We invest our income with the ultimate objective of trying to maximize our total returns. There are two prominent methods of investing your income, to increase your total returns. In this article, we examine both sides of this returns story and find out which is most suitable for you based on a few factors.

The Returns Formula

Total Returns = Capital Appreciation (Growth) + Dividend Yield

- Capital Appreciation (Growth): Earnings and price of stock increase above market average

- Dividend Yield: Quarterly or Yearly cash payouts for your investment in the company based on performance

Dividend Investing

A strategy that involves building a collection of safer blue-chip or dividend-paying stocks. Investors will then enjoy getting to enjoy the returns in form of regular cash deposits into their respective brokerage account.

Pros

- Investors receive regular returns in form of dividend payouts. This dividend payouts can be reinvested.

- Singapore’s biggest Index stocks have the highest dividend yield in Asia at 3.7%.

- Dividend-paying stocks have a better track record of performing better when market condition is weak.

- Price of dividend stocks are less volatile, which means lesser risk

Cons

- A large amount of capital is usually required from investors, as the stock price is high.

- Since price is less volatile, increase in stock price is lesser than growth stocks. In other words, some investors may find it boring.

- Dividend payments are not carved in stones, companies can reduce dividends anytime if there’s a reason to.

Possible Investment Instruments: High-yield dividend stocks, Business trusts, and REITs

Growth Investing

Growth investing refers to a strategy where investors invest in companies whose earnings are expected to increase at a rate that is above the market average. This is in hope of making returns through an increase in price or value of vested stock in future.

Pros

- Investing in the right company can increase your returns at a rate which is higher than that of the overall market.

- The possibility of getting higher returns than dividend stocks in the short run.

Cons

- No dividends will be given out to offset investor’s risk, as the company tends to reinvest their earnings.

- Volatile stock prices

- Exposed to higher risk

Possible Investment Instruments: Growth stocks, stocks of smaller companies or emerging markets

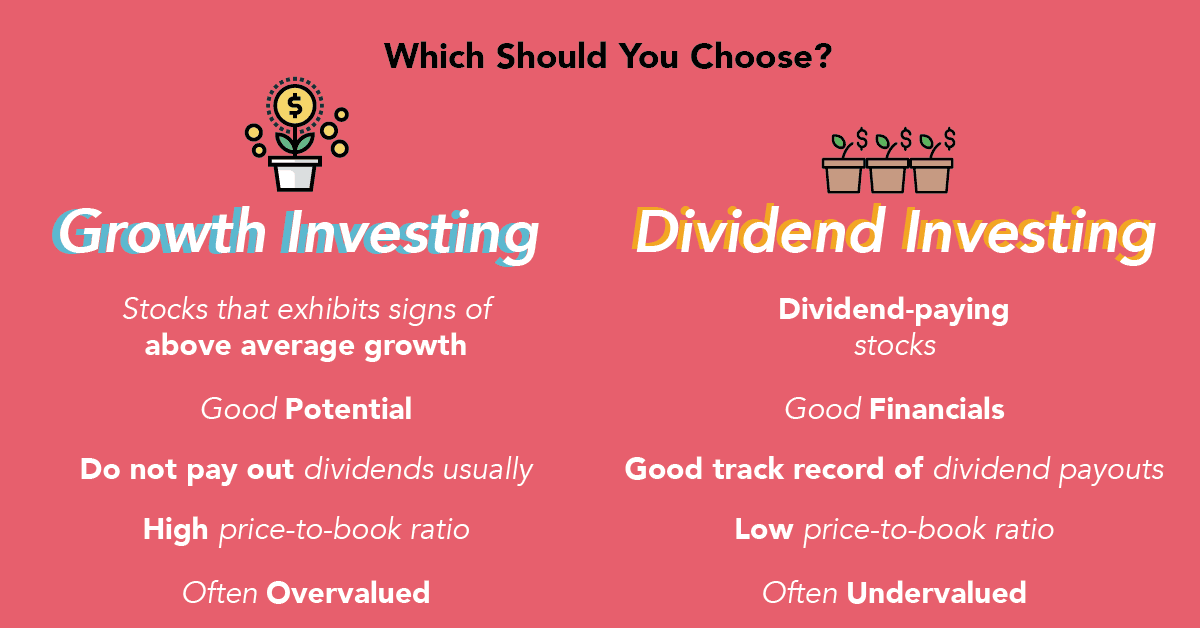

Dividend Investing VS Growth Investing – Which should I pick?

Growth and dividend stocks differ in certain ways. This is mainly due to investors having expectations that growth stocks will one day have the possibility of generating high capital gains, while dividend stocks are usually old companies that are stable and less innovative.

| Growth Investing | Dividend Investing |

|---|---|

| Companies that exhibit signs of above-average growth. | Dividend-paying stocks |

| Good potential | Good financials |

| Do not pay out dividends | Good track record of dividend payouts |

| Often overvalued | Often undervalued |

| Expensive price-to-book ratio | Low price-to-book ratios |

There will always be an ongoing argument on which method gives a higher return. Each school of thought will also be able to provide evidence to back their argument too. Unless you are a seasoned investor, a diversified portfolio consisting of both growth and dividends stocks will be the safer way to do so. The decision on the percentage % of dividend stocks and growth stocks lies on a few factors:

Factor 1: Age and Risk Profile

Your appetite for risk changes over time.

