COVID-19 Recovery Grants (2021): Financial Support for Singaporean/PR Employees and Self-Employed Persons

●

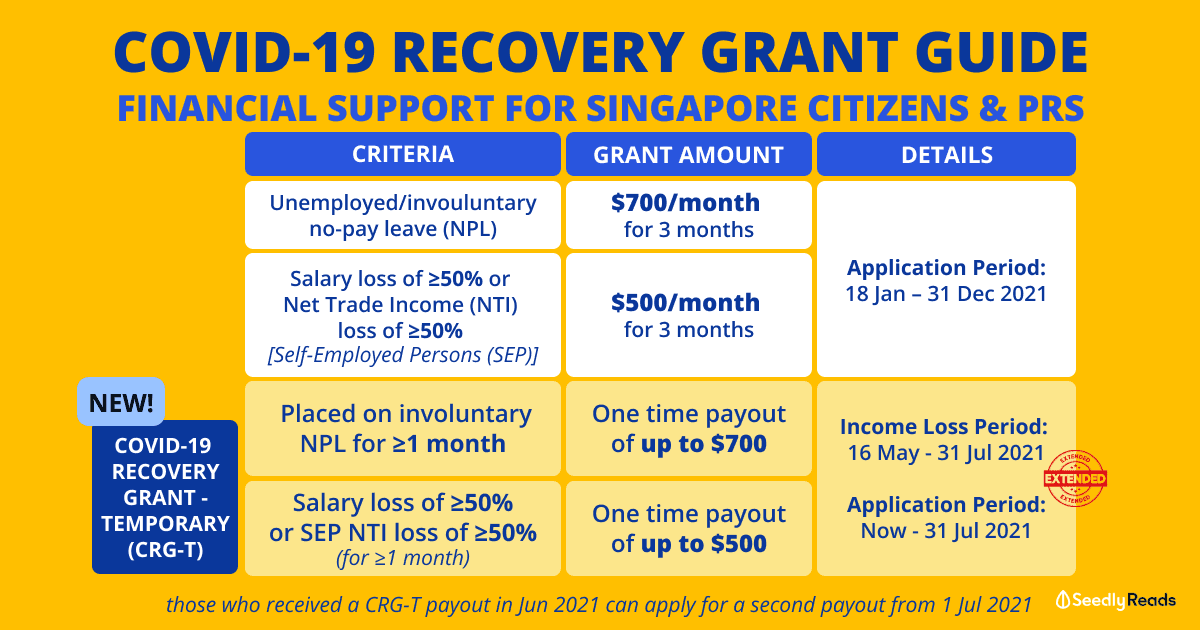

In December 2020, the Ministry of Social and Family Development (MSF) announced the launch of a new grant to support low and middle-income Singapore Citizens (SCs) and Permanent Residents (PRs).

Dubbed the COVID-19 Recovery Grant, this grant will support workers who have experienced involuntary job loss, involuntary no-pay leave (NPL) or income loss due to the economic impact of COVID-19.

Under this grant, eligible SCs and PRs who are older than 21 years of age can receive up to $700 a month for three months.

On 28 May 2021, the Ministry of Finance (MOF) announced that a new temporary grant, COVID-19 Recovery Grant (Temporary) (CRG-T) will be rolled out to support lower- to middle-income workers who have been financially impacted by the latest COVID-19 measures.

Subsequently on 23 Jul 2021, MOF announced that it will extend the CRG-T to 31 August 2021 in light of the tightened COVID-19 safe-management measures and their impact on workers.

MOF has clarified that ‘existing recipients of the grant who continue to require assistance can apply for a second payout under the scheme.’

This will be a supplement to the COVID-19 Recovery Grant, and this grant covers those who are self-employed as well.

