Latest T-Bills Singapore Guide (12 Dec 2024): Rates, Auction Dates How to Buy & More

Are you not so keen on parking your cash for 10 years in the Singapore Savings Bond (SSB) or Singapore Government Securities (SGS) bonds for the full tenor?

Or are you looking for an alternative to fixed deposits?

Enter treasury bills (T-bills) with short maturities of only six months or one year and the same backing from the Singapore Government, which is well-known for its high credit (AAA) rating.

You’ll also receive a fixed interest payment upfront, and you can invest with cash, Supplementary Retirement Scheme (SRS), or Central Provident Fund (CPF) funds with no overall limit.

Here’s all you need to know.

TL;DR: T-Bills Singapore Guide — Treasury Bill Rates, Auction Dates & More

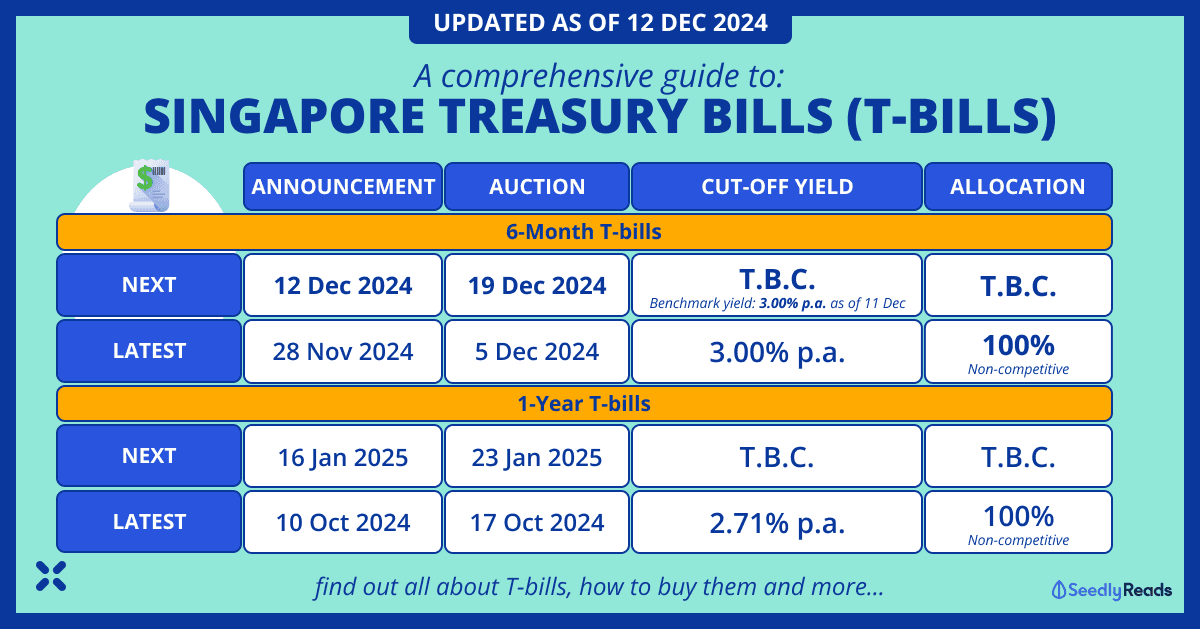

Singapore 6-Month T-Bill Rate

The previous 6-month Singapore T-bill BS24124Z (5 Dec 2024) offered a cut-off yield of 3.00% p.a.. 100% of non-competitive applications were allotted.

Singapore 1-Year T-Bill Rate

The latest 1-year Singapore T-bill, BY24103N (17 Oct 2024), offered a cut-off yield of 2.71% p.a. with 100% non-competitive allocation.

Click to Jump:

- This Month’s T-bills Auction Updates

- What are Singapore T-Bills?

- T-bills vs Similar Risk Level Products

- SSB vs SGS vs T-Bills

- How Do I Buy T-bills?

- What Is Competitive and Non-competitive Bidding?

- How Do I Sell T-bills?

- How Do I Check My T-bills?

- FAQs

- Are T-bills Right For Me?

- Upcoming T-bill Auctions for 2024 and 2025

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their due diligence and consider their financial goals before investing in any investment product. Note that the information is accurate as of 12 Dec 2024.

