A few years back, you may have heard about the debate surrounding the Central Provident Fund (CPF) Retirement Sum Scheme (RSS) from your grandparents.

These days, the RSS isn’t really being talked about, and new schemes like CPF Lifelong Income For the Elderly (LIFE) have emerged as due to changing times and rising life expectancy; the CPF LIFE scheme was implemented back in 2009 to replace the RSS and ensure retirees do not outlive their savings.

More specifically, the CPF LIFE scheme is a national longevity insurance annuity that provides its beneficiaries with a steady stream of monthly payouts for as long as they live.

CPF LIFE is actuarially fair and works through risk-pooling. In other words, the interest earned on the annuity premium is shared amongst all members to form part of their monthly payouts.

The RSS is old news, but there’s a need to talk about it because there are still Singaporeans that are part of the scheme.

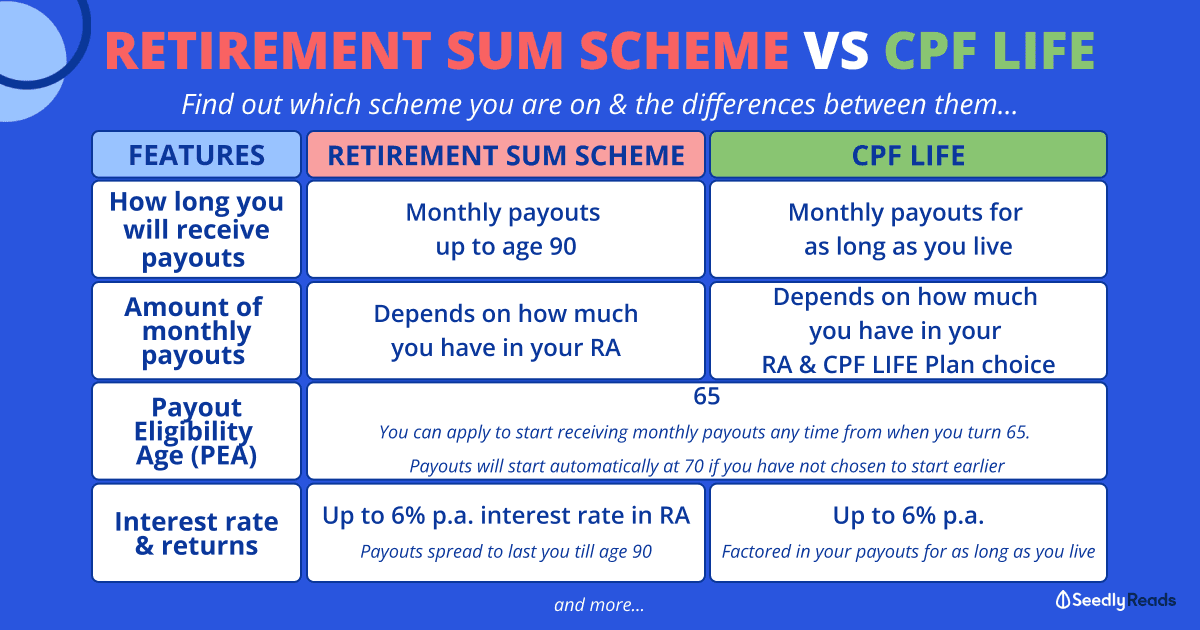

For the uninitiated, here’s a quick introduction to CPF LIFE and RSS and the differences between them.

TL;DR: CPF LIFE VS Retirement Sum Scheme (RSS): Which One Are You On & What’s the Difference?

| Retirement Sum Scheme | CPF LIFE | |

|---|---|---|

| How long You will Receive Payouts | Monthly payouts are drawn from your CPF Retirement Account (RA) and will be spread out to last up till age 90 | Monthly payouts for no matter how long you live |

| Amount of Monthly Payouts | Amount of monthly payouts depends on how much you have in your RA | Amount of monthly payouts depends on how much you have in your RA and what CPF LIFE plan you choose |

| Payout Eligibility Age (PEA) | 65 You can apply to start receiving monthly payouts at any time after age 65. Payouts will start automatically at 70 if you have not chosen to start earlier | 65 You can apply to start receiving monthly payouts at any time after age 65. Payouts will start automatically at 70 if you have not chosen to start earlier |

| Interest Rate Returns | Receive up to 6% p.a.* in your RA and your payouts will be spread out to last up till you are 90 years old | Up to 6% p.a.* which is factored into your monthly payouts that you will enjoy no matter how long you live |

| Lifelong Payouts & Interest | No -Retirement Sum Scheme (RSS) payouts will last up to age 90 at most, instead of age 95. -Hence older members who are already receiving payouts with a duration exceeding age 90 will have their payout amount adjusted upwards -RSS members who turn age 65 from 1 July 2020 onwards will be on the new payout rules. -For older members, who have started receiving their payouts, the new payout rules will only apply to them if their payout amount is higher under the new rules -Hence, this group of members will receive either the same or higher payout -For the RSS scheme, your beneficiaries will receive the remaining RA savings plus interest (if any) when you pass on | Yes All three CPF LIFE plans will provide you with monthly payouts no matter how long you live. When you pass away, your CPF LIFE premium balance (if any), together with any remaining CPF savings, will be distributed to your loved ones |

*Your CPF savings in the Ordinary Account (OA) earn guaranteed interest of 2.5% per annum, while savings in the Special Account (SA), MediSave Account (MA) and Retirement Account (RA) currently earn interest of 4% per annum.

