So…

You’ve decided to apply for the latest HDB BTO Launch and now have to decide what HDB flat type to choose.

Should you just buy the largest flat that you can afford?

What if you only wish to live in the flat until you meet the Minimum Occupation Period (MOP) and want to sell it?

Are there any considerations that you should think about when deciding between a 3-Room, 4-Room, or a 5-Room flat?

WAIT.

Before we get ahead of ourselves, let’s do a little math to find out: what type of HDB flat can you REALLY afford?

TL;DR: Only Buy a House That You Can Comfortably Afford

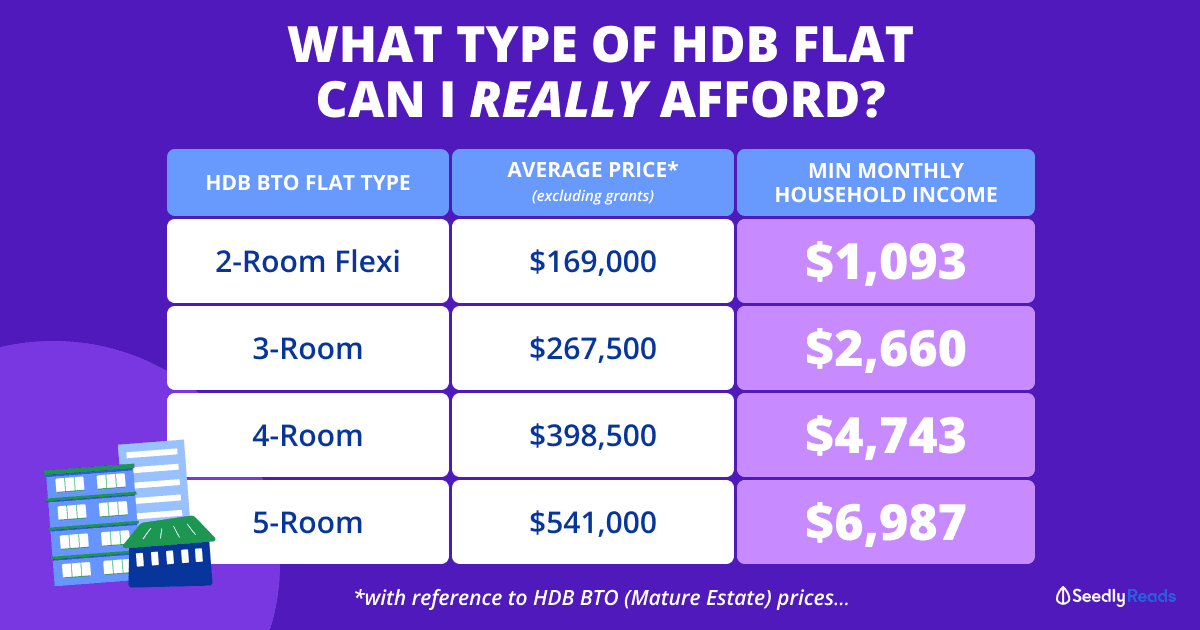

For this exercise, I determined what is the minimum average monthly household income needed when considering what type of HDB flat to get.

How did I do this?

Simple.

I just…

- used the Tampines August 2021 HDB BTO Launch prices as a reference (since it’s one of the most recent launches which has almost all of the existing HDB flat types)

- assumed that I would be taking an HDB housing loan and would put down a 10% downpayment

- calculated how much Enhanced CPF Housing Grant I would get with respect to my household’s monthly income bracket

- applied the Mortgage Servicing Ratio of 30%

This is what I found out:

| HDB BTO Flat Type | Average Price (Excluding Grants) | Minimum Monthly Household Income Needed |

|---|---|---|

| 2-Room Flexi | $169,000 | $1,093 |

| 3-Room | $267,500 | $2,660 |

| 4-Room | $398,500 | $4,743 |

| 5-Room | $541,000 | $6,987 |

Note: this price and income range is ONLY a guide, a flat in a high-demand estate is definitely going to cost more

Feel free to apply my calculations to your respective BTO or Resale flat purchase to see which type of HDB flat you can comfortably afford.

And if you’ve got questions about buying your first property, why not ask our friendly Seedly Community for help?

How Much Does the Average HDB Flat Cost?

Before we get started, I’ll be using the Tampines August 2021 HDB BTO Launch as a reference.

Since it’s one of the few (and more recent) HDB projects which has almost all the various HDB types to choose from, namely:

- 2-Room Flexi

- 3-Room

- 4-Room

- 5-Room

Take note that this is a BTO project in a mature estate, so it’s gonna be a little more expensive than usual.

