In 2020, there was a surge in the number of Central Provident Fund (CPF) members who made voluntary housing refunds to their CPF.

A total of 14,980 CPF members had actually put in $1.48 billion back into their CPF accounts via the CPF voluntary housing refunds.

But to put this statistic into context, only 0.7% of the 2,070,000 active CPF members (at the end of Q1 2021.) have made voluntary housing refunds.

So you might be wondering, why is this select group of people making CPF voluntary housing refunds?

Should you do so as well?

Here’s what you need to know!

TL;DR: CPF Voluntary Housing Refund

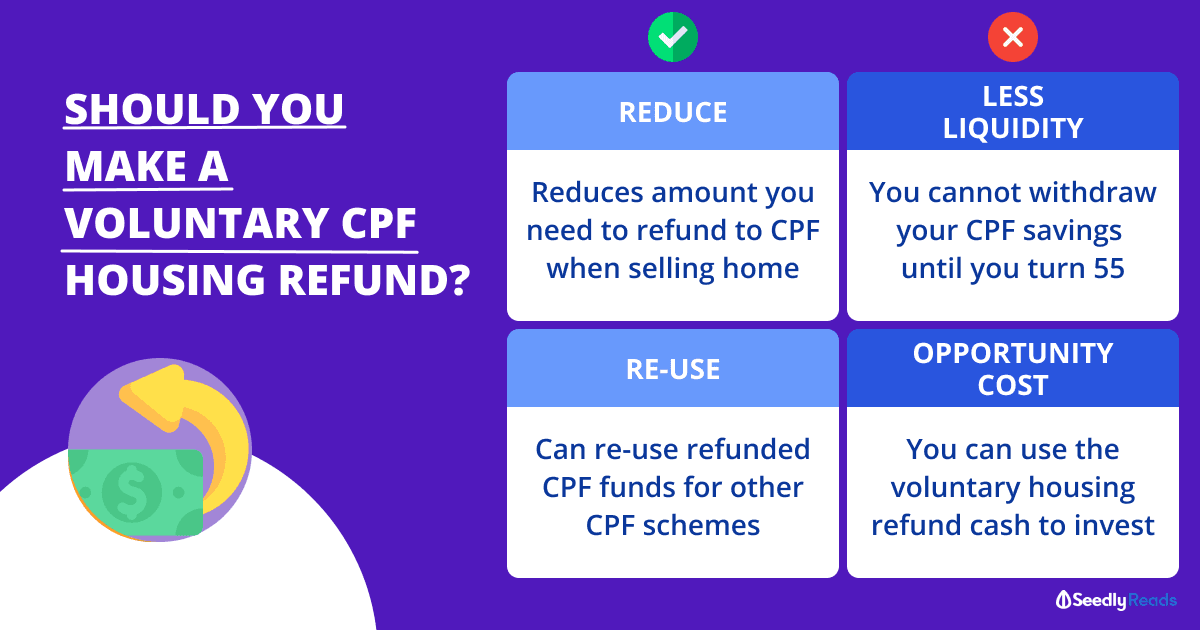

Pros

- Reduce Amount You Need to Refund to Your CPF When Selling Your House

- Can Re-Use CPF Funds For Other CPF Approved Schemes

Cons

- Less Liquidity: You Cannot Withdraw Your CPF Until You Turn 55

- You Can Use The Voluntary Housing Refund Cash to Invest

CPF Ordinary Account (OA) Funds

Before we begin, it is important for you to know that the Government takes retirement planning for Singaporeans very seriously.

Although you can take funds out of your own CPF OA account to use for housing expenses like:

- CPF Home Protection Scheme (HPS) premiums

- Stamp duty

- Legal fees

- Paying part of or the entirety of your home’s downpayment

- Paying mortgage loan instalments.

It all comes at a cost, as any funds that you take out of your CPF OA account HAS to be refunded with interest [2.5% per annum (p.a.)] when you sell your home.

In other words, you will have to repay the Principal taken out of your CPF OA plus the compounded Accrued Interest (i.e. the amount of interest your money would have made in your CPF OA if it was not withdrawn).

In a sense, you are borrowing money from your own CPF OA for your housing expenses.

The amount you have to refund includes Housing and Development Board (HDB) Grant money, as the funds from the grants are actually credited into your CPF OA first before there are deducted for your property purchase.

In addition, CPF has stated that ‘if you have received more than $30,000 in housing grants, part of the housing grants may be credited to your Special Account (SA)/Retirement Account (RA) and Medisave Account (MA).’

If you are curious, here’s how to check how much you need to refund to your CPF OA, SA/RA and MA:

- Login to the CPF website with your Singpass

- Select “My Statement”

- Look under Section C and select ‘Property’

- Select “My Public or Private Housing Withdrawal Details”

What Is the CPF Voluntary Housing Refund?

If you have used your CPF savings to pay for your housing expenses, you can actually choose to make a voluntary housing refund of the amount you have withdrawn to your CPF accounts.

The amount you can refund is capped at the entire principal amount you have withdrawn for your property expenses plus accrued interest.

Generally, any housing refunds you make will be sent back to your CPF OA if you are younger than 55.

But, if you are 55 years old and above, any voluntary housing refund you make will be first be directed to your CPF RA to meet your cohort’s Full Retirement Sum (FRS).

| Retirement Sums for Members Reaching Age 55 In The Respective Years | ||||

|---|---|---|---|---|

| 55th Birthday In | 2024 | 2025 | 2026 | 2027 |

| Basic Retirement Sum (BRS) | $102,900 | $106,500 | $110,200 | $114,100 |

| Full Retirement Sum (FRS) | $205,800 | $213,000 | $220,400 | $228,200 |

| Enhanced Retirement Sum (ERS) | $308,700 | $426,000 | $440,800 | $456,400 |

If you already have your cohort’s FRS in your CPF RA, your voluntary refunds above your FRS will remain in your CPF OA and/or CPF SA.

