Best High Interest Savings Account 2024/25 Guide: Best Bank Interest Rate in Singapore!

We all know by now that inflation has FINALLY tapered down slightly…

And while the stock market is volatile still, there is still something we need to constantly do – to save:

As such, we have updated this guide to help you sort through all the high-interest savings accounts in Singapore and find the best one for your needs.

Here’s everything you need to know!

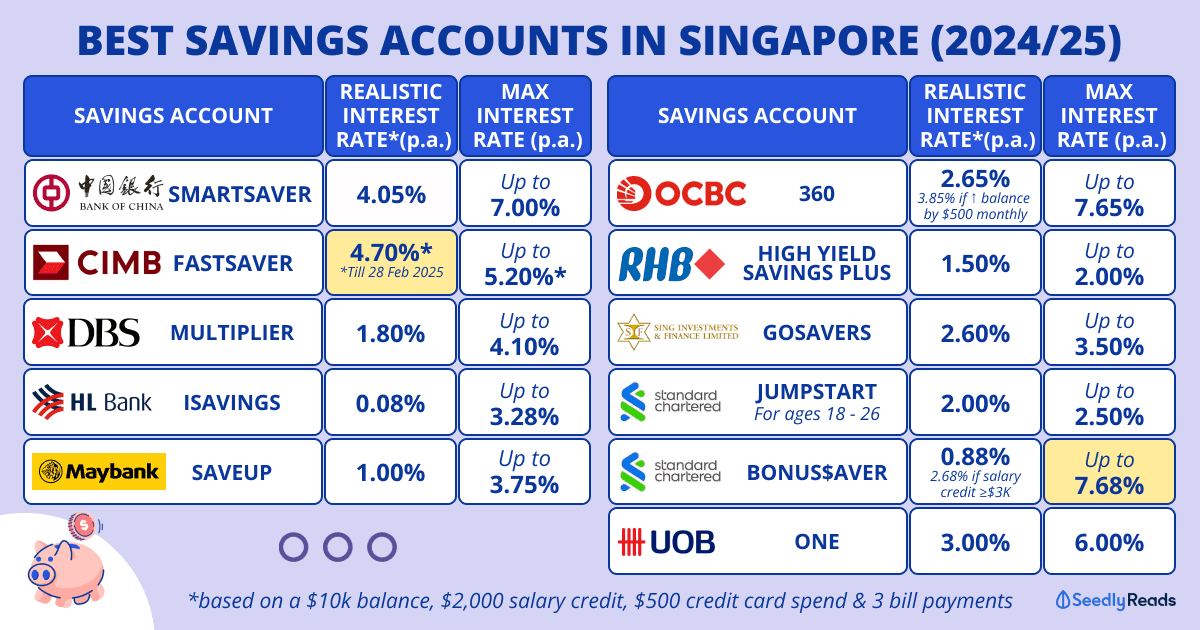

TL;DR: Best High Yield Savings Account Singapore 2024/25 Guide – Full Savings Account Comparison

To find the best savings account, we created this example of a typical working adult in Singapore and assumed the following:

- Has a minimum account balance of $10,000 to enjoy bonus interests and avoid the fall below fees

- Has at least $2,000 in salary credited into the savings account after CPF contributions

- Spends a minimum of $500 a month via Paylah!, debit or credit cards on daily expenses (e.g. transport and food)

- Pays at least three bills (home loan, insurance & telco).

Based on the criteria that we set out, here’s how much interest you’ll be getting from these high-interest savings accounts:

| Savings Account | Realistic Interest Earned (p.a.) | Maximum Interest Earned (p.a.) |

|---|---|---|

| Bank of China SmartSaver | 4.05% | Up to 7.00% |

| CIMB FastSaver | 4.70% (Till 28 Feb 2025) | Up to 5.20% till 28 Feb 2025 |

| DBS Multiplier | 1.80% | Up to 4.10% |

| Hong Leong iSavings | 0.08% | Up to 3.28% |

| Maybank Save Up | 1.00% | Up to 3.75% |

| OCBC 360 | 2.65% | Up to 7.65% |

| RHB High Yield Savings Plus Account | 1.50% | Up to 2.00% |

| Sing Investments & Finance (SIF) GoSavers Account | 2.60% | Up to 3.50% |

| SCB JumpStart* | 2.00% | Up to 2.50% |

| SCB Bonus$aver | 0.88% (2.68% if salary credit is $3,000 & above) | Up to 7.68% |

| UOB One | 3.00% | Up to 4.00% |

*Only those who are 18 and 26 years old are eligible to open a JumpStart account. But you will be able to keep the account and enjoy the prevailing interest on your balance after you turn 26 years old.

Highest Savings Account Interest Rate Singapore (2024/25)

Which savings account in Singapore should you put your money in? The answer is that it really depends.

But let’s say you are a young working adult. The JumpStart account will give you the highest interest of 2.00% per annum (p.a.) without any hoops to jump through. You will get an additional 0.50% when you invest.

