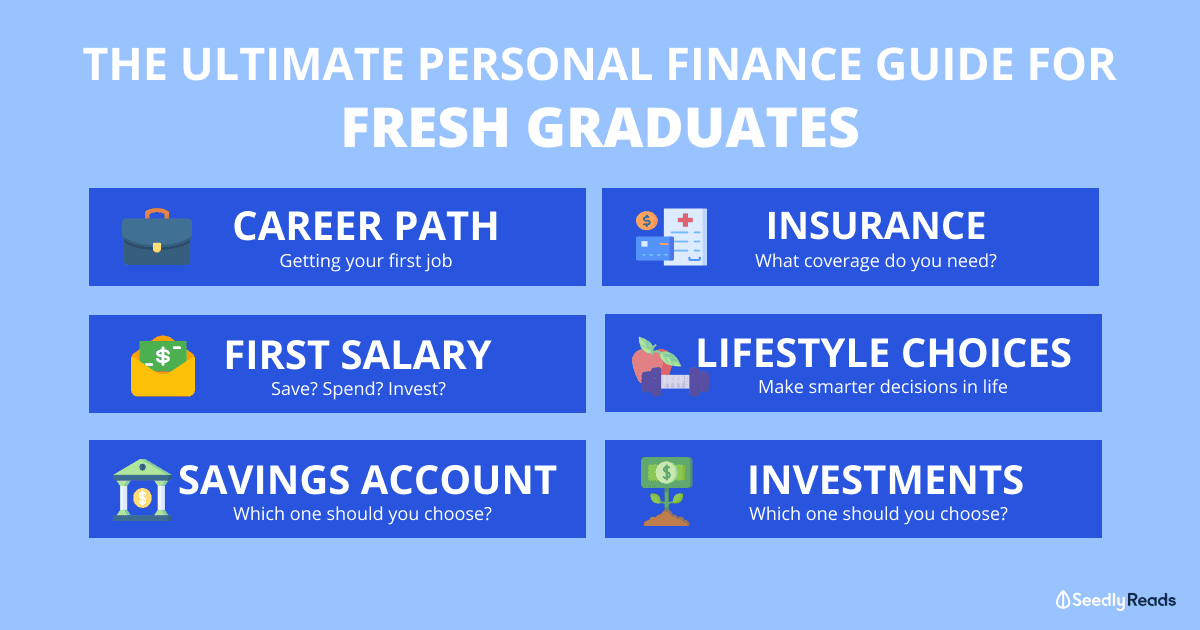

Fresh Graduates & First Jobbers: Your Ultimate Personal Finance Guide (24-30 Years Old)

Ruth Lum

Ruth Lum●

Most fresh graduates think their biggest worry upon graduating is finding a job.

Surprise surprise, it’s actually your PERSONAL FINANCE that you should pay most attention to.

Personal finance is everything to do with managing your money, saving and investing. It covers budgeting, banking, insurance, mortgages, investments, retirement planning, tax planning and estate planning.

The hard truth is: your finances are not going to manage themselves.

Snap out of the comforts of papa and mama’s allowance and kids’ savings account – it’s time to start making your own (smart) financial decisions.

We’ve curated these relevant articles onto one learning platform, guiding you through some of the more commonly asked questions relating to personal finance.

*Click me! Click me!*

*Click me! Click me!*

Beginning Your Career

Yeah, you’d probably know of kia-su friends who have since long secured a full-time job even before graduation. FRET NOT, it’s important to know what you want, what to expect, and where to look for the most appropriate job openings. Remember, best is subjective.

Looking for Jobs

You can hunt for jobs through job search websites or recruitment agencies.

Before that, you have to prepare necessary documents like:

- Resume or CV

- Certificates of your highest education qualifications

- Transcripts

Here are some tips on writing a good resume. In case you’re worried about the lack of relevant experience, we have a guide on how to potentially get a job with no prior experience

If your profile fits the company, the HR department might give you a call to schedule you for an interview.

Interviews can be nerve-wracking; it is alright to fumble every now and then, just get yourself used to the process and you’d be accustomed in no time!

