Dreaming of a Working Holiday in Australia or New Zealand? Here's Your Ultimate Comparison Guide

I don’t enjoy living in Singapore.

Call me whatever you like — ungrateful, a typical millennial, extremely ungrateful — but living alone in Melbourne for two years only reaffirmed the fact.

I’m not here to expound my case, though, lest you peg this as the start of a clichéd spiel dredged in condescension. (“It already is!” you may be thinking, wishing desperately for a downvote button.)

Either way, this guide’s designed for anyone who’s slightly curious about the costs and application process behind applying for a working holiday visa in Australia or New Zealand, and how the two compare.

As an overview, here’s exactly what this piece covers:

- Working Holiday Visas, Compared: Australia vs New Zealand

- What Are the Benefits of a Working Holiday Visa?

- The Application Process: Prerequisites and Costs

- Getting a Job in Australia or New Zealand: Taxes and Job Options

- Costs to Consider: Accommodation and Living Expenses

- Extending Your Working Holiday Visa

TL;DR: Should I Take a Working Holiday in Australia or New Zealand?

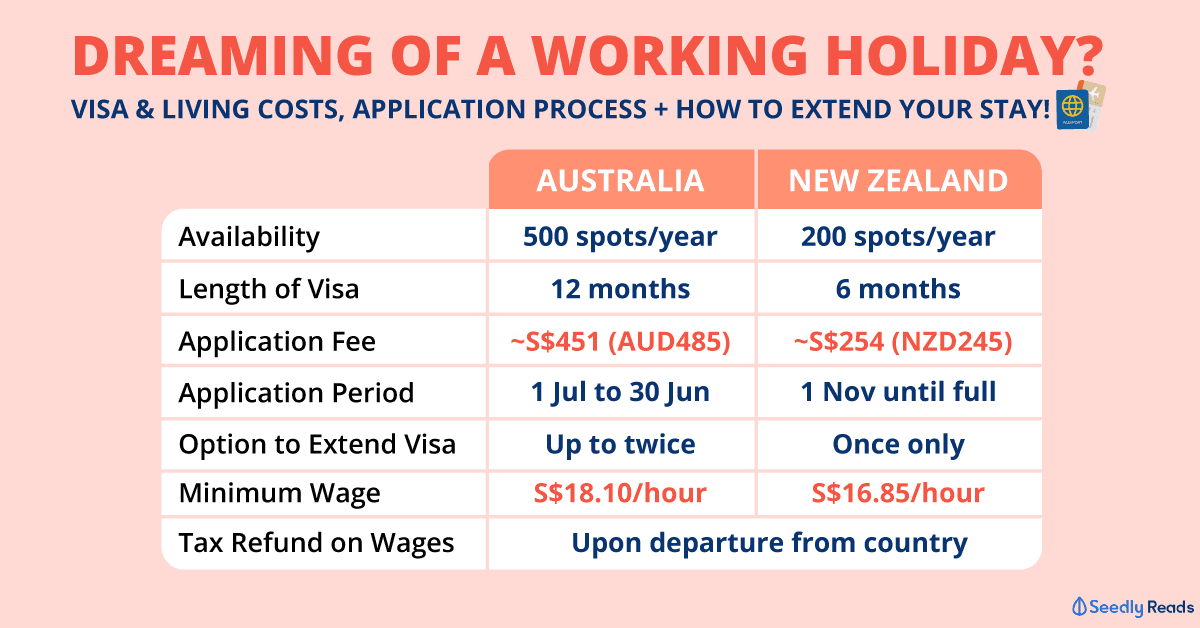

It’s a happy dilemma to be in — but deciding where to go for your working holiday can be tricky.