Average Price of the Various HDB Flat Types (Excluding Grants)

Using the indicative prices as listed on HDB, here’s how much the various HDB flat types cost:

| HDB Flat Type | Average Price (Excluding Grants) |

|---|---|

| 2-Room Flexi | $169,000 |

| 3-Room | $267,500 |

| 4-Room | $398,500 |

| 5-Room | $541,000 |

Average Price of the Various HDB Flat Types (Including Grants)

Assuming you and your partner are first-timers who meet all the eligibility criteria for the Enhanced CPF Housing Grant (EHG).

You can expect to receive between $5,000 to $80,000 in grants.

Naturally, the final amount you qualify for will ultimately depend on your average monthly income.

| Average Monthly Household Income* Over 12 Months | EHG Grant Amount | 2-Room Average Price (after EHG) | 3-Room Average Price (after EHG) | 4-Room Average Price (after EHG) | 5-Room Average Price (after EHG) |

|---|---|---|---|---|---|

| Not more than $1,500 | $80,000 | $89,000 | $187,500 | $318,500 | $461,000 |

| $1,501 to $2,000 | $75,000 | $94,000 | $192,500 | $323,500 | $466,000 |

| $2,001 to $2,500 | $70,000 | $99,000 | $197,500 | $328,500 | $471,000 |

| $2,501 to $3,000 | $65,000 | $104,000 | $202,500 | $333,500 | $476,000 |

| $3,001 to $3,500 | $60,000 | $109,000 | $207,500 | $338,500 | $481,000 |

| $3,501 to $4,000 | $55,000 | $114,000 | $212,500 | $343,500 | $486,000 |

| $4,001 to $4,500 | $50,000 | $119,000 | $217,500 | $348,500 | $491,000 |

| $4,501 to $5,000 | $45,000 | $124,000 | $222,500 | $353,500 | $496,000 |

| $5,001 to $5,500 | $40,000 | $129,000 | $227,500 | $358,500 | $501,000 |

| $5,501 to $6,000 | $35,000 | $134,000 | $232,500 | $363,500 | $506,000 |

| $6,001 to $6,500 | $30,000 | $139,000 | $237,500 | $368,500 | $511,000 |

| $6,501 to $7,000 | $25,000 | $144,000 | $242,500 | $373,500 | $516,000 |

| $7,001 to $7,500 | $20,000 | $149,000 | $247,500 | $378,500 | $521,000 |

| $7,501 to $8,000 | $15,000 | $154,000 | $252,500 | $383,500 | $526,000 |

| $8,001 to $8,500 | $10,000 | $159,000 | $257,500 | $388,500 | $531,000 |

| $8,501 to $9,000 | $5,000 | $164,000 | $262,500 | $393,500 | $536,000 |

*Includes ALL working persons’ (applicants and occupiers) income

So… What’s the Takeaway Here?

At the risk of stating the obvious…

The lower your monthly household income, the more grants you’ll receive.

This means that (ideally) you should apply for an HDB BTO as early as possible.

Let’s look at two scenarios:

Couple A

- One is a final-year university undergraduate ($0 monthly income)

- The other is a fresh grad with a first job ($2,500 monthly income)

Their monthly household income would be $2,500 which means they qualify for $70,000 in EHG.

Couple B

- Both have started work for at least one year ($3,000 monthly income each)

Their monthly household income would be $6,000 which means they only qualify for $35,000 in EHG.

.

.

.

See?

The difference in grants qualified is almost twice for Couple A.

BUT before you even apply, make sure that you’re in a committed relationship.

And avoid breaking-up after you BTO as it’s a really expensive and messy affair!

How Much Do I Need to Pay for My Monthly Mortgage?

Without getting into the debate of whether a bank loan or HDB housing loan is better.

Let’s look at how much you’d need to pay if you took an HDB housing loan.

After making the 10% down payment, you would be borrowing the rest at an interest rate of 2.6% per annum for 25 years.

Here’s what your monthly mortgage would look like:

| Average Monthly Household Income Over 12 Months | Monthly Mortgage for 2-Room Flexi^ (after 10% downpayment) | Monthly Mortgage for 3-Room (after 10% downpayment) | Monthly Mortgage for 4-Room (after 10% downpayment) | Monthly Mortgage for 5-Room (after 10% downpayment) |

|---|---|---|---|---|

| Not more than $1,500 | $328 | $730 | $1,265 | $1,846 |

| $1,501 to $2,000 | $350 | $752 | $1,287 | $1,869 |

| $2,001 to $2,500 | $373 | $775 | $1,310 | $1,892 |

| $2,501 to $3,000 | $396 | $798 | $1,333 | $1,915 |

| $3,001 to $3,500 | $418 | $820 | $1,355 | $1,937 |

| $3,501 to $4,000 | $441 | $843 | $1,378 | $1,960 |

| $4,001 to $4,500 | $464 | $866 | $1,401 | $1,983 |

| $4,501 to $5,000 | $486 | $889 | $1,423 | $2,005 |

| $5,001 to $5,500 | $509 | $911 | $1,446 | $2,028 |

| $5,501 to $6,000 | $532 | $934 | $1,469 | $2,051 |

| $6,001 to $6,500 | $554 | $957 | $1,491 | $2,073 |

| $6,501 to $7,000 | $577 | $979 | $1,514 | $2,096 |

| $7,001 to $7,500 | Not applicable | $1,002 | $1,537 | $2,119 |

| $7,501 to $8,000 | $1,025 | $1,560 | $2,141 | |

| $8,001 to $8,500 | $1,047 | $1,582 | $2,164 | |

| $8,501 to $9,000 | $1,070 | $1,605 | $2,187 |

^Average gross monthly household income for 2-Room Flexi (99-Year Lease) cannot exceed $7,000

