All You Need to Know About Financing Your Child's Primary School Education

Congratulations, you!

Exciting times are ahead as your child enrols in primary school as part of the compulsory education in Singapore.

With 186 primary schools located all over Singapore, choosing the right primary school to enrol your child into is probably going to give you a headache…

So, focus on that and let us help with the fees and whatnot!

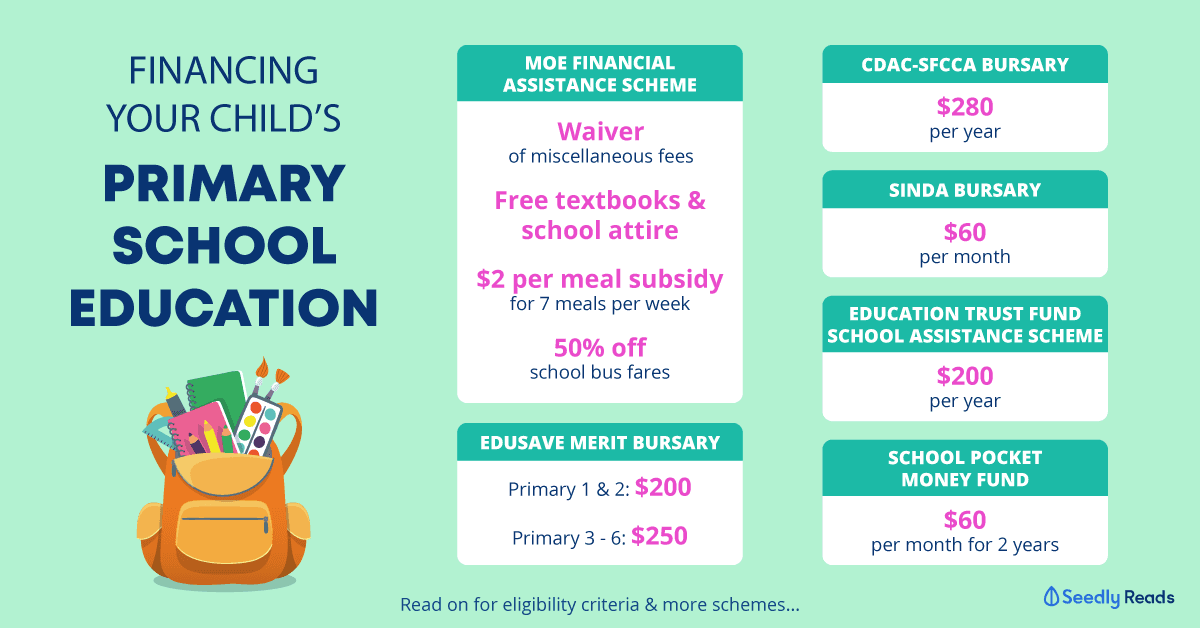

TL;DR: Financing Your Child’s Primary School Education

If primary school education is free for Singaporeans, why do we still have to pay or apply for financial assistance?

Well, that’s because primary school fees are fully subsidised by the government, but you’ll still have to pay for miscellaneous fees, school textbooks and attire!

| Singapore Citizen | Permanent Resident | International Student (ASEAN) | International Student (non-ASEAN) |

|

|---|---|---|---|---|

| Monthly school fees | $0 | $205 | $465 | $750 |

| Monthly miscellaneous fees | $6.50 | $6.50 | $6.50 | $6.50 |

| Monthly second-tier miscellaneous fees (maximum) | $6.50 | $6.50 | $6.50 | $6.50 |

| Monthly payable (maximum) | $13 | $218 | $478 | $763 |

Psst… You know you can use your child’s Edusave monies to pay for their second-tier miscellaneous fees, right?

Here are the various financial assistance schemes and awards to help finance your child’s primary school education.

| Financial Assistance Scheme | Amount Awarded |

|---|---|

| MOE Financial Assistance Scheme | Waiver of miscellaneous fees |

| Free textbooks & school attire | |

| $2 per meal subsidy for 7 meals per school week | |

| 50% off school bus fares OR $120 transport credit | |

| Edusave Merit Bursary | $200 (Primary 1 & 2) |

| $250 (Primary 3 - 6) |

|

| Edusave Good Progress Award | $100 (Primary 2 & 3) |

| $150 (Primary 4 - 6) |

|

| Edusave Character Award | $200 (Primary 1 - 3) |

| $350 (Primary 4 - 6) |

|

| Edusave Scholarship | $350 (Primary 5 & 6) |

| Edusave Award for Achievement, Good Leadership and Service (EAGLES) | $250 (Primary 4 - 6) |

| CDAC-SFCCA Bursary | $280 per year |

| Education Trust Fund School Assistance Scheme (ETF-SAS) | $200 per year |

| SINDA Bursary | $60 per month |

| School Pocket Money Fund | $60 per month (for 2 years) |

How Much Are My Child’s Primary School Fees?

