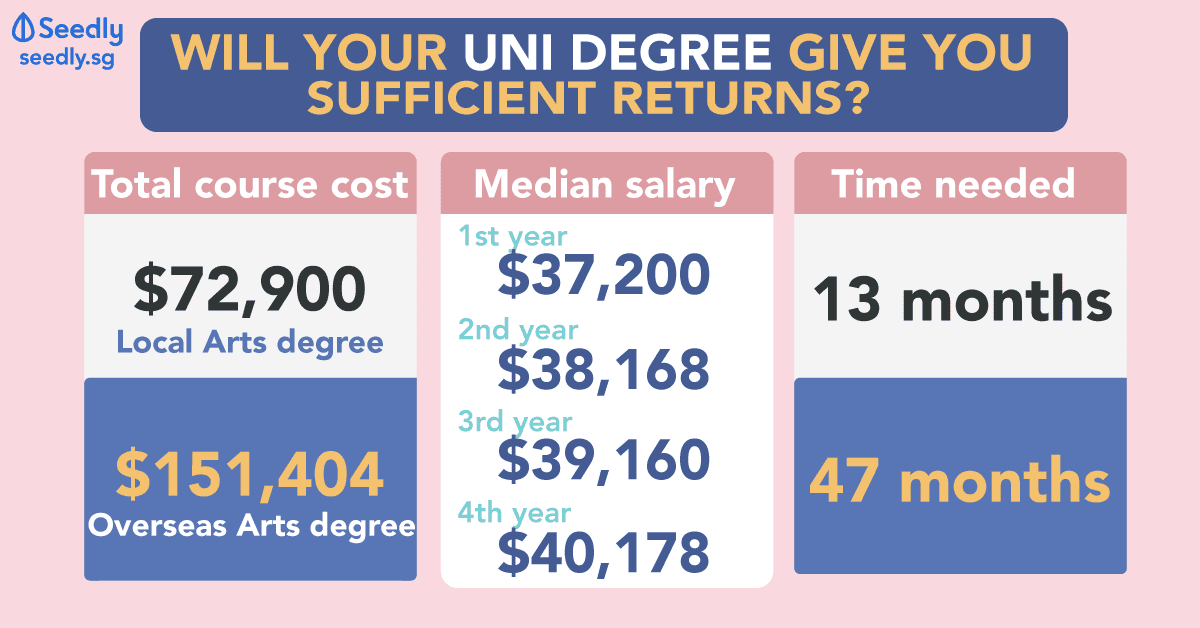

Let’s now do a side-by-side comparison of total costs incurred against salaries for Arts degree holders – and how long it might take to get returns.

| Total course cost (Based on stage totals) | Median starting salary: 1st year (annually) | Median salary increment (~2.6% annually) | Years needed to recover cost of degree | |

|---|---|---|---|---|

| Local Arts degree | $72,900 | $37,200 | 2nd year: $38,168 3rd year: $39,160 4th year: $40,178 | 1 year 11 months |

| Overseas Arts degree | $151,404 | 3 years 11 months |

It’s crazy, if unsurprising, that an overseas Arts degree takes at least an extra two years to recoup in cost.

And tough luck if you’re considering a private uni degree: it’ll take you even longer to get returns.

Of course, these results could vary depending on:

- Your actual salary: Thanks to my lack of research, I accepted a starting salary far lower than the norm.

- The length of your course: My diploma allowed me advanced standing in my (overseas) degree, which I completed in two years instead of three.

- Job promotions/changes: Getting promoted or hopping to another job could significantly boost your salary.

Source: Tenor - Your field of work: Sectors such as banking or law offer far higher starting salaries.

- Your lifestyle: When I first arrived in Melbourne for uni, I spent a fair amount on secondhand clothes and a ukulele…and drinks.

And brunch. And magazines.

It’s nothing to boast about – but TL;DR: be realistic in budgeting your expenditure.

Final Tips: Your Pre-University Checklist

Embarking on your degree is equal parts exciting and scary. It could also heavily dent your parents’ or your finances.

Keep in mind these questions before making your decision:

- Degree or nah?: This depends greatly on your field of work.

- Scholarships or grants: Are there university grants or scholarships you could make use of?

Source: Tenor - Education loans: Will you need an education loan to fund your degree if you go overseas?

This list covers the best interest rates for local and overseas degrees. - Talk to professionals: Attending university fairs is your best chance to meet lecturers or student alumni.

This would give you a keen sense of the school’s course structure, fees and culture. - Do your budgeting: The biggest mistake I made was flying a full-service airline – and during peak months, at that.

Don’t skimp on budgeting; it could save you thousands in the long run.

As much of a hassle as it may be, measuring the returns on your degree could help you make a better decision in the long run – never rush into it.

Advertisement