A typical working adult scenario – Paying bills

In our Seedly personal finance community, we asked our members which were the best way to pay their bills in our #SavingsSaturdays discussion. Here’s what we uncovered: Nearly 100 respondents chose to pay via credit cards. We found out more strategies which we will share below.

This seems to be a recurring topic most working adults consider on a monthly basis. Especially since we take on the responsibility of paying our bills such as Utilities, Telco, TV, Entertainment, Spotify, Netflix etc.

TL;DR: It’s best to Pay Bills using card to earn Cashback or Miles

For the savviest working adults, this is actually the best suggestion for a few key reasons:

- Maximise your spending on credit cards spend and clock up Cashback or Miles

- You will use this as a monthly recurring spend that will clock towards a minimum spend every month (which should be between $500 to $600 for most cards with tiered cashback e.g OCBC365, UOBONE or BOC Family Card)

- You can simply set up a GIRO to pay off the credit card bill in full when the billing date comes so you do not get into Credit Card Debt

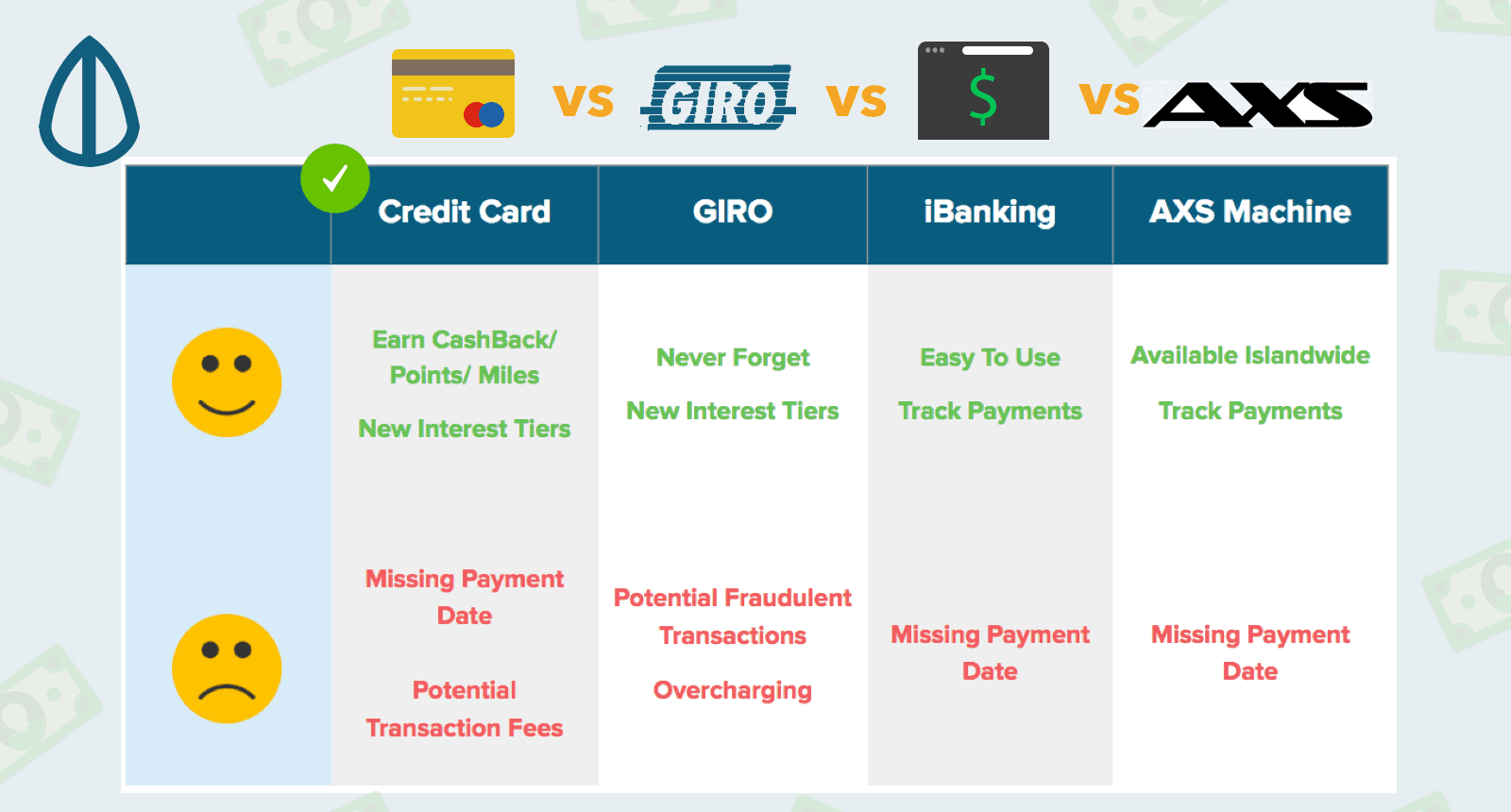

The 4 common methods to pay bills

Method 1: Credit Card

As described above, this seems to be the best strategy adopted by many working professionals. By charging all the bills under the Credit Card, you get to earn Miles or Cashback. Another level above this would be to GIRO the credit card bill amount every month so you never miss paying your credit card bill dates.

Pros:

- Double tap! By getting points/cashback on your cards but also be able to count this as a GIRO spend

- May unlock a new tier of savings interest by hitting a minimum overall spend of $500 – 600 a month.

Cons:

- There may be fees associated with several credit card transactions (depending on the providers)

- You may miss payments if you are not disciplined to note down these dates in your calendar

Method 2: GIRO

This is the traditional way to make payments. Usually done by filling up a form to authorize your bank to directly pay the bill (whatever amount they charge).

Pros:

- You would have no reason to forget your bill as it’s already automated on a certain date

- It counts towards a form of bill payment (which can help you increase interest tiers for banks such as OCBC360, DBS Multiplier, and UOBONE

Cons:

- If there are insufficient funds in your linked bank account, it would be delayed or even void

- There have been cases of fraudulent transactions where the service provider (eg utility or telco) automatically charging any amount thus you may be unaware of these activities as likely you will not receive any notifications as well

Method 3: iBanking

You can add a payee and make payment via bank transfer to your service provider (eg Singtel, M1, etc.) on the online banking system

Pros:

- Relatively easy to use by online iBanking platforms (eg DBS, OCBC and UOB has pretty good interfaces and support)

- It creates a good habit as you become very aware of all payments and amounts you paying (going up or down over months)

Cons:

- You may miss payments if you are not disciplined to note down these dates in your calendar

- Payments also may take a few days to process, so be sure to pay early

Method 4: AXS Machine

Simply bring your letter or bill statement and scan the QR or barcode to assess your bill and make payment using a card or NETS.

Pros:

- Relatively available at many petrol kiosks islandwide and easy to use

- Creates a healthy habit of awareness of how much these recurring bills are costing you every month

Cons:

- You may miss payments if you are not disciplined to note down these dates in your calendar

- Payments also may take a few days to process, so be sure to pay early

Conclusion: Choosing between discipline and convenience

Like mentioned through the 4 different options, it is a balance between the two things above. If you choose to do it via Credit card payments, be sure to look to set up a kind of recurring payment system. If not it may be bad if you miss a payment date.

Let us also share two apps designed to track all your monthly bill payments on a recurring basis so you do not get over-charged.

App 1: Seedly App

It is designed to automatically pull transactions from your bank and card accounts and categorise them according to categories: eg “bills” and “utilities”

App 2: TrackMySubs

Helps you record all your subscriptions that you manually or automatically link them to your email. What happens is that you get updates on billing dates and cycles so you never forget them.

Advertisement