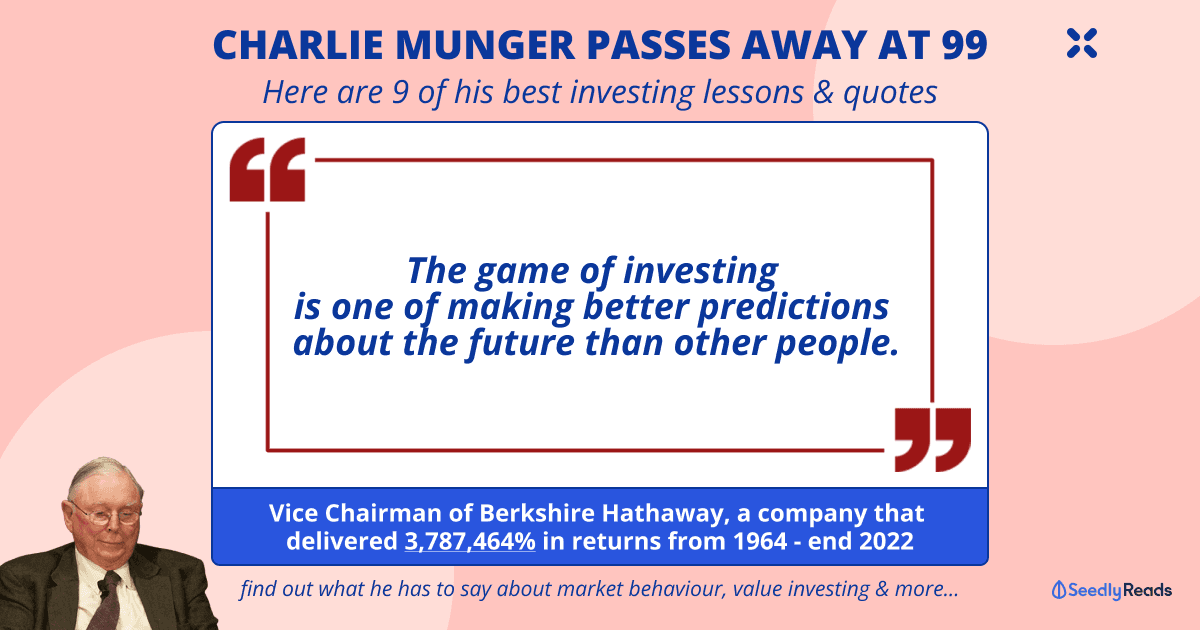

Charlie Munger Passes Away at 99: Here Are 9 of His Best Investing Lessons/Quotes

Sudhan P

Sudhan P●

Charlie Munger, Warren Buffett’s partner at Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), has influenced the latter a great deal.

Thanks to Munger, Buffett transitioned from buying unusually cheap stocks of companies that don’t necessarily have strong business prospects (called “cigar butts”) to buying wonderful companies that may not trade cheaply.

Unfortunately, the company announced yesterday (28 November 2023) that the legendary investor had peacefully departed at a California hospital at the ripe old age of 99.

To honour this legacy, here are some of the best quotes about investing and life uttered by the wise man (italics are used to emphasise key points when quoting Munger).

Who is Charlie Munger?

For the uninitiated, Charlie Munger, born on January 1, 1924, is a renowned American investor, entrepreneur, and philanthropist. He is widely recognized as the Vice Chairman of Berkshire Hathaway, arguably one of the most successful investment firms of all time.

Munger achieved legendary status in the investing world as he played a crucial role in aiding Buffett in refining his investment approach and significantly contributed to the extraordinary 3,787,464% returns (not a typo) generated for shareholders by the company from 1964 to the end of 2022.

In addition, from 1962 to 1975, he managed an investment partnership named Wheeler, Munger & Co., which was subsequently dissolved. The partnership’s performance was remarkable, yielding an insane annualised return of 19.8% (before fees), in stark contrast to the 5% return of the Dow Jones Industrial Average over the same period.

1. On Market Behaviour and Psychology

Someone asked about the broad stock market frenzy and the psychological implications of this type of market behaviour.

The person also asked what investors can do to better cope with such market euphoria.

This is what Munger had to say:

‘Well, these things do happen in the market economy. You get crazy booms. Remember, the dot-com boom? When every little building in Silicon Valley ran at a huge price, and a few months later, they were about — 1/3 of them were vacant. There are these periods in capitalism. And I’ve been around for a long time, and my policy has always been to just ride them out. And I think that’s what shareholders do. In fact, what shareholders actually do is a lot of them crowd in to buying stocks on frenzy frequently on credit because they see that they’re going up. And of course, that’s a very dangerous way to invest. I think that shareholders should be more sensible and not crowd into stocks and just buy them just because they’re going up and they like to gamble.

2. On Value Investing

There’s a general thinking that value investing is dead since growth companies like Amazon.com (NASDAQ: AMZN), Palantir (NYSE: PLTR), and Tesla (NASDAQ: TSLA) have been outperforming value stocks by a huge margin.