T-Bills Auction Updates

The interest rate for T-bills changes every month and is only determined at the auction. So here’s a look at the latest and upcoming auctions:

6-Month T-Bill Singapore (19 Dec 2024 Auction): BS24125S

| BS24125S 6-Month T-bill (Open) | |

| Issue Code | BS24125S |

| ISIN Code | SGXZ30036156 |

| Tenor | 6 months |

| Amount Offered | $6.8 billion |

| Amount Allotted | TBC |

| % of Competitive Applications at Cut-off Allotted | TBC |

| % of Non-Competitive Applications Allotted | TBC |

| Interest Rate (Cut-off Yield) | TBC Benchmark yield as of 11 Dec 2024: 3.00% p.a. |

| Announcement Date | 12 Dec 2024 |

| Auction Date | 19 Dec 2024 |

| Issue Date | 24 Dec 2024 |

| Maturity Date | 24 Jun 2025 |

| Application Period | Opens: 12 Dec 2024 Closing Date: Typically 1 – 2 business days before the auction date (Do check with your bank for the exact closing date.) |

| Investment Amounts | Minimum of $1,000 (in multiples of $1,000) |

Source: MAS

1-Year T-Bill Singapore (23 Jan 2025): BY25100H

| BY25100H 1-Year T-bill (Upcoming) | |

| Issue Code | BY25100H |

| ISIN Code | SGXZ85890994 |

| Tenor | 1 year |

| Amount Offered | TBA |

| Amount Allotted | TBA |

| % of Competitive Applications at Cut-off Allotted | TBA |

| % of Non-Competitive Applications Allotted | TBA |

| Interest Rate (Cut-off Yield) | TBA |

| Announcement Date | 16 Jan 2025 |

| Auction Date | 23 Jan 2025 |

| Issue Date | 28 Jan 2025 |

| Maturity Date | 27 Jan 2026 |

| Application Period | Opens: 16 Jan 2025 Closing Date: Typically 1 – 2 business days before the auction date (Check with your bank for the exact closing date.) |

| Investment Amounts | Minimum of $1,000 (in multiples of $1,000) |

Source: MAS

6-Month T-Bill Singapore Historical Cut-off Yield

| Auction Date | Issue Code | Cut-off yield (p.a.) |

|---|---|---|

| 4 Jan 2024 | BS24100F | 3.74% |

| 18 Jan 2024 | BS24101Z | 3.70% |

| 1 Feb 2024 | BS24102S | 3.54% |

| 15 Feb 2024 | BS24103H | 3.66% |

| 29 Feb 2024 | BS24104T | 3.80% |

| 14 Mar 2024 | BS24105X | 3.78% |

| 27 Mar 2024 | BS24106W | 3.80% |

| 11 Apr 2024 | BS24107N | 3.75% |

| 25 Apr 2024 | BS24108V | 3.74% |

| 9 May 2024 | BS24109A | 3.70% |

| 23 May 2024 | BS24110T | 3.65% |

| 6 Jun 2024 | BS24111X | 3.76% |

| 20 Jun 2024 | BS24112W | 3.74% |

| 4 Jul 2024 | BS24113N | 3.70% |

| 18 Jul 2024 | BS24114V | 3.64% |

| 1 Aug 2024 | BS24115A | 3.40% |

| 15 Aug 2024 | BS24116E | 3.34% |

| 29 Aug 2024 | BS24117F | 3.13% |

| 12 Sep 2024 | BS24118Z | 3.10% |

| 26 Sep 2024 | BS24119S | 2.97% |

| 10 Oct 2024 | BS24120V | 3.06% |

| 24 Oct 2024 | BS24121A | 2.99% |

| 7 Nov 2024 | BS24120V | 3.04% |

| 21 Nov 2024 | BS24123F | 3.08% |

| 5 Dec 2024 | BS24124Z | 3.00% |

Source: MAS Auctions and Issuance Calendar

1 Year T-Bill Singapore Historical Cut-off Yield

| Auction Date | Issue Code | Cut-off yield (p.a.) |

|---|---|---|

| 26 Jan 2023 | BY23100X | 3.87% |

| 20 Apr 2023 | BY23101W | 3.58% |

| 27 Jul 2023 | BY23102N | 3.74% |

| 19 Oct 2023 | BS23121E | 3.70% |

| 25 Jan 2024 | BS24101Z | 3.45% |

| 18 Apr 2024 | BY24101X | 3.58% |

| 25 Jul 2024 | BY24102W | 3.38% |

| 17 Oct 2024 | BY24103N | 2.71% |

Source: MAS Auctions and Issuance Calendar

Individual investors can submit bids for SGS through selected banks’ ATMs and Internet banking portals. Applications through these channels may close one to two business days before the auction, and individual investors should check with their banks on the exact cut-off time.