If you deposit $10,000 with that account and fulfil the conditions monthly for a year, you will get $200 a year.

Best High Interest Savings Accounts (2024/25): Best Interest Rate for Savings Account

Read on to find out which savings account you should use to store your savings and get some interest.

Best Savings Account – Click to Teleport:

- BOC SmartSaver Account

- CIMB FastSaver Account

- DBS Multiplier Account

- Hong Leong Bank iSavings Account

- Maybank SaveUp Account

- OCBC 360 Account

- RHB High Yield Savings Plus Account

- Sing Investments & Finance (SIF) GoSavers Account

- Standard Chartered JumpStart Account

- Standard Chartered Bonus$aver Account

- UOB One Account

- Digital Bank Savings Accounts: High Interest With Lesser Hoops

- Other Considerations When Choosing the Best Savings Account

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised financial advice. All banks mentioned are protected by the Singapore Deposit Insurance Corporation (SDIC) for up to $100,000 per bank relationship. Readers should always do their due diligence, consider their financial goals before committing to any financial product, and consult their financial advisor before making any decisions. Information is accurate as of 12 December 2024.

Bank of China Savings Account: BOC SmartSaver Account

BOC SmartSaver Savings Account Interest Rates

The Bank of China (BOC) SmartSaver is a savings plan that allows BOC Multi-Currency Savings (MCS) account holders to earn bonus interest on top of the prevailing interest.

The base prevailing interest rate for BOC Savings Accounts ranges from 0.15% – 0.40% p.a., depending on the deposit amount. The more you deposit, the higher the prevailing interest rate.

For account balances above $100,000 to $1,000,000, you can enjoy the extra savings bonus and prevailing interest to earn up to 1.00% p.a.

| Deposit Amount | Interest Rate (p.a.) |

|---|---|

| Below $5,000 | 0.15% |

| $5,000 to $20,000 | 0.20% |

| $20,000 to $50,000 | 0.30% |

| $50,000 to $100,000 | 0.30% |

| $100,000 and above | 0.40% |

Note: a minimum monthly average effective balance of $1,500 is required to enjoy bonus interest.

BOC SmartSaver Savings Account Bonus Interest Category

Account holders can stand to earn up to 7.00% p.a. of bonus interest rates on the first $100,000 of their account balance by fulfilling these categories:

| Bonus Interest Categories | Criteria | Bonus Interest Rate (p.a.) |

|---|---|---|

| Wealth | Purchase eligible BOC wealth products to earn this bonus interest for 12 consecutive months | 2.40% |

| Card Spend | Spend at least $500 - $1,500 posted in a month by using BOC Cards | 0.50% |

| Spend at least $1,500 posted in a month by using BOC Cards | 0.80% | |

| Salary Crediting | Monthly salary crediting of $2,000 & above | 2.50% |

| Payment | Perform at least 3 bill payments of at least $30 each via GIRO or BOC Internet Banking/BOC Mobile Banking Bill Payment function | 0.90% |

| Extra Savings | Fulfil at least one of the requirements for either Card Spend, Salary Crediting, or Payment bonus interest Prevailing interest rate will apply to your account balance above $1,000,000 | 0.60% |

*Prevailing interest rate of up to 0.40% p.a. is applicable for your entire account balance

Do note that any amount from $100,000 to $1,000,000 in the account will only enjoy up to 1.00% p.a. of interest.

Also, here is more information you need to know about this account:

- Minimum initial deposit: $200

- Minimum monthly balance to enjoy bonus interest: $1,500

- Monthly fall below fee: $3 (if monthly average daily balance falls below $200)

- Early account closure fee (within six months): $30

Things To Note About the BOC SmartSaver Savings Accounts

Even with “over 200 ATMs” located around Singapore, finding a Bank of China ATM is difficult when needed.

This is one inconvenience you must deal with when using the BOC SmartSaver.

How To Earn Bonus Interest With the BOC SmartSaver Saving Account?

If you’re earning a high income, BOC Smart Saver is a good choice, as you don’t need to jump through too many hoops to qualify for the additional interest.

Here’s how much interest you can get based on the criteria we set out:

| Category (fulfilled monthly) | Interest Rate (p.a) |

|---|---|

| Base Interest Rate ($10,000) | 0.15% |

| Monthly Salary Crediting ($2,000) | 2.50% |

| Card Spend ($500 a month) | 0.50% |

| Payment (3 bills of at least $30 each) | 0.90% |

| Total Interest | 4.05% |

CIMB Savings Account: CIMB FastSaver Account

Next, we have the CIMB FastSaver account, which has increased interest frequently in recent months.

CIMB FastSaver stands out from the crowd with the highest base interest rate with up to 3.30% from now till 28 Feburary 2025 depending on your amounts. You can get up to a total of 5.20% p.a.** in interest!