The first $60,000 of your combined balances earns an extra 1% interest per annum. If you are 55 years old and above, you will earn 2% extra interest on the first $30,000 of your combined balances and 1% extra interest on the next $30,000.

The RSS and CPF LIFE schemes are the payout schemes Singaporeans will enjoy during their retirement.

CPF LIFE was created to replace the Retirement Sum Scheme, meaning that it is a new and improved version of the old RSS.

What Is Retirement Sum Scheme? What Is CPF Life Scheme?

Here’s how to find out if you’re part of the RSS or the CPF Life scheme.

Note that both schemes allow you to receive monthly payouts from when you hit the PEA, which is age 65 from 2018.

Basically, it is determined by three factors:

- When you were born

- The amount of savings in your RA before reaching age 65

- Your citizenship status.

RSS Eligibility

The Retirement Sum Scheme will still apply to those who are:

- Born before 1958;

- Born in 1958 or after and have less than $60,000 in your RA when you start your monthly payouts; OR

- Are a non-Singapore Citizen or Non-Permanent Resident.

CPF LIFE Eligibility

In general, you will be automatically included in the CPF LIFE scheme if you are:

- Born in 1958 or after; and

- Have at least $60,000 in your RA six months before you reach your payout eligibility age

- A Singapore Citizen or Permanent Resident

Those who are potentially not included in the CPF LIFE scheme include housewives, self-employed individuals and business owners who don’t contribute regularly to their CPF.

If you don’t satisfy the above criteria to be automatically enrolled into CPF LIFE, you can still opt to switch from the RSS to the CPF LIFE scheme anytime before you turn 80.

Monthly Payouts: RSS vs CPF LIFE

The main difference between the RSS and CPF LIFE is that for RSS, you will receive monthly payouts till you turn 90 years old or another five years, whichever ends later. While for CPF LIFE, you will receive payouts for life.

RSS Payouts

If you are not on CPF LIFE, your payouts will be calculated to last you for up to 20 years. This is after taking into account the projected growth of your retirement savings which has a current base interest rate of 4% p.a..

To protect you against the risk of outliving your payouts, the Government will pay bonus interest of up to 2% p.a. to extend your RSS payouts beyond 20 years up to when you turn 90 or for another five years — whichever ends later.

For clarity, you can use this payout estimator to check how much in monthly payouts you can receive from your retirement savings.

CPF LIFE Payouts: What Is the Retirement Sum for 2022?

For CPF LIFE, the lifetime monthly payout amounts are dependent on whether you hit the Basic, Full or Enhanced Retirement Sum at age 55:

| Year That Members Reach Age 55 | ||||||

|---|---|---|---|---|---|---|

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Estimated monthly payouts provided by retirement sums at age 65 (Assumes male member under CPF LIFE standard plan, starting payouts at age 65) |

||||||

| Basic retirement sum (BRS) | $850 | $870 | $900 | $930 | $950 | $980 |

| Full retirement sum (FRS) | $1,570 | $1,620 | $1,670 | $1,730 | $1,780 | $1,840 |

| Enhanced retirement sum (ERS) | $2,300 | $2,370 | $2,450 | $2,530 | $2,610 | $2,690 |

| Retirement sum at age 55 | ||||||

| BRS | $96,000 | $99,400 | $102,900 | $106,500 | $110,200 | $114,100 |

| FRS | $192,000 | $198,800 | $205,800 | $213,000 | $220,400 | $228,200 |

| ERS | $288,000 | $298,200 | $308,700 | $319,500 | $330,600 | $342,300 |

Source: Ministry of Finance

Is That Enough? How Does CPF Retirement Scheme Work?

As CPF often reiterates, one in three Singaporeans will live past 90 years old.

If that’s the case, the RSS would be less attractive as compared to CPF LIFE, which boasts retirement payouts for life.

Treatment of RA Savings and Interest

There’s also one other factor you need to consider regarding the interest on your RA savings and how it is distributed to your beneficiaries when you pass on.

RSS Scheme Treatment

For the RSS scheme, your beneficiaries will receive the remaining RA savings plus interest (if any) when you pass on.

CPF Life Scheme Treatment

Whereas for CPF LIFE your CPF LIFE premium balance (if any), together with any remaining CPF savings, will be distributed to your loved ones when you pass on.

However, interest earned on that CPF LIFE premium will be pooled to the CPF LIFE annuity to ensure that the remaining CPF LIFE members continue to enjoy monthly payouts for as long as they live.

This may be the case, but on balance, the interest accumulated on your CPF LIFE premium (and premiums of other CPF LIFE members) is what allows you to continue receiving payouts even after your CPF LIFE premium balance is depleted.

RSS and CPF Life Schemes in Singapore

However, for the majority of Singaporeans, you will most likely be enrolled automatically into CPF LIFE.

Thus, to find out more, you can read our CPF LIFE article:

Read More

Advertisement