Dates: Where the issue/settlement date, coupon payment or redemption date, or closing date of the application specified above falls on a day that the electronic payment system, established by the Monetary Authority of Singapore, is not in operation, issuance/settlement, coupon payment, redemption, or the close of application, as the case may be, will be effected on the next business day when the electronic payment system is in operation.

What Are Singapore T-Bills?

Treasury bills (T-bills) are government bonds that pay a fixed interest rate and have six-month or one-year maturities. The most common T-Bill is the 6-month.

Unlike SGS bonds, however, you are not paid with coupons. Instead, you buy T-Bills at a discount to the face (par) value and are given the full value at maturity.

According to the issuance calendar on the MAS website, the 6-month T-bills are typically issued every two weeks, while the 1-year T-bills are issued every quarter.

The minimum application is $1,000, while the maximum application is up to $1,000,000 per applicant.

Do T-Bills Pay Monthly?

In other words, if I were to buy a 6-month T-bill worth $10,000 with a yield of 3% p.a., I would only need to pay $9,850 upfront. Thus, they do not pay monthly.

At the end of the tenor, I will receive the entire $10,000 worth (back into my bank, CPF, or SRS account) and would have earned $150.

MAS T-Bill Rates Are Only Revealed at the Auction

The big caveat is that you will only know the actual interest rates after announcing the auction results. Unlike SSBs, where MAS will tell us the exact interest rate we will get, T-Bills are auctioned, and the yields are determined then.

Historical Rates

Luckily, we can roughly estimate the rates by looking at historical data from the MAS website!

Are T-Bills a Good Investment?

Before we discuss how to buy T-bills, let’s examine what investing in them means for us and how it differs from SSBs and SGS bonds.

Why Does The Government Offer T-Bills?

According to MAS, the Government issues SGS bonds and T-bills primarily to:

- Build a liquid SGS market to provide a robust government yield curve, which serves as a benchmark for the corporate debt market

- Grow an active secondary market for cash transactions and derivatives to enable efficient risk management

- Encourage issuers and investors, both domestic and international, to participate in the Singapore bond market.

If you didn’t understand any of that, T-bills essentially serve as a way for you to lend the Singapore government money so that they can develop the local debt markets.

How Do I Withdraw Money From T-Bills?

Investors cannot redeem T-bills early. However, you may sell your T-bill on the secondary market at DBS, OCBC, or UOB’s main branches.

That said, the price of the T-bill may rise or fall before maturity, and the trading volume for T-bills is low, making them relatively illiquid. So be sure you are okay with locking up your money for the duration of the tenor!

Are T-Bills Risk-Free?

T-bills are wholly backed by the Singapore Government, which has a “AAA” credit rating.

This reduces the risks of investing in T-bills to the bare minimum (read: there are still risks).

Singapore is one of only 11 countries to enjoy the “AAA” credit rating by Standard and Poor (S&P), the folks behind the S&P 500 index! Other countries that have this rating include Switzerland, Australia, and Finland.

Such a strong rating arguably makes the T-bills one of the safest products in the market.

The only way you will lose all your money is if the Singapore Government defaults, which has never happened!

T-Bills vs Similar Risk-Level Products

In this section, we’ll compare other assets with similar risk levels to determine if T-bills are right for you, starting with fixed deposits, as that’s the one most Singaporeans are familiar with!

T-Bills vs. Fixed Deposits

T-bill interest rates are typically more competitive compared to fixed deposits:

Both are considered safe investments, with T-bills backed by the Singapore government and Fixed Deposits capital guaranteed by the Singapore Deposit Insurance Corporation (SDIC).

Fixed deposits offer a bit more flexibility regarding the tenure and are more liquid than T-Bills, although you will have to pay early withdrawal fees.

The choice between T-bills and Fixed Deposits ultimately boils down to whether you want to know the interest rate you are getting beforehand and are confident enough to lock your money up for 6 months.

For those of us who want to invest for the long term (i.e., five to ten years), consider SSBs or SGS bonds instead!