CIMB FastSaver Savings Account Interest Rates

| Account Balance | Prevailing Interest Rate (p.a.)* | Bonus Interest Rate (p.a.)** | Total Interest Rate (p.a.)** | Additional Interest Rate (p.a.)^ when you credit your salary or schedule a recurring transfer (Standing Instruction via GIRO) of min. S$1,000 |

Additional Interest Rate (p.a.)^^

when you spend on your CIMB Visa Signature Credit Card |

|---|---|---|---|---|---|

| First S$25,000 | 1.19% | 2.01% | 3.20% | 0.50%^ | (a)1.00%^^ (with min S$300 monthly eligible spend)

(b)1.50%^^ (with min S$800 monthly eligible spend) |

| Next S$25,000 | 2.19% | 1.01% | – | ||

| Next S$25,000 | 3.30% | 0.00% | 3.30% | – | |

| Above S$75,000 | 0.80% | 2.40% | 3.20% | – |

According to CIMB, to qualify for this promotion you will need to open your account from 1 to 31 December 2024 and deposit and maintain a minimum of S$5,000 in fresh funds#.

Which Bank Has No Minimum Balance in Singapore?

One cool thing about CIMB FastSaver is that it is one of the few accounts with no minimum monthly balance requirement. There is no fall below fees either.

- Minimum Initial deposit: $1,000

- Minimum monthly balance: $0 (but you must maintain a monthly daily average balance of at least $1,000 to get the interest!)

- Monthly fall below fee: N.A.

- Early account closure fee (within six months): $50

- Bonus interest cap: N.A.

How to Maximise CIMB FastSaver Savings Accounts Interest Earned Based on the Above Criteria

The best thing about CIMB FastSaver is that it is a pretty straightforward savings account.

- Has a minimum account balance of $10,000 to enjoy bonus interests and avoid the fall below fees

- Has at least $2,000 in salary credited into the savings account after CPF contributions

- Spends a minimum of $500 a month via Paylah!, debit or credit cards on daily expenses (e.g. transport and food)

- Pays at least three bills (home loan, insurance & telco).

With the criteria we set out, you will get 4.70% p.a. on the first $25,000 in your CIMB FastSaver account from now till 25 February 2024.

DBS Savings Account: DBS Multiplier Account

Next, we have Singapore’s biggest bank, DBS and the DBS Multiplier account.

For some context, Post Office Savings Bank (POSB) now operates as part of DBS.

What is POSB Savings Interest Rate?

If you are still hanging on to your Post Office Savings Bank (POSB) My Account for Kids, you might have outgrown it and the paltry 0.05% interest it offers.

Since POSB is now a part of DBS, you can convert your My Account to a DBS Multiplier Account to earn higher interest – up to 4.10% p.a.!

DBS Multiplier Savings Account Interest Rates: Best Salary Crediting Account?

Suppose you’re currently using the DBS Multiplier account. In that case, you’ll be glad to know that the savings account went through some changes to make earning interest easier, and you can even earn bonus interest without having an income!

You can earn up to 4.10% p.a. from the previous 3.50% p.a. on the first $50,000 – $100,000.

You can earn bonus interest on Multiplier Account balances this way:

- Credit your income;

- Transact in one or more categories (credit card/ Paylah! retail spend, home loan instalment, insurance, investments); and

- Spend at least S$500 per month

| Income + one category | Income + two categories | Income + three or more categories | |

| Total eligible transactions per month | First $50,000 balance | First $100,000 balance | First $100,000 balance |

| $500 or more to below $15,000 | 1.80% p.a. | 2.10% p.a. | 2.40% p.a. |

| $15,000 or more to below $30,000 | 1.90% p.a. | 2.20% p.a. | 2.50% p.a. |

| $30,000 or more | 2.20% p.a. | 3.00% p.a. | 4.10% p.a. |

If you’re thinking you can’t pay bills, this is one of the few Savings Accounts that allows you to pay bills and earn interest because eligible PayLah! transactions include:

- Payments to merchants through PayLah! in-app checkout, web checkout, express checkout

- Scan & Pay transactions

- Payments to billing organisations

- Donations to charitable organisations

Option 1 (Working Adult 30 Years Old And Above):

- Salary Credit: Credit your salary into your DBS/POSB SGD-denominated account via GIRO/FAST/PayNow with transaction code “SAL”/“PAY” or transaction description “SALARY”/“PAYROLL”/“COMMISSION”/“BONUS”

- Dividends Credit: Credit your dividends into your DBS/POSB account, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) account or CPF Investment Account (CPFIA) with transaction code “CDP”/“NDIV” or transaction description “DIVIDEND”

- Eligible dividends include:

- Central Depository Pte Ltd (CDP)

- DBS Vickers Securities, DBS Online Equity Trading (OET)

- DBS Unit Trusts

- DBS Online Funds Investing

- DBS Invest-Saver. OR

- Eligible dividends include:

- Annuities Credit: Credit your CPF payouts or SRS withdrawals via GIRO/FAST/PayNow with transaction code “CPF”/“SRS” or transaction description “CPF”/“SRS” into your DBS/POSB account.

