Singapore may be one of the safer countries in the world, but that theory will be out the window when we talk about scams.

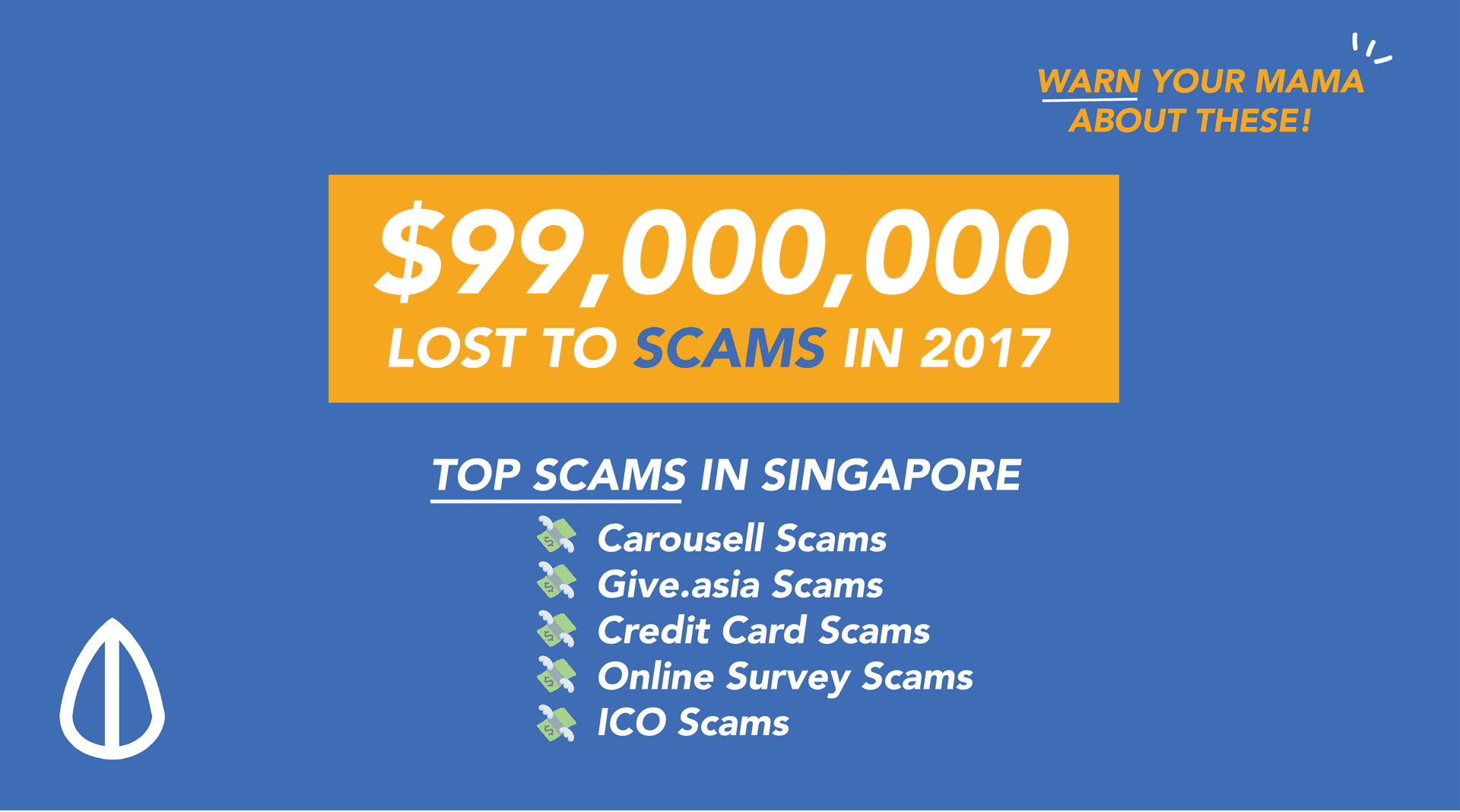

In the year 2017, a total of S$99 million is lost to scams.

To put that into better perspective, S$99 million equates to

- 33 million plates of Nasi Lemak at S$3 each.