COVID-19 Recovery Grant Temporary (CRG-T): 23 Jul 2021 Update

Here’s a quick summary of the CRG-T:

| Criteria | Income Loss Period | Grant Amount | Application Period |

|---|---|---|---|

| Employees | |||

| Individuals who experience at least one month of involuntary No-Pay Leave (NPL) | 16 May and 31 July 2021 | Payout of up to $700 | 3 Jun to 31 Jul 2021 |

| Income loss of at least 50% for at least a month | One-off payout of up to $500 | ||

| Self-Employed Persons (SEPs) | |||

| Loss in Net Trade Income (NTI) of at least 50% for at least one month compared to average monthly NTI in 2019 or 2020 | 16 May and 31 July 2021 | One-off payout of up to $500 | Now to 31 Jul 2021 |

Source: MOF

Do note that even if you have received CRG-T support for Jun 2021, you can apply again for the second tranche of CRG-T support from 1 Jul 2021.

But, you will need to continue to meet the eligibility criteria.

COVID-19 Recovery Grant Temporary (CRG-T) Eligibility Criteria

| Employees | Self-Employed Persons (SEPs) | |

|---|---|---|

| Employment | Placed on involuntary NPL for at least one month Salary loss of at least 50% for at least one month The income loss or involuntary NPL should have occurred between 16 May and 31 July 2021 | Loss in Net Trade Income (NTI) of at least 50% for at least one month, compared to average monthly NTI in 2019 or 2020 The income loss or involuntary NPL should have occurred between 16 May and 31 July 2021 |

| Age | Aged 21 years old and above | |

| Citizenship | Singapore Citizens (SCs) and Permanent Residents (PRs) | |

| Annual Value (AV) of Property | Living in a property with AV not more than $21,000. Applicant should not own more than one property. |

|

| Prior household income | Prior to job or income loss or involuntary NPL, gross household income of not more than $7,800 or gross per capita household income of not more than $2,600. | |

| Economically active | Employees should have worked for at least six months cumulatively between January 2019 and December 2020. | SEPs should have declared* annual NTI in 2019 or 2020. Additionally, SEPs should provide supporting documents on their line of work *SEPs may retroactively declare their NTI in past years by submitting Form IRAS144 to the CPF Board. The form can be found via the CPF website here. To ensure that applicants continue to save for their healthcare needs, all applicants, including present employees who were previously SEPs, and who have received CRG previously and are applying for CRG-T must have no outstanding MediSave contributions at the point of application. Alternatively, applicants can commit to making contributions via a GIRO plan. MediSave obligations are waived only for applicants who are applying for their first tranche of CRG support, to allow them to receive timely assistance. |

| Exclusion criteria | Applicants should not be concurrently receiving support from any of the following Government schemes when applying for CRG-T: -COVID-19 Recovery Grant -ComCare Short-to-Medium-Term Assistance -ComCare Long-Term Assistance -Seafarers Relief Package -COVID-19 Driver Relief Fund -SGUnited Mid-Career Pathways Programme: Company Training -SGUnited Skills Package. Applicants who are Full-time National Servicemen at the point of application are not eligible. |

|

Source: MOF

COVID-19 Recovery Grant Temporary (CRG-T) Application

You can apply via this link which is available 24/7 from now to Sunday 31 Jul 2021, 11.59pm.

If you need assistance with filing in the online application form you can contact:

- ComCare at

1800-222-0000) - Email

[email protected] - Visit their nearest Social Service Office

go.gov.sg/ssolocator)

COVID-19 Recovery Grant

Next up we have the COVID-19 Recovery Grant.

P.S. The COVID-19 Recovery Grant is a new scheme that is separate from the current COVID-19 Support Grant or the Self-Employed Person Income Relief Scheme (SIRS). Also, the application window for the COVID-19 Support Grant and SIRS will close by 31 Dec 2020 and end 2020 respectively.

Applications for the COVID-19 Recovery Grant will be open from 9am to 10pm daily (inclusive of weekends and public holidays), starting 18 Jan 2021 and ending on 31 Dec 2021.

Here is all you need to know about the COVID-19 Recovery Grant (CRG)!

Click to teleport!

