Singapore Savings Bonds (SSB) Jan 2025 Guide: Latest Interest Rates and How to Apply

SSB SG Explained: Singapore Saving Bonds Interest Rate and More

The Singapore Savings Bonds (SSB) is one of the more common options for Singaporeans to invest their money and one of the easier ways for risk-averse investors to fight inflation in Singapore.

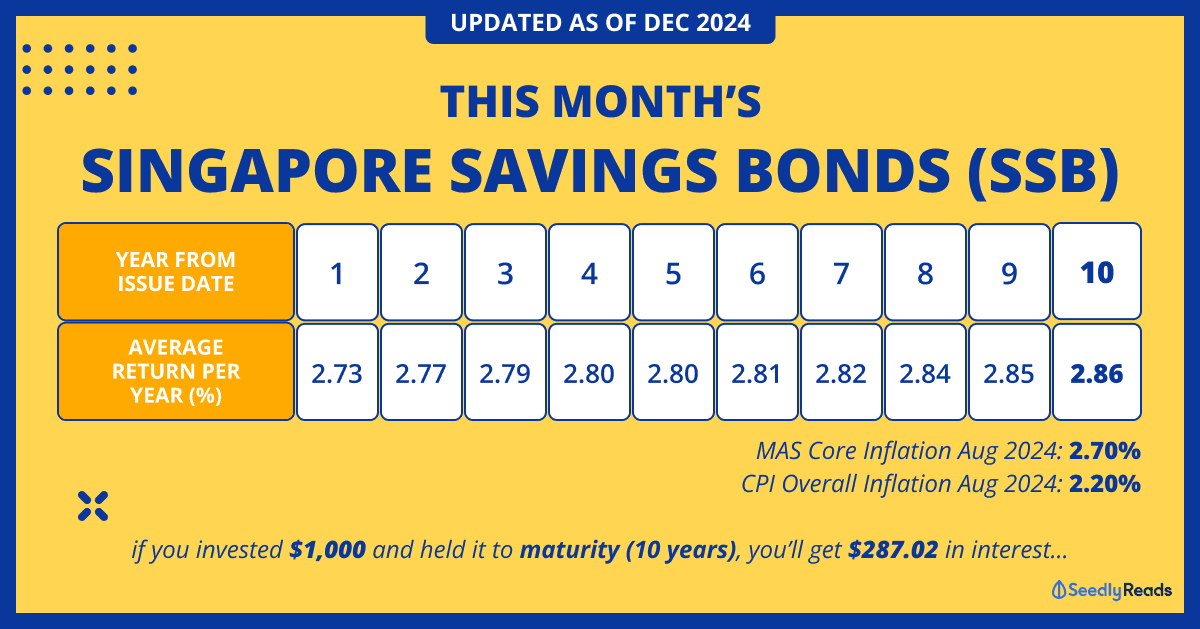

For reference, the Monetary Authority of Singapore (MAS) Core Inflation (excludes accommodation and private transport costs) was 2.70% in Aug 2024, compared to 2.50% in July 2024. Meanwhile, overall inflation (CPI-All Items inflation) was 2.20% in Aug 2024, down from 2.40% in July 2024.

For the whole of 2024, core inflation is expected to average 2.5 per cent to 3.5 per cent, while overall inflation should range between 2 per cent and 3 per cent.

But if you want to protect your money against inflation, this SSB guide will be your best friend.

Click to Teleport:

- What is SSB? + This Month’s SSB Interest Rates

- What Are The Benefits of Parking My Savings With SSB?

- Step-By-Step Guide to Investing in Your First SSB

- What to Do After Application of SSB? How is SSB Allotted?

- SSB vs Fixed Deposits

- Singapore Savings Bond Past Issuance Results

- What If I Have Questions About SSBs?

TL;DR: SSB This Month January 2025 — SSB Rate, SSB Deadline and More

The interest rate for SSB changes every month with each issue… You will get to buy next month’s SSB the previous month, which is why this month’s SSB is the January 2025 SSB.

Here are the details for this month’s Singapore Savings Bonds (via MAS):

| Details Of This Month's Bond | |

|---|---|

| Bond ID | GX25010E SBJAN25 GX25010E in your CDP statement Interest payment will be reflected as CDP-SBJAN25 in your bank statement GX25010E in your SRS statement |

| Tenor | Approximately 10 years |

| Amount Offered | S$600.0 million |

| Issue Date | 2 Jan 2025 |

| Maturity Date | 1 Jan 2035 |

| Interest Payment Dates | Upcoming payment: 1 Jul 2025 Subsequent payments (until maturity): Every 6 months on 1 Jan and 1 Jul |

| Application Period | Opens: 2 Dec 2024, 6pm Closes: 26 Dec 2024, 9pm Allotment: 27 Dec 2024, after 3pm Issuance: 2 Jan 2025 (by end of day) |

| Redemption Period | Opens: 2 Dec 2024, 6pm Closes: 26 Dec 2024, 9pm Redemption of Bonds: 2 Jan 2025 (by end of day) |

| Investment Amounts | Minimum of $500 (in multiples of $500) The total amount of Savings Bonds you can hold at any one time cannot exceed $200,000 |

*The total amount issued may be less than the maximum amount offered if the total eligible subscriptions are less than the maximum amount offered.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their due diligence and consider their financial goals before investing in any investment product.