In addition to how many and how much transactions you make in the following categories:

- Credit Card Spend / PayLah! Retail Spend

- Home Loan Instalments

- Insurance (only for the first 12 consecutive months)

- Investments (only for the first 12 consecutive months).

| Total Eligible Transactions Per Month | Income + 1 category | Income + 2 categories | Income + ≥ 3 categories |

|---|---|---|---|

| First $50,000 balance | First $100,000 balance | First $100,000 balance | |

| ≥ $500 to < $15,000 | 1.80% p.a. | 2.10% p.a. | 2.40% p.a. |

| ≥ $15,000 to < $30,000 | 1.90% p.a. | 2.20% p.a. | 2.50% p.a. |

| ≥ $30,000 | 2.20% p.a. | 3.00% p.a. | 4.10% p.a. |

Based on the criteria we set out above, your eligible transaction will earn you about 1.80% interest.

The trick for Option 1 is to transact in more categories, and the higher the amount you transact in, the more interest you’ll earn.

Option 2 (Aged 29 and Below & No Income)

Previously, for those 29 and below, you could only earn up to 0.40% for PayLah! Retail Spends AND you’re required to credit your salary or have dividends credit or have connected DBS NAV Planer with SGFinDex.

You can now earn up to 1.50% of the first $50,000 balance with no minimum spend required for Credit Card/PayLah Retail Spend!

So, even though you’re not crediting your salary to the DBS Multiplier account, as long as you make eligible transactions, you can still earn the bonus interest.

Imagine this: You’re a 21-year-old tertiary student with no income, and you spend about $100 per month using PayLah!, you will qualify for the 1.50% p.a. for the first $50,000.

If you’re doing an internship or part-time work and credit your salary into the DBS Multiplier Account, the interest rate you’ll be earning will be increased from 1.50% to 1.80%.

Option 3 (Retirees)

For those who’ve retired, you might receive CPF Life monthly payouts through DBS, and you’re transacting through PayLah!

If you’re receiving a $700 monthly payout and making $200 PayLah! transactions every month, your total eligible transaction would be $900. This qualifies you for the 1.80% p.a. interest rate for your account’s first $50,000 cap.

And, if you would like to earn a higher interest rate, all you need to do is to transact in more categories.

Things To Note About the DBS Multiplier Account

The interest is credited into your DBS Multiplier Account in 2 parts:

- Base interest: Credited on the last calendar day of the month

- Bonus interest (if any): Credited by the 7th working day of the following month

This overhaul of the DBS Multiplier Account is suitable for all ages, especially those who are entering their first job or retiring.

Also, here are more details about the DBS Multiplier savings account:

- Minimum initial deposit: $0

- Minimum monthly balance: $3,000

- Fall below fee: $5 (if monthly average daily balance falls below $3,000, waived if you are 29 years old and younger or if this is your first account with DBS/POSB (online applications only)

- Early account closure fee (within six months): $30

- Bonus interest cap: $100,000

DBS Multiplier Account Calculator

For those who would want to calculate how much interest you’ll be getting, use this automated calculator.

Hong Leong Bank Savings Account: Singapore Dollar iSavings Account

You can earn interest rates of up to 3.28% p.a. with Hong Leong Bank’s iSavings account.

Hong Leong Bank iSavings Account Interest Rates

Here are the latest interest rates of the Hong Leong Bank iSavings account:

| Daily Balance | Prevailing Rates (p.a.) | Bonus Rates* (p.a.) | Promotional Rates* (p.a.) |

|---|---|---|---|

| First $20,000 | 0.08% | - | 0.08% |

| Next $30,000 | 0.08% | 0.80% | 0.88% |

| Next $50,000 | 0.08% | 1.20% | 1.28% |

| Next $50,000 | 0.08% | 1.80% | 1.88% |

| Next $50,000 | 0.08% | 3.20% | 3.28% |

| Above $200,000 | 0.08% | 1.80% | 1.88% |

*These interest rates . There will be no passbook given for an iSavings account. HL Bank reserves the right to change, vary or revise these interest rates from time to time at its own absolute discretion.

In addition, here are some important details about the Hong Leong Bank iSavings Account:

- Minimum initial deposit: $0

- Minimum monthly balance: $5,000

- Fall below fee: $5 (if monthly average daily balance falls below $5,000)

- Early account closure fee (within six months): $30

- Bonus interest cap: $1,000,000

How to Earn Bonus Interest With the Hong Leong Bank iSavings Account Based on the Above Criteria

The good thing about Hong Leong’s iSavings Account is that earning interest is pretty simple.

With our criteria, we will be getting 0.08% p.a.

