Ultimate Guide to Executive Condos (ECs): Eligibility, Grants, and Upcoming EC Launch 2023 & Beyond

●

Fancy a private condominium at a discount?

You might want to consider an Executive Condominium (EC), a public and private housing hybrid.

ECs are constructed and planned by private developers and have condo amenities like function rooms, gyms, BBQ pits, and swimming pools:

If you are looking for one, you’re in luck, as the Government has announced the first half of the 2023 Government Land Sales (GLS) programme with a total of seven new housing sites, including three ECs in the confirmed and reserved lists. This raises the projected number of private housing units, including ECs, by 16.7 per cent from H2 2022 to a total of 17,020 units.

Intrigued?

Here’s all you need to know!

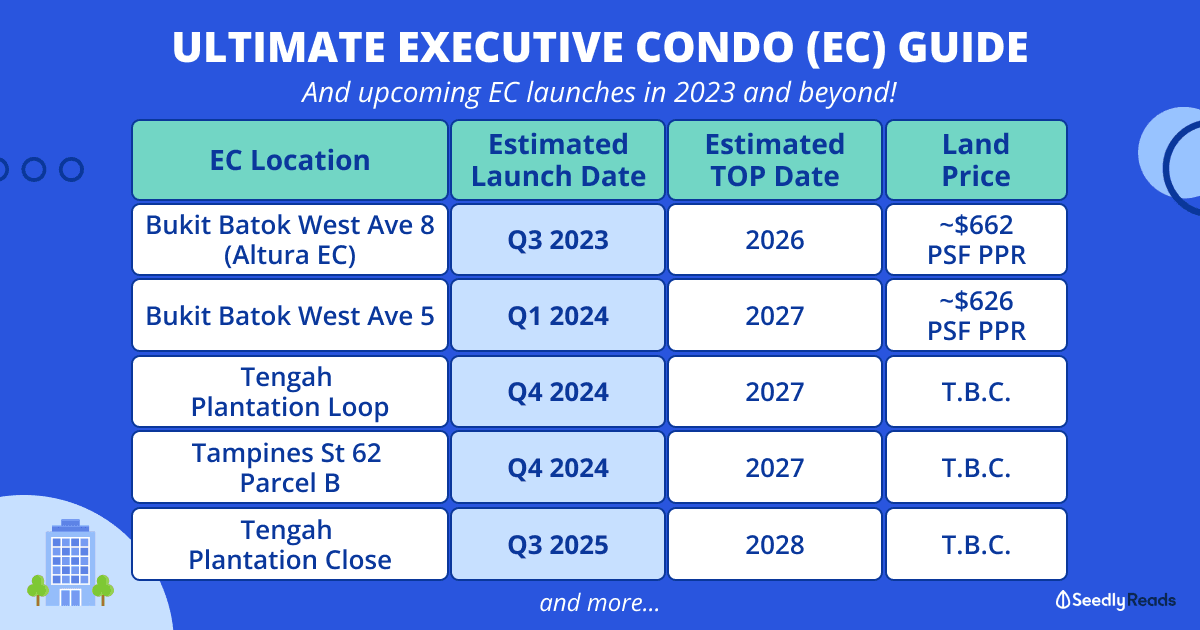

TL;DR: Executive Condo Singapore Guide and Upcoming EC Launch 2023 and Beyond

| Executive Condo Location | Estimated Launch Date | Estimated TOP Date | Land Price |

|---|---|---|---|

| Bukit Batok West Ave 8 (Altura EC) | Q3 2023 | 2026 | ~$662 PSF PPR |

| Bukit Batok West Ave 5 | Q1 2024 | 2027 | ~$626 PSF PPR |

| Tengah Plantation Loop | Q4 2024 | 2027 | T.B.C. |

| Tampines St 62 Parcel B | Q4 2024 | 2027 | T.B.C. |

| Tengah Plantation Close | Q3 2025 | 2028 | T.B.C. |

Click to Teleport

- What Are Executive Condominiums (ECs)?

- Executive Condo Eligibility: Can PR Buy EC?

- Executive Condo Grants

- Financing for ECs: How Much Is a Downpayment on EC?

- Conditions to Take Note of After Buying Your EC

- Existing ECs With Balance Units: FYI — Copen Grand @ Tengah Garden Walk is Sold Out

- Upcoming HDB EC Launch 2023 and Beyond

- HDB Executive Condo Launch (2023) FAQs

What Are Executive Condominiums (ECs)?

Simply put, ECs are considered public and private housing due to two main reasons.

Firstly, they are built and managed by private developers on Government subsidised land. Secondly, when you buy an EC, it is considered public housing for the first ten years and private property thereafter.