What Is a Singapore Savings Bond (SSB)?

Singapore Savings Bonds are issued by the Monetary Authority of Singapore (MAS) to provide Singaporeans with a safe and flexible option for long-term savings.

These bonds are regarded as a secure and low-risk investment choice for individuals residing in Singapore.

Singapore Saving Bonds Interest Rate

The interest rates for this month’s SSB are:

| Year From Issue Date | Interest Rate(%) | Average Return Per Year (%)* |

|---|---|---|

| 1 Year | 2.73 | 2.73 |

| 2 Years | 2.82 | 2.77 |

| 3 Years | 2.82 | 2.79 |

| 4 Years | 2.82 | 2.80 |

| 5 Years | 2.82 | 2.80 |

| 6 Years | 2.85 | 2.81 |

| 7 Years | 2.90 | 2.82 |

| 8 Years | 2.95 | 2.84 |

| 9 Years | 2.99 | 2.85 |

| 10 Years | 3.01 | 2.86 |

If you invest $1,000 in this issue of Singapore Savings Bonds and hold it for the full 10 years.

The effective interest rate per year will be 2.86%, and you’ll get $287.02 in interest (via the official SSB calculator).

ilovessb SSB Singapore Bond Interest Rate Interest Rate Prediction

Wondering if you should invest in the current month’s Singapore Savings Bond (SSB) or wait for next month for potentially higher interest rates?

Thanks to SSB technical specifications by the Money Authority of Singapore (MAS) and some really complicated mathematics done by user “@hwckhs” from I Love SSB, we can actually predict with high accuracy what next month’s SSB interest rate will be!

So there’s no need to rush to apply for SSBs when the window to apply opens as confidence increases towards the end of the month as more daily SGS yields become available.

Is Singapore Savings Bond Worth Buying? How Does SSB Work?

Before we jump into investing in the SSB, let’s take a closer look at the risks and benefits and how SSB works.

1. SSB Redemption / SSB Withdrawal: Can I Withdraw Singapore Savings Bonds?

The longer you hold on to the bond, the higher the interest rate you enjoy.

There is also no penalty for individuals who wish to exit their investment early.

Once you submit your redemption request, you will get your principal back (along with any accrued interest) by the second business day of the following month.

What does this mean?

Assuming you choose to redeem $1,000 anytime during January…

You’ll receive $1,000 and any accrued interest by the end of the second business day of February.

Find out how to redeem SSBs here:

2. How Do I Withdraw Money From SSB? Can I Withdraw SSB Anytime?

You also can withdraw it at any time.

So, if you hate the feeling of having your money locked up for extended periods, the SSB is one of the many solutions available.

But you must pay a $2 transaction fee for each withdrawal.

3. SSB Redemption Period: How to Sell SSB

You can initiate the process of redeeming your Savings Bonds as soon as the month the bond is issued. The funds from the redemption will be disbursed no later than the second business day of the subsequent month.

4. Are Singapore Savings Bonds Risk-Free? How Safe Are Government Bonds?

The amount you invest in the SSB is completely backed by the Singapore Government.

Whatever your political views might be, it IS a fact that the Singapore Government received a “AAA” credit rating.

This reduces the risks of investing in the SSB to the bare minimum (read: there are still risks).

Switzerland and cities like Hong Kong are the only other countries that enjoy the same “AAA” credit rating.

Having such a strong rating arguably makes the SSB one of the safest products in the market.

5. How Much Should I Invest in Singapore Savings Bonds? $500 Is All It Takes

You don’t need to starve or eat grass to invest in SSBs.

The minimum amount to invest is $500.

Which makes it suitable for almost everybody.

SSB Limit

However, the Individual Limit for SSB is currently set at $200,000 (this includes bonds bought with cash and your SRS monies).

So even if you’re a millionaire, you can’t dump all your money into SSBs.

6. Can I Use My CPF to Buy SSB? Can SSB Use CPF?

Also, if you were wondering, you cannot use your Central Provident Fund (CPF) to buy SSB.

7. Is SSB Taxable?

Also, in case you are wondering, SSB is exempt from tax in Singapore.

