A Newbie's Guide To The Cheapest Motorcycle Insurance In Singapore

Ever picture yourself on a motorbike weaving in and out of traffic? Maybe even cornering a tight bend?

In case you need help imagining… here’s Tom Cruise being all cool on that bike of his.

Oh and did you know? This scene was actually acted out by the man himself, TOM CRUISE. That’s some mad skillz he’s got there.

Ok, that’s beside the point.

Anyway, Tom Cruise also acted out this scene in Mission Impossible: Fallout.

Where again, he was being all cool one moment before he collided with a car.

Although it was a movie, my point here is that if you ride a motorcycle, surely, anything can happen. And that is why you need motorcycle insurance.

If you are at least 18 years old, just passed your Traffic Police (TP) Class 2B test, and looking to purchase your first motorcycle…

Congratulations!

As you go about searching for a bike, you will also have to purchase motorcycle insurance. To help make things slightly easier, I’ve created this guide so you can get an idea of the various motorcycle insurance policies that are available to you and even compare to see which is the best for you.

TL;DR: Which Is The Cheapest (But Most Value For Money) Motorcycle Insurance?

This one’s a little subjective, but for me, I selected these options based on price (cheapest but it must give me the most value for money) as well as the amount of coverage it offers me. Basically, which one gives me the most bang for my buck.

Presenting…

My Choice

- TPO (Third Party Only): NTUC Income

- TPFT (Third Party, Fire and Theft): Etiqa Insurance

- Comprehensive: NTUC Income

Disclaimer: The ones that didn’t make my choice does not mean that they’re not good. Some might be a little more expensive. But it’s because they offer more protection and coverage for more kiasu riders. And there’re some that might provide perks which I don’t feel that I need since I’m on a tight budget. So take my recommendations and do your due diligence to see which motorcycle insurance really is the best for YOU.

Some Assumptions To Find The Cheapest Motorcycle Insurance In Singapore

Before we actually go into the different motorcycle insurance policies offered by the different insurance companies (which is also one of the factors that affect insurance prices) let’s begin with the factors that affect how motorcycle insurance policies are priced.

Your motorcycle insurance premium will vary due to these factors.

1. Age

The younger you are, the more expensive your insurance policy premiums will be. And it’s probably because you are more inexperienced. Or for some riders, they might be more reckless. Not me… I’m a safe and responsible rider. 😀

2. Type Of Bike

Premiums for a sport bike will cost more than a street bike. Sport bikes are known to have more power as they’re purpose-built for speed. Insurance companies know that if you buy a fast bike, you’re likely going to ride it fast. And riding fast means there’s a higher chance of injury (or death) which results in higher cost of insurance.

3. Year Of Registration Of Bike

The newer the bike, the more expensive the insurance.

And it’s probably because older bikes have a higher probability of breaking down (especially if they’re not well-maintained or taken care of) and causing injury or fatality. So naturally, insurance companies would increase premiums to offset the increased risk of a loss.

4. Type Of Usage

Premiums for a bike that you use for commercial purposes (for eg. food delivery) will be more than one for personal use.

5. Previous Claim History And No-Claim Discount (NCD)

The more claims you have submitted, the more expensive the insurance.

Conversely, NCD, or No-Claim Discount, is an entitlement given to you if no claim has been made under your policy for a year or more under the current or existing insurer. It’ll only be valid as long as you stay with your insurer.

Think of it as a reward given to you every year for being a safe rider (more reasons to ride safe, ladies and gentlemen).

Currently, in Singapore, the maximum NCD you can get is NCD20 or 20% after 3 consecutive years of safe riding with no claims.

Motorcycle Rider Profile For Comparison

With all of the above in mind, here’s the motorcycle rider profile I submitted to get the various motorcycle insurance quotes:

- 18 years old

- Male

- Intending to purchase a second-hand Yamaha street bike that was registered in 2014, for personal use only

- Less than 2 years of riding experience (just passed 2B Traffic Police test that type)

- 0% No Claim Discount

What Are The Types Of Motorcycle Insurance Available?