Good news to Singapore Citizens, your child’s primary school education is essentially free!

| Singapore Citizen | Permanent Resident | International Student (ASEAN) | International Student (non-ASEAN) |

|

|---|---|---|---|---|

| Monthly school fees | $0 | $205 | $465 | $750 |

| Monthly miscellaneous fees | $6.50 | $6.50 | $6.50 | $6.50 |

| Monthly second-tier miscellaneous fees (maximum) | $6.50 | $6.50 | $6.50 | $6.50 |

| Monthly payable (maximum) | $13 | $218 | $478 | $763 |

Though you’ll still have to pay for the miscellaneous fees, which are set by the Ministry of Education (MOE).

The miscellaneous fees payable goes towards the schools’ budgets to maintain their facilities to provide a conducive environment for your children.

The second-tier miscellaneous fees for each school defer depending on the school’s requirement.

Don’t worry though, it won’t be a ridiculous amount as schools can only charge up to 100% of the standard miscellaneous fees.

International students from Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, The Philippines, Thailand, and Vietnam enjoy lower rates courtesy of Singapore’s close ties Association of Southeast Asian Nations (ASEAN) countries.

Do We Have to Pay School Fees for December?

If you’re thinking that you don’t have to pay your child’s school fees for December since it’s their school holidays, sorry to burst your bubble!

You’ll still have to pay for December as school fees are calculated on a yearly basis, but the payments are spread out over 12 months.

What Are the Different Payment Methods?

Payment for school fees, miscellaneous fees and second-tier miscellaneous fees can be made through GIRO, AXS, cash or cheque.

In fact, you are also able to make an advance payment by cash or cheque on a yearly basis.

Also, did you know that your child’s second-tier miscellaneous fees can also be paid with their Edusave monies?

What Is An Edusave Account & What Is It Used For?

The Edusave programme aims to meet the educational opportunities for Singapore Citizen students and an Edusave account will be created automatically for them.

Starting from their primary school years, students will receive yearly contributions in their Edusave account until their secondary school education is completed.

Edusave

Yearly Contributions for Primary School Students

(for 2020) $230

Usage of Edusave Funds Enrichment programmes organised by their schools

Second-tier miscellaneous fees

Miscellaneous fees (Autonomous government and government-aided schools only)

The Edusave account draws the same interest rates as the Central Provident Fund (CPF) Ordinary Account, which is currently at 2.5%.

Once your child turns 17 years old or once they are no longer studying in a MOE-funded school (whichever is later), their Edusave account will close and the funds will be transferred to their Post-Secondary Education Account (PSEA).

Can I Top-Up My Child’s Edusave Account?

Unlike the Child Development Account (CDA), you are not able to make voluntary contributions into your child’s Edusave account.

What Are the Financial Assistance Schemes Available for Primary School?

Even though your child’s primary school education is heavily subsidised by the government, raising a child in Singapore is still very expensive.

Who doesn’t want to save some money on their child’s school fees and use it to pamper them or pay for other expenses?

MOE Financial Assistance Scheme (FAS)

Managing finances can be tedious, especially if you’re supporting a low-income family.

But the MOE Financial Assistance (FAS) should help to provide some financial support and defray the cost of your child’s education.

| MOE FAS Eligibility Criteria | |

|---|---|

| Nationality | Singapore Citizen |

| School | Government or government-aided schools |

| Income Ceiling | Monthly gross household income of $2,750 or less OR |

| Monthly per capita income of $690 or less | |

Application forms for the MOE FAS can be picked up from your child’s school or downloaded from MOE’s website.

Eligible students will receive financial assistance for their school’s miscellaneous fees, along with school-related expenses.

| Primary School Expenses | MOE FAS Benefits |

|---|---|

| School Fees | Full waiver |

| Standard Miscellaneous Fees | Waiver of $6.50 per month |

| Textbooks | Free |

| School Attire | Free |

| Transport | 50% off school bus fares per year OR |

| $120 transport credit per year | |

| School Meals | $2 per meal subsidy for 7 meals per school week (under the School Meals Programme) |

Under the MOE FAS, school attire includes two sets of uniform, Physical Education (PE) attire, a pair of school shoes and two pairs of socks.

