Standard Chartered JumpStart: What Are The Changes in January 2021?

Ah… the Standard Chartered JumpStart account.

A favourite amongst students, fresh grads, and those who just entered the workforce.

Why?

Well… you get to earn a flat 2.00% p.a. interest with (almost) no strings attached.

There’s no minimum deposit required.

No minimum spend to meet.

And no need to credit your salary either.

The only catch?

You MUST be between 18 and 26 years old when you apply for the account.

.

.

.

But unfortunately, all good things must come to an end.

Which is why the Standard Chartered JumpStart savings account is revising its interest rates AGAIN come 1 January 2021.

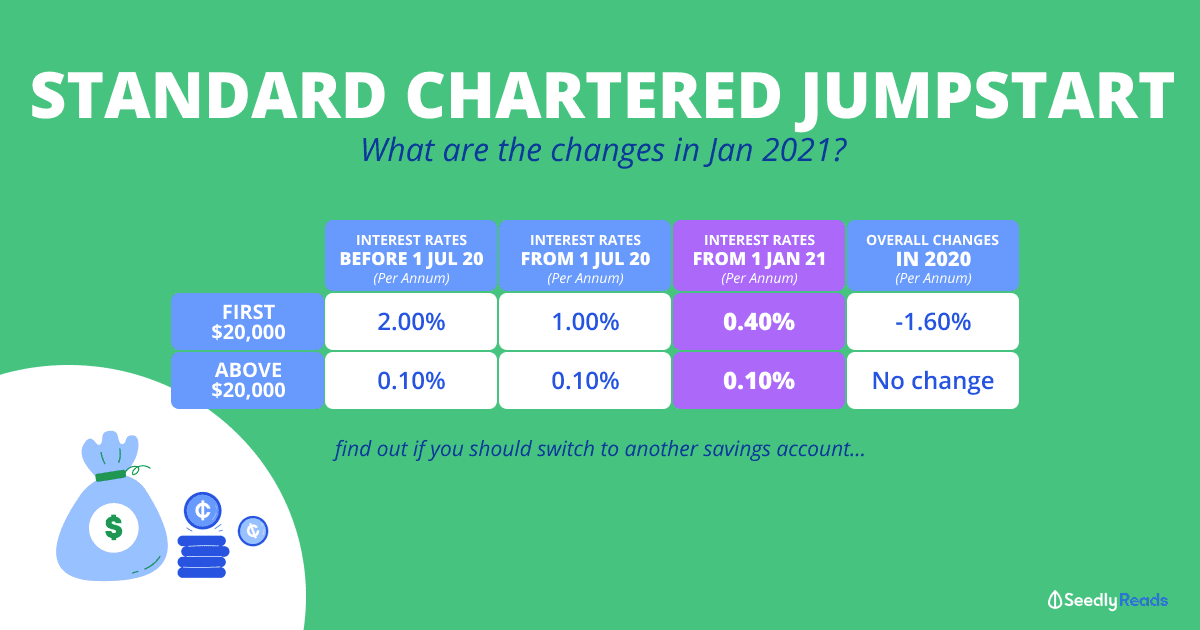

TL;DR: Changes to Standard Chartered JumpStart from 1 January 2021

The prevailing interest rate on the first $20,000 of your eligible balance will drop from 1.00% p.a. to 0.40% p.a.

FYI: before any of the revisions kicked in, you could get 2.00% p.a. without doing anything

Anything above the first $20,000 will still continue earning the 0.10% p.a. interest.

Revision of Interest Rates for Standard Chartered JumpStart from 1 January 2021

| Requirements | Before 1 July 2020 | From 1 July 2020 | From 1 January 2021 | Changes in 2020 |

|---|---|---|---|---|

| First $20,000 | 2.00% p.a. | 1.00% p.a. | 0.40% p.a. | -1.60% p.a. |

| Above $20,000 | 0.10% p.a. | 0.10% p.a. | 0.10% p.a. | No change |

Standard Chartered JumpStart’s interest rates requirements are pretty straightforward.

Just.

Put.

Money.

In.

Yep, it’s that fuss-free.