If you’re wondering how I got these figures…

I used HDB’s Enquiry on Monthly Instalment calculator to work out what is the monthly mortgage (after deducting the 10% downpayment and EHG from the average property price).

For young couples who:

- want to keep their expenses low

- want to upgrade to a larger property in the future

- don’t plan to have children

the monthly mortgage for a 3-Room HDB BTO is relatively manageable at under $1,000.

Assuming I use the abovementioned Couple B’s income bracket ($5,501 to $6,000) as an example…

They would pay around $934 a month on their mortgage for a 3-Room HDB BTO flat.

Which works out to be about 16% of their monthly household income.

But wait!

You’re probably going, “They’re using HDB housing loan what… there’s nothing to do with their monthly household income!”

Good point.

The thing is… if you can keep your monthly mortgage to below 30% of your monthly household income.

It gives you the very comfortable option of choosing to service it via a bank loan or an HDB housing loan.

Now, lemme explain the science behind this magical number: 30%

What Type of HDB Flat Should I Be Getting Based on My Monthly Income?

Buying a big-ticket item like a house is where we need to be brutally honest with ourselves in order to stay within our financial lane.

To get a good measure of that, I’ll be using the Mortgage Servicing Ratio (MSR) which caps the amount that you can spend on mortgage repayments to 30% of your gross monthly income.

This way, we have a more realistic way of evaluating what kind of flat you can actually afford.

In cases where the MSR is more than 30%, I’ll indicate it with a “Not Applicable”.

This means that if you fall within that particular income bracket and are considering that HDB flat type, you might want to reconsider your options…

| Average Monthly Household Income Over 12 Months | 2-Room Flexi | 3-Room | 4-Room | 5-Room |

|---|---|---|---|---|

| Not more than $1,500 | $1,093 | Not Applicable | Not Applicable | Not Applicable |

| $1,501 to $2,000 | $1,167 | |||

| $2,001 to $2,500 | $1,243 | |||

| $2,501 to $3,000 | $1,320 | $2,660 | ||

| $3,001 to $3,500 | $1,393 | $2,733 | ||

| $3,501 to $4,000 | $1,470 | $2,810 | ||

| $4,001 to $4,500 | $1,547 | $2,887 | ||

| $4,501 to $5,000 | $1,620 | $2,963 | $4,743 | |

| $5,001 to $5,500 | $1,697 | $3,037 | $4,820 | |

| $5,501 to $6,000 | $1,773 | $3,113 | $4,897 | |

| $6,001 to $6,500 | $1,847 | $3,190 | $4,970 | |

| $6,501 to $7,000 | $1,923 | $3,263 | $5,047 | $6,987 |

| $7,001 to $7,500 | Not Applicable | $3,340 | $5,123 | $7,063 |

| $7,501 to $8,000 | $3,417 | $5,200 | $7,137 | |

| $8,001 to $8,500 | $3,490 | $5,273 | $7,213 | |

| $8,501 to $9,000 | $3,567 | $5,350 | $7,290 |

From this table, we can see that if you’re considering a 3-Room HDB BTO flat, your minimum monthly household income should start from $2,660.

For a 4-Room HDB BTO, your minimum monthly household income should ideally be $4,743 or more.

Want to spring for that 5-Room HDB BTO? Your minimum household income jumps up to $6,987 or more.

What Else Should I Consider When Deciding If I Can Afford an HDB Flat?

Considering that we’re using an HDB Housing Loan to service the mortgage.

It means that we’ll be using our monthly CPF contributions to pay the monthly mortgage.

Some of you might find yourself in a situation where your monthly CPF contribution is insufficient to cover the cost of your monthly mortgage (eg. using one person’s CPF to make payments for the HDB housing loan).

Should you perform cash top-ups on top of your CPF payments in order to ‘afford’ that house?

Well… yes. And no.

If your cash top-ups come from a steady stream of passive income that is unaffected by unfortunate events like you losing your job (touchwood).

Then sure… why not?

But if you’re using money from your monthly household income (aka cash top-ups) to supplement your CPF contributions.

Then you’ll want to be very careful.

In the unfortunate event where either you or your partner are unable to continuously bring in that extra amount of money to meet your monthly mortgage.

You’ll eventually find that your finances will be severely stretched.

Advertisement