Characteristics of younger investors:

- tend to have a higher risk appetite

- go for long-term capital growth

- Hence, a portfolio with a higher percentage of growth stocks

Characteristics of investors close to retirement:

- tend to have a lower risk appetite

- go for consistent income

- Hence, a portfolio with a higher percentage of dividend stocks.

Factor 2: Economic conditions

Dividend investing is popular when the economy is facing uncertainty or slower growth. Growth stocks generally perform better when interest rates are falling and company earnings increase.

Factor 3: Company news and performance

Ultimately, there is a company behind every stock and the company’s news and performance affects the price of a stock.

Seedly Community: How to decide if one should go for income based (Dividend) investing or growth based investing

- Kyith Ng Lip Hong

Income investing focus with an intent of a particular income goal. Growth investing is prioritizing capital appreciation over current income.

However, looking at them this way is a bit flawed. To get the income one needs the stock to earn enough earnings to sustainably pay it out. Hence, what we should focus on is the growth of the earnings. There are growth stocks which starts with 2% in dividend but your dividend yield on cost eventually becomes 7%, so a growth stock can also have income.

The key is to focus on a good company that earns growing income and purchases it at REASONABLE to CHEAP prices. In that way, you have both income and growth.

Income and growth are prioritizing the amount we pay out from earnings. Let’s just focus on the earnings. - Siti Putri

I started with value growth companies, which stabilized and starts paying/increasing dividends eventually. However, do note that such is unlike REITs where they must pay dividends, although dividends yield may reduce, depending on the performance of the company too.

Best is to focus on fundamentals foundation of companies.

I have all types because I think it is somewhat like a ‘stock-cycle’. The key thing is to pick your investments properly. Here are some guidelines:

Deep value:

This means it is super cheap with good fundamentals but yet to be discovered much or still new. However, this means that it can also take a long time to see price movements per share.

Value-growth:

A mix between relatively fair value and good growth.

High growth:

Typically double-digit growths each year. However also need to be mindful of their liabilities. Typically tech companies like Tencent, amzn, but the valuation is hard to swallow because they are always expensive.

Dividend Income:

Typically more on REITs or blue chips stable returns and gives dividends.

Extra Tools: Investment Moats Singapore Dividend Stock Tracker

For Singaporeans who are interested in dividends investing, we are really lucky to have Investment Moats High Dividend Stock Tracker to keep an eye on high dividends yielding stocks.

Investment Portfolio of one of the more successful dividend investor

We managed to have STE’s Stocks Investing share his portfolio with us in a previous article. Here’s a snapshot of it:

| Counter | Weightage | Counter | Weightage |

|---|---|---|---|

| Accordia Golf T | 6.9% | First REIT | 6.9% |

| Keppel Corp | 6.7% | Frasers Comm | 6.4% |

| Soilbuild REIT | 4.3% | AIM | 3.7% |

| Lippo Mall | 3.6% | ESR-REIT | 3.3% |

| SembCorp Ind | 3.3% | Capital-comm | 3.2% |

| OCBC | 3.1% | CDL-HT | 2.7% |

| M1 | 2.6& | Ascendas HT | 2.5% |

| Global Inv | 2.5% | Croesus RT | 2.4% |

| Singtel | 2.2% | Frasers H Trust - FHT | 2.0% |

| Viva Ind T | 2.0% | Hotung Inv | 1.9% |

| DBS | 1.6% | Frasers L&I Trust | 1.6% |

| Design Studio | 1.5% | Suntec | 1.5% |

| Far East H Trust | 1.3% | ComfortDelGro | 1.2% |

| Mapletree GCC | 1.0% | TTJ Holding | 0.9% |

| Manulife REIT (USD) | 0.8% | Asian Pay TV | 0.8% |

| Thai Bev | 0.8% | BHG R REIT | 0.7% |

| SIA Eng | 0.7% | Starhub | 0.7% |

| I REIT Global | 0.6% | SPH | 0.6% |

| UOB | 0.6% | Fu Yu | 0.6% |

| Singpost | 0.6% | Starhill | 0.5% |

| KSH | 0.5% | ST Eng | 0.3% |

| Mapletree Comm | 0.3% | ||

| Total: 100% | |||

Further reading: Dividend investing vs growth investing results

An illustration of the growth of $1 from the year 1927 to the year 2005, if one invest in various stocks. Do note that value stocks refer to dividend stocks in this case.

A $1 investment in 1927 would have grown to:

A $1 investment in 1927 would have grown to:

- $7,662 in the year 2005 if placed in large value stocks

- $54,966 if placed in small value stocks

- $974 if placed in large growth stocks

- $1,371 if place in small growth stocks

Advertisement