Maybank Savings Account: Maybank SaveUp Account

Maybank SaveUp Interest Rate

You may earn up to 4.00% p.a. on the first $75,000 with the Maybank SaveUp account. Here is a breakdown of the account’s interest rates:

| Plus Base interest up to 0.25% p.a. | ||||

|---|---|---|---|---|

| Bonus interest | Take up 1 product | Take up 2 products | Take up 3 products | Take up 4 products |

| Save Up Programme (For retail customers) | ||||

| First $50,000 | 0.30% p.a. | 1.00% p.a. | 2.75% p.a. | - |

| Next $25,000 | 1.00% p.a. | 1.50% p.a. | 3.75% p.a. | - |

| Maximum Effective Interest Rate on First $75,000 | 0.53% p.a | 1.17% p.a. | 3.08% p.a. | - |

Additionally, here are more details about the Maybank SaveUp account:

- Minimum initial deposit:

- $500 (Singaporeans/Permanent Residents)

- $1,000 (Foreigners)

- Minimum monthly balance: $1,000

- Monthly fall-below fee: $2 (if monthly average daily balance falls below $1,000 + waived for customers aged 25 and under)

- Early account closure fee (within six months): $30

- Bonus interest cap: $50,000

How to Maximise Maybank SaveUp Interest Earned Based on the Above Criteria

The Maybank Save Up programme lets you choose from nine different products and services to get the bonus interest:

| Qualifying Products | Minimum Transaction Amount | Bonus interest period (Months) | |

|---|---|---|---|

| Save | GIRO Payment* (To other billing organisations) AND/OR Salary Crediting* (Via GIRO or Maybank Payroll) | $300 monthly (GIRO) AND/OR $2,000 monthly (Salary) | 1 month |

| Spend | Card (Transact with Maybank Platinum Visa Card and/or Horizon Visa Signature Card) | $500 monthly | 1 month |

| Invest | Structured Deposits | $30,000 | 3 months |

| Unit Trusts | $25,000 cash investments | 12 months | |

| Insure | Etiqa Life Insurance | $5,000 in annual premium | 12 months |

| Borrow | Home Loan (excludes Equity Loan) | $200,000 | 12 months |

| Car Loan | $35,000 | ||

| Renovation Loan | $10,000 | ||

| Education Loan | $10,000 |

*If you meet the minimum salary credit amount and/or the minimum aggregate GIRO debit amount stated in the table above, it will be considered one Qualifying Product.

Note: looking at the number of loans available, it seems like Maybank Save Up would be ideal if you plan to take a loan.

To optimise your interest rate, you’ll basically want to fulfil at least three products and services to clock the maximum bonus interest of 3.08% p.a.

If we stick with the criteria we set out (credit $2,000 and spend $500) — meaning you only fulfil two products or services — you’ll get at least 1.00% to 1.50% p.a. depending on your account balance.

How to Maximise Maybank SaveUp Interest Earned Based on the Above Criteria

You will want to fulfil at least three products and services to clock the maximum bonus interest of 3.08% p.a. on the first $75,000 in your account.

If we stick with the criteria we set out (credit $2,000 and spend $500), i.e. you only fulfil two products or services — you’ll get at least 1.00% on the first $10,000 in your account.

OCBC Savings Account: OCBC 360 Account

Next up, we have the OCBC 360 account.

You can earn an effective interest rate of up to 4.65% p.a. on the first $100,000 in your account.

Also, you can earn an additional 3.00% p.a. when you buy insurance or investment products with the bank, to a maximum interest rate of up to 7.65% p.a.!

OCBC 360 Savings Account Interest Rates

Here are the latest bonus interest rates of the OCBC 360 Savings Account:

| Account Balance | Salary (Monthly Salary Credit of at Least $1,800 Through GIRO) | Save (Increase Your Average Daily Balance by at Least $500 Monthly) | Spend (Charge at least $500 to your OCBC 365 Credit Card each month) | Insure (Purchase an Eligible Insurance Product From OCBC) | Invest (Purchase an Eligible Investment Product From OCBC) | Grow (Maintain an Average Daily Balance of at Least $200,000) |

|---|---|---|---|---|---|---|

| First $75,000 | 2.00% | 1.20% | 0.60% | 1.20% | 1.20% | 2.40% |

| Next $25,000 | 4.00% | 2.40% | 2.40% | 2.40% | ||

| Effective Interest Rate* | 2.50% | 1.50% | 0.60% | 1.50% | 1.50% | 2.40% |

*For maximum EIR illustration purposes for your first S$100,000:

Salary + Save: You will earn a maximum EIR of 4.50% a year.

Salary + Save + Spend: You will earn a maximum EIR of 4.65% a year.

Salary + Save + Spend + Insure / Invest: You will earn a maximum EIR of 6.15% a year.

Salary + Save + Spend + Insure + Invest: You will earn a maximum EIR of 7.65% a year.

Note: You will earn a base interest of 0.05% p.a. on your entire account balance regardless of whether you fulfil the above categories.

Tips on Maximising OCBC 360 Account Interest Rates

The simplest way besides salary crediting and saving is to optimise your spending using a credit card.