There are three types of motorcycle insurance available in the market.

To make it easier for you, I asked for quotes for all three options, from as many insurance companies as I can (with the above rider profile in mind) and included the cost of their premiums so you can have a better sense of which company to go with.

However, price is not the only factor to consider! Some companies might be a little more expensive because they place more emphasis on better customer service or have built a reputation that lets you make your claims easier.

So it’s always good to talk to your other friends to get some recommendations too! Alternatively, you can even ask our friendly Seedly community in our Seedly QnA!

Ask your motorcycle insurance related questions here!

Third-Party Only (TPO)

What is it: Third-party insurance is essentially a form of liability insurance to protect yourself against third-party claims. You, on the other hand, are still responsible for your own damage or losses, regardless of the cause of those damages. This is the minimum level of motorcycle insurance and also the most basic coverage you get. Third party insurance generally covers you for:

- Third-party injury to a passenger or a person on another motorcycle

- Damage to another person’s motorcycle

- Damage to another person’s property

Why: This policy is to help defray the cost you need to pay for damages to other people, vehicles, and property in the event of an accident that was deemed to be your fault.

Who is it for: Those who want to be insured against any claims from a third party only.

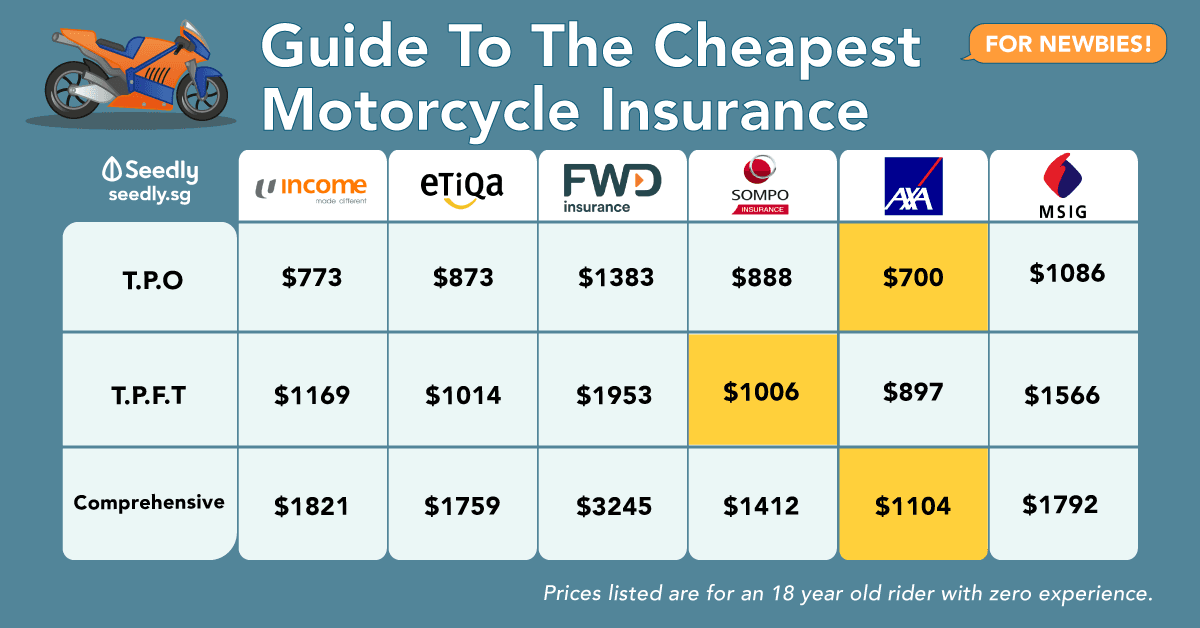

| Third Party Only Motorcycle Insurance Coverage | NTUC Income | Etiqa Insurance | FWD Insurance | Sompo Insurance | AXA | MSIG Insurance |

|---|---|---|---|---|---|---|

| Price | $772.63 | $873.12 | $1382.58 | $888.10 | $699.78 | $1086.05 |

| Covers death or bodily injury to third party | Unlimited coverage | Only available upon quotation | Only available upon quotation | |||

| Damage to third party property | Claim up to S$500,000 |

|||||

| Others | NA | Legal costs and expenses | One-time transport cost cover, to anywhere in Singapore | NA | ||

| 24hr roadside assistance in case of a breakdown |

||||||

Third Party, Fire and Theft (TPFT)