But Munger feels buying strong companies is still considered value investing:

“Value investing the way I regard it will never go out of style because value investing the way I can see it is always wanting to get more value than you pay for when you buy a stock. And that approach will never go out of style. Some people think that value investing is you chase companies which have a lot of cash and they’re in a lousy business or something. But I don’t define that as value investing. I think all good investing is value investing. It’s just that some people look for values in strong companies and some look for values in weak companies. But every value investor tries to get more value than he pays for.”

3. On Not Following the Crowd

Munger recognizes that successful investing requires you to predict the future. However, he emphasises the critical factor of making better predictions compared to others:

“The game of investing is one of making better predictions about the future than other people.”

This quote highlights the competitive dynamics of financial markets and states that investors must cultivate unique perspectives and steer clear of avoiding the herd mentality to achieve success.

Take the US-listed Monster Beverage (NASDAQ: MNST), for example.

From 1995 to 2015, the stock topped the charts. Its shares produced a total return of 105,000%, turning every $1,000 into more than $1 million.

Who would have thought you could make so much money selling energy drinks.

4. On Diversification

Many aspects of investing are touchy topics, including diversification.

Some investors want to have a diversified portfolio, while others prefer to concentrate their money on a few stocks.

Munger, who belongs to the latter camp, had this to say on the topic of diversification:

What is interesting is that in wealth management, a lot of people think they have 100 stocks they’re investing more professionally than they are, they have 4 or 5. I regard this as insanity, absolute insanity. I find it much easier to find 4 or 5 investments, where I have a pretty reasonable chance of being right that they’re way above average. I think it’s much easier to find 5 than just to find 100. I think the people who argue for all this diversification — by the way, I call it diworsification and — which I copied from somebody. And I’m way more comfortable owning 2 or 3 stocks, which I think I know something about and where I think I have an advantage.

5. On the Importance of Patience

Munger also highlights the value of exercising patience when it comes to investing.

“The big money is not in the buying and selling, but in the waiting.”

When it comes to investing, many might feel tempted to engage in frequent trading or react impulsively to market changes like a market crash. Munger’s advice highlights the importance of adopting a long-term outlook and having the capacity to endure short-term fluctuations in the market.

6. On Compounding

Munger is also a firm believer in the power of compounding, a fundamental concept in investing.

He cautions against unnecessary interference in the compounding process, highlighting the importance of letting investments accumulate and develop naturally over a long period of time:

“The first rule of compounding: Never interrupt it unnecessarily.”

7. On Being Humble, Avoiding Mistakes and Learning From Others

Munger highlights the importance of avoiding common traps and mistakes when investing. Instead of focusing solely on pursuing investing knowledge, he advocates that a substantial aspect of achieving success lies in reducing mistakes and drawing valuable lessons from the mistakes made by others.

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

Munger added that mistakes are unavoidable:

“Part of what you must learn is how to handle mistakes and new facts that change the odds.” Most notably, he was famous for stating that life is “like a poker game” and that “you have to learn to quit sometimes when holding a much-loved hand.”

While it’s impossible to go through life or act in a manner that avoids making mistakes altogether, you can learn how to make fewer mistakes than others and learn how to fix them more promptly when you commit them.

8. On the Value of Sharing Knowledge

Speaking of learning from others’ mistakes, Munger values the act of sharing knowledge, viewing it as a noble pursuit. In the investing world, this quote underscores the significance of mentorship and the value of acquiring wisdom from others:

“The best thing a human being can do is to help another human being know more.”

In the investing world, this statement underscores the significance of mentorship and the value of acquiring wisdom from others. The best investors typically surround themselves with experienced mentors and peers capable of offering valuable perspectives.

9. On Brokerages Like Robinhood That Provide ‘Free’ Trades’

Robinhood, the pioneer in zero-commission trading, is seen as the main gateway for young investors in the US to gain stock market access.

This is Munger’s take on the new type of brokerages springing up:

“Well, it’s most egregious in the momentum trading by novice investors lured in by new types of brokerage operation like Robinhood. And I think all of this activity is regrettable. I think civilization would do better without it. You’ll remember that when the first big bubble came, which was the South Sea bubble in England back in 1700s, it created such havoc eventually when it blew up that England didn’t allow hardly any public trading and securities of any companies for decades thereafter. It just created the most unholy mess. So human greed and the aggression of the brokerage community creates these bubbles from time to time, and I think wise people just stay out of them.”

He also explained why trades made through Robinhood are not “free”:

“Well, Robinhood trades are not free. When you pay for order flow, you’re probably charging your customers more and pretending to be free. It’s a very dishonorable low grade way to talk. And nobody should believe that Robinhood trades are free.”

Want More In-Depth Analysis And Discussion?

You can participate in the lively discussion regarding stocks here at Seedly and get your questions answered right away!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. Image credit: Bidsketch

Advertisement