Ultimate Novel Coronavirus (COVID-19) Insurance Guide: Does My Travel Insurance Cover Me For The Wuhan Coronavirus Outbreak?

As of 10 February 2020, we have a total of 81 confirmed cases of the novel coronavirus (COVID-19).

Or better known as the Wuhan Coronavirus (2019-nCoV) in Singapore.

With the emergence of a local transmission cluster and the raising of the DORSCON (Disease Outbreak Response System Condition) level to orange, more Singaporeans are:

- avoiding crowded places,

- observing more stringent personal hygiene, and

- getting the appropriate insurance coverage

In fact, we’re thankful that some of our Seedly community members have taken the initiative to compile a guide on all things insurance-related with regard to novel coronavirus coverage!

Wondering if your travel insurance will cover the novel coronavirus (COVID-19)?

Unsure if your current insurance coverage will protect you against COVID-19-related claims?

Here’s a quick guide on travel insurance as well as the other different types of insurances that cover COVID-19 in Singapore.

P.S. Bookmark this article as we’ll be updating it with the latest updates to coronavirus-related insurance announcements!

TL;DR: Does My Insurance Cover Me for the Novel Coronavirus COVID-19?

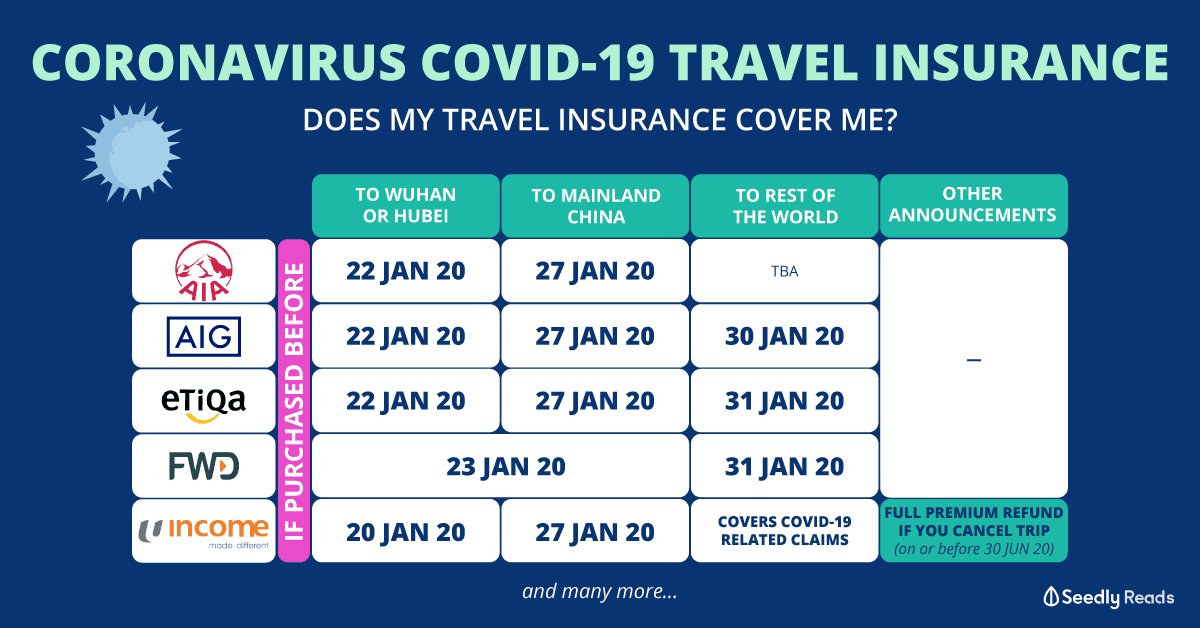

Here are the latest announcements made by the various insurance providers with regard to travel insurance coverage of the novel coronavirus COVID-19:

| Travel Insurance Company | To Wuhan or Hubei | To Mainland China | To Rest of the World | Other Announcement(s) |

|---|---|---|---|---|

| AIA | Covers if policy is purchased before 22 January 2020. Travel insurance bought after 27th January 2020 will not be covering the virus | Coverage for policies bought before 27 Jan 2020. Claims arising form nCov will not be covered after 27 Jan 2020. | No announcement | - |

| AIG | Covers if policy purchased before 22 Jan 2020, 12:01 am | No coverage for policies issued after 27 Jan 2020, 12:01 am | Covers if policy bought before 30 Jan 2020, 12:01 am (subject to assessment) | - |

| Allianz Travel | Covers if policy purchased before 22 Jan 2020 | - | ||

| Allied World Insurance | No coverage for policies issued on or after 23 Jan 2020, 12:01am (includes other cities in China placed under quarantine) | No coverage for policies issued on or after 31 Jan 2020, 12:01am (excludes Hong Kong and Macau) | Covers COVID-19 related claims | - |

| Aviva | Covers all related claims if policy purchased before 20 Jan 2020 | Customers can submit a trip cancellation request within 30 days from their departure date to Wuhan in central China. Those who are travelling elsewhere but are affected by COVID-19 can claim for unused and non-refundable travel, accommodation and entertainment costs that they have paid. Quarantine allowance (from $50-$500) can also be claimed depending on the policies. |

