Welcome to adulthood.

This is probably a scary time as your responsibilities are suddenly WAAAAAY larger, and it’s even more important that your personal finances are sorted out because you’re:

- Probably married (or are planning to)

- Buying your first home

- Thinking of retirement (whether it’s yours or for your ageing parents’)

- Paying for bills like utilities and your car

- Getting stuff like insurance and paying more attention to healthcare

Amongst other boring adult stuff that never used to be your problem.

Man… School days seem so much better now huh?

But hey, fret not.

That’s why Seedly‘s here to help!

If you’re ever feeling lost, we gotchu bruv.

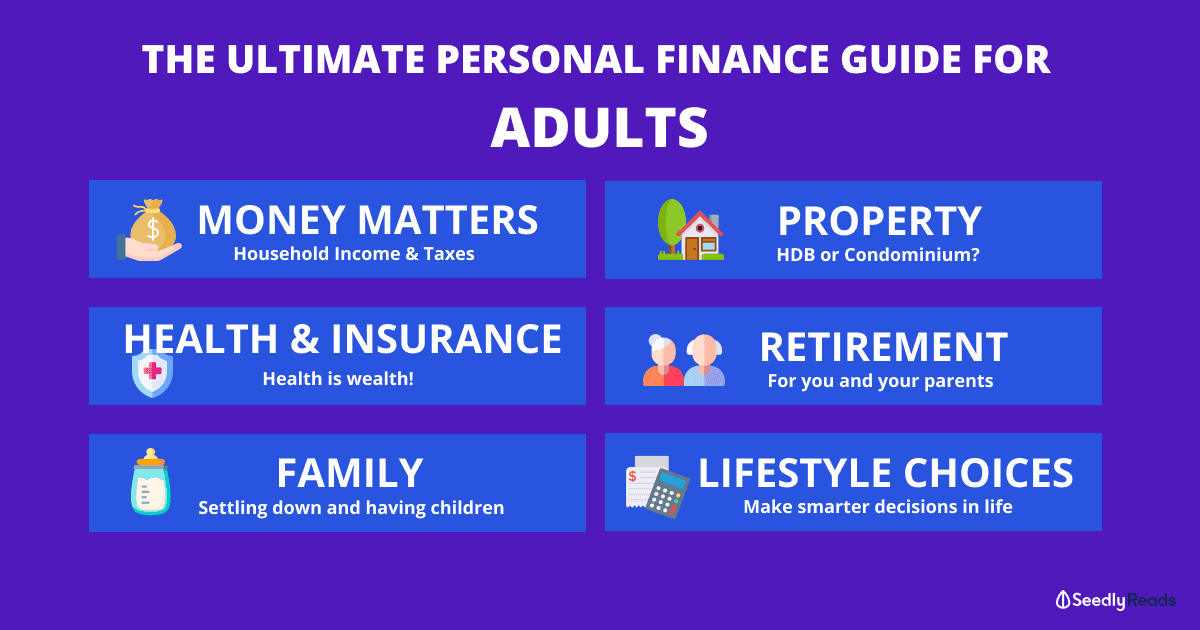

Your Personal Guide To Adulthood

Here’s a checklist of all things personal finance in your 30s to 40s:

Money Matters

If you need a refresher or are just hearing about personal finance for the first time… Don’t worry. It’s never too late to start planning and saving for your future.

First, start with the Seedly Money Framework:

Or if you’re a more visual kind of person, check out our Seedly TV Episode 1 for a Beginner’s Guide To Personal Finance instead:

You’re also probably earning a steady paycheque, but the theory behind allocating your monthly salary still remains the same as when you just got your first job.

And since you’ve already been working for a while, you’ll also want to take note of:

- The Average Singaporean Household Income: Where Do You Stand?