Getting That Dough aka your salary

After securing your offers (congratulations btw), you might be wondering: am I getting paid right? What’s the average starting salary in Singapore? And what’s considered a good salary in Singapore?

Fret not, we did some checking, and here are our findings on Graduate Starting Salary in Singapore and an general Salary Guide for Singaporeans

It is also important to understand all your employee benefits, like overtime pay or off-in-lieu, before signing the contract.

Getting your first salary, what should you do?

Arguably, no other firsts holds a candle to attaining your first paycheck.

While each individual begins their first job at different stages, the theory behind allocating your monthly salary generally remains the same.

You might have other concerns like to treat yo self, or whether or not to portion out some allowance for your parents.

For those who just landed a job, it is important to start your personal finance foundation right. Hence, learning how to allocate your monthly salary is incredibly important. This will help you in your personal finance journey later on.

It is also helpful to leverage whatever tools available, like an *ahem* personal finance tracker, or comparison tools to help you choose.

Choosing The Best Savings Account

The most immediate thing to do upon getting your first pay cheque should be to open a savings account that gives you the best possible interest rate.

Unfortunately or fortunately (depending on your point of view), banks are constantly competing against one another. As a result, plans can end up with too many terms and conditions, ultimately confusing everyday Singaporeans.

Banks are also getting increasingly creative with their interest rates allocations which require you to fulfill certain criteria before you can accrue bonus interest rates.

Generally, there are 2 types of savings accounts – one allows you to earn higher interest rates with conditions, and another which allows you to earn by simply leaving a lump sum in the account.

How to find your ideal savings account:

- For youngins who are still students, here’s a compilation of the Best Savings Accounts For Student

- For those who prefer a simple “park it there” type of sayings account: Best Savings Accounts With No Condition

- And for the highest interest rates for savings accounts in Singapore: Best Savings Accounts In Singapore with high-interest rates

- Tool to use: Seedly has a Savings Account Calculator Tool to forecast the interest rates you can accumulate in your savings account

Choosing The Best Credit Cards

Whilst getting on the right savings account can help you earn extra interest on your savings, leveraging on credit cards can aid in generating considerably more savings!

I’m sure you’ve heard of the debate Cashback or Miles?

Depending on your lifestyle, there are multiple types of cards to choose from – Cashback, Miles, Rewards and Rebates.

Additionally, many savings accounts allow you to get bonuses interest rates when you spend on one of their credit cards.

Like the UOB ONE Account with the UOB One Card, or the DBS Multiplier Account with selected DBS Credit Cards.

These resources can help you choose the best credit cards:

- Which should you choose? Understanding Cashback vs Miles vs Rewards vs Rebates

- Cheat Sheet: Best Credit Cards For Students

- The Ultimate Cheatsheet: Best Cashback Credit Cards For Working Adult

- Best Credit Cards For Paying Insurance Premiums

- Best Credit Cards For Public Transport: Bus & MRT

- We’re here if you need help with the process of applying for debit or credit cards

- Real User Reviews On Credit Cards

Getting Your First Insurance

As convenient as it may seem, there isn’t a one-size-fits all solution to getting sufficient coverage for one’s self.

Therefore, understanding your needs and how much you would be willing to spend on coverage remains of utmost importance before signing for an insurance policy.

What type of insurance coverage should you be getting?

For adults, here are some important insurance policies to get covered for

This general Key Policies Insurance Guide could come in handy when looking to get your first insurance policy.

For health insurance

Health Insurance aims to cover hospitalisation and surgical bills, as well as certain outpatient treatments.

- Here’s a complete Beginner’s Guide To Health Insurance

- If you’re a Singaporean Citizen or PR, it will also be important to know about Integrated Shield Plans

For life insurance

Life insurance pays out a lump sum of money in the event of death.

- The Working Adult Guide: Term Life vs Whole Life Insurance. Which Should I Get?

- Understanding Life Insurance for Beginners

- Should You Cancel Your Aviva MINDEF/MHA Group Insurance After Your Ord?

For critical illness insurance

Critical illness coverage gives additional financial support for critical emergencies like heart attack, stroke or cancer.