SSB vs SGS vs T-Bills: What Are The Differences?

| Singapore Savings Bonds (SSB) | Singapore Government Securities (SGS) Bonds | Treasury Bills (T-Bills) | |

|---|---|---|---|

| What is it? | Safe and flexible bond option for investors | Tradable government debt securities | Short-term tradable government debt securities |

| How does it work? | Pays interest every 6 months | Pays a fixed couple every 6 months | Investors buy it at a discount. Upon maturity, investors will then receive the full face value of the bill |

| Investment duration | 10 years | 2, 5, 10, 15, 20, 30, 50 years | 6 months or 1 year |

| Minimum investment | $500, and in multiples of $500 | $1,000, and in multiples of $1,000 | $1,000, and in multiples of $1,000 |

| Maximum limit per investor | $200,000 | Auction: up to allotment limit for auctions Syndication: None | No Limit; up to the allotment limit for auctions |

| Fees | Cash: $2 | Cash: $2 (Waived if you apply through DBS internet banking) | Cash: $2 (Waived if you apply through DBS internet banking) CPFIS: $2.50 transaction fee, $2 quarterly service fee per counter |

| Type of Interest Payment | Fixed coupon, steps up each year | Fixed coupon | No coupon; issued and traded at a discount to the face (par) value |

| Payment of interest | Every 6 months, starting from the month of issue | Every 6 months, starting from the month of issue | At maturity |

| How is the price and rate determined? | The interest rate is fixed and published by Monetary Authority of Singapore (MAS) every month The interest rate is announced before the application | Determined by auction | Determined by auction |

| How to apply? | Apply through DBS/POSB, OCBC and UOB ATMs or internet banking | Apply through DBS/POSB, OCBC and UOB ATMs or internet banking | Apply through DBS/POSB, OCBC and UOB ATMs or internet banking |

| How to redeem? | Redeem the full principal with accrued interest through Online Bank or ATM There will be no penalty for early withdrawal | No early redemption | No early redemption |

| Can we buy/sell on secondary markets? | No | At DBS, OCBC or UOB main branches; on SGX through brokers | At DBS, OCBC or UOB main branches |

| Transferable? | No | Yes | Yes |

| Can we invest using our SRS account? | Investors can invest through their respective SRS Operator's internet banking portal | Investors can invest through their respective SRS Operator's internet banking portal | Investors can invest through their respective SRS Operator's internet banking portal |

| Can we invest using our CPF/SRS? | CPF: No SRS: Yes | Auction: Yes Syndication: No | Yes |

| Tax | There is no capital gains tax in Singapore | ||

Source: MAS

T-Bills vs. SSBs

Both T-bills and SSBs are considered safe investments. However, you’ll often find that T-bills have a higher interest rate than SSBs. That said, SSBs are meant to be long-term investments, and you can effectively “lock in” the interest rate for 10 years!

You should consider SSBs instead if you want:

- Interest rates that increase the longer you hold, with a 10-year maturity.

- Flexibility of redeeming in any month. You’ll get the principal back with accrued interest by the second business day of the next month.

- A low minimum investment of S$500 (capped at S$200,000 overall per individual).

T-Bills vs. SGS Bonds

The comparison for SGS bonds and T-bills is pretty much the same for T-bills and SSBs. However, you cannot redeem SGS bonds early, and the only way to get your money back is by selling them on the secondary market like T-bills. SGS bonds also offer more flexibility in choosing tenors ranging from 2 to 50 years.

You should consider SGS Bonds instead if you want:

- A fixed interest rate, with maturities from 6 months to 50 years.

- Ability to invest in larger amounts with no overall limit. The minimum amount is S$1,000 (capped at the limits for each auction).

T-Bills Vs Cash Management Accounts

For the uninitiated, cash management accounts offer stable, low-risk returns with high liquidity.

This product optimises liquidity, maximises returns, and preserves capital while addressing investors’ short-term financial needs.

However, it’s important to note that unlike T-Bills, which are backed by the government, cash management accounts are not capital-guaranteed by the Singapore Deposit Insurance Corporation (SDIC), and there is still a risk of losing money.

How to Buy T-Bills in Singapore?

Before applying, make sure you have the following:

- A bank account with any local banks in Singapore (DBS/POSB, OCBC, or UOB)

- Central Depository (CDP) account that is linked to the bank account you intend to invest with

- A CPF Investment Account with one of the three CPFIS agent banks (DBS/POSB, OCBC, and UOB) for CPFIS-OA investments (no account needed for CPFIS-SA investments).