||

| AXA | Covers if policy purchased before 11 Jan 2020 | Covers if policy purchased before 27 Jan 2020 | No announcement | - |

| Chubb | Covers all related claims if policy purchased before 22 Jan 2020 | Covers if policy purchased before 27 Jan 2020 | No announcement | - |

| Etiqa | Covers if policy purchased before 22 Jan 2020, 12:01 am | Covers if policy purchased before 27 Jan 2020, 12:01 am | Covers if policy purchased before 31 Jan 2020 | - |

| FWD | Covers if policy purchased before 23 Jan 2020 (except Hong Kong, Macau & Taiwan) | Covers if policy bought before 31 Jan 2020 | - | |

| Great Eastern | Covers if policy purchased before 24 Jan 2020, 9:30am | Covers if policy purchased before 28 Jan 2020, 11:59pm | No announcement | - |

| HL Assurance | Covers if policy purchased before 23 Jan 2020 | No announcement | - | |

| MSIG | Covers if policy purchased before 22 Jan 2020 (Wuhan) and before 23 Jan 2020 (Hubei) | Covers if policy purchased before 27 Jan 2020 (except Hong Kong, Macau & Taiwan) | No announcement | - |

| NTUC Income | Covers if policy purchased before 20 Jan 2020, 8pm | Covers if policy purchased before 27 Jan 2020, 7pm | Covers COVID-19 related claims | Will give full premium refunds cancelled trips due to the COVID-19 outbreak. This applies to all single trip Travel Insurance plans to any destination that have been purchased for travel dates that are on or before 30 June 2020. |

| Sompo | Covers if policy purchased before 22 Jan 2020 | Covers if policy purchased before 27 Jan 2020 | No announcement | - |

We’ve also put together whatever information we could find about coverage for:

- Health Insurance

- Life Insurance

- Critical Illness Cover

As well as any other novel coronavirus-related insurance announcements for your ease of reference!

Travel Insurance Updates Regarding the Novel Coronavirus COVID-19

“Due to the Wuhan virus outbreak, are my cancelled plans covered by travel insurance?”

If you’re travelling soon and are worried about COVID-19 coverage because you haven’t purchased your travel insurance yet…

Tough.

In general, most travel insurance providers will not accept claims related to COVID-19 (aka Wuhan coronavirus) after a certain cut-off date and time.

And that’s because the Ministry of Health (MOH) issued a travel advisory on 22 January 2020 for Singaporeans to defer all travel to Hubei, China, and all non-essential travel to mainland China.

So if you purchase your policy or make a novel coronavirus-related claim on 22 January 2020.

You’d most probably be rejected because the insurance companies consider COVID-2019-related risks as ‘known risks’.

Here are some of the notable announcements from the various insurance providers in Singapore:

| Travel Insurance Company | To Wuhan or Hubei | To Mainland China | To Rest of the World | Other Announcement(s) |

|---|---|---|---|---|

| AIA | Covers if policy is purchased before 22 January 2020. Travel insurance bought after 27th January 2020 will not be covering the virus | Coverage for policies bought before 27 Jan 2020. Claims arising form nCov will not be covered after 27 Jan 2020. | No announcement | - |

| AIG | Covers if policy purchased before 22 Jan 2020, 12:01 am | No coverage for policies issued after 27 Jan 2020, 12:01 am | Covers if policy bought before 30 Jan 2020, 12:01 am (subject to assessment) | - |

| Allianz Travel | Covers if policy purchased before 22 Jan 2020 | - | ||

| Allied World Insurance | No coverage for policies issued on or after 23 Jan 2020, 12:01am (includes other cities in China placed under quarantine) | No coverage for policies issued on or after 31 Jan 2020, 12:01am (excludes Hong Kong and Macau) | Covers COVID-19 related claims | - |

| Aviva | Covers all related claims if policy purchased before 20 Jan 2020 | Customers can submit a trip cancellation request within 30 days from their departure date to Wuhan in central China. Those who are travelling elsewhere but are affected by COVID-19 can claim for unused and non-refundable travel, accommodation and entertainment costs that they have paid. Quarantine allowance (from $50-$500) can also be claimed depending on the policies. |

||

| AXA | Covers if policy purchased before 11 Jan 2020 | Covers if policy purchased before 27 Jan 2020 | No announcement | - |

| Chubb | Covers all related claims if policy purchased before 22 Jan 2020 | Covers if policy purchased before 27 Jan 2020 | No announcement | - |

| Etiqa | Covers if policy purchased before 22 Jan 2020, 12:01 am | Covers if policy purchased before 27 Jan 2020, 12:01 am | Covers if policy purchased before 31 Jan 2020 | - |

| FWD | Covers if policy purchased before 23 Jan 2020 (except Hong Kong, Macau & Taiwan) | Covers if policy bought before 31 Jan 2020 | - | |

| Great Eastern | Covers if policy purchased before 24 Jan 2020, 9:30am | Covers if policy purchased before 28 Jan 2020, 11:59pm | No announcement | - |

