Unless you have just woken up from a 10-year coma, it is likely that you would heard of a little cryptocurrency called Bitcoin.

Not too long ago (31 October 2008 to be exact) the mysterious Satoshi Nakamoto published a White Paper titled Bitcoin: A Peer-Peer Electronic Cash System.

FYI Satoshi Nakamoto is actually just a pseudonym used by the individual or group that created the cryptocurrency in 2009.

This paper was just the beginning.

A few months later on 3 January 2009, Satoshi Nakamoto mined the genesis block of bitcoin (block number 0), which gave a reward of 50 bitcoins. With that, the Bitcoin network was born.

This was the first implementation of blockchain technology as a public and decentralised ledger for transactions made using Bitcoin.

After Satoshi published the Bitcoin whitepaper and launched the Bitcoin blockchain, they vanished without a trace in 2010.

Why Bitcoin Matters

For context Bitcoin was created amidst the 2008 Global Financial Crisis (GFC).

During the GFC, we saw many major banks and financial institutions collapse largely due to mismanagement and the Governments bailing them out on the taxpayer’s dime.

This crisis exposed the frailties of the traditional centralised financial system.

There are no easy solutions to this problem.

But Bitcoin, a payment system that eliminates the need for centralised entities like banks, financial institutions and Governments could possibly provide a fix or provide an alternative to the current state of affairs.

In about two months time. Bitcoin is turning 13.

Despite its short history, Bitcoin has sparked a global blockchain and cryptocurrency revolution

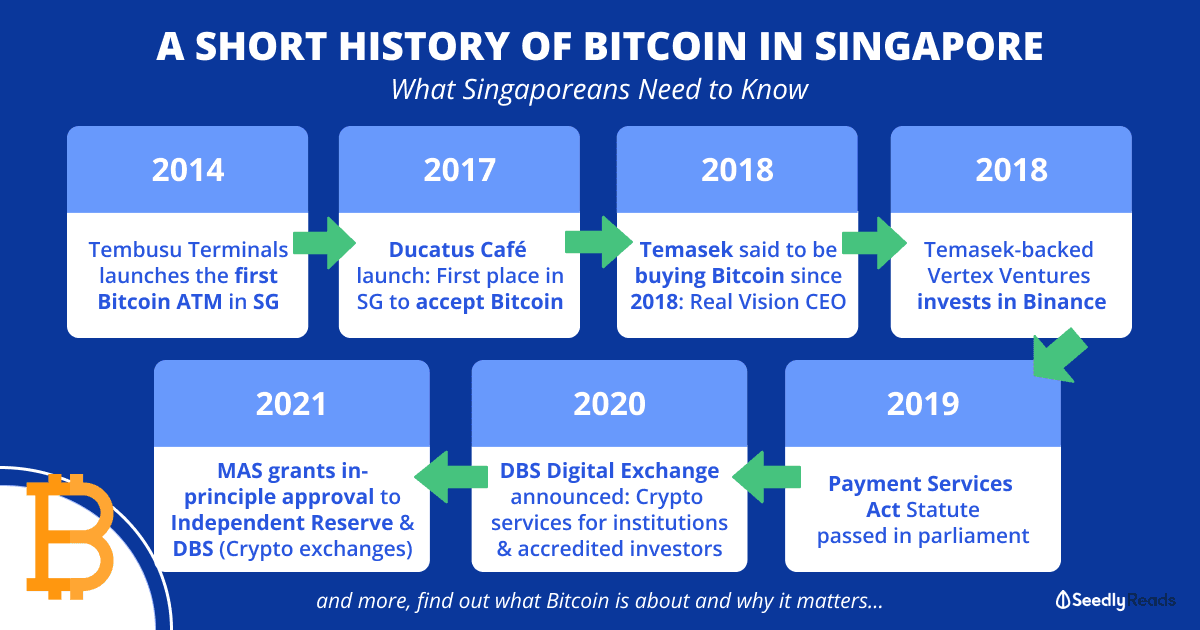

Here is a short history of key Bitcoin developments in Singapore.

#Ownthefuture

As much as we are talking about history, Bitcoin’s future is still developing rapidly.

If you want to own a piece of said future, we got something you might be interested in.

We have partnered with SingSaver and American Express to launch this super exclusive Bitcoin campaign for the first time ever in Singapore.

You will receive up to S$365 worth of Bitcoin when you successfully apply for a credit card. This offer is ONLY available on Seedly & SingSaver. You will not find it anywhere else.

These rewards will be given out from now until 7 November 2021 OR until S$1 million worth of Bitcoin has been claimed, whichever is earlier.

Also, the first 2,000 eligible applicants will receive an additional S$100 worth of Bitcoin so get to it!

If you were wondering, these rewards will also be given out to your Gemini account as they are our exclusive cryptocurrency wallet partner for this campaign.

How to Apply:

- Apply for your favourite credit card.

- Receive up to S$265 (S$265 for new customers and S$50 for existing customers) worth of Bitcoin after you fulfil the eligibility requirements.)