- An SRS account if you are using funds from your SRS.

How Do I Apply For T-Bills?

Cash

You can apply for a T-bill through two methods:

- Apply at an ATM (only DBS/POSB, OCBC, or UOB) near you OR

- Apply through Internet Banking under “Singapore Government Securities”.

Note that the $2 transaction fee (excluding GST) is waived if you apply through DBS.

SRS

Apply through the internet banking portal of your SRS Operator (DBS/POSB, OCBC, or UOB)

Using CPF for T-Bills

Submit an application in person at the main branch of your respective Central Provident Fund (CPF) Investment Scheme (CPFIS) agent bank (DBS/POSB, OCBC, or UOB).

For DBS, OCBC and UOB customers, you may also apply for T-bills using your CPF-OA funds online via i-banking under “Singapore Government Securities”.

Do note that agent banks charge a one-time fee of $2.50 (excluding GST) per transaction and a quarterly $2 service fee (excluding GST) per counter. A T-bill investment using your CPF Ordinary Account (OA) will incur a total cost of $6.50 or $7.085 after the prevailing GST of 9%.

However, if you cannot get your desired allocation for 1-year T-bills, you can consider Maybank’s 12-month CPF Time Deposit.

The bank now offers CPF time deposits. CPF members can open a Maybank 12-month CPF time deposit account by depositing at least $20,000 from their CPF OA.

This is above the breakeven point, as covered in our commentary on whether you should use your CPF funds to buy T-bills or Fixed Deposits:

How to Apply for Older T-Bills

Dealer Banks (Secondary Market)

Aside from bidding at a T-bill auction, you can also buy T-bills with primary dealer banks (DBS/POSB, OCBC, or UOB). This allows you to buy older T-bills for an even higher return!

What Is a Competitive Bid and a Non-competitive Bid?

As you apply for new T-bills, you will have the option of a “non-competitive” and “competitive” bid.

Non-competitive Bid

A non-competitive bid does not specify the yield. Instead, you only specify the amount you want to invest, and those funds will be invested regardless of the yield. This is the option that the average Singaporean should go for.

Non-competitive bids will be allotted first, up to 40% of the total issuance amount. If the amount of non-competitive bids exceeds 40%, the bond will be allocated to you on a pro-rated basis.

Competitive Bid

On the other hand, a competitive bid is usually for institutional investors or the more investment-savvy, where investors will bid for their desired yield.

Opting for a competitive bid means your funds will only be invested if the cut-off yield exceeds your specified yield.

Do note that you may not get the total amount that you applied for, depending on how your bid compares to the cut-off yield :

- If your bid is lower than the cut-off yield, you will get an allotment of what you bid

- If your bid is equal to the cut-off yield, your allocation amount might be lower as the allocation is pro-rata

- If you bid above the cut-off yield, you will not be allocated.

The balance (60%) of the total issue amount will then be awarded to competitive bids from the lowest to highest yields.

In essence, everyone will get the cut-off yield so long as your (competitive) bid does not exceed the cut-off yield!

How to Sell T-Bills

Since you cannot redeem your T-bills early, you may consider selling them through dealer banks (DBS/POSB, OCBC, or UOB).

But remember, the bond price may rise or fall before maturity, so you could lose some capital if you sell at a value below par.

How To Check T-Bills

Once you’ve applied for T-bills, the waiting game begins!

You will be issued T-bills three days (T+3) after the auction.

You may view your purchases or sales of T-bills at the respective platforms based on your purchase method.

How To Check T-Bills in Your CDP Account

Your successful T-Bills allotment paid for in cash will be reflected in your CDP statement (NOT SGX!):

If you have purchased $6,000 worth of T-bills, for example, you will be allocated a quantity of 60 units, with each unit worth $100.

So don’t panic if you’ve put in $10,000 and only see a quantity of 100!

T-bills Application for CPF and SRS

SRS application: Statements from your SRS Operator (DBS/POSB, OCBC and UOB are SRS operators).

CPF-OA application: CPFIS statement sent by your agent bank (DBS/POSB, OCBC and UOB are CPFIS agent banks).

CPF-SA application: CPF statement.

FAQ: T-Bills Allocation and More

I Made a $10,000 Non-Competitive Bid With Cash and Received a Refund of $5,075 in My Bank Account. What’s Going On?