While it used to give 2.00% p.a. interest on the first $20,000 in your account…

It’ll be slashed to 0.40% p.a. interest, come 1 January 2021.

In terms of fuss-free savings accounts, it still beats CIMB FastSaver‘s 0.30% p.a. interest on the first $50,000.

Want to look for other fuss-free savings accounts?

Check out our FREE Savings Account Calculator and find out which is the best high-interest savings account for you!

Is it Still Worth Opening a Standard Chartered JumpStart Account After 1 January 2021?

This is the second time that Standard Chartered has decided to revise the JumpStart account interest rates since introducing it back in 2019.

Overall, we’ve seen both revisions in 2020 and they’re considerably hefty cuts.

But given this low-interest-rate environment that we’re in, and the fact that the economy isn’t doing that well.

It’s no surprise that they’re lowering the interest rates for the JumpStart.

Even the Standard Chartered Bonus$aver wasn’t spared either.

Although to be fair, the JumpStart still has its merits since it has:

- No minimum deposit

- No fall-below fee

- No lock-in period

- No need to credit your salary

- No need to invest or buy insurance

- No annual or monthly fees

- No minimum spend needed

In fact, you can get 1% cashback on eligible spending with a debit card — capped at $60 a month.

All of this means that it’s still a savings account worth considering because it’s one of the rare few which doesn’t need you to jump through 5 million hoops.

Or at the very least, credit your monthly salary with them in order to qualify for any kind of bonus interest.

Should I Switch out of My Standard Chartered JumpStart Savings Account?

If you haven’t celebrated your 27th birthday yet and still have the JumpStart account.

Don’t be so quick to close it now that they’ve lowered the interest to 0.40% p.a.

“Why leh?” you ask.

Because, my young padawan, you can continue to maintain the account even after you turn 27 years old.

AND you can continue to receive the prevailing interest on your JumpStart account balances for as long as Standard Chartered doesn’t decide to change the terms and conditions.

I mean, they might have revised the interest rates down now.

But who’s to say that they won’t bring it back up again when things get better?

You can just keep the account there as a standby — since you don’t even need to maintain a minimum deposit — until they restore their interest rates.

And then put your money back in to enjoy fuss-free interest.

.

.

.

What if you’re above 26 years old and are no longer eligible to apply for the JumpStart?

Or what if you’re thinking of switching out of your JumpStart savings account to another account which gives more interest instead?

Well… there’s another similar fuss-free high-interest savings account which you might be considering.

Enter: the CIMB FastSaver savings account.

Like the Standard Chartered JumpStart savings account, the CIMB Fastsaver has:

- No fall-below fee

- No lock-in period

- No need to credit your salary

- No need to invest or buy insurance

- No annual or monthly fees

- No minimum spend needed

HOWEVER, there is a minimum deposit of $1,000 required.

And you’ll need a lot MORE capital in order to hit the highest interest rate of up to 0.75% p.a.

CIMB FastSaver Revised Interest Rates | From 15 January 2021 | Latest Changes (Apply with CIMB Visa Signature Credit Card) |

|---|---|---|

| First $10,000 | 0.30% p.a. | 1.00% p.a. |

| Next $65,000 | 0.30% p.a. | 0.30% p.a. |

| Above $75,000 | 0.15% p.a. | 0.15% p.a. |

See what I mean?

Let’s say you have $20,000 in your JumpStart account right now and want to shift it to some other savings account to earn more interest since you’re not happy with the 0.40% p.a.

You could consider the CIMB FastSaver, however, you’d only be clocking 0.30% p.a. interest.

Because your account balance only qualifies you for the interest earned on the first $50,000.

In fact, you’d need at least $100,000 on hand to be able to qualify for the up to 0.75% p.a. interest

And frankly, with that kind of amount, you might want to consider investing or other financial instruments to make your money go further.

Heck, even leaving it in an insurance savings plan might net you more…

Still want to look for other fuss-free high-interest savings accounts which can do the same (or better) for you?

Try our FREE Savings Account Calculator to find out.

It’ll only take you less than a minute.

Advertisement