If you are an investor who has been keeping up with the news recently, you would be familiar with this man:

For the uninitiated, this man is Jerome Powell, a.k.a. Papa Powell, the current chairman of the U.S. Federal Reserve (Fed) and arguably one of the most influential policymakers in the financial markets today.

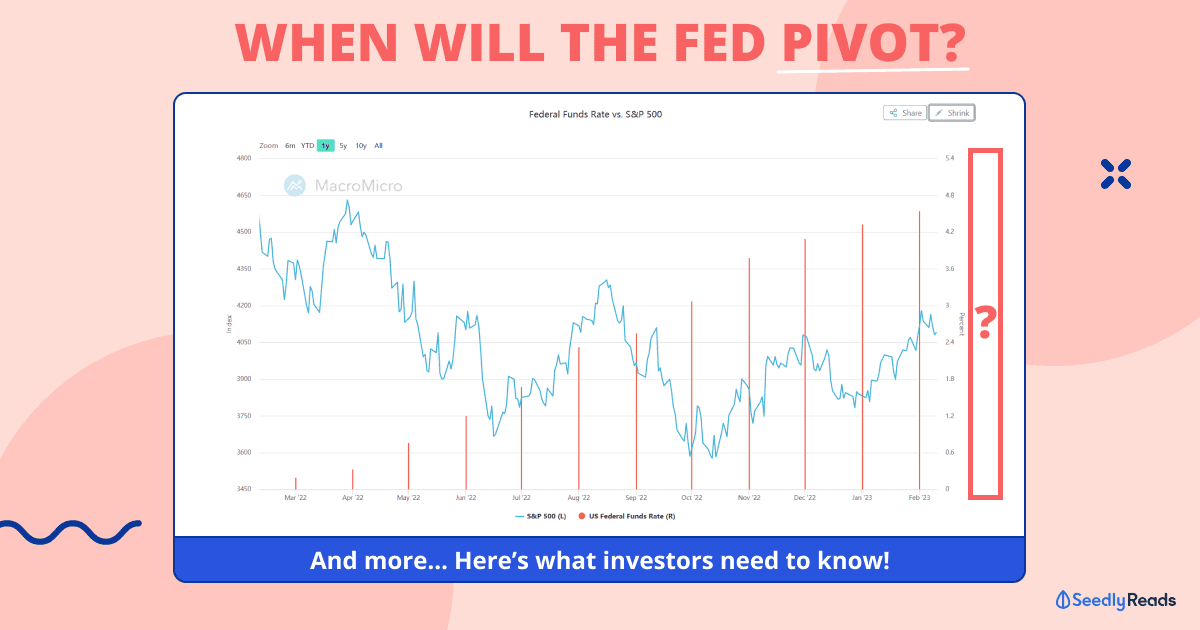

Many observers are keeping a close watch as when the Fed increased interest rates last year in a bid to fight inflation, the stock market and investments tanked.

Now investors are looking to see when the Fed will pivot and are hoping the markets rally again.

But is it all as straightforward as it seems?

Here’s what investors need to know!

TL;DR: Will There Be a Fed Pivot in 2023?

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their due diligence and consider their financial goals before investing in any investment product. Note that the information is accurate as of 13 February 2023.

When Did the Fed Start Manipulating Interest Rates?

First, a bit of a history lesson. The Fed began targeting the money supply to fight inflation in 1971.

Back then, the Fed chairman was Arthur F. Burns, who served from 1970 to 1978 as the tenth Fed chair.

In 1971, the U.S. Gross Domestic Product (GDP) increased by 3.3%, the unemployment rate was 6.0%, and inflation was recorded at 4.4%.

The following table compares the Federal Funds Rate and the events that prompted any changes, if applicable:

| DATE (1971) | FED FUNDS RATE* | EVENT |

|---|---|---|

| 12 January | 4.25% | Expansion |

| 9 February | 3.75% | No notable event |

| 9 March | 5.0% | Inflation at 4.7% year-over-year |

| 27 July | 5.5% | Nixon shock; weakened gold standard; tariffs |

| 24 August | 5.75% | Wage-price controls |

| 19 October | 5.25% | The Fed lowered rates to boost growth |

| 16 November | 5.0% | No notable event |

Source: The Balance | *High end of the range, while the low end is 0.25% lower

What Is a Fed Pivot? What Does Pivot Mean in Finance?

The Fed’s goal is to promote “maximum employment and stable prices in the U.S. economy”.

Stable prices also mean keeping inflation in check, which can be combated by lowering the Fed Funds Rate:

Lowering interest rates is considered expansionary or ‘loose’ monetary policy for central banks as it ‘pumps; more money into the economy to boost growth.