COVID-19 Recovery Grant Eligibility Criteria

| Details | Employees | Self-Employed Persons (SEPs) |

|---|---|---|

| Age | 21 years old and above | |

| Citizenship | Singapore Citizens (SCs) and Permanent Residents (PRs) | |

| Annual Value (AV) of Property | Living in a property with AV not more than $21,000. Applicant should not own more than one property. |

|

| Prior household income | Prior to job or income loss or involuntary NPL, household income of not more than $7,800 or per capita household income of not more than $2,600. | |

| Economically active | Employees should have worked for at least six months cumulatively between January 2019 and December 2020. | SEPs should have declared annual net trade income (NTI) in either 2019 or 2020. Additionally, SEPs should provide supporting documents on their line of work. *SEPs may retroactively declare their NTI in past years by submitting Form IRAS144 to the CPF Board. |

| Job / Income loss | Full-time or part-time employee affected by the economic impact of COVID-19: -Presently involuntarily unemployed (due to retrenchment/contract termination); -Presently on involuntary No-Pay Leave (NPL) for a period of at least three consecutive months (e.g. Jan – Mar 2021); or -Presently experiencing salary loss of at least 50% on average for at least three consecutive months from all jobs as a part-time or full-time employee (e.g. Jan – Mar 2021) Job loss/NPL/salary loss must have taken place after 23 Jan 2020, when the first case of COVID-19 was detected in Singapore | Experiencing average loss in net trade income (NTI) of at least 50% over a period of at least three consecutive months, compared to their average monthly NTI in 2019 or 2020. NTI loss must have taken place after 23 Jan 2020, when the first case of COVID-19 was detected in Singapore |

| Job search or training requirement | Applicants must have actively participated in job search or training, and show proof of any of the following activities in the two months prior to application: -Submitted at least two applications via Government-linked touchpoints (e.g. MyCareersFuture portal, the Professional Conversion Programme portal) for jobs, traineeships, or attachments; or -Attended at least two job interviews; or -Actively receiving career coaching services at WSG’s Careers Connect or NTUC-e2i career centres; or -Applied for at least one training programme listed on MySkillsFuture (MySF) portal. Notes: In lieu of the job search or training requirement, SEPs may also submit supporting evidence of two attempts to improve their business revenue or reach out to new clients/business opportunities, as proof of job search. Employees who are facing salary loss or are on involuntary NPL will be exempted from this requirement. |

|

| Exclusion Criteria | Applicants should not be concurrently receiving support from any of the following Government schemes when applying for the CRG: -ComCare Short-to-Medium-Term Assistance; -ComCare Long-Term Assistance; -Seafarers Relief Package; -COVID-19 Driver Relief Fund; -SGUnited Mid-Career Pathways Programme – Company Training; or -SGUnited Skills Package Recipients of the COVID-19 Support Grant (CSG) may apply for the CRG when receiving their last month of CSG payouts. If approved, their CRG grants will commence only after the cessation of their CSG payments. Applicants who are Full-time National Servicemen at the point of application are not eligible. |

|

| Application Date | 18 Jan 2021 - 31 Dec 2021 9am to 10pm daily (inclusive of weekends and public holidays) |

|

Source: MSF

COVID-19 Recovery Grant Payout

Here is how much financial support that successful applicants of the CRG will receive:

| Payout (For 3 Months) | Criteria |

|---|---|

| $700 per month | Unemployed due to retrenchment or involuntary contract termination or; |

| Placed on involuntary no-pay leave (NPL) for at least three consecutive months | |

| $500 per month | Employees who are facing salary loss of at least 50% on average for at least three consecutive months at the point of application; and |

| SEPs who are facing an average loss in net trade income (NTI) of at least 50% over a period of at least three consecutive months at the point of application, compared to their average monthly NTI in 2019 or 2020. |

The job loss, involuntary NPL, or income loss should have happened after 23 January 2020: the date when the first case of COVID-19 was detected in Singapore.

After approval, the funds will be directly credited to the successful applicant’s bank account every month for three months.

