If you’ve been camping your whole life, looking for a high yield instrument to invest… Well, this could be it.

Maybe.

Well, investment products are kind of like eye candies – they only appear awesome in the eye of the beholder.

About The Astrea V Bond

While the details for Astrea V bonds are still being confirmed, we understand that Fitch Ratings (one of the Big Three credit rating agencies) have upgraded the ratings that were given to Astrea III and Astrea IV.

If you have been following this closely, you’ll know that these two bonds are both private-equity (PE) bonds and are both Temasek-linked PE products.

So What’s The Big Deal About Astrea V?

Here’s how much we know about Astrea V at the moment – given that not much is not revealed yet:

- Astrea V is a Temasek-linked private equity (PE) vehicle

- Has same structure as Astrea IV (Yes. The one that just got upgraded in terms of rating)

Interest Rate, Interest Rate Step-Up And Maturity Date Of Astrea V

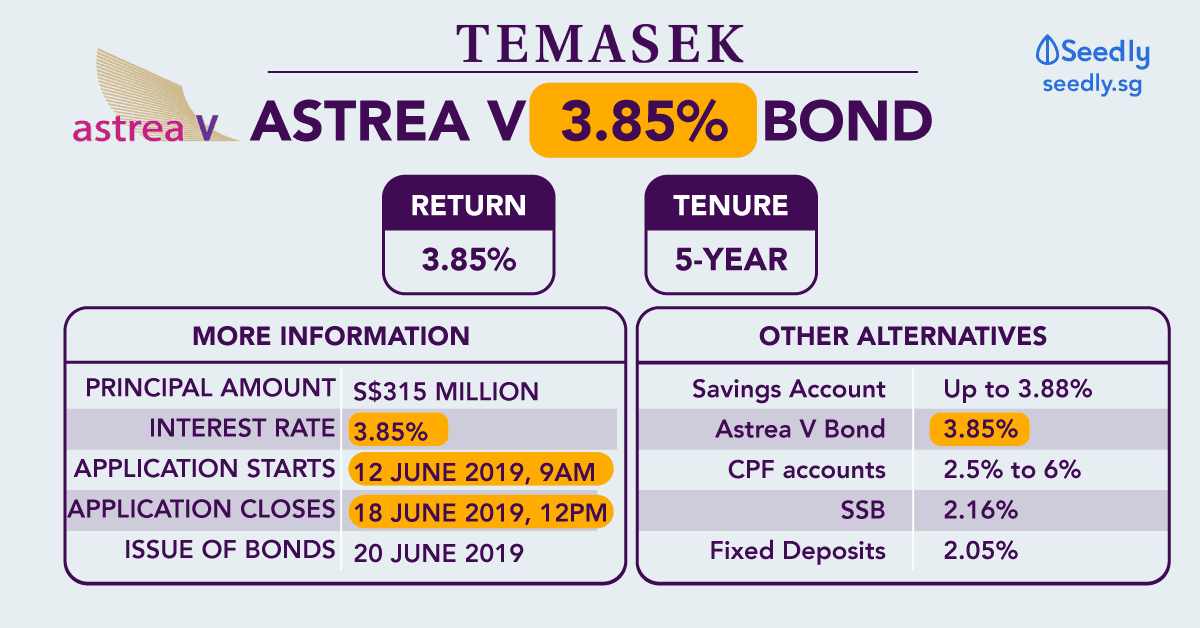

For a quick summary of information about the Astrea V:

| Principal Amount | S$315 million |

|---|---|

| Interest Rate | 3.85% per annum |

| Scheduled Call Date | 20 June 2024 |

| Interest Rate Step-Up | 1.0% per annum |

| Maturity Date | 20 June 2029 |

| Expected Ratings (Fitch/ S&P) | Asf/ A+(sf) |

How Much Do I Need To Invest In The Astrea V Bond?

Retail investors will need a minimum of S$2,000 to invest in the Astrea V Bond, similar to that of Astrea IV.

At the moment, Astrea V has plans for three tranches, in the hope of raising a total of US$600 million in total. That works out to be about S$827 million.

The three bond tranches are:

- Class A-1 bonds where they plan to raise S$315 million, with a lock-in period of 5 years

- Class A-2 bonds where they expect to raise US$230 million, also looking at a 5-years’ period

- Class B bonds with an expectation of US$140 million

For retail investors like us, we’ll probably be looking at the Class A-1 bonds. Do note that Class A-1 bonds are the least risky.

How To Buy Astrea V Bonds?