All you need to do is spend a minimum of $500 on your OCBC 365, OCBC 90°N, OCBC Titanium Rewards or OCBC NXT Credit Card.

Not to forget, here are some important details about the OCBC 360 account.

- Minimum initial deposit: $1,000

- Minimum monthly balance: $3,000 (fall below fee waived for the first year)

- Fall below fee: $2 (if the monthly average daily balance falls below $3,000 + the fall below fee is waived for the first year)

- Early account closure fee (within six months): $30

- Bonus interest cap: $100,000

How to Earn Bonus Interest With the OCBC 360 Account Based on the Above Criteria

If you don’t like reading the terms and conditions, here’s our suggestion on how to maximise your OCBC 360 Saving Account’s interest rate.

The criterion to hit the OCBC 360 Grow Bonus interest rate is probably out of reach for most of us.

Like seriously, who has $200,000 lying around in the bank?!

Instead, you’ll want to fulfil as many other categories as you can:

- Credit your monthly salary (Min. $1,800) through GIRO to earn the Salary Bonus

- Increase your bank balance by at least $500 a month to earn the Save Bonus

- Spend at least $500 on your OCBC 365 Credit Card each month to earn the Spend Bonus

- Buy unit trusts or endowment insurance plans from OCBC to build your retirement portfolio and earn the Insure Bonus or Invest Bonus.

Even if you’re unsure about buying insurance or investment products from OCBC and may not be able to increase your bank balance by $500 per month, here’s how much interest you can earn based on the criteria set out:

| Condition (Fulfilled Monthly) | Interest Rate |

|---|---|

| Base Interest | 0.05% p.a. |

| Bonus: Salary Bonus (Credit your salary of at least $1,800 through GIRO) | 2.00% p.a. |

| Bonus: Spend Bonus (spend at least $500 on OCBC credit cards) | 0.60% p.a. |

| Total Interest | 2.65% p.a. |

RHB Savings Account: High Yield Savings Plus Account

Sick of jumping through hoops to get more interest? Check out RHB’s High Yield Savings Plus account!

RHB High Yield Savings Plus Account Interest Rates

| Deposit Balance Amount | Interest Rates (p.a.) |

|---|---|

| First $50,000 | 1.50% |

| Next $25,000 | 1.60% |

| Next $25,000 | 1.80% |

| Above $100,000 | 2.00% |

- Minimum initial deposit: $0

- Minimum daily balance: $0

- Monthly fall below fee: $0

- Early account closure fee: $30 only if an account is closed within 6 months of opening

- Bonus interest cap: N.A.

How to Earn Bonus Interest With the High Yield Savings Plus Account Based on the Above Criteria

This is another straightforward account that lets us earn a decent 1.50% p.a. on our $10,000 deposit. The best part is that there are absolutely zero hoops to jump through!

The Sing Investments & Finance (SIF) GoSavers account is a premier savings account offered by Sing Investments & Finance Limited and stands as the company’s flagship product. This institution is not only licensed but also under the regulatory oversight of the Monetary Authority of Singapore (MAS), signifying its compliance with local financial standards.

Sing Investments & Finance Limited was established in Singapore on 13 November 1964 and was listed on the Singapore Stock Exchange (SGX) in 1983.

In addition to the GoSavers Account, the company provides a suite of financial solutions that encompass fixed deposits, various loan options for individuals (including home, HDB, and car loans), and financing services for corporate and SME clients (covering commercial property loans, machinery loans, and more).

Pioneering in the Singaporean finance industry, SIF introduced a set of mobile and business applications, offering a spectrum of E-services. These services facilitate straightforward personal account openings through MyInfo, FAST transfer capabilities, and the convenience of placing fixed deposits online.

The SIF GoSavers Account is designed as a straightforward savings account, rewarding savers with interest rates up to 3.50% p.a. It structures its interest tiers as follows:

Account Details

- Minimum initial deposit: $0

- Minimum average daily balance: $1,000

- Monthly fall below fee: $2

- Early account closure fee: $0

- Bonus interest cap: N.A.

How to Earn Bonus Interest With the SIF GoSavers Account Based on the Above Criteria

This straightforward account lets us earn a decent 2.60% p.a. on our $10,000 deposit. The best part is that there are absolutely zero hoops to jump through! The only thing that you have to take note of is the fall-below fee of $2 if your average daily balance falls below $1,000.

Standard Chartered Savings Account for Youth: JumpStart Savings Account – Best Savings Account Singapore Without Salary Credit

If you are a young working adult looking to jumpstart your personal finance journey, there’s no better savings account than the Standard Chartered (SCB) JumpStart account.

Emphasis on the word young as you need to be between 18 and 26 years old to qualify for a JumpStart account.

Rest assured that once you open a JumpStart account, you can keep it and enjoy the prevailing interest on your balance after you turn 26 years old.