In other words, they can be technically considered Government subsidised private condos that cater to the sandwiched class of home buyers who exceed the income ceiling for HDB Build-to-Order (BTO) flats and find private condominiums too expensive.

In terms of facilities, ECs are comparable to private condos as they have similar facilities like gyms, swimming pools, tennis courts, and security guards who ensure the safety of EC residents.

Executive Condo Hdb Overview: What Is the Income Ceiling for EC (2023)?

To help you understand ECs better, here is a brief comparison of ECs and private condos:

| EC | Private Condo | |

|---|---|---|

| Price | Less expensive (About 20% - 25% cheaper compared to similar private condos | More expensive |

| Lease | 99 years | 99 years or freehold |

| Private or public? | Public for the first 10 years | Private |

| Minimum Occupancy Period (MOP) | Five years (But takes 10 years to be privatised) | N.A. |

| Income ceiling | $16,000 | N.A. |

| CPF housing grants availability | Housing Grant or Half-Housing Grant for first times | N.A. |

| Location | Usually quite inaccessible | Locations all around the island |

| Launch frequency | One to two per year | Any time of the year |

| Completion date | Up to five years, depending on the development | Immediately |

Executive Condo Eligibility: Can PR Buy EC?

However, there are some criteria you will need to fulfil to buy an EC according to HDB:

| Criteria | Details |

|---|---|

| Family nucleus | You have to qualify for any of the eligibility schemes: Public Scheme Fiancé/Fiancée Scheme Orphans Scheme Joint Singles Scheme |

| Citizenship | You must be a Singapore Citizen (SC) At least 1 other applicant must be an SC or Singapore Permanent Resident (SPR) All singles must be SCs if applying under the Joint Singles Scheme |

| Age | At least 21 years old At least 35 years old, if applying under the Joint Singles Scheme |

| Monthly household income ceiling | Your monthly household income must not exceed $16,000. |

| Ownership/ Interest in property in Singapore or overseas other than HDB flat | All applicants and occupiers listed in the application: Must not own or have an interest in any local or overseas private property; and Must not have disposed of any private property in the last 30 months before the application to buy an EC unit from a property developer Private properties include but are not limited to houses, buildings, land, EC units and privatised HUDC flats. You have acquired an interest in a property through purchase or when it is: Acquired by gift Inherited as a beneficiary under a will or from the Intestate Succession Act Owned, acquired, or disposed of through nominees |

| Previous housing subsidies | A subsidised housing unit refers to: A flat bought from HDB A resale flat bought with CPF housing grant A Design Build and Sell Scheme (DBSS) flat bought from a property developer An EC unit bought from a property developer Other forms of housing subsidy (e.g. enjoyed benefits under the Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate, etc) If you have not taken a housing subsidy before, you are a first-timer and may buy an EC unit from a property developer. If you have taken a housing subsidy, you are a second-timer and may buy an EC unit from a property developer. You have to pay a resale levy. Find out more on the resale levy payable. If you have already bought 2 subsidised housing, you will not be eligible to apply or be listed as an essential occupier in an application to buy an EC unit from a property developer. |

| Ownership/ Interest in HDB flat | If you or any persons listed in the application have an interest in any HDB flat, you must dispose of the interest within 6 months of completion of the EC unit purchase. |

| Undischarged bankrupt | Prior consent must be obtained from the Official Assignee (OA) or the private trustee for the purchase of an EC unit. However, occupiers who are bankrupts do not need prior consent. |

| Wait-out period before applying to buy an EC unit from a property developer | Cancellation of application after booking a flat from HDB If you have booked a flat from HDB and subsequently cancel your flat booking, you must wait out a 1-year period from the date of the cancellation before you may apply or be listed as an essential occupier to buy an EC unit from a property developer. Termination of the Sale and Purchase Agreement for an EC unit If you had previously bought an EC unit from a property developer with a CPF Housing Grant and subsequently terminated the Sale and Purchase Agreement, you must wait out a 5-year period from the date of the termination before you may apply or be listed as an essential occupier to buy an EC unit from a property developer. Owners/ Ex-owners of an EC unit bought from a property developer If you currently own or have recently disposed of your ownership in an EC unit, you must wait out a 30-month period from the date of disposal of the EC unit before you may apply or be listed as an essential occupier in an application to buy another EC unit from a property developer, subject to other eligibility conditions. |

Executive Condo Grants

The Government will also offer CPF housing grants of up to $30,000 as follows, according to HDB:

| Average Gross Monthly Household Income of All Persons in Application, i.e. Applicants and Occupiers | Family Grant | Half-Housing Grant If You Are a First-Timer (Ft) SC and Your Co-Applicant Is a Second-Timer (St) Who Has Previously Taken 1 Housing Subsidy, i.e. Ft/ St Couple |

|

|---|---|---|---|

| Singapore Citizen (SC / SC) Household | SC / Singapore Permanent Resident (SC / SPR) Household | ||

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $16,000 | Nil | Nil | Nil |

Financing for ECs: How Much Is a Downpayment on EC?