In this scenario, only $5,000 worth of T-bills was successfully applied, with the additional $75 being the interest earned.

This means that the cut-off yield for this round is at 3% per annum. If you’ve only received a partial allocation, this means that the T-bill you applied for was oversubscribed.

I’ve received the T-bill refund, but my CDP account does not reflect my T-bill holdings.

As T-bills are currently oversubscribed, it may take some time for MAS to process the information, resulting in a delay on your CDP account.

No need to worry and be patient for the holdings to appear.

Can I Submit Multiple Bids at the T Bills Auction?

Yes, you can! Additional bids will not overwrite your previous submission.

If I submit a competitive bid, will I get the cut-off yield or the bid I submitted if the cut-off yield is higher?

You will get the cut-off yield if you’ve submitted a bid lower than the cut-off yield.

Will T-Bills Interest Rates Increase in the Future? How Much Interest Do T-bills Pay?

T-Bills have recently become popular, resulting in high demand and oversubscription. On top of that, some people have spoiled the market by submitting very low competitive bids to get fully allotted while enjoying a higher interest rate.

As a result, the T-bill interest rates have been fluctuating recently.

Are T-Bills Right For Me?

If you are an investor who wants to invest for a short period (i.e. 6 months or one year), T-Bills are a great and safe way to park your spare cash.

The median yield of T-Bills are often higher than that of fixed deposits, SSBs, and other similar risk-level products.

That said, the interest rates are only determined at the auction, and if there is another oversubscription, you can expect interest rates to fall further and only a partial allocation.

Do note that with the headline inflation rate averaging 4.80% in 2023, you are facing a tough battle.

Should You Invest in T-Bills Now?

Treasury Bills have already begun falling in interest, and will likely further fall with the Fed announcing a cut in interest rates in the U.S.

That said, most other products are also falling in interest as a result.

Alternatively, you can build a bond ladder and dollar-cost-average into T-bills with each issuance to cushion the impact.

To help you make a better decision, check out the T-bills’ benchmark yields here.

Upcoming T-Bill Singapore Auctions

Sometimes, we may miss out on T-bill auctions, so setting a calendar reminder is good. Over at r/SingaporeFI, user “D2GCal” has blessed us with a Google calendar for 2024’s T-Bills:

| 6-Month T-Bill Calendar | Add calendar |

| 1-Year T-Bill Calendar | Add calendar |

Also, here are the next T-Bill auctions for 2024/2025:

6-Month T-Bills Calendar 2024

| Announcement Date | Auction Date | Issue Date | Maturity Date | Tenor | Issue Code | ISIN Code | Status |

|---|---|---|---|---|---|---|---|

| 12 Dec 2024 | 19 Dec 2024 | 24 Dec 2024 | 24 Jun 2025 | 6-month | BS24125S | SGXZ30036156 | Open |

6-Month T-Bills Calendar 2025

| Announcement Date | Auction Date | Issue Date | Maturity Date | Tenor | Issue Code | ISIN Code | Status |

|---|---|---|---|---|---|---|---|

| 09 Jan 2025 | 16 Jan 2025 | 21 Jan 2025 | 22 Jul 2025 | 6-month | BS25101F | SGXZ52757945 |

Upcoming

|

| 21 Jan 2025 | 28 Jan 2025 | 04 Feb 2025 | 05 Aug 2025 | 6-month | BS25102Z | SGXZ33655317 |

Upcoming

|

| 06 Feb 2025 | 13 Feb 2025 | 18 Feb 2025 | 19 Aug 2025 | 6-month | BS25103S | SGXZ89539258 |

Upcoming

|

| 20 Feb 2025 | 27 Feb 2025 | 04 Mar 2025 | 02 Sep 2025 | 6-month | BS25104H | SGXZ84869254 |

Upcoming

|

| 06 Mar 2025 | 13 Mar 2025 | 18 Mar 2025 | 16 Sep 2025 | 6-month | BS25105T | SGXZ91426395 |

Upcoming

|

| 19 Mar 2025 | 26 Mar 2025 | 01 Apr 2025 | 30 Sep 2025 | 6-month | BS25106X | SGXZ85532927 |

Upcoming

|

| 03 Apr 2025 | 10 Apr 2025 | 15 Apr 2025 | 14 Oct 2025 | 6-month | BS25107W | SGXZ85227049 |