Here’s a comparison between Australia’s Working Holiday Makers (WHM) Program and New Zealand’s Singapore Work Exchange Programme Visa.

| Australia: Working Holiday Maker (WHM) Program | New Zealand: Singapore Work Exchange Programme | |

|---|---|---|

| No. of Slots for Singaporeans | 500 slots/year | 200 slots/year |

| Length of Working Holiday Visa | 12 months | Six months |

| Application Fee | ~S$451 (AUD485; estimate only) | ~S$254 (NZD245; estimate only) |

| Application Period | 1 Jul to 30 Jun, or until full | 1 Nov |

| Option to Extend | Yes; up to twice | Yes; once |

| Prerequisites for Singaporeans | Between 18 to 30 years old (i.e. not 31 at time of application) |

|

| - | You must either be studying in a university or polytechnic, or have graduated from one in the past 3 years | |

| Meet health and character requirements | ||

| Not have had a visa cancelled or previous application refused | ||

| Copy of bank statement or proof of adequate funds | ||

| Hold a valid passport | Have a passport valid for at least three months after your planned departure | |

| Max Term Allowed Per Job | Six months | 12 months |

| Minimum Wage | ~S$18.10 (AUD19.49/hour; estimate only) before compulsory superannuation | ~S$16.85 (NZD18.90/hour; estimate only) |

| Taxes | 15% (working holidaymaker rate) for first AUD37,000 earned; excludes superannuation sum | From 11.95% (if you earn NZD14,000 or less) to 46.45% (if you earn NZD70,001 or more). |

| Additional 65% DASP (Departing Australia Superannuation Payment) upon departure from Australia | - | |

| Can I Get a Tax Refund Upon Departure? | Yes, after the AU financial year has ended on 30 Jun. This tax refund excludes the 65% DASP. | Yes, after the NZ financial year has ended on Mar 31. |

| Before Going: What You'll Need | Tax File Number (TFN) | IRD number Tax number (for work) Hospitality NZ 18+ Card |

| Accommodation | ||

| Health/hospitalisation insurance | Health/hospitalisation and travel insurance | |

| ~AUD5,000 for initial stay, and enough to pay for a ticket out of AU | ~NZD2,250 for 12 months, and enough to pay for a ticket out of NZ | |

| Industries to Find Work In | Agriculture Horticulture/viticulture Tourism & Hospitality F&B Retail Fundraising Aged Care and Disability Services Building & Construction Au pair work |

|

| Job Portals | Gumtree Seek Indeed Scout by Broadsheet Travellers At Work Fruit Picking Jobs | TradeMe Seek Indeed NZ Farm Source Backpacker Jobs NZ Jora |

| Can I Work More Than One Job While There? | No | Yes; jobs are subject to varying tax rates |

| Can I Study With a Working Holiday Visa? | Yes; up to four months | Yes; up to six months |

What Are the Benefits of A Working Holiday Visa?

Whether you’re looking to squeeze in a gap year or take a work sabbatical, a working holiday might be one of the best ways to explore a country in its almost-entirety.

Apart from allowing you to travel in and out of the country an unlimited number of times, you’ll be able to secure a job to offset your living and travel expenses.

In Australia, the maximum period you can work per job is six months — and, over in New Zealand, 12 months.

You’ll also be able to study, or have your working holiday extended so long as you complete specified kinds of work.

The Application Process: Prerequisites and Costs

It costs $451 for the Australia Working Holiday Maker Program, and $254 for the New Zealand Singapore Work Exchange Programme — but you’ll of course have to meet several prerequisites (detailed in the above table).

Application fees also exclude additional costs, such as a mandatory health check-up before applying for you visa, and a Hospitality NZ 18+ card, the latter of which is mandatory in New Zealand for proof of age.

Unfortunately, the New Zealand working holiday visa is also only open to Singapore citizens who:

- Are studying at a polytechnic or university, or

- Have graduated in the past three years, and no later.

So if, like my sad self, you don’t meet those prerequisites…then your only option’s Australia, unless you’re hoping to travel yet further out.

What You’ll Need to Apply

Prior to your online application, you should ready the following documents:

- Identity check: Copy of your passport or birth certificate

- Proof of financial independence: A bank statement or evidence that you’ve enough money i) for your stay, and ii) for a ticket to leave the country. It’s AUD5,000 for Australia, and NZD2,250 for New Zealand.