Pros of The CPF Voluntary Housing Refund

1. Reduce Amount You Need to Refund to Your CPF When Selling Your House

When you sell your house, you are required to refund some ‘refunds’ from the sales proceeds.

Otherwise, you are required to make two refunds:

First, your existing home loan’s outstanding balance needs to be paid back. This could be your HDB home loan or bank loan. This is the first refund that needs to be made and takes priority over everything else.

Secondly, you will need to refund all the CPF funds you took out from your CPF savings inclusive of the principal and the accrued interest.

This can include expenses like the downpayment, lawyer’s fees, stamp duties and HDB grants.

The amount you have to refund generally consists of the principal amount you took out from your CPF OA as well as the accrued interest that compounds annually and is calculated from the date you withdrew money from your CPF OA.

In other words, you will have to refund the interest on the principal amount based on the current CPF-OA interest rate of 2.5% p.a.!

Think of it as a reverse interest; the longer the money is out of the account, the more the accrued interest you’ll have to refund into your CPF OA when you sell your property.

This may result in a negative cash sale, a scenario where you might have to refund cash to your CPF OA when selling your house.

Here is an example of a negative cash sale:

| Selling Price | $460,000 |

|---|---|

| Outstanding Mortgage Loan | $300,000 |

| Remaining Sales Proceeds After Paying Off Outstanding Mortgage Loan | $160,000 |

| Total Required CPF Refund (Principal Amount + Accrued Interest) | $180,000 + $48,000 = $228,000 |

| Negative Sale (Remaining Sale Proceeds – Total Required CPF Refund) | $160,000 – $228,000 = -$68,000 |

In the illustration above, there is a negative cash sale of $68,000.

However, in the event that there is a negative cash sale and the amount that you have to refund to your CPF savings is more than your sale proceeds in cash, CPF will write off the additional amount.

In other words, you will not have to fork out any cash above the sales proceeds from your HDB flats. But, do note that this is only the case if you managed to sell your property at either its market value or above it.

In the event that you sell your property at below its market value and the amount that you have to refund to your CPF OA is more than your sale proceeds in cash; you will be required to refund all the money you took out of your CPF account plus accrued interest.

This means that you will have to top up cash to make up for the shortfall.

But on balance, you can write to CPF and appeal to write off this ‘debt’ if you are strapped for cash. Approval however is up to CPF’s discretion and is judged on a case-by-case basis.

To avoid this situation, you can make either a partial voluntary housing refund or a full voluntary housing refund to reduce the amount of accrued interest you have to refund.

This will reduce the amount of CPF savings that need to be refunded when you sell your property.

After all compound interest works both ways.

The sooner you refund your CPF savings, the less you have to refund to your CPF accounts when you sell or transfer the property.

1. Less Liquidity: You Cannot Withdraw Your CPF Until You Turn 55

Although you can use your CPF OA for many things, it is still not as liquid as having cash in hand.

Once you have made the voluntary housing refund, you can only start withdrawing the money you put into your CPF when you turn 55.

More specifically you can only withdraw up to $5,000 from your Special and Ordinary Accounts, or your CPF savings above the Full Retirement Sum (FRS) set aside in your CPF RA — whichever is higher.

2. You Can Use The Voluntary Housing Refund Cash to Invest

One of the perks of using your CPF OA to pay for your home expenses is that you can use your freed up cash to invest.

However, you will need to invest and attain returns of more than 2.5% p.a. (or 3.5% p.a. for first $20k) as you are basically ‘borrowing’ from your own CPF OA account at this interest rate to invest.

As mentioned above, you will have to refund the principal you took out from your CPF OA plus the accrued interest when you sell your flat.

Let’s illustrate this with an example.

Let’s say that you bought an HDB flat that costs $460,000 and used cash to make the downpayment, Buyer Stamp Duty (BSD), conveyancing fees and the other initial expenses.

You then took up an HDB housing loan.

HDB Housing Loan Amount ($414,000 over 20 years)

- Estimated HDB Housing Loan amount (90% of purchase price): $414,000

- Repayment Period (In Years): 20

- Interest rate of HDB Housing Loan: 2.6% p.a.

- Accrued interest rate for CPF funds taken out of OA: 2.5% p.a.

- Estimated monthly instalment: $2,214

I am removing the home loan interest out of the equation as you will have to pay this home loan interest regardless of whether you are using cash or CPF OA to pay for the home loan.

Instead of using cash to pay your home loan instalments, you use your CPF OA instead.

If you used cash you would only have to pay $414,000 after 29 years

But if you used your CPF OA to repay your home loan instalments, you would have to refund about $678,670 to your CPF OA at the end of 20 years when you sell your flat at or above the flat’s market value.

Since you used your CPF OA to repay your home loan, you could use the $2,214 you set aside each month for the home loan instalments to invest in a hypothetical low-cost Exchange Traded Fund (ETF) that gives your 5% p.a. in returns each year.

At the end of 20 years, you would have about $878,496 in liquid cash.

This would have netted you about $200,000 even after having to refund $678,670 to your CPF OA when selling your house.

But just a disclaimer, when you invest, you bear the risk of losing your capital. As such we would recommend that you read up and fully understand what you are getting into before you start investing.

These guides should help:

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice to buy or sell any investment product. Readers should always do their own due diligence and consider their financial goals before investing.

Advertisement