Morbid topic, I know.

Of course, if you’ve already made a valid will, the executor will execute your will accordingly. You want to give who, they get lah.

But what if you don’t want to make a will or have yet to make a will?

Given that accidents happen, it’s important that we know what happens to our money if we pass on, especially if we did not make a will.

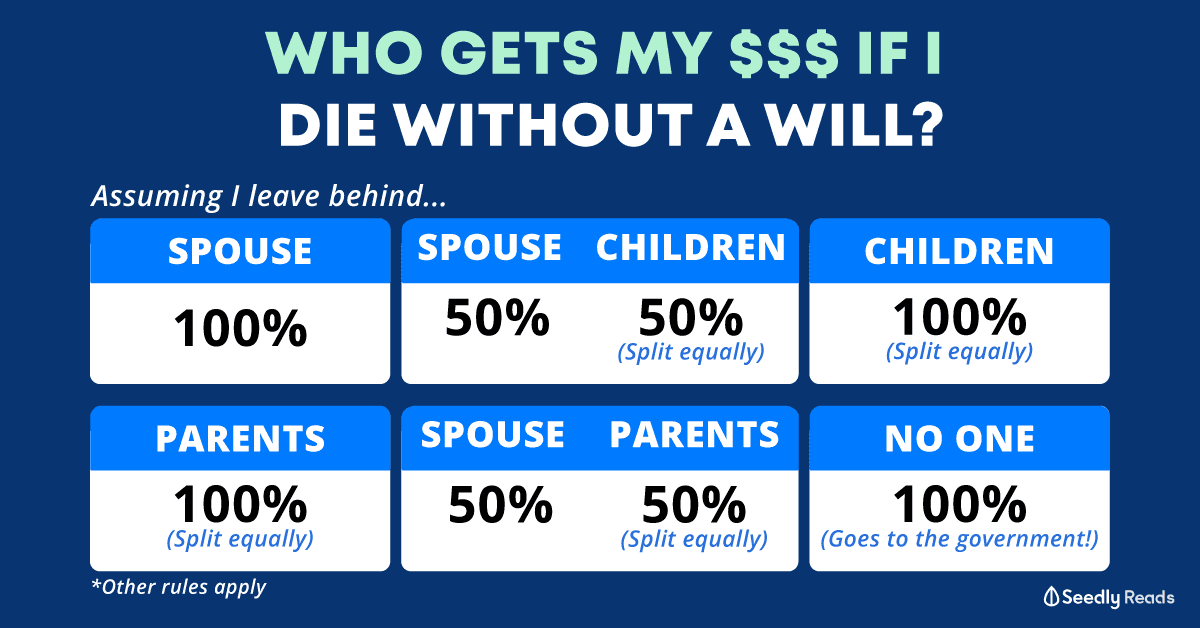

In the eyes of the law, passing on without having left a valid will make you an intestate and your estate will be distributed according to the Intestate Succession Act.

| Scenario | Recipients | Percentage of Entitlement |

|---|---|---|

| Surviving Spouse only | Spouse | 100% |

| Surviving Spouse & Children only | Spouse | 50% |

| Children | 50% Split equally |

|

| Surviving Children only | Children | 100% Split equally |

| Grandchildren | Their parent's share split equally if parents are deceased | |

| Surviving Spouse & Parents only | Spouse | 50% |

| Parents | 50% Split equally |

|

| Parents only | Parents | 100% Split equally |

| Siblings only (or children of deceased sibling) | Siblings | 100% Split equally |

| Nieces & Nephews | Their parent's share split equally if parents are deceased | |

| Grandparents only | Grandparents | 100% Split equally |

| Uncles & Aunts only | Uncles & Aunts | 100% Split equally |

| No Relatives | Government | 100% |

Disclaimer: This is not a sponsored post. Opinions and interpretations expressed in the article should not be taken as legal advice. Please consult the relevant legal documents or a legal professional for clarification and more information.

Who Will Handle My Money If I Die Without A Will?

Your Family Members

In the event that you choose not to leave a valid will and pass on as an intestate, your next-of-kin will need to apply for a Grant of Letters of Administration.

It is a legal document which makes your next-of-kin the administrator of your estate – for the purpose of distributing your estate.

The death of a loved one is an unfortunate and stressful event, and your next-of-kin does not have to deal with this alone. The court can appoint up to 4 administrators but they must act together to distribute the assets.

Public Trustee Office

In the event that your estate is less than $50,000 and you do not have any outstanding liabilities, the Public Trustee Office can assist your family members in distributing your estate.