| HL Assurance | Covers if policy purchased before 23 Jan 2020 | No announcement | - | |

| MSIG | Covers if policy purchased before 22 Jan 2020 (Wuhan) and before 23 Jan 2020 (Hubei) | Covers if policy purchased before 27 Jan 2020 (except Hong Kong, Macau & Taiwan) | No announcement | - |

| NTUC Income | Covers if policy purchased before 20 Jan 2020, 8pm | Covers if policy purchased before 27 Jan 2020, 7pm | Covers COVID-19 related claims | Will give full premium refunds cancelled trips due to the COVID-19 outbreak. This applies to all single trip Travel Insurance plans to any destination that have been purchased for travel dates that are on or before 30 June 2020. |

| Sompo | Covers if policy purchased before 22 Jan 2020 | Covers if policy purchased before 27 Jan 2020 | No announcement | - |

Note: most of these announcements are subject to situational changes

If you bought your travel insurance policy early, you’ll probably have a chance of claiming coverage (touchwood).

For refunds for cancelled flights and trips, insurance providers recommend approaching the airlines you’re flying with.

Or the travel agency you booked your tour from.

Health Insurance Updates Regarding the Novel Coronavirus COVID-19

The following insurance providers have mentioned that their health insurance policies will cover hospitalisation and outpatient expenses related to the coronavirus (depending on your purchased policy):

- AIA

- Allianz

- AVIVA

- AXA

- NTUC Income

- Prudential

Of note, Prudential’s private health insurance plan Prudential PRUShield covers hospital admission and pre- and post-hospitalisation medical costs

Life Insurance Updates Regarding the Novel Coronavirus COVID-19

TokyoMarine Life Insurance will give $5,000 to policyholders — should they contract the novel coronavirus infection.

Policyholders need to submit proof of medical certification from Singapore hospitals specifying the diagnosis of the coronavirus.

NTUC Income Star Assure life insurance plan comes with an optional rider to provide a payout if the insured is hospitalised in an intensive care unit for five days or more due to a serious infection, such as the 2019-nCoV.

Personal Accident Coverage Updates Regarding the Novel Coronavirus COVID-19

NTUC Income will extend COVID-19 protection to individuals insured under Personal Accident Assurance with Infectious Disease cover and Personal Accident Infectious Disease policy – for six months until 31 August 2020.

The extended coverage will provide insured persons with a cash pay-out of $100 per day of hospitalisation in Singapore due to COVID-19, for up to 30 days.

There will also be a one-time pay-out of $10,000 if the insured person were to pass away due to COVID-19.

This pay-out will be in addition to other benefits that the insured person may have according to his or her PA plan.

To further support lower-income households in Singapore, Income is also extending COVID-19 benefits to the Income Family Micro-Insurance Scheme (IFMIS).

The IFMIS currently offers a pay-out of $5,000 if the insured person were to pass away or suffer a total and permanent disability.

The Scheme now includes COVID-19 benefits until 31 August 2020, which provide the insured person a cash pay-out of $200 per day of hospitalisation in Singapore due to COVID-19, for up to 30 days.

The claim is payable upon the first day of diagnosis.

Critical Illness Coverage Updates Regarding the Novel Coronavirus COVID-19

In general, most critical illness (CI) coverage plans do not cover the novel coronavirus.

From what we understand, it might be admissable as an End-Stage Lung Disease if it fulfils the CI criteria of your policy.

Other Coronavirus-Related Insurance Announcements

Prudential has announced that the PrUPanel Connect Concierge services in Raffles Hospital and Mount Alvernia Hospital have been temporarily suspended.

Is the Government Doing Anything With Regard to the Novel Coronavirus COVID-19 Situation?

The Singapore Government is footing the hospital bills for all suspected and confirmed cases since their illness is caused by an emerging disease.

On top of that, every household will be given a pack of four masks to be used only in emergencies.

You can collect your masks using this locator to find your closest designated RC Centres or CC.

As of 9 February 2020, the deadline for mask collection has been extended to 29 February 2020.

In order to collect your masks, you’ll need to present your NRIC for verification.

If you (or someone you know) are unable to collect the masks due to immobility, you can contact your CC or call 1800-3330-999 for assistance.

And if you missed your collection date, you can contact your CC to make alternative arrangements.

Related Articles

- Ultimate Singapore Malaysia Land VTL (Vaccinated Travel Lane) Guide: Bus Ticket Prices, PCR Tests Costs & More!

- Ultimate Guide To Vaccinated Travel Lanes (VTLs): Costs, Things To Do and What To Take Note Of

- Flying to Korea via VTLs? What Costs To Expect When You Want To Curb That K-craze!

- An Ultimate Guide: Key Insurance Policies You Should Get In Singapore 2022

- Student Exchange Insurance Plans: Should I Add-On To My School’s Insurance?

- Which Countries Can We Travel to When COVID-19 Restrictions Ease?

- Air Travel Bubbles, Air Travel Passes & Reciprocal Green Lanes: Where Can I Travel Overseas Right Now?

- Things To Look Out For When Buying Travel Insurance

Advertisement