- Full List of Paternity and Maternity Leaves You Are Entitled To (Incl. Adoption Leave)

- Know Your Rights! Employee Benefits: Off-in-lieu, Paid Leaves, Overtime Pay

- Long Weekends In 2021: Disappear From Work For 38 Days

Oh, and since you’re paying taxes, these will come in handy:

- Your Cheat Sheet: Personal Income Tax In Singapore

- Migrating Out Of Singapore Because You Think The Income Tax Is Too High? Think Again

Healthcare & Insurance

Taking care of your health is a means of taking care of your wealth.

Think about it.

If you eat poorly and don’t take care of your body, your health will suffer. And that probably means more visits to the doctor or for the really serious cases (knocking on wood) hospitalisation and treatments that could cost you more in the long run.

You may have been able to survive on instant noodles in your twenties, but if you stick to a diet like that in your 30s going 40, your body’s not going to forgive you (or your bank account) for that.

Healthcare

- The True Cost Of Healthcare In Singapore That Every Singaporean Should Be Aware Of

- Singaporean’s Guide To Cost Of Hospitalisation Treatment: Which Hospital Is The Cheapest?

- The Ultimate Guide To HPV Vaccines Singapore For Both Male and Females Against Cancer

- Can You Afford Cancer Treatment? An Insight On The True Cost Of Cancer Treatment In Singapore

Here are some government initiatives that you should be aware of.

- Dependants’ Protection Scheme (DPS): All You Need to Know About DPS In 5 Minutes

- The New CHAS: Not Just For Lower-Income Singaporeans Anymore

- Ultimate Singaporean’s Guide to CHAS Card Singapore

And if you haven’t gotten insurance or are looking to increase your coverage due to your dependants (eg. children, parents, spouse)

- An Ultimate Guide: Key Insurance Policies You Should Get In Singapore

- Direct Purchase Term Life Insurance Comparison: Which One’s Best for Me?

- Best Critical Illness Insurance Plans in Singapore

- The Ultimate Female Insurance Plans Comparison (With Free Health Checkup)

Settling Down And Starting A Family

Marriage

This is also probably the time when you’re planning to get married. And if you are, here’s a guide to help you figure out what the cost of a wedding will be.

If you’d like a breakdown of the various costs involved in a wedding:

- The Seedly Wedding Playbook: Your Ultimate Wedding Guide for a Sensible Wedding

- A Personal Story: Buying An Engagement Ring In Singapore

- How Much Can You Save If You Hold Your Wedding At A Kopitiam?

- Alternate Wedding Venues You Should Consider

- The Ultimate Compilation: 30 Actual Day Wedding Photography & Videography Rates

- The Ultimate Guide To Wedding Florist Rates

- The Ultimate Guide To Wedding Dress Boutique Rates: Designer, Bespoke & Rental

- Should You Get Wedding Insurance?

And if you’re not getting married, you’re probably attending weddings. So this Definitive Guide To Wedding Ang Bao Rates In Singapore should come in handy.

As A Couple

Open communication and sharing the same financial goals with your spouse is extremely important, especially if you’re planning to build a home together and have children:

- A Singaporean Couple’s Cheat Sheet For Saving Together (Guide Included)

- How I Almost Died Talking To My Wife About Money

- A Couple Can Save An Extra $120,000 By Just Following A Simple Budgeting Rule

- The Ultimate Couples’ Guide To Saving up for a Financially Stable Future

Planning For Children

Having children is a HUGE personal and financial responsibility.

Here’re a couple of resources that should help you plan ahead for that bouncing bundle(s) of joy!

- Ultimate Guide: Cost Of Giving Birth In Singapore And Baby Bonuses To Help You Save

- The Ultimate Guide: Baby Bonus in Singapore (Payout, Schedule, CDA)

- The Complete Guide: Best Children’s Savings Account (CDA)

- Parents and Parents-To-Be: Here’s How To Get Free Baby Product Samples To Try in Singapore

- Parenthood Hacks: How We Saved Close To S$8,000 in the First Year as Parents

For insurance:

- How Can You Fully Insure Your Child with Child Insurance?

- This Is For Your Newborn Baby: Should You Get Whole Life or Term Life?