Standard Chartered JumpStart Account Interest Rate

As for interest, you will get to enjoy:

- 2.00% p.a. interest on your account balances of up to $50,000

- 0.50% p.a. step-up interest on account balances of up to $50,000 when you perform one of the actions*

- 0.10% p.a. interest on your incremental balances above $50,000

*at least ONE buy or equity transaction on the Standard Chartered Online Trading platform OR Online Unit Trust platform OR from any Bank Branch in a calendar month

That’s not all.

You will get 1% cashback on eligible purchases with the SCB Cashback Debit Card (Mastercard) linked to your JumpStart account. Note that monthly cashback is capped at $60 per JumpStart account.

There is also no lock-in, minimum spend requirement, salary crediting requirement for the account or annual fees for the linked Cashback debit card.

Standard Chartered JumpStart Account Details

- Minimum initial deposit: $0

- Minimum daily balance: $0

- Monthly fall below fee: $0

- Early account closure fee (within six months): $0

- Bonus interest cap: $50,000.

How to Earn Bonus Interest With the JumpStart Account Based on the Above Criteria

The best part about this card is that you do not have to perform any actions to enjoy the 2.00% on the first $50,000 in your JumpStart account.

But, if you would like to get the bonus 0.50% interest, you will have to make a monthly investment with SCB.

Standard Chartered Savings Account: Standard Chartered (SCB) Bonus$aver Account

Bonus$aver comprises a Bonus$aver account (a Current Account) and Bonus$aver World MasterCard credit and/or debit card(s), which may be linked to the Bonus$aver account.

Standard Chartered Bonus$aver Account Interest Rates

You can earn up to 7.68% p.a. interest on your savings for the first $100,000 in your Bonus$aver account when you do any of the following:

- Credit your salary through GIRO

- Pay at least three bills online/through GIRO

- Spend on your Bonus$aver Credit or Debit Card

- Invest with a Unit Trust with a minimum subscription of S$30,000

- Insure with a regular premium insurance policy with a minimum annual premium of S$12,000.

| Bonus Interest Categories For First $100,000 | Interest Rate |

|---|---|

| Monthly Salary Credit (≥$3,000) | 2.00% |

| Monthly Card Spend | 0.65% ($500 - $1,999 a month) |

| 1.45% (>$2,000 a month) | |

| Bill Payments (Make Min. 3 Eligible Bill Payments of $50 Each) | 0.23% |

| Invest (Invest in Eligible Products with a minimum subscription of S$30,000) | 2.00% for 12 months |

| Insure (Buy Eligible Insurance Products with a minimum annual premium of S$12,000) | 2.00% for 12 months |

Note: Prevailing interest rate is 0.05%.

- Minimum initial deposit: $0

- Minimum daily balance: $3,000

- Monthly fall below fee: $5 (if the monthly average daily balance falls below $3,000)

- Early account closure fee (within six months): $30

- Bonus interest cap: $100,000

Note: you’ll have to maintain a minimum daily balance of $3,000 in your account to avoid getting charged a fall-below fee of $5 per calendar month.

How to Maximise SCB Bonus$aver Interest Earned?

The Standard Chartered BonusSaver account is excellent because it gives you extra interest if you spend more via a Standard Chartered debit or credit card.

Based on our criteria, you’re crediting your salary, spending $500 with your credit card and making three bill payments – you’ll only earn 0.88% p.a.!

To maximise the account, you need a monthly salary credit of $3,000 and above for a 2.00% bump in the bonus interest rates for an interest rate of 2.88% p.a.!

Or you could clock the ‘Invest’ or ‘Insure’ category to really see a boost in your bonus interest rate.

UOB Savings Account: UOB One Account

UOB One Savings Accounts Interest Rates

The UOB One Savings account allows you to earn up to 6.00% p.a..

Realistically, it’s about 3.00% when you have a monthly average balance of $30,000, and this is if you:

- Spend a minimum of $500 on an eligible UOB card* a month and credit your salary AND

- Credit your salary of minimally $1,600 OR make three GIRO payments** (Only salary credit transactions made via GIRO/PayNow that are reflected as “SALA”/”PAYNOW SALA” per calendar month. Any other forms of salary credit will not qualify).

*Eligible UOB Credit and Debit Cards: UOB One Card, UOB Lady’s Card (all card types), UOB EVOL Card, UOB One Debit Visa Card, UOB One Debit Mastercard, UOB Lady’s Debit Card and UOB Mighty FX Debit Card.

**GIRO arrangements for Mortgage loans and Car loans do not count towards the eligible GIRO transactions for bonus interest.

