“Bro, X REIT has a yield of 8%. Can invest or not?”

This is a common question I get from my friends.

Not exactly in that form, but it’s along those lines of whether a particular Singapore real estate investment trust (REIT) can be invested based on its high distribution yield.

What I would advise is that potential Singapore REIT investors should look beyond the distribution yield (similar to dividend yields of listed companies) as the distribution yield of a REIT tells us nothing about the sustainability of its distributions or the strength of the REIT.

Only then can they make a more informed decision on whether to buy the particular REIT.

So, let’s explore some criteria I use to pick good Singapore REITs!

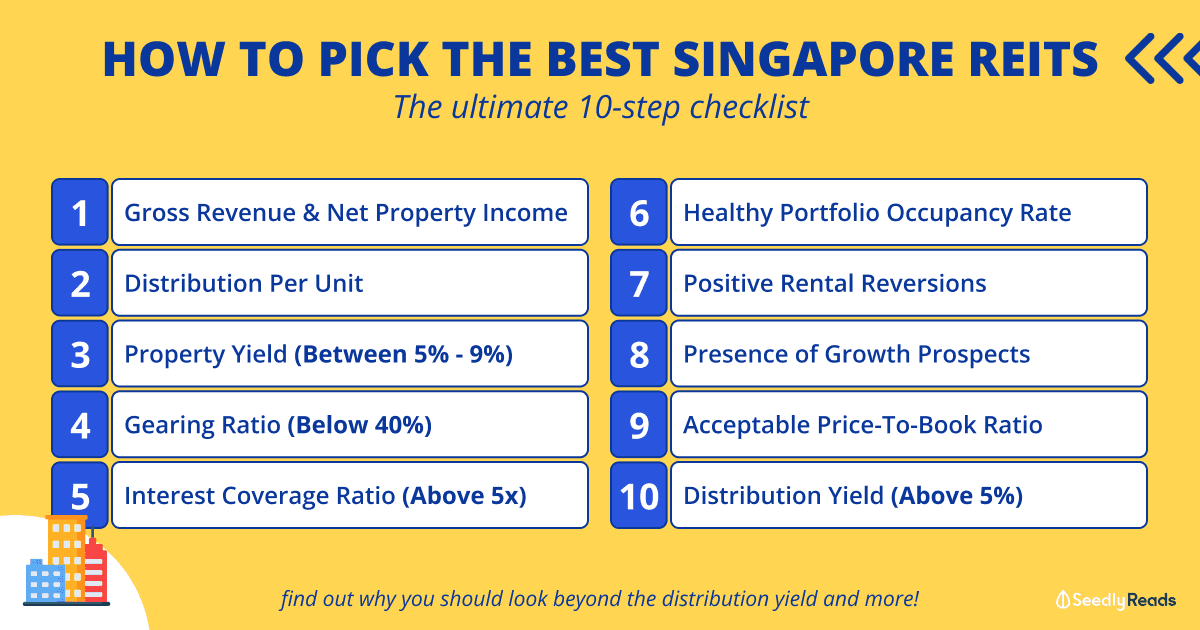

TL;DR: How To Pick the Best Singapore REITs

At a glance, here are the 10 steps to picking the best Singapore REITs:

- Growth in Gross Revenue and Net Property Income

- Growth in Distribution Per Unit

- Property Yield of Between 5% and 9%

- Gearing Ratio of Below 40%

- Interest Coverage Ratio of Above 5x

- Healthy Portfolio Occupancy Rate

- Positive Rental Reversions

- Presence of Growth Prospects

- Acceptable Price-To-Book Ratio

- Distribution Yield of Above 5%

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

1. Growth in Gross Revenue and Net Property Income

Firstly, I like to look at whether the REIT’s gross revenue and net property income (NPI) are growing consistently each year.

Gross revenue is money a REIT receives from its tenants mainly through the rentals.

After deducting property-related expenses such as property management fees, property tax and maintenance expenses, we derive at the NPI figure.

Let’s use Parkway Life REIT (SGX: C2PU) as an example here to illustrate the metrics.

Parkway Life REIT is one of Asia’s largest listed healthcare REITs, with 61 properties in total in Singapore, Japan, and Malaysia.

In Singapore, the REIT owns three hospitals — Mount Elizabeth Hospital, Gleneagles Hospital, and Parkway East Hospital.

The following table shows how gross revenue and NPI have grown in the last five years for Parkway Life REIT:

| Financial Year | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Gross revenue (S$' 000) | 112,838 | 115,222 | 120,892 | 120,705 | 129,972 |

| Net property income (S$' 000) | 105,404 | 108,255 | 112,528 | 111,234 | 121,868 |

Parkway Life REIT’s gross revenue and NPI dipped slightly in 2021, but in the following year, it recovered and surpassed the 2020 figures.

Therefore, with consistent growth in gross revenue and NPI, Parkway Life REIT ticks the first box.

2. Growth in Distribution Per Unit

Apart from gross revenue and NPI, I also look at whether a REIT’s distribution per unit (DPU) is improving consistently every year.

Growth in DPU is critical as DPU is ultimately what unitholders receive for investing in a REIT.

If a REIT is growing its gross revenue, NPI, and distributable income without an increase in DPU, it’ll be a red flag for me. This could mean that management is issuing new units to the detriment of unitholders.

Taking Parkway Life REIT as an example again, its DPU has been rising steadily from 2018 to 2022 (excluding one-off divestment gains):

| Year | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| DPU (Singapore cents) | 12.87 | 13.19 | 13.79 | 14.08 | 14.38 |

Again, Parkway Life REIT looks good with growing DPU.

