These Young Singaporeans Cleared Their Student Loans Within 2 Years. Here's How They Did It.

Student Loan: The First Loan To Hit You

Read also: A Typical Singaporean Financial Journey

Read also: A Typical Singaporean Financial Journey

The student loan is usually the first financial milestone for many of us, given that it kicks in at the earlier stage of our lives. With an estimated amount of S$21K incurring on your personal finance journey even before you embark on your first job, clearing it requires a lot of discipline and hard work. We might have written about the 6 steps to repaying a student loan, but applying it, in reality, is a whole new level.

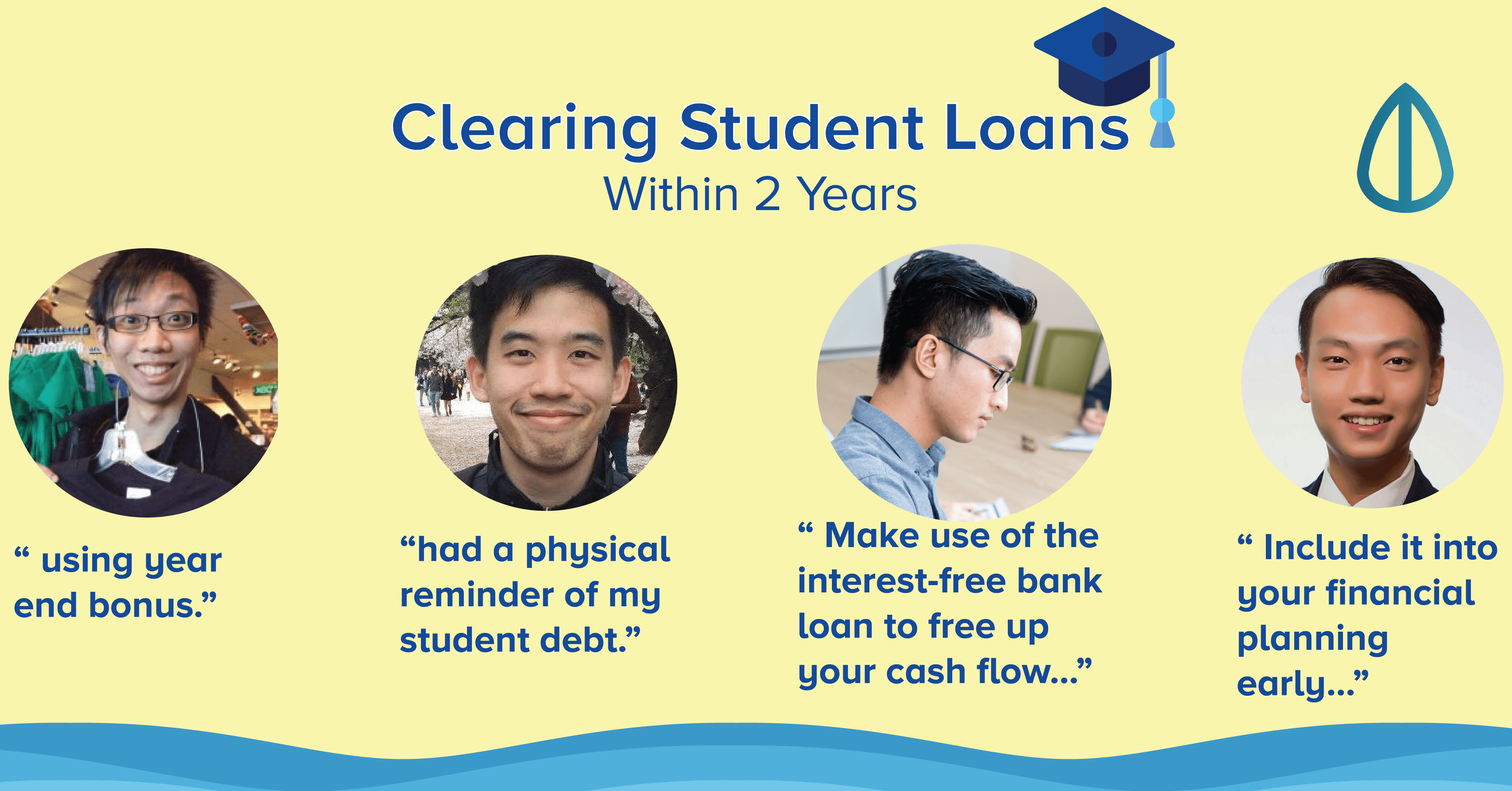

Here are some young Singaporeans who managed to clear their student loans within 2 years, and here’s how they do it.

Jackie Tan Yen

Co-founder at fundMyLife

What is the amount of your student loan?

$20K

How long did you take to clear it?

2 years

How did you manage to do so in a short period of time?

I did it by resolving myself to clear it as soon as possible. I had a physical reminder of my student debt which I stared at it from time to time. While it was stressful, it was also a reminder whenever my willpower faltered in the face of temptation. I also pumped all of my bonus in the past into repaying the loan and not spending it on things like travel.

Any advice for fresh graduates clearing their student loans?

Fresh graduates, nothing makes you sleep better at night more than being debt-free. Clear student loans quickly before other liabilities pile up in your subsequent life stages. Be disciplined, be tough. If you chart your student loans over time, you’ll see more motivated to see the chart go downwards.

Andrew Wong

Analyst, German MNC

What is the amount of your student loan?

S$25k. My loan is a bit low because school fees were still quite cheap back in 2009 when I secured my place in the university. The current gauge for local uni will be around S$35 – S$40k given fees have increased significantly

How long did you take to clear it?

Around 1 year.

How did you manage to do so in a short period of time?

I paid off half of my principal before the interest kicked in using my savings and investment. I get a fair bit of money from the school through awards and bursaries which helped me in the repayment.

Any advice for fresh graduates clearing their student loans?

I personally feel that it is good to take bank loan rather than using parents CPF if applicable. This is because when you use a bank loan, should you enter a local university, it is essentially interest-free in the 4 years. For CPF, the accrued interest will kick off the moment you take money out. If you have any spare cash, do not use it to pay school fees right away. Make use of the interest-free bank loan to free up your cash flow for your school exchange programmes or make your own investments.

Community Contribution:

We open our floor to our community to seek advice on individuals who can advise us on this particular topic.

Jefferson Soh

Founder, The Cat Cafe

Should you land yourself a full-time job, the year end bonus will be a great help in clearing your debt. Most of my friends paid off using their year end bonus. Assuming a 2 months bonus for a S$3,500 per month job, that will be around S$6,000 each year. In 2 years, the bonus would have helped them with S$12,000 worth of loans.

Top this up with a monthly payment of $1,000, clearing it within 2 years should be attainable. Some of my staff work during the holidays to pay off the loan.

Jackie Tan

Financial Consultant, Finexis Advisory

Another way to fund for education fee is to include it into your financial planning early. Time is needed to compound returns, and it is a limiting factor we have no control over.

For some, the repayment of loan starts right after graduation, depending on the type of loan you took up. If the course of your education is around 3 or 4 years, we have that additional years to compound some returns to pay off a portion of the loan before interest is incurred.

Advertisement