8. SG Bonds Upcoming Bonds

In case you were wondering, the Singapore-based SSBs are issued every month. This means you will only have to wait until next month for the next SSB.

How to Buy a Singapore Savings Bond: Step-By-Step Guide to Investing in Your First Singapore Savings Bonds (SSB)

Here’s how you go about applying for the Singapore Savings Bonds.

1. SSB Application: What Do You Need?

Before applying, make sure you have the following:

- A bank account with any local banks in Singapore (DBS/POSB, OCBC or UOB)

- A Central Depository (CDP) account is linked to the bank account you intend to invest with.

2. How To Invest in Singapore Savings Bonds: CDP Login and SRS Login

You can apply for a Singapore Savings Bond through two methods:

- Apply at an ATM (only DBS/POSB, OCBC, or UOB) near you OR

- Apply through Internet Banking under Singapore Government Securities.

Note: If you are using OCBC, the OCBC mobile app works too!

Remember to have your CDP account number on hand when applying.

How to Purchase SSB: How Much Singapore Savings Bonds Can I Buy?

Take note that a minimum investment of $500 is required.

If you wish to invest more, you can do so in multiples of $500.

Each application is capped at $50,000.

What to Do After Application of SSB? How is SSB Allotted?

Once you have applied for your SSB, all you have to do is sit back and relax.

The results will be announced after the “last day to apply date”.

You can find important dates like the “last day to apply date”.

SSB Subscription and SSB Allotment Explained

Do note that if there is an event of over-subscription, meaning more demand than the amount available, you might find yourself only allotted a portion of the amount you applied for.

The rest of the amount will be returned back to your bank account.

SSB Allocation: SSB Redemption Calendar

The successfully allocated Savings Bonds will be issued on the first business day of the following month.

You can expect your first interest six months after the bonds are issued.

Interests are payable every six months.

All these will be reflected in your statement, and interest is automatically credited to your bank account.

Is SSB a Good Investment? Should I Buy a Savings Bond or a Fixed Deposit in Singapore?

If you’re deciding between SSBs and fixed deposits.

This quick comparison should help you with your decision:

| Singapore Savings Bond (SSB) | Regular Bank Savings Account | Fixed Deposits | |

|---|---|---|---|

| Liquidity | Yes | Yes | Somewhat (can withdraw but usually with penalties) |

| Easy to Get Into? | Yes | Yes | Yes |

| Returns >1% Per Annum? | Depends | No (0.05% base) | Depends (at least better than regular bank savings account) |

You might also want to look at the most recent Fixed Deposit Promotional Rates:

Singapore Bonds Interest Rate Average Returns (SSB)

If we compare it with the average return per year for this month’s SSB, it seems that leaving your money in the Fixed Deposit is a better short-term investment if you have at least $5,000 in fresh funds.

But if your investment horizon is longer, you might want to consider SSBs. Also, an important thing to note is that you won’t be able to get an ample allotment.

Alternatively, you could also look at high-interest savings accounts. But you might need to jump through a few hoops to get the highest interest rate possible. The interest rate is also not guaranteed:

Singapore Savings Bonds Interest Rate and Past Issuance Results

For those of us who want to build a bond ladder or are just curious about past results, here are the past issuance results for 2024:

| Issue Month/Year | Jan 2024 | Feb 2024 | Mar 2024 | Apr 2024 | May 2024 | June 2024 | July 2024 | August 2024 | September 2024 | October 2024 | November 2024 | December 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SSB Interest Rate (Average 10-year return p.a.) | 3.07% | 2.81% | 2.88% | 3.04% | 3.06% | 3.33% | 3.30% | 3.22% | 3.10% | 2.77% | 2.56% | 2.81% |

Are Savings Bonds Singapore a Good Investment? What If I Have Questions About SSBs?

We know that you’ve got limited funds to work with and want to maximise your investment potential.

SSB vs. T-Bills vs. Fixed Deposit

Are you wondering if investing in bonds like SSBs is better than T-bills?

Wondering what is the best SSB strategy to adopt?

Thinking about investing in ETFs or SSB?

There’s an easier way out.

Why not try asking the friendly community members on Seedly?

This way, you can get answers, and everybody learns too!

Related Articles:

- $12,000 Dividend Per Year: Here’s How Much You Need To Invest!

- Step-By-Step Guide: Opening A CDP And Stock Trading / Brokerage Account In Singapore

- How to Invest: A Singaporean’s Guide To Investing for Beginners

- Ultimate Cash Management Accounts Comparison

- Working Adults: Which Savings, Expenses And Investment Accounts Should I Start With?

- Budget 2024 Singapore Summary

- Best Travel Insurance in Singapore

- Best Credit Cards in Singapore

- Best Travel Insurance in Singapore (2024): Find The Best One For Your Needs

Advertisement