What Is Considered As My Estate?

Even though we might think that we do not have much, the little that we have in our name is all considered as part of our estate. Here’re a few common things which the average Singaporean would have in his or her name.

Bank Accounts

The banks will ‘freeze’ your bank accounts immediately upon notification of your death.

No withdrawals can be made while the bank closes the account.

Joint Accounts

After the account is closed, your surviving joint account holder can then withdraw the account balance.

In order to do so, they will need to provide the bank with:

- A copy of your death certificate

- Proof of their identity

Single Accounts

Similarly, after the individual account is closed, your next-of-kin can then request for the bank to release the funds in your accounts.

Typically, most bank policies will also require the same documents as above, along with the Letters of Administration before they will release the funds.

However, there are some banks that might not require letters of administration if your account has… say… less than $5,000.

CPF Savings

![]()

If you have made your nominations previously, your CPF savings will be distributed according to the percentages you have allocated to each nominee.

However, if you did not make any nominations, the Intestate Succession Act will be used to distribute your CPF savings to your surviving family members.

Property

HDB Flat: Joint Tenancy Scheme

Most of us will eventually belong in this category where you and your co-owners have equal interest and rights, regardless of who paid more for the flat.

Well, nothing’s going to happen to your flat physically, but your share in the flat will be transferred to your co-owners if they are eligible.

Your co-owners will have to lodge a Notice of Death with the Singapore Land Authority (SLA), either through HDB or directly with SLA, for the process to take place.

HDB Flat: Tenancy-in-Common

Not all HDB flats are purchased under the Joint Tenancy Scheme, some owners may choose to purchase their flat under the Tenancy-in-Common scheme.

Under this scheme, the shares are divided clearly and not necessarily in equal portions. This scheme may be more suitable for individuals purchasing the flat as an investment, or for couples who cannot be married.

In this case, instead of being transferred to the co-owners, your share in the flat will be distributed according to the Intestate Succession Act if you do not have a valid will.

With their Letters of Administration, your next-of-kin will need to register their legal right in order to manage your estate.

Private Property

Things are a little more straightforward when it comes to private property, they are either distributed according to your will or in the same fashion as all other assets according to the Intestate Succession Act.

Insurance

Certain insurance policies come with a death benefit, which will be paid out accordingly if you have made nominations previously.

However, if you do not have a will and did not make any nominations for distribution of the policy monies in the event of your death, the monies will be payable to the proper claimant of the policy, which is very likely, your family members.

Income Tax

All income earned prior to your demise is also subjected to income tax, and the administrator of your estate will be able to file income tax for you.

Yep, it’s inescapable… even in death.

Car

For those who own a car and did not leave a valid will, your car will be sold and the monies will be distributed according to the Intestate Succession Act.

In cases where there is only one surviving relative, they may not be required to sell off the car as they will be entitled to 100% of the estate.

What If I Have Debts?

For those of us lucky enough to leave this world with no debt to our names, the entirety of our estate will be left to those we leave behind. But for the majority of us, here are some debts we might still be servicing if we, unfortunately, leave this world prematurely.

Outstanding Mortgage Loan

If you took on the mortgage solely, as your administrator, your next-of-kin will sell off your property to pay off the mortgage.

Financing through a bank loan

In cases where you co-signed a bank mortgage, your surviving mortgagor will be responsible for paying off the mortgage.

However, if they have exhausted all means and are unable to do so, the bank has the right to take possession of the property.

Financing through CPF loan

All individuals financing their mortgage using their CPF savings will be insured under the Home Protection Scheme. In the event of your premise, the outstanding housing loan will be settled by the CPF Board (up to the sum insured).

Outstanding Car Loan

Typically, any outstanding car loan taken by you will be paid for by your estate.

However, if the car loan was taken under a joint account, your surviving joint account holder will need to pay off the remaining car loan.

Other Debts

Generally, your loved ones are not legally responsible if you were to depart with remaining debts.

But of course, your debts will still have to be paid off by your estate, before your will can be executed or your administrator can distribute your estate.

However, in the event that your debts exceed your estate, your estate will first be used to pay for your funeral and administrative expenses, before settling your debts according to the Bankruptcy Act. Most of the time, your remaining debts will be written off in this scenario.

Even though it’s not a topic that we enjoy talking about, estate planning is important as it ensures that your assets are distributed to your beneficiaries according to your wishes.

Have you done your homework and written your will yet? Let us know in the comments below!

Advertisement