How to Apply For The COVID-19 Recovery Grant

If you are eligible, you will be able to apply for the CRG from 18 Jan 2021 – 31 Dec 2021, 9am to 10pm daily (inclusive of weekends and public holidays).

Here is the link to the online application form.

If you need help with the application process you may:

- Call the ComCare Call hotline: 1800-222-0000

- Email: [email protected]

For those who cannot apply online, you may visit the nearest Social Service Office for assistance.

COVID-19 Recovery Grant Application Processing Time

Upon successful application for the CRG (supporting documents submitted), applicants will be notified of the outcome of his/her application via SMS two weeks later.

Please be patient with the process as I foresee that MSF will be processing a huge volume of applications at the start of the scheme.

COVID-19 Recovery Grant Supporting Documents

Applicants need to submit all of the following supporting documents which you can start preparing now.

Employees

- Documents on bank account details for fund disbursement.

- Relevant documents indicating involuntary loss of job, placement on involuntary no-pay leave (NPL) or income loss, including:

- A letter of retrenchment/termination of contract; or

- A letter from employer stating placement on involuntary NPL for at least three consecutive months; or

- A letter from the employer indicating an average monthly salary loss of at least 50% for at least three consecutive months; or

- Payslip(s) or CPF contribution statement(s) showing last drawn monthly salary before and after the job loss, placement on involuntary NPL or salary loss.

Self-Employed Persons (SEPs)

- Relevant documents indicating that you are working as a self-employed person e.g. valid trade licence(s), contracts for service, income statements, tax invoices billed to service buyers, receipts issued for services, or list of client engagements.

- Relevant documents indicating your active participation in job search or training e.g. confirmation of application for training via Government touchpoints. The documents should minimally indicate:

- Your name; and

- Date of application; and

- The name of the company/employer that you applied or interviewed at, or the training provider and course title of the training that you attended.

For SEPs, you can submit relevant supporting evidence of your efforts to reach out to new clients and businesses in the 2 months before your application.

This can include anything from:

- Pivoting business to cater to a wider target audience

- Actors attending auditions, putting up advertisements to solicit for business).

COVID-19 Recovery Grant Job Search/ Training Efforts Supporting Documents

| S/N | Type of Job Search and/or Training Efforts | Permissible Documents |

|---|---|---|

| 1 | At least two applications via Government-linked touchpoints (e.g. MyCareersFuture portal) for jobs, traineeships or attachments | Record of job, traineeship or attachment applications Note: Where possible, MSF will retrieve your job application records from MyCareersFuture portal directly. |

| 2 | At least two job interviews | Record of job interviews Acknowledgement letters/emails/screenshots of interviews scheduled/attended |

| 3 | Actively receiving career coaching services at WSG or NTUC-e2i Career Centres | Record(s) of career coaching received at: WSG [Careers Connect, Career Matching Providers (Ingeus or MAXIMUS)] or NTUC-e2i Career Centres |

| 4 | At least one application for a training programme listed on MySkillsFuture (MySF) portal | Record showing application for/enrolment in course(s) under MySF portal Email receipts or screenshots showing application for/enrolment in course(s) supported by SkillsFuture Singapore, or certificates attained upon successful completion of course(s). Emails or screenshots should minimally indicate name of applicant, date of application, course title, and name of training provider. |

Source: MSF

*Traineeships and attachments refer to opportunities under the SGUnited Traineeships and SGUnited Mid-Career Pathway Programme-Company Attachments. Individuals can apply for these opportunities through the MyCareersFuture portal.

**Training programmes include SGUnited Mid-Career Pathways Programme – Company Training, SGUnited Skills Programme, and other SkillsFuture-supported courses. These training programmes can be found on the MySkillsFuture portal, and interested individuals can approach the respective training providers listed to apply for courses.

For more information, you might want to head on over to the COVID-19 Recovery Grant website!

Also, if you have any questions about applying for the COVID-19 Support Grant, you can also head on over to Seedly and ask your question there.

Advertisement