Upcoming

|

| 16 Apr 2025 | 24 Apr 2025 | 29 Apr 2025 | 28 Oct 2025 | 6-month | BS25108N | SGXZ68156801 |

Upcoming

|

| 29 Apr 2025 | 07 May 2025 | 13 May 2025 | 11 Nov 2025 | 6-month | BS25109V | SGXZ52581949 |

Upcoming

|

| 15 May 2025 | 22 May 2025 | 27 May 2025 | 25 Nov 2025 | 6-month | BS25110H | SGXZ95105383 |

Upcoming

|

| 29 May 2025 | 05 Jun 2025 | 10 Jun 2025 | 09 Dec 2025 | 6-month | BS25111T | SGXZ99133456 |

Upcoming

|

| 12 Jun 2025 | 19 Jun 2025 | 24 Jun 2025 | 23 Dec 2025 | 6-month | BS25112X | SGXZ71255038 |

Upcoming

|

| 26 Jun 2025 | 03 Jul 2025 | 08 Jul 2025 | 06 Jan 2026 | 6-month | BS25113W | SGXZ89298723 |

Upcoming

|

| 10 Jul 2025 | 17 Jul 2025 | 22 Jul 2025 | 20 Jan 2026 | 6-month | BS25114N | SGXZ64378292 |

Upcoming

|

| 24 Jul 2025 | 31 Jul 2025 | 05 Aug 2025 | 03 Feb 2026 | 6-month | BS25115V | SGXZ18992552 |

Upcoming

|

| 07 Aug 2025 | 14 Aug 2025 | 19 Aug 2025 | 17 Feb 2026 | 6-month | BS25116A | SGXZ36919934 |

Upcoming

|

| 21 Aug 2025 | 28 Aug 2025 | 02 Sep 2025 | 03 Mar 2026 | 6-month | BS25117E | SGXZ42067843 |

Upcoming

|

| 04 Sep 2025 | 11 Sep 2025 | 16 Sep 2025 | 17 Mar 2026 | 6-month | BS25118F | SGXZ80741986 |

Upcoming

|

| 18 Sep 2025 | 25 Sep 2025 | 30 Sep 2025 | 31 Mar 2026 | 6-month | BS25119Z | SGXZ10256311 |

Upcoming

|

| 02 Oct 2025 | 09 Oct 2025 | 14 Oct 2025 | 14 Apr 2026 | 6-month | BS25120N | SGXZ14348890 |

Upcoming

|

| 15 Oct 2025 | 23 Oct 2025 | 28 Oct 2025 | 28 Apr 2026 | 6-month | BS25121V | SGXZ81806382 |

Upcoming

|

| 30 Oct 2025 | 06 Nov 2025 | 11 Nov 2025 | 12 May 2026 | 6-month | BS25122A | SGXZ92535467 |

Upcoming

|

| 13 Nov 2025 | 20 Nov 2025 | 25 Nov 2025 | 26 May 2026 | 6-month | BS25123E | SGXZ46389284 |

Upcoming

|

| 27 Nov 2025 | 04 Dec 2025 | 09 Dec 2025 | 09 Jun 2026 | 6-month | BS25124F | SGXZ55213599 |

Upcoming

|

| 11 Dec 2025 | 18 Dec 2025 | 23 Dec 2025 | 23 Jun 2026 | 6-month | BS25125Z | SGXZ20824181 |

Upcoming

|

1-Year T-Bill Calendar 2025

| Announcement Date | Auction Date | Issue Date | Maturity Date | Tenor | Issue Code | ISIN Code | Status |

|---|---|---|---|---|---|---|---|

| 16 Jan 2025 | 23 Jan 2025 | 28 Jan 2025 | 27 Jan 2026 | 1-year | BY25100H | SGXZ85890994 |

Upcoming

|

| 09 Apr 2025 | 16 Apr 2025 | 22 Apr 2025 | 21 Apr 2026 | 1-year | BY25101T | SGXZ26944249 |

Upcoming

|

| 17 Jul 2025 | 24 Jul 2025 | 29 Jul 2025 | 28 Jul 2026 | 1-year | BY25102X | SGXZ97057780 |

Upcoming

|

| 08 Oct 2025 | 15 Oct 2025 | 21 Oct 2025 | 20 Oct 2026 | 1-year | BY25103W | SGXZ34147660 |

Upcoming

|

Related Articles

Advertisement