SIA Retail Bond 2019 - The Good, The Bad and Everything You Should Know

Singapore Airlines will be releasing S$500 million worth of bonds – S$300 million to the public and the rest to institutional investors. Should the SIA Retail Bond 2019 be oversubscribed, they will extend the tranche to up to S$750 million.

Previously, we had

How does Temasek Holdings (“Temasek”) come into play with these companies?

- Astera IV Bond: Issued by Astrea Capital IV who is a subsidiary of Azalea Asset Management is a wholly-owned subsidiary of Temasek

- Temasek Bond: Issued by Temasek Financial (IV) who is a wholly-owned subsidiary of Temasek

- SIA Retail Bond 2019: Temasek also happens to be a major shareholder of Singapore Airlines (55.53%)

Disclaimer: This is not a sponsored post. Opinions expressed in the article should not be taken as investment advice. Please do your own due diligence!

Important Details About SIA Retail Bond 2019

| Coupon Rate | 3.03% p.a. |

| Tenor/ Duration | 5 years |

| Coupon Payment | Semi-annually |

| Application Fee | S$2 |

| Min. Amount | S$1,000 and in multiples of S$1,000 thereof |

| Issue Date | 28 March 2019 |

| Maturity Date | 28 March 2024, or earlier if sold in the secondary market on SGX |

| Application Period | Opens: 20 Mar 2019 (Wed), 9am Closes: 26 Mar 2019 (Tue), 12pm |

| Public Offer | S$300 million |

| Bond Type | [IMPT] Unsecured Bond* |

| Use of CPF/ SRS Funds | Not applicable |

*Unsecured Bonds are bonds that are not backed by some type of collateral. In other words, the bond is only secured by the bond issuer’s good credit standing.

To put it bluntly, your returns of 3.03% are not guaranteed.

If (a very BIG IF) SIA is unable to pay its debts, the bondholders will go through the liquidation process that Hyflux bondholders are currently experiencing.

As extracted from the Prospectus, this is what it says in legalese:

“The Bonds constitute unsecured obligations of the Issuer. Accordingly, on a winding-up of the Issuer at any time prior to maturity of any Bonds, the Bondholders will not have recourse to any specific assets of the Issuer and its subsidiaries and/or associated companies (if any) as security for outstanding payment or other obligations under the Bonds and/or Coupons owed to the Bondholders and there can be no assurance that there would be sufficient value in the assets of the Issuer after meeting all claims ranking ahead of the Bonds, to discharge all outstanding payment and other obligations under the Bonds and/or Coupons owed to the Bondholders.”

