Credit Score – What is it? What does it do? How does it affect me?

Particularly, credit scores can critically impact your financial situation if not maintained properly.

For example, qualifying for loans very much depends on your credit scores and having a low credit score automatically renders it more difficult for you to qualify for higher tiered loans such as home mortgages or business loans.

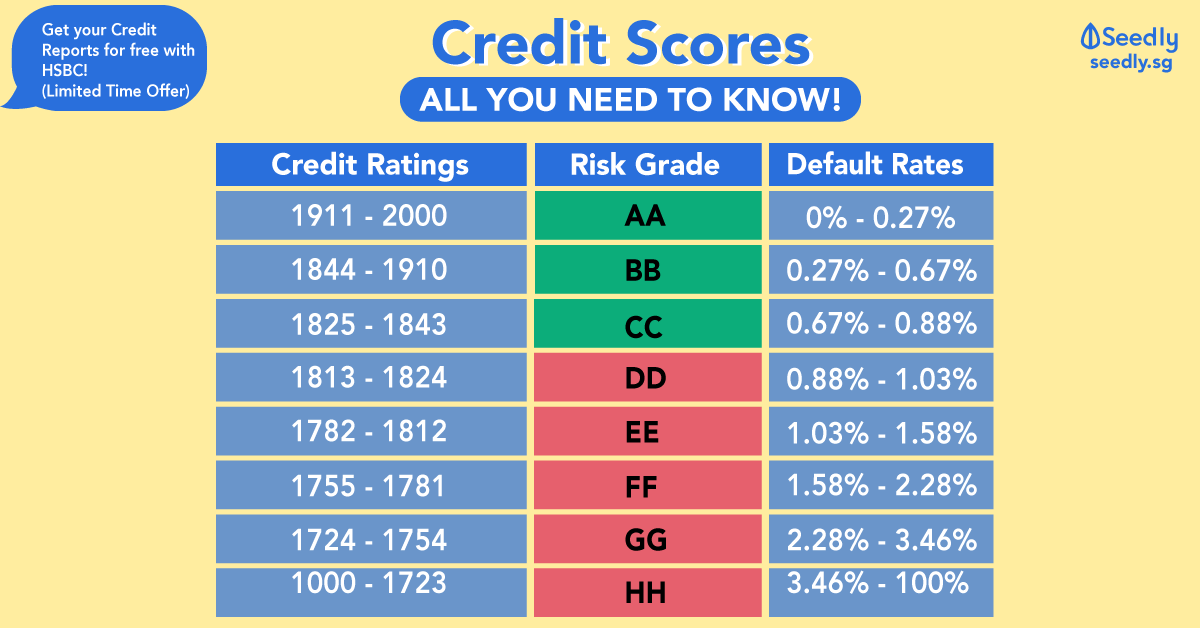

TL;DR: All Credit Score Ratings you should know

| Scores | Risk Grade | Default Rates |

|---|---|---|

| 1911 - 2000 | AA | 0% - 0.27% |

| 1844 - 1910 | BB | 0.27% - 0.67% |

| 1825 - 1843 | CC | 0.67% - 0.88% |

| 1813 - 1824 | DD | 0.88% - 1.03% |

| 1782 - 1812 | EE | 1.03% - 1.58% |

| 1755 - 1781 | FF | 1.58% - 2.28% |

| 1724 - 1754 | GG | 2.28% - 3.46% |

| 1000 - 1723 | HH | 3.46% - 100% |

While credit scores are an integral part in applying for loans, they form only 1 of the many other deciding factors. They include:

- Annual Salary

- Bankruptcy/Litigation Information

- Length of Employment

- Number of Credit Facilities (AKA number of loans you are currently on)

Other Credit Scores

Apart from the risk grades mentioned above, there are others that you should take note of.

Specifically,

- HH – Probability of default is extremely high.

- HX – Involved in legal situations or have had bankruptcy records filed against yourself.

- HZ – Have defaulted on some loans or had to renegotiate loan repayments.

- GX – No credit history or no credit enquiries made by banks on you. No credit scores available.

- CX – Not enough credit history resulting in inability to derive a score.

In essence, should your credit score happen to be a HH grade or any of the risk grades above, it is generally advised to avoid applying for any loan applications and to first work towards improving your scores.

What Affects your Credit Scores?

There are 6 factors that affect your credit scores.

| Factor | Remarks |

|---|---|

| 1) Type/Amount of credit utilization | The amount you borrow or owe on all your accounts. |

| 2) Recent Credit | Amount of credit you accumulate within a time period. Borrow in moderation. |

| 3) Delinquency Rate | History of late payments. |

| 4) Credit History | Do you have an established credit history? Any late payments? |

| 5) Available Credit | Number of accounts currently opened/active for credit. |

| 6) Enquiry Activities | Number of new application enquiries found in your credit. Enquiries accumulate when financial institutions checks your credit reports each time you apply for a loan. |

How does Credit Scores affect you?

Naturally, with a lower credit score, most banks would be hesitant to grant loans as a result of higher default rates.

To put that into perspective, say you’ve decided on purchasing a HDB BTO or resale flat.

(As of July 2018, loan ceilings have been updated again)

| Loan Tenure | No Outstanding Loan | 1 Outstanding Loan | 2 or more outstanding housing loans |

|---|---|---|---|

| ≤ 25 years | 75% | 45% | 35% |

| > 25 years or loan period goes beyond borrower's age of 65 | 55% | 25% | 15% |

- Flat is valued at $400,000

- Based on the new Loan Ceilings, the maximum loan you can obtain = $300,000

- This means that the remaining $100,000 has to be financed independently

- Note that this is based on a situation where there are no outstanding loans due

Therefore, with a credit rating of BB and below, the chances of a bank approving the loan of $300,000 might be slim.

Again, this is dependent.

Improving your Credit Scores

Improving your credit scores may seem daunting, but it is achievable. Unsurprisingly, be prepared for longer termed process in repairing your credit scores. After all, you’re dealing with huge financial institutions who are actively tracking millions of other accounts.

Generally, the rule-of-thumb behind improving your credit ratings revolve around making consistent and timely repayments on all your loans.

In a sense, the easiest way to repair your damaged credit ratings is to fully settle any small loans (<$1,000). By doing so, your credit scores could improved to the optimal grade by the time you send in your application for a business, home or education loan.

Reports

For a detailed insight into your credit scores and what they entail exactly, you can request for the following reports:

- Enhanced Consumer Credit Report

- Telco Credit Report

That said, obtaining these reports may cost you a small fee. However, there are circumstances where you can obtain them for free.

Options to Obtain your Credit Reports

| Option | Requirements |

|---|---|

| Free | New Credit Facility Applicants Credit Facility must be a Credit Bureau (Singapore) member |

| Free | HSBC Account Holders Limited Time Offer till 31st March 2019 Terms & Conditions Apply |

| $6.42 Purchase | Purchase via eNets or Credit Card |

For paid options, requesting for express service (Only available at SingPost Branches) would cost an additional $17.12.

Collection Points

Credit reports can be obtained from the following locations:

- Credit Bureau (Singapore) Office @ 2 Shenton Way, SGX Centre 1

- 57 SingPost Branches Islandwide

- Crimsonlogic Service Bureau @ 133 New Bridge Road, Chinatown Point or @ Supreme Court Building

Advertisement