- Should one eat 3 plates of Nasi Lemak every day, it can feed him 11 million days

- 11 million days equates to 30,136 years (about 301 generations)

You get the point.

This article can save you, and the rest of your 300 generations by warning you about the popular scams in Singapore.

Popular scams in Singapore

Carousell Scam

Our team almost fell for this while trying to purchase a Google Pixel 2 XL online.

From Sony PlayStation 4 to event tickets, Carousell scams usually involve selling an object at a price which is too-good-to-be-true.

These scammers usually have a few tell-tale signs:

- They usually claim that they belong to a company or certain warehouse

- Sell collection is never possible and they prefer to deliver it to you.

- They usually send you photos of an “IC” to assure you

- Possibly new accounts

source: Facebook

Once a buyer is convinced and makes his first payment, they will never get both the goods and their money back.

Some of these greedy scammers might even try to rip the victim off even more by claiming the need for insurance, GST and transport fees before he can get his goods.

Credit/ Debit Card Scam

Imagine waking up one morning to numerous of such messages sent while you were sound asleep.

This is followed by several unknown transactions made using your card over the night. Apparently, our SMS 2FA technology is not as secure as it may appear to be, hence, being vigilant is still the way to go.

Should you receive any weird notifications as such, always check your bank balance and inform the bank if there is anything amiss.

Online Survey Scam

They usually come in form of an SMS or Facebook post where they reward customers with gift cards.

source: Seedly Personal Finance Facebook Group

NTUC Fairprice online survey with a S$400 NTUC Fairprice gift card is the latest addition to such scam.

source: Channel NewsAsia

ICO Scam

An ICO scam happens when money collected during an ICE was stolen and the team disappeared after which.

Unlike our financial markets, cryptocurrencies are unregulated.

ICO scammers find the sweet spot to trick investors into putting their money with them by riding on the cryptocurrency hype and the complexity of the cryptocurrency market.

An example will be PlexCoin which managed to scam a total of US$15 million.

Phishing Scheme

A recent phishing scheme targetting POSB Bank customers acts as a really good reminder to always check the Email of senders when we read our Emails.

An example of a malicious email looks like this:

source: Channel NewsAsia

As realistic as the Email looks with the use of POSB’s logo, it is important that we take note of the links and sender Email to determine how credible the source is.

These sites can be dangerous if one is unaware of it. Damages include stealing of details, login credentials, passwords, PINs etc.

Phone Impersonation Scams

Some of us would have received a phone call in both English and Mandarin by now, from an automated operator system claiming themselves to be from the Singapore Police Force or Immigration and Checkpoints Authority (ICA).

This is usually followed by instructions to ask the recipients to provide details about themselves such as name, NRIC number for “verification purposes”.

Here are some pointers to take note of, to prevent falling victim to such scams:

- Always be extra wary should a caller start requesting for your personal information such as your name, identification number, passport details, contact details, bank account, credit card details or other banking information such as usernames, passwords etc.

- Government agencies should already have your personal details should they be calling you. Even if they do not, they will not ask for details over an automated voice machine.

Whatsapp Loan Shark

Unlicensed moneylenders have upped their game when it comes to trapping victims into taking up unlicensed loans.

Moneylenders now embrace technology such as Whatsapp or SMS text message to offer their loan services. Should one agree to take up a loan with them, the victim will be asked to transfer a deposit over.

However, once the transfer is done, no loan will be disbursed, and the victim loses his deposit.

A good takeaway will be that licensed moneylenders are not allowed to advertise their service through messaging platforms. Hence, always pay extra attention to such text messages.

Losing Money Raised From Give.asia To Scammer

It is quite shocking to know the level scammers swooped down to, just to scam some money.

Recently, online scammers have been targetting people who raised money on crowdfunding platforms such as Give.asia. From which, they offer to help the beneficiaries out by handling their bills for them, but end up scamming them of their donation money.

Heartless!

Ask For Help

If you ever encounter any suspicions about scams or are in a situation like that yourself, you can:

- Check out Scam Alert SG to spot scams by finding out how different ones work

- Check forums such as Hardwarezone and Reddit where people share scam experiences

- Ask the Seedly community, our everyday financial gurus can help and you can also help by alerting the masses

Advertisement