Is it time to change? These are the current interest rates:

| Account Monthly Average Balance (MAB) | Spend min. S$500 (per calendar month) on eligible UOB Card | Spend min. S$500 (per calendar month) on eligible UOB Card AND make 3 GIRO debit transactions | Spend min. S$500 on eligible UOB Card AND credit your salary via GIRO |

| First S$75,000 | 0.65% | 2.00% | 3.00% |

| Next S$50,000 | 0.05% | 3.00% | 4.50% |

| Next S$25,000 | 0.05% | 0.05% | 6.00% |

| Above S$150,000 | 0.05% | 0.05% | 0.05% |

- Initial deposit: $1,000

- Minimum monthly balance: $1,000

- Fall below fee: $5 if the monthly average daily balance is less than $1,000 (Waived for the first six months for accounts opened online)

- Early account closure fee (within six months): $30

- Bonus interest cap: $100,000

Things To Note About The UOB One Savings Account

To maximize the UOB One savings account, you must have an account balance of $150,000 and fulfil the two conditions stated above.

If your savings exceed $100,000, the updated interest rate system of the UOB One Account should benefit you. With the raised bonus interest cap, you’ll now accrue bonus interest on your initial $150,000 rather than just the first $100,000.

With these changes, you can now earn up to $6,000 total interest in a year for deposits of $150,000 when you spend a minimum of $500 on eligible UOB Cards and credit your salary (minimum S$1,600) via GIRO/PAYNOW each calendar month. This is calculated based on the Effective Interest Rate (EIR) of 4.00%.

Comparatively, for now, based on the EIR of 5.00% p.a. for deposits of S$100,000, you can earn up to $5,000 and essentially lower before the change, and hence it will be more worth it to earn bonus interest on your first $150,000.

But this may be prohibitive for most who don’t want to leave so much in their bank accounts.

How Can I Maximise the UOB One Account Interest Rate Based on the Above Criteria?

If you want a savings account with a decent interest rate.

And don’t want to crack your head over complicated T&Cs…

Then, the UOB One is your best bet because you only need to make sure that you spend $500 a month on your UOB debit or credit cards.

The option to pay three bills by GIRO instead of making a monthly salary credit (min. $1,600) means that this is also ideal for those without a steady paycheck (think freelancers and stay-at-home moms).

Based on this alternative criteria we set out, you’ll earn bonus interest of 2.00% p.a. from the UOB One account as you are only spending at least $500 per calendar month on an eligible UOB card AND paying three bills via GIRO.

Alternatives: Best Online Savings Accounts (Digital Bank) & Low-risk Investments

If you don’t mind not having a physical branch to go to or ATMs to withdraw cash, digital banks with their typically higher interest accounts and a few hoops to jump through could be your preferred option.

These accounts usually have perks such as no minimum balance and interest that accrues daily!

Which Bank Is Best for Savings for Fresh Graduates?

If you’ve just graduated or started working, you probably still have your DBS or POSB savings account from when you were a kid.

Don’t leave it as a kid’s savings account and earn the meagre 0.05% p.a. interest when you can put your money in high interest savings accounts instead. If you’re too lazy to switch banks, you can at least change to the DBS Multiplier.

The application can be made online and will only take a few minutes.

However, sticking with DBS also brings about certain disadvantages, such as:

- You have to apply for a DBS credit card AND spend a minimum sum on it

- You will usually have to wait a while when withdrawing money as the queue for DBS or POSB ATMs is generally the longest (since almost everyone’s using them)

Best Savings Rates: Which Bank Has The Highest Interest Rate in Singapore?

While interest rates have consolidated, some banks have done the same.

Oh, before you switch your bank accounts.

Check with your company’s HR manager to see if your monthly salary GIRO credit is credited using the correct transaction code stated by the bank.

This is extremely important because most savings accounts require you to credit your salary to get the bonus interest!

You should also note that ATMs for foreign banks like the Bank of China and Standard Chartered are usually limited.

This means that cash withdrawals are a little more tricky, although this might help you save more since you can’t withdraw your money that easily.

Some Seedly Community members have also decided to switch to other banks. Lastly, go through our Seedly Reviews for the various savings accounts and pay attention to our community’s feedback concerning customer service and how easy it is to use their iBanking and mobile banking apps.

Is It Better To Have a Savings Account With High Interest Rate or Invest?

If you would like to beat inflation, you can consider investing.

But before you start investing, be sure to get your house in order!

You can consider these low-risk investments:

- This Month’s Singapore Savings Bonds (SSB): Interest Rates & How To Buy

- Best Fixed Deposit Rates Singapore: UOB, OCBC, DBS, Maybank & More

- Latest T-Bills Singapore Guide: Rates, Auction Dates How to Buy & More

But remember to do your due diligence before parking your savings anywhere!

Related Articles

- Best Fuss-Free Savings Accounts With No Conditions in Singapore

- Best Savings Accounts for Kids: Best Places to Grow Your Child’s Money

- Best Saving Accounts For Students

- Ultimate Cash Management Accounts Comparison

- Still, Holding Onto Your First Savings Account? Here’s Why You Should Change It

- Which Child Development Account (CDA) Should You Open for Your Child?

- Working Adults: Which Savings, Expenses And Investment Accounts Should I Start With?

Advertisement