When it comes to financing your EC, there are a few things you need to take note of:

Downpayment Amount: Unlike HDB flats that require you to pay a 20% down payment in cash or CPF, you will have to make a downpayment of 25% (5% cash + 20% cash/CPF) for ECs.

Home Loan: You can only take a bank loan for ECs.

Loan Limits: You will also have to comply with the Mortgage servicing ratio (MSR) and Total debt servicing ratio (TDSR) set by the Monetary Authority of Singapore (MAS).

MSR refers to the portion of a borrower’s gross monthly income that goes towards repaying all property loans, including the loan being applied for, which is capped at 30% of a borrower(s)’ gross monthly income.

TDSR refers to the portion of a borrower’s gross monthly income that goes towards repaying the monthly debt obligations (any type of loan, including car, education, personal loans, etc.), including the loan being applied for. A borrower’s TDSR should be less than or equal to 55%.

There are also some additional costs you need to take note of.

On top of the selling price of ECs, you will have to pay legal fees of around $2,500 to $3,000 and valuation fees of about $200.

There is also the small matter of Buyer’s Stamp Duty (BSD):

| On or after 15 Feb 2023 | ||

|---|---|---|

| Purchase price or market value of the property | BSD rates for residential properties | BSD rates for non-residential properties |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | 5% |

Conditions to Take Note of After Buying Your EC

In addition, it is important to take note of these conditions you need to adhere to after you buy an EC unit from a property developer according to HDB:

Existing ECs With Balance Units: FYI — Copen Grand @ Tengah Garden Walk is Sold Out

If you are looking to get an EC in Singapore, here are some of the ECs with balance units left.

FYI: All units of Copen Grand EC, which was launched back in November 2022, were bought up one month after its launch.

North Gaia @Yishun North Ave 9 Balance Units

Here are the most updated sold/available units for the North Gaia EC in Yishun:

Tenet New EC @Tampines St 62 Parcel A

And the Tenet EC at Tampines:

Upcoming HDB EC Launch 2023 and Beyond: Latest EC Launch To Look Out For

If the ECs above don’t catch your eye, here are the upcoming ECs you can look forward to:

| Executive Condo Location | Estimated Launch Date | Estimated TOP Date | Land Price |

|---|---|---|---|

| Bukit Batok West Ave 8 (Altura EC) | Q3 2023 | 2026 | ~$662 PSF PPR |

| Bukit Batok West Ave 5 | Q1 2024 | 2027 | ~$626 PSF PPR |

| Tengah Plantation Loop | Q4 2024 | 2027 | T.B.C. |

| Tampines St 62 Parcel B | Q4 2024 | 2027 | T.B.C. |

| Tengah Plantation Close | Q3 2025 | 2028 | T.B.C. |

There’s another thing you need to take note of. According to the Urban Redevelopment Authority (URA), there are two main processes by which sites are released to the real estate market.

Sites identified for sale on the Confirmed List (CL) are launched for sale at pre-determined dates, and most land parcels are sold through tenders.

Sites on the Reserve List (RL) are not immediately released for tender but are made available for application. An RL site will be put up for tender when a developer has indicated a minimum price which is accepted by the government.

There are also potentially two future EC locations at Senja Close (Reserve) and Tampines St 95 (Reserve) which developers have applied for.

HDB Executive Condo Launch (2023) FAQs

One more thing, we would like to answer some of the commonly asked questions about ECs.

Can I Buy EC With HDB Loan? How Much Is the Downpayment for EC?

As ECs are considered private property, you cannot use an HDB loan to buy an EC.

You will also have to make a downpayment of 25% of the property price when buying an EC and pay 5%.

Can Single Buy EC?

Unfortunately, as a single, you can only buy new ECs under the Joint Singles Scheme (JSS). This scheme is where you can apply for an EC with up to four singles and a minimum of two singles.

Read More: What Type of HDB Flats Can Single Singaporeans Buy?

But the singles have to fulfil the following conditions:

- You and your proposed applicant(s) must be SCs

- Single and at least 35 years old

- Divorced or legally separated from spouse and at least 35 years old

- Widowed or orphaned, and at least 21 years old.

Can I Buy EC Twice?

Yes you can buy an EC two times as you cannot own two ECs at one time. As such, you will need to sell your EC on the open market and wait for 30 months before submitting a new EC application.

Are ECs Worth Buying?

As each person’s situation is different, this article might not be enough to answer all your questions.

But fret not.

You can always join the Property group on Seedly and ask a question with your Seedly account or anonymously.

Our savvy community members are on hand to help!

Read More

Advertisement