For childcare and schooling:

- Ultimate Guide To Childcare: Your Options & How Much

- Infant Care in Singapore: The Ultimate Guide To School Fees, Locations, Subsidies and More

- Preschools in Singapore: Playgroup or Kindergarten Fees Can Cost You as Much as $2,000 per Month

Getting Your First Property

This is also probably the time when you’re planning or are getting your first property.

- A Singaporean’s Step-By-Step Guide: Applying For Your First HDB BTO

- My CPF Ordinary Account (OA) will not be wiped off when taking a HDB Loan, so what?

- Home Insurance 101: Lessons Learnt When My Wife Tried To Set Me On Fire

- A Complete Guide to CPF Housing Grants for BTO and Resale Flats

- The Seedly HDB Grant Guide: A Complete Guide To CPF Housing Grants for HDB BTO, HDB SBF, and Resale Flats

- Do You Get All Your Money From Your HDB Sales Proceeds For Your Retirement?

- Deciding Between Private Condominium vs Executive Condominium

- Should You Use Cash or CPF To Pay for Your Home?

Home Renovation

After getting your first property, you’ll want to carry out some renovations to create a place called home. Here’re a couple of tips for first-time home-owners.

- The First-Time Home Owner’s Guide To Home Renovation Loans

- Heavily Subsidised Renovation To Upgrade Your HDB With Housing Improvement Programme (HIP)

- The Ultimate List of Interior Designers To Avoid In Singapore

For Singles And Same-Sex Couples

Affordable housing is still very much in your reach, you just need to know what your options are.

Retirement

Planning For Your Retirement

It’s never too early to start planning for your retirement.

- How Much Singaporeans Need To Save Now To Retire At 55 Or 62 Years Old

- Age vs Risk Profile: What Investments Should You Be Holding At Your Age?

- A Typical Singaporean Financial Journey – Up To $430,425 Projected Expenses

- How Long Will I Take To Retire A Millionaire?

- How Much Do You Need To Save To Meet Your Basic Needs Upon Retirement?

- Net Worth: A Singaporean’s Most Important Number In Personal Finance

- Singaporean’s Guide to Supplementary Retirement Scheme (SRS): Tax Relief, Promotions, Investment Options etc.

And if you haven’t, it’s time to have the conversation with your parents in order to ensure that they’re properly taken care of in their silver years.

And as much as we hate to let go of our parents (or grandparents), we have to be prepared for the inevitable 🙁

- How Much Does It Cost To Hold A Funeral Service In Singapore?

- What Happens To Your CPF When You Pass Away?

Making Smarter Lifestyle Choices

Car

If you have a family, you’ll probably be thinking of getting a car. But did you know that you need to be earning at least S$7,500 first in order to afford a car like a financially responsible adult?

- Ultimate Comparison of Petrol Prices and Credit Card Promotions

- Ultimate Compilation: Car Parks With Free Parking In Singapore To Save On Parking Fees

- Ultimate Driver’s Guide To The Best Car Insurance In Singapore

- What Should You Do When You Get Into A Car Accident?

Or if you’re still single and would like to feel the wind in your hair (just kidding, please practice road safety and WEAR A HELMET).

Utilities

Yep. Water and electricity aren’t free. Learn how to set up your utilities with SP Group.

Or make full use of the Seedly Open Electricity Market Comparison Tool to figure out which electricity retailer plan is the best for you!

- The Ultimate Comparison: Which Electricity Retailer Is The Cheapest In Singapore?

- Hidden Fees And T&Cs To Take Note When Choosing An Electricity Retailer

- Best Credit Cards for Utilities Bills in Singapore

Maids And Domestic Helpers

- Singaporean’s Ultimate Guide: How Much Does It Cost To Hire A Maid/ Domestic Helper?

- A Singaporean’s Guide To Part-Time Maids: Are They Worth It?

Daily Necessities

Now that you’re the one who’s buying groceries and stocking up necessities, you’ll want to know how to maximise your savings as much as possible.

Advertisement