Astrea V follows the same mechanics as Astrea IV, it will be available for our subscription through ATMs at multiples of S$1,000, at a minimum investment of S$2,000 to invest.

Retail investors (the public) will be offered S$180 million Class A-1 Bonds at a fixed coupon rate of 3.85% per annum!

- Application for Astrea V Bond starts on 12 June 2019 at 9am

- It will close on Tuesday, 18 June 2019 at 12pm

- Issue date of the bond will be 20 June 2019

What Is The Interest Yield For Astrea V Bond?

The interest yield for Astrea IV differs with each tranche. For Class A-1 bonds which we can invest in, we’re looking at a potential yield of 4.35%.

For the Astrea V bond, the interest rate is at 3.85% per annum.

Should I Invest In Astrea V Or Not?

The best investor profile for the Astrea V will be:

- If you want a fixed flow of regular income

- If you are investing in your spare cash which you are willing to park somewhere for at least 5 years

- You are going for a more stable and chill approach, instead of looking for high capital growth.

What Is The Maturity Of Astrea V Bond?

Astrea V have a scheduled call date of five years and a legal maturity date of 10 years.

This means that investors can expect to be paid a one-time bonus payment of 0.5% (if conditions are met), and you’ll effectively miss out on the next five years’ worth of interest payments where there is a step-up interest.

The yearly interest rate of 3.85% is quite beguiling though…

If the Class A-1 Bonds are not redeemed in full on their Scheduled Call Date, there will be an additional 1.0% per annum step-up in their interest rate. In short, 5 years later, if they did not exercise their cash to call, you receive an extra 1% interest! Huat ah!

In short, investors will either be enjoying:

- 3.85% interest for 5 years

- or 3.85% interest for 5 years plus 4.85% for the next 5 years.

What Am I Investing In Exactly If I Buy The Astrea V Bond?

Astrea V diversifies your investment money into a portfolio of private equity.

This portfolio consists of:

- 38 Funds

- These 38 private equity funds account for a net asset value (NAV) of USD1.324 billion.

A quick recap on Astrea IV’s portfolio of private equity. It consists of 36 funds, diversified by vintage, sector, geography, and strategy.

Class A-1 of Astrea IV was given a rating of A(sf) by S&P and Fitch Ratings. Astrea IV was recently upgraded by Fitch Ratings. And in case you’re wondering, A(sf) is not a typo. The (sf) stands for structured finance, and it’s to distinguish structured finance ratings from the ratings of other securities. Most importantly, it means that Astrea IV is a class A bond. Not quite AAA, but still an A – which is pretty good.

If this is any indication, then the Class A-1 tranche of Astrea V is expected to get a really good rating too. We’ll need to wait for more information to confirm this.

Read also: Keep calm and invest in Singapore Savings Bond (SSB)

Further Reading: Pros and Cons of Astrea V

If you missed the chance to invest in the Astrea IV, here’s a good opportunity to read more about the structure, benefits, and disadvantages of the bond.

When it comes to investing, it’s always good to understand more about the benefits and risks which you will be undertaking when investing in Astrea V.

Pros: Structure Of Astrea V

As seen above, DBS Bank acts as a capital call facility. This means that if there is a shortage of cash flow, DBS will step in to provide short-term funding.

DBS Bank also acts as a liquidity facility to inject liquidity in cases where there is a shortage of liquidity to pay for interest or expenses.

Pros: The Astrea V Portfolio Is Well Diversified

In fact, Astrea V seems more diversified than Astrea IV, in terms of numbers. Diversified meaning they split the investment money into more funds and investments.

Here’s a quick comparison:

- Astrea IV: 36 funds and a total of 596 underlying investments across various sectors and regions.

- Astrea V: 38 funds and a total of 862 companies, across various sectors and regions.

The following is a breakdown of some of the portfolio’s characteristics:

As you can see, the portfolio sector breakdown is as such:

- IT: 24% (good news for IT fans)

- Healthcare: 18%

- Consumer Discretionary: 15%

- Industrials: 14%

- Communication Services: 8%

- Financials: 7%

- Consumer Staples:4%

- Materials: 4%

- Materials: 45

- Energy: 3%

- Real Estate: 2%

- Utilities: 1%

Pros/Cons: Capabilities Of The Manager

The manager of Azalea Investment Management has extensive experience in the industry.

The connection between Temasek and Azalea is definitely an additional benefit.

The only con is that the management team lacks a track record. But then again, past performance is never indicative of future results, plus Astrea IV was quite a good investment till date.

Advertisement