3. Property Yield of Between 5% and 9%

A REIT’s property yield is its NPI divided by the valuation of the properties held in the REIT’s portfolio.

Property Yield = (Net Property Income / Portfolio Valuation) * 100%

The property yield reveals the strength of the REIT’s underlying properties and is more important than calculating the REIT’s distribution yield, which is ultimately a function of the stock market price.

Too low a yield could mean that the REIT is not maximising its income potential while too high a yield might indicate that the REIT is charging exorbitant rents, which is unsustainable.

In 2022, Parkway Life REIT had an NPI of S$121.9 million and S$2.2 billion in investment properties. This equates to a property yield of 5.5%. Property yields in the range of 5% to 9% are excellent, in my opinion.

Parkway Life REIT’s property yield of slightly above 5% just cuts the mark. I would prefer its property yield to be higher, but as mentioned, anything between 5% and 9% is acceptable to me.

The property yield can be compared on a yearly basis to look for a trend or with other REITs operating in the same industry as well.

4. Gearing Ratio of Below 40%

The gearing ratio reveals the strength of a REIT’s balance sheet.

The gearing ratio is calculated by dividing the total loan of a REIT by its total assets.

Gearing Ratio = (Total borrowings / Total Assets) * 100%

As of 31 December 2022, Parkway Life REIT had a gearing ratio of 36.4%.

REITs in Singapore require the gearing ratio to be below 45%, as mandated by the Monetary Authority of Singapore.

In the case of Parkway Life REIT, it still has a debt headroom of S$365.1 million before reaching the 45% gearing limit.

A relatively low gearing ensures that when the economy goes south, and asset prices come down, there’s enough margin of safety before the gearing limit is breached.

5. Interest Coverage Ratio of Above 5x

Another aspect to look at is a REIT’s interest coverage ratio.

The interest cover is obtained by dividing the NPI by finance costs. Finance costs mainly consist of interest expense on borrowings.

Interest Cover = Net Property Income / Finance Costs

I would like the REITs I invest in to have interest covers above 5 times.

At the end of 2020, Parkway Life REIT had ample interest coverage of more than 15 times (NPI of S$121.9 million divided by finance costs of S$5.75 million).

The high-interest cover of 15 shows that even if Parkway Life REIT’s NPI were to decline drastically, the REIT would still be able to service its debt.

6. Healthy Portfolio Occupancy Rate

Moving on, the portfolio occupancy rate shows the ratio of a REIT’s rented space to the total amount of space available.

I prefer REITs that have a full occupancy rate or at least close to it to maximise the space. No one likes to walk into an empty shopping mall.

If a 100% occupancy rate is not possible, I prefer the REITs to have an occupancy rate of at least above the market average.

7. Positive Rental Reversions

Rental increase is the most common way for REITs to grow their gross revenue.

A REIT’s rental reversion shows how new leases signed during a period have changed compared to the previous period. If the new leases are better than the previous one, it leads to a positive rental reversion.

I look out for REITs that have a history of positive rental reversions. At the minimum, rental reversions should grow at the same pace as the average long-term inflation of the country in which the REIT has majority assets.

Investors should note that not all REITs compare rental reversions the same way. So, a comparison of this metric across different REITs, even in the same industry, may not be an apple-to-apple comparison.

8. Presence of Growth Prospects

On top of growing through rental reversions, a REIT can also grow through acquisitions and asset enhancement initiatives (AEIs).

A REIT with a strong sponsor can help on the acquisition front.

The sponsor looks for properties to be placed into the initial portfolio of the REIT and may continue to provide a pipeline of assets for the REIT to acquire. The good sponsor also owns significant stakes in the REIT manager and the REIT.

A strong sponsor usually offers a right-of-first-refusal (ROFR) of its properties to the REIT it’s sponsoring. This means the sponsor will offer properties to the REIT first before offering it to any third-party companies.

Meanwhile, AEIs refer to the revamping of a property to enhance its value, and hence, its future rental income.

AEIs are commonly carried out by retail REITs to continually refresh the malls to attract shoppers and tenants alike. Upgrading amenities, sprucing up a mall’s façade, and adding play and rest areas are some forms of AEIs.

9. Acceptable Price-To-Book Ratio

The price-to-book (PB) ratio is a valuation metric commonly used to value REITs. It consists of two parts: the unit price of a REIT and its book value.

The book value (also known as net asset value) is the difference between a REIT’s assets and its liabilities, and it shows the REIT’s net worth.

PB Ratio = Unit Price / Book Value Per Share

I prefer REITs to have a PB ratio of below 1. However, that’s not always possible, especially for a quality REIT like Parkway Life REIT.

For such cases, I’m willing to pay up for the REIT.

10. Distribution Yield of Above 5%

Next up is the distribution yield, which is similar to a dividend yield for a listed company.

Distribution yield, another valuation metric, is obtained by dividing a REIT’s DPU by its unit price and multiplying that by 100%.

Distribution Yield = (DPU/Unit Price) * 100%

I prefer REITs to have distribution yields of more than 5% to be commensurate with the risk I’m taking on.

You will also notice that distribution yield is the last factor I look at.

As mentioned earlier, the distribution yield of a REIT tells us nothing about its quality. So, we have to assess a REIT’s stability before even looking at the valuation metrics.

We have come to the end of the Singapore REITs investing cheat sheet.

The checklist presented above is by no means exhaustive. But they form the basis for what investors should look at before investing in Singapore REITs.

With that, happy REITs-investing!

[Post-publication note: If you want to know how to apply the above factors to analyse a REIT, you can check out an example with Ascendas REIT (SGX: A17U).]

Related Articles

Advertisement