- Spend S$500 on the card within the first 30 days of card approval.

- Be one of the first 2,000 eligible applicants to receive up to an additional S$100 worth of Bitcoin.

Eligible Cards: American Express in Singapore

Here are the cards you can apply for with this campaign:

More details about the cards can be found on the landing page. And of course, terms and conditions apply.

P.S. if you are new to cryptocurrencies, do read our beginner-friendly cryptocurrency 101 guide.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Seedly does not recommend that any cryptocurrency should be bought, sold, or held by you. Readers should always do their own due diligence and consider their financial goals before investing in any investment product and consult your financial advisor before making any investment decisions.

Seedly and Singsaver will never ask you for your crypto wallet address nor instruct you to transfer any crypto to us throughout any of the campaigns.

A Short History of Bitcoin in Singapore

2014: Tembusu Terminals Launches The First Bitcoin ATM in Singapore

In March 2014, Singapore based startup Tembusu Terminals launched the first Bitcoin Automated Teller Machine (ATM) in Singapore.

The ATM was installed at Boat Quay bar The Spiffy Daffer.

Anyone could use the vending machine to exchange fiat currency for bitcoins at the cost of a five per cent service fee.

2017: First Cashless Cafe That Accepts Bitcoin Opens in Singapore

In December 2017, Singapore based cryptocurrency mining firm Ducatus Global opened the Ducatus Café in Singapore.

Located at Oxley Tower on Robinson Road, the cafe is a cashless establishment that accepts bitcoins and the Ducatus Coin (DUC) cryptocurrency.

The cafe also accepts other cashless payment methods like credit cards and Nets.

2018: Temasek Said To Be Buying Bitcoin Since 2018

On 25 March 2021, Raoul Paul an ex global hedge fund manager and Real Vision co-founder and CEO spoke at Real Vision’s online Crypto Gathering event.

He claimed that state-owned investment firm Temasek Holdings vestment firm Temasek Holdings have been buying Bitcoin from miners since 2018.

He then repeated the claim on Twitter:

As of today, Temasek has not confirmed or denied the claim.

2018: Temasek Backed Vertex Ventures Invests in Cryptocurrency Exchange Binance

But you should know that Temasek which closed the financial year ended 31 March 2021 with a Net Portfolio Value (NPV) of S$381 billion is not new to the cryptocurrency space.

In October 2018, Reuters reported that Temasek backed venture capital (VC) firm Vertex Ventures had invested an undisclosed amount into Binance to set up a fiat to cryptocurrency exchange in Singapore that will allow its customers to trade cryptocurrencies like Bitcoin with Singapore dollars.

A year later, Binance set up a separate entity, Binance Asia Services (BAS) which launched cryptocurrency exchange Binance Singapore (Binance.sg) in Singapore.

2019: Payment Services Act Statute Passed in Parliament

On 14 January 2019, the Payment Services Act 2019 (PS Act) statute was passed in Singapore’s parliament.

will have to be either licensed by MAS or granted the status of an exempt payment service provider.

2020: DBS Announces the DBS Digital Exchange Which Will Allow Institutional Investors and Accredited Investors to Trade Bitcoin and Other Cryptocurrencies

On 10 December 2020, DBS Group Holdings Ltd’s (SGX: D05) announced that it will be launching a digital exchange in Singapore to allow ‘Institutional Investors and Accredited Investors to tap into a fully integrated tokenisation, trading and custody ecosystem for digital assets.’

The DBS Digital Exchange will provide services like:

-

Security Token Offerings – A regulated platform for the issuance and trading of digital tokens backed by financial assets, such as shares in unlisted companies, bonds and private equity funds.

-

Digital Currency Exchange – Cryptocurrency trading that will facilitate spot exchanges from fiat currencies to cryptocurrencies and vice versa. The DBS Digital Exchange will offer exchange services between four fiat currencies (SGD, USD, HKD, JPY), and four of the most established cryptocurrencies, namely Bitcoin, Ether, Bitcoin Cash and XRP.

-

Digital Custody Services – An institution-grade digital custody solution to meet the increasing demand for secure custodial services tailored for digital assets under their prevailing regulatory standards. Leveraging DBS’ experience in providing world-class custody services for conventional assets, DBS’ digital custody services provide the custody of cryptographic keys that control digital assets on behalf of clients.

In addition, it was announced that Singapore Exchange Limited (SGX: S68) (SGX) had taken a 10 per cent stake in the DBS Digital Exchange.

2021 MAS Grants in Principle Approval of Independent Reserve and DBS Vickers To Provide Cryptocurrency Exchange Services in Singapore

But recently, two entities, DBS Vickers (DBS’s brokerage arm) and Australian cryptocurrency exchange Independent Reserve announced that they have received in-principle approval from MAS to offer DPT services in Singapore.

Currently, the Independent Reserve exchange is up and running and you can trade Bitcoin and other cryptocurrencies there.

But, DBS Vickers which is part of DBS’s (SGX: D05) Digital Exchange (DDEX) will not be able to provide DPT services until it receives the full operating license from MAS.

Advertisement