- Character check: A police certificate (only upon request)

Keep in mind that applying doesn’t guarantee you a visa, given there’re a limited number of slots for Singaporeans annually — 500 spots for Australia, and just 200 in NZ.

Getting a Job in Australia or New Zealand

While you don’t have to secure a job before heading off on your working holiday, you should go in with an open mind — so be prepared to do walk-in interviews, or face rejection.

Casual jobs you might want to dabble in include fruit-picking, helping in a vineyard, or working in the lines of retail, F&B or construction.

Taxes and Superannuation

Upon arrival in Australia or New Zealand, one of the first things to do is set up a bank account.

Here’s what you’ll need prior to applying for jobs, and the minimum wages you can expect to receive.

| Australia | New Zealand | |

|---|---|---|

| Paperwork needed | Tax File Number | IRD Number Tax number Hospitality NZ 18+ Card |

| Minimum Wage | ~S$18.10 (AUD19.49/hour; estimate only) before compulsory superannuation | ~S$16.85 (NZD18.90/hour; estimate only) |

| Taxes | 15% (working holidaymaker rate) for first AUD37,000 earned; excludes superannuation sum | From 11.95% (if you earn NZD14,000 or less) to 46.45% (if you earn NZD70,001 or more). |

| Additional 65% DASP (Departing Australia Superannuation Payment) upon departure from Australia | - | |

| Can I Get a Tax Refund Upon Departure? | Yes, after the AU financial year has ended on 30 Jun. This tax refund excludes the 65% DASP. | Yes, after the NZ financial year has ended on Mar 31. |

In Australia, you’ll need a Tax File Number (TFN) to be registered for taxes and superannuation. The latter, which kinda works like CPF, can only be claimed upon your departure from the country — subject to a 65% DASP.

It’s free to get a TFN, but you’ll have to apply for it online with your work visa prior to your arrival in the country. And remember: you should only share your TFN number after you’ve begun working.

Heading to New Zealand? Then you’ll need:

- An IRD number — not unlike the US’ social security number. Applications can be submitted at NZ PostShop branches; you’ll have to submit your completed IR595 form, passport, visa and proof of age.

- A Hospitality 18+ card, which likewise can be submitted at NZ PostShop branches with a passport-sized photo, your Singapore IC, passport number and proof of address.

Other Things to Consider: Accommodation and Living Expenses

It’s scary stepping into a new country all alone with little to no clue of the best area to reside in, or how much you should be setting aside for rent.

This checklist should serve as a (non-exhaustive) primer:

| Australia | New Zealand | |

|---|---|---|

| Accommodation (Assuming shared house, with Wi-Fi and utilities included) | ~$275 (AUD295/week) | ~$205 (NZD230/week) |

| Accommodation Downpayment | 2 months' rent | |

| Mobile Data | ~$27/month (AUD30) | ~$26/month (NZD30) |

| Living Expenses | ~$150/week (AUD160/week) | ~$89/week (NZD100/week) |

These assumptions are estimates only, and ultimately depend on your quality of life. For instance, what will your transport options be like — and do you plan on cooking? It’s the little things that’ll help you save.

Extending Your Working Holiday Visa

If your working holiday’s coming to an end sooner than you want it to, all is not lost — there’re means of extending your stay.

In Australia, that includes:

- Taking a job in plant and animal cultivation, fishing and pearling, tree farming and felling, mining and construction. Your job must match the definitions listed on the official Department of Home Affairs (Australia) site.

To be eligible for a Second Working Holiday (subclass 417) visa, you must commit to a job in one of the above industries for a minimum of three months while on your first working holiday visa.

And if you’re thinking about going for a Third Working Holiday (subclass 417) visa, you must once more commit to a job in one of the above industries while on your second working holiday visa — except this time for a six-month period.

New Zealand’s a little more lax on this front. To qualify for a three-month working holiday visa extension, you’ll have to:

- Prove that you’ve worked in the horticulture/viticulture industry amounting to three months. Jobs might include planting or harvesting crops.

- If approved, you’ll be granted an additional three months’ stay in the country.

Related Articles:

Advertisement