Conversely, if the economy is growing too quickly and inflation is skyrocketing, central banks may implement contractionary, or ‘tight’ monetary policy by raising interest rates to slow it down.

Because the economy experiences periods of growth and slowdown, the Fed often switches between tightening or loosening monetary policy.

Financial observers have dubbed this action as the Fed’ pivoting.’

When Was the Fed Pivot?

Thus, the latest pivot was in 2020 when the Fed cut interest rates near zero at the start of the COVID-19 pandemic:

| DATE (2020) | FED FUNDS RATE | EVENT |

|---|---|---|

| 3 March | 1.25%* | Coronavirus pandemic |

| 29 April | 0.25% | Effectively zero |

| 10 June | 0.25% | Effectively zero |

| 29 July | 0.25% | Effectively zero |

| 16 September | 0.25% | Effectively zero |

| 5 November | 0.25% | Effectively zero |

| 16 December | 0.25% | Effectively zero |

Source: The Balance | *High end of the range, while the low end is 0.25% lower

But with high inflation in the U.S. throughout 2022 and early 2023, the Fed has been increasing interest rates to bring inflation down:

Source: Forbes

The latest hike was at the start of the month when the Fed declared a 0.25% interest rate hike after the 31 January to 1 February FOMC meeting, which brought the Fed Funds Rate to 4.50% – 4.75%.

This was the eighth consecutive time that the Fed raised interest rates and is part of a bid to quickly decrease the amount of money available in the financial markets to control excessive inflation.

For context, the consumer price index (CPI) in the U.S. went up by 6.2% year-on-year (y-o-y) in January 2023, down from 6.5% y-o-y in December 2022.

Although inflation in the U.S. is falling steadily, it is still at decade-high levels and remains someway off the 2% target set by the Fed.

The primary concern for many market observers is the extent to which the Fed will increase interest rates and the severity of the potential recession that may follow.

Stock market investors are also watching the Fed like a hawk.

Here’s why.

What Happens to Stocks When Fed Pivots?

It is important to note that the connection between interest rates and the U.S. stock market is not a straightforward one.

That being said, it is not certain how the market will respond to any specific interest rate adjustment made by the Fed.

However, if we look at the past five years, we can see that higher interest rates have coincided with the fall in the U.S. stock market, which can be represented by the S&P 500 index:

FYI: The S&P 500 index (or Standard & Poor’s 500 Index) includes 500 of the top U.S. companies in leading industries and is considered an excellent proxy to the U.S. stock market performance.

In addition, when interest rates go up, it makes it more expensive for companies to borrow money, and this hampers their growth prospects as well as near-term earnings.

That’s not all.

Fed rate hikes also impact market sentiment or investor perception of market conditions. Whenever the Fed announces rate hikes, some investors would panic sell their stocks and divest into more conservative investments instead of waiting for the gradual and complex effects of higher interest rates to trickle through the economy.

What Should Investors Do?

Evidently, the Fed has made some progress on inflation as the CPI has fallen to 6.2% y-o-y in January 2023.

But it is still some mile off its target of 2%.

Also, the addition of over 260,000 jobs in the United States economy in October has reassured the Fed that its stark increases in interest rates have not caused widespread job losses or a recession just yet.

Read More: The Ultimate Singaporean’s Guide to Surviving a Recession

But, in a February 2022 Economic Club of Washington, D.C. Question and Answer session, Powell stated that:

The disinflationary process, the process of getting inflation down, has begun and it’s begun in the goods sector, which is about a quarter of our economy,” the central bank chief said during an event in Washington, D.C. “But it has a long way to go. These are the very early stages.”

His comments seem to suggest that we are still some way off a Fed pivot.

But, experts interviewed by Forbes say ‘it’s reasonable to expect the first cut to happen late in 2023 or, at the latest, in early 2024.’

Then again, I would like to emphasise that it is not certain how the market will respond to any specific interest rate adjustment made by the Fed.

I would continue to Dollar Cost Average (DCA) and not time the market because it is simply impossible.

Why?

Let’s take a look at this chart from Hartford Funds:

Here’s the thing. The S&P 500 index fell by 19.44% in 2022, its worst-performing year since 2008.

But as Hartford Funds have pointed out (emphasis are mine):

Avoiding the market’s downs may mean missing out on the ups as well.

78% of the stock market’s best days occur during a bear market or during the first two months of a bull market. If you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half. And missing the best 30 days would have reduced your returns by an astonishing 83%.

Granted, investing in equities bears the risk of losing your money.

Read More: How Much Investment Risk Should You Take as You Grow Older?

But after seeing the above information, I have come to a straightforward conclusion that the risk of not participating in the market is substantial.

Given this, I prefer a less risky, albeit uneventful, approach to remaining invested. Doing so ensures that I won’t miss out on the market’s best days.

Read More:

Advertisement