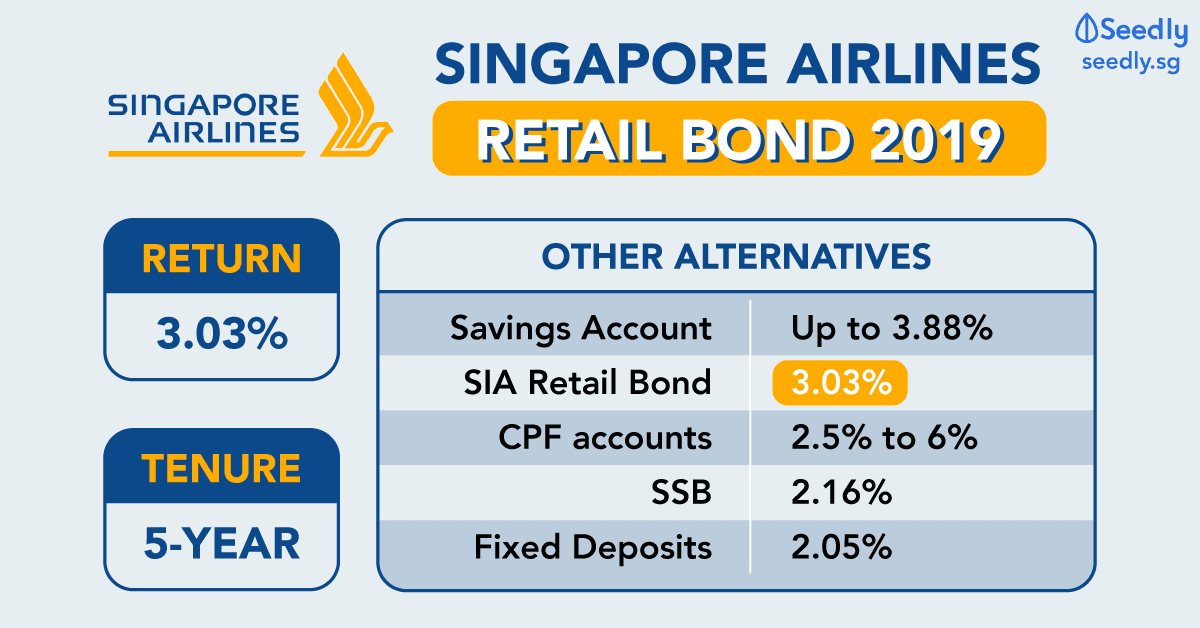

Other Alternatives To SIA Retail Bonds That You Can Consider

| Alternative Investment Instrument | Expected Returns | Lock-in Period | |

|---|---|---|---|

| 1 | High Interest Savings Account | Up to 3.88% | - |

| 2 | SIA Retail Bond 2019 | 3.03% p.a. | Up to 5 years |

| 3 | CPF Accounts | 2.5% to 6% p.a. | Till age 55 or older |

| 4 | Singapore Savings Bonds | Up to 2.63% p.a. | Up to 10 years |

| 5 | Fixed Deposits | Up to 2.05% p.a. | 3 to 13 months |

What Will SIA Be Doing With Your Money?

SIA will be using your money to fund their new aircraft purchases and for aircraft-related payments. Which honestly could be anything – maintenance, repair works, airport tax, fuel or even lifejackets? ??♀️

According to an earlier released media statement, net proceeds will be used to refinance existing borrowings, finance investments and fixed assets, and for general working capital purposes.

Read more on their FAQs.

Who Is SIA Retail Bond 2019 Suitable For?

After the whole Hyflux incident, we should all be very careful with where we place our money. The fact that they are blue-chip companies doesn’t mean that they are immortal.

So who is the SIA retail bond best suited for?

- If you want regular income at a fixed rate

- If you are comfortable with the uncertainty of the aviation industry in Singapore

- Or you just really love SIA and would love to support them all the way

How Can You Get A Piece Of The SIA Retail Bond Action?

You need to have an individual CDP account linked with your bank account before making an application. Don’t have a CDP account yet, check out this step-by-step guide on how to set it up.

Where To Apply For The SIA Retail Bond?

- ATMs of DBS (including POSB), OCBC and UOB (“Participating Banks”)

- Internet banking websites of the Participating Banks

- Mobile banking application of DBS (including POSB)

Note: For DBS and OCBC, applications can be submitted 24/7. For UOB, applications (both ATM and ibanking) can only be submitted between 6am to 9.30pm, daily.

What The Community Is Discussing

The community has chimed in with their thoughts and how they feel about the SIA Retail Bond 2019 here.

“Personally I might if I have spare cash, but will not splurge and will have exit plans.” ~ Khairul Dzakirin

“Airline Industry Challenged. 3.03% may or may not be sufficient to compensate you for taking the risk.” ~ Goh Kah Kiat

Kyith from Investment Moats has aptly pointed out,

“SIA’s net debt to asset has been deteriorating in the last 10 years and they are now in a net debt position. However, the level of debt is still very very low.

Their financial position looks strong enough to pay the coupon payment.”

While there are also opposing (and equally valid) views by the like of Goh Kah Kiat,

“The interest rate is fairly low for a company with known defects. If you compare it to the 5-year yield of Singapore Savings Bonds (2.01%) and Temasek Bonds (2.70%), you are being compensated as if the bond is risk-free, when it is not.

The Singapore Airlines 3.03% 5 year Bond is certainly not risk-free. Between its poor industry outlook and deteriorating financials, Singapore Airlines is certainly flying through some turbulence.”

Looking back at the other (safer) alternatives mentioned above like SSBs (2.16% – Apr 19) or even CPF accounts (2.5% to 6%), it is apparent to me that you are better compensated there.

Will you put your money in SIA Retail Bonds? Let us know in the comments below!

Advertisement