- Compilation of the Best Critical Illness Insurance Plans in Singapore

Making Even Smarter Personal Financial Decisions On Lifestyle Choices

While it is important to invest, get insured and be on the best savings account and credit card plans, there is notably more to personal finance. Often times, adjusting our daily and monthly expenses could potentially contribute even more to our savings.

Here are some content to make better lifestyle choices:

- For movie-goers: Ultimate Movie Ticket Price Guide

- For cheaper electricity alternatives: The Ultimate Comparison: Electricity Retailer In Singapore

- For cheaper mobile plans: Which Singapore Telco Plan Is The Best For You: Data vs Price, alternatively, you can read real user reviews on mobile plans or use Seedly’s SIM-only comparison tool

- For food delivery promos and online grocery deals: Food & Grocery Delivery Guide

- For home fibre-broadband: Which Singapore Fibre Broadband Plan Is Best For You

- For video streaming services: The Best Video Streaming Subscription for 2020: Netflix vs Amazon vs Apple vs HBO vs Viu & More

- For music streaming services: Ultimate Music Streaming Services in Singapore Comparison (2021)

- For dating: Best Dating Apps in Singapore: Which Is The Cheapest of Them All?

Making Your First Investment

Ready to embark on your investment journey? Here’s a “Should-I-Invest” checklist for you.

This section aims to help Singaporeans get started on their investment journey by providing sufficient knowledge on investing.

Investing should never be a rash decision. One should get to know his financial health and his investing mindset such as risk preferences better. Here are some articles that you can start with!

- An Absolute Beginner’s Guide To Investing

- When Should I Begin Investing?

- Should I Pick Dividend or Growth Investing or Value Stocks?

- Should I Invest A Small Sum Regularly Or A Big Sum At One Go?

- Age vs Risk Profile: What Investments Should You Be Holding?

- Best Investments In Singapore That Caters To Every Risk Profile, For Short, Medium and Long-Term Investors

Now that you’re ready, it’s time to open a CDP account or get on a brokerage:

- CDP vs Custodian Account? Which Should I Use and Why?

- Step-by-step Guide: Opening A CDP and Stock Trading/ Brokerage Account In Singapore

- Ultimate Cheatsheet: Cheapest Stock Trading/ Brokerage House In Singapore

- Real User Reviews On Online Brokerage

Singapore Savings Bond:

- Guide To Investing and Buying Singapore Savings Bond (SSB)

- How Is The Interest Rate For Singapore Savings Bond (SSB) Determined?

Fund Investing:

Stocks Investing:

- A Singaporean’s Guide To Buying Stocks

- 4 Forces That Move A Stock Price

- 10 Stocks To Buy In The Next Market Crash

- Does A High P/E Ratio Mean That The Stock Market Is Overvalued?

Regular Savings Plan:

Kicking off with a Regular Savings Plan aids in cultivating a habit of investing. Plus, it sets aside a portion of your salary automatically, no doubt, helping some of you spendthrifts out there!

- Working Adults: Easiest Ways To Invest A Monthly Sum For Beginners

- What is Regular Shares Savings Plan?

- Which Regular Shares Savings (RSS) Plan Is The Cheapest? DBS vs FSMOne vs OCBC vs PhillipCapital

Exchange Traded Funds Investing:

- How To Choose The Right Exchange Traded Fund (ETF) To Invest In?

- STI ETF: A Simple Way To Invest In Singapore’s Top 30 Companies

Real Estate Investment Trusts (REITs) Investing:

If you’re looking to add REITs to your investment portfolio, here are some complimentary articles.

- Guide to REITs Investing In Singapore

- REIT Jargon 101: Commonly-Used Terms That REIT Investors Must Know

- Understanding REITs Better: What Makes Up a Typical REIT Structure?

- How To Choose The Right REITs To Invest In?

Alternative Investments: P2P Lending Platforms, Cryptocurrencies and Robo-Advisors

- P2P Lending Platforms Comparison

- Robo-Advisor Comparison

- Best Crypto Exchange 2021: Which Centralised Crypto Exchange Should You Use?

- Non-Fungible Tokens (NFT) Investing

- Investing In Luxury Watches

Tools To Help You Get Started On Your Investment Journey

Advertisement