What is it: Third party, fire and theft insurance provides the same coverage as TPO. On top of that, it also covers your motorcycle in case it gets damaged or destroyed in a fire, or even worse, stolen. TPFT generally covers you for:

- Same coverage as TPO

- Damage that happens as a result of an attempted theft

- Damage that happens as a result of fire

- Stolen bike

Why: Same reasons as TPO. However, you will also be insured against fire and theft situations.

Also, if you park your bike in an area where there is a higher risk of your motorcycle being stolen or involved in a fire (accidental or not), then a third party, fire and theft policy could help to cover the cost or repairs or a replacement motorcycle. I mean, who will really know when the next fire might happen… right?

Who is it for: Those who are looking for an in-between but still want additional coverage for fire and theft scenarios.

| Third Party Fire and Theft Motorcycle Insurance Coverage | NTUC Income | Etiqa Insurance | FWD Insurance | Sompo Insurance | AXA | MSIG Insurance |

|---|---|---|---|---|---|---|

| Price | $1168.68 | $1014.36 | $1952.73 | $1005.80 | $896.66 | $1565.41 |

| Excess | NA | $300 excess | NA | $300 excess | Only available upon quotation | Only available upon quotation |

| Covers death or bodily injury to third party | Unlimited coverage | |||||

| Damage to third party property | Claim up to S$500,000 |

|||||

| Loss or damage by fire or theft | Up to market value at the time of loss or damage | |||||

| Vehicle stolen outside Singapore | An excess amount of up to 50% of the prevailing value of the stolen motorcycle capped at S$2,500 | An excess amount equal to 50% of the market value of your vehicle capped at S$2,500 | NA | NA | ||

| Towing Services | NA | Up to $50 | NA | |||

| Others | NA | Legal costs and expenses | One-time transport cost cover, to anywhere in Singapore | Policy excess as shown on the schedule of certificate of Insurance applies for each and every accident claim |

||

| 24hr roadside assistance in case of a breakdown |

||||||

Comprehensive

What is it: Comprehensive motorcycle insurance is the highest level of cover you can purchase for you and your motorcycle. Comprehensive motorcycle insurance policies generally cover:

- Same coverage as TPFT

- Damage that happens as a result of an accident

- Personal injuries resulted from an accident

Why: This policy is to provide you with complete coverage over any unforeseen circumstances.

Who is it for: For those who feel insecure if they are not well covered and for those who don’t have any other form of insurance eg. personal insurance.

Comprehensive Motorcycle Insurance Coverage NTUC Income Etiqa Insurance FWD Insurance Sompo Insurance AXA MSIG Insurance

Price $1820.75 $1758.65 $3244.57 $1412.40

$1104.24 $1792.25

Excess NA $800 excess NA $800 excess Only available upon quotation Only available upon quotation

Covers death or bodily injury to third party Unlimited coverage

Damage to third party property

Claim up to S$500,000

Loss or damage by fire or theft Up to market value at the time of loss or damage

Vehicle stolen outside Singapore An excess amount of up to 50% of the prevailing value of the stolen

motorcycle capped at S$2,500An excess amount equal to 50% of the market value of your

vehicle capped at S$2,500 NA

Loss or damage by other insured causes up to market value at the time of loss or damage

Towing Services

Up to $50

Others Policy excess as shown on the Schedule or Certificate of Insurance applies for each and every accident claim

Legal costs and expenses

One-time transport cost cover, to anywhere in Singapore

Policy excess as shown on the schedule of certificate of Insurance applies for each and every accident claim

24hr roadside assistance in case of a breakdown

If you’re a rider, do you currently have motorcycle insurance? What’s the best or cheapest motorcycle insurance in the market right now? Let us know in the comments below!

Advertisement