Edusave Awards & Scholarships

As you can see, the eligibility criteria for MOE FAS is pretty strict and does not cover middle-income families.

Not to worry, as there are other financial aid schemes such as Edusave bursary or awards available for your child.

| Primary School Level | Eligibility | Edusave Award Amount | |

|---|---|---|---|

| Edusave Merit Bursary (EMB) | |||

| Primary 1 & 2 | Students who consistently demonstrated positive learning dispositions in the course of the year, have demonstrated good conduct | Monthly household income ≤ $6,900 OR Per capita income ≤ $1,725 | $200 |

| Primary 3 | top 25% of their school’s level and course in terms of academic performance, have demonstrated good conduct | Monthly household income ≤ $6,900 OR Per capita income ≤ $1,725 |

|

| Primary 4 to 6 | $250 | ||

| Edusave Good Progress Award (GPA) | |||

| Primary 2 & 3 | Students who do not qualify for Edusave Merit Bursary, but showed the greatest improvement in learning disposition in the course of the year and have demonstrated good conduct. | $100 | |

| Primary 4 to 6 | Top 10% of their school’s level and course in terms of improvement in academic performance and have demonstrated good conduct. | $150 | |

| Edusave Character Award | |||

| Primary 1 to 3 | Up to 2% of students in each school who demonstrated exemplary character and outstanding personal qualities through their behaviour and actions. | $200 | |

| Primary 4 to 6 | $350 | ||

| Edusave Scholarship | |||

| Primary 5 & 6 | Top 10% of their school’s level and course in terms of academic performance, and have demonstrated good conduct. | $350 | |

| Edusave Award for Achievement, Good Leadership and Service (EAGLES) | |||

| Primary 4 to 6 | 10% of students from each school who have demonstrated leadership qualities, service to community and schools, excellence in non-academic activities, and good conduct. | $250 | |

No application is required as you will receive a letter by early December if your child is eligible for one of the awards.

The awards will be given in form of cheques at the award ceremonies held by your respective People’s Association Constituency Offices from January to February.

I still remember being really proud of myself for receiving the Edusave awards every year!

Other Financial Aid Schemes

While both the MOE FAS and Edusave awards are catered for Singapore Citizen students only, there are other financial assistance schemes available to lighten the load for permanent residents too.

| Eligibility Criteria | Amount Awarded | |||||

|---|---|---|---|---|---|---|

| Student Status | Race | Nationality | Household Income | Other Criteria | ||

| CDAC-SFCCA Bursary | Full-time MOE primary student in government/government-aided, autonomous, independent/specialised independent school or Special Education School (SPED) | Chinese | Singapore Citizen or Permanent Resident | Gross Monthly Household Income ≤ $2,400 OR Gross Monthly Per Capita Income ≤ $800 | Conduct must be at least "Good" | $280 per year |

| School attendance of at least 90% | ||||||

| Education Trust Fund School Assistance Scheme (ETF-SAS) | Full-time MOE primary student | Malay or Muslim | Singapore Citizen or Permanent Resident | Nett Monthly Household Income ≤ $1,800 OR Monthly Per Capita Income ≤ $450 | Students must register for MENDAKI Tuition Scheme/Collaborative Tuition Programme and obtain at least 85% attendance | $200 per year |

| SINDA Bursary | Full-time primary student in government school or Independent school | Indian | Singapore Citizen or Permanent Resident | Nett Monthly Per Capita Income ≤ $1,000 | Not receiving bursary from Tamils Representative Council or SPMC from any Family Service Centre | $60 per month |

| Not a recipient of HOPE (Home Ownership PLUS Education) Scheme | ||||||

| All applicants must exhaust 24 months of SPMF before being granted SINDA Bursary | ||||||

| School Pocket Money Fund (SPMF) | Full-time primary student studying in government, specialised/special education, specialised independent, religious school | - | Singapore Citizen or Permanent Resident | Gross Monthly Per Capita Income ≤ $690 | Living in a HDB 4-room flat or smaller | $60 per month (for 2 years) |

Cheesy as it may sound, no child should be left behind due to their financial situation. The above financial assistance schemes can be used to offset school-related expenses to